what are the 4 phases of Medicare part D coverage? Throughout the year, your prescription plan costs may change depending on the coverage stage you’re in. If you have a Part D plan, you can move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage. Learn more about every stage in the following article.

Read More: Compare Medicare Part D plans for 2021

Medicare Part D Helps You Save on Prescriptions

Medicare Part D is drug coverage that can help lower your current and future drug costs covered by Medicare. You can only sign up for a Part D plan offered by private insurers like Blue Cross Blue Shield.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Part D plan:

You can get Medicare Part D in two ways:

- A Part D Independent Prescription Drug Plan (PDP) to align with a Medicare Supplement Plan, Original Medicare Plan, or Medicare Advantage (MA) that does not include Part D.

- A Medicare Advantage (MA) that includes Part D. Not all MA plans include Part D coverage.

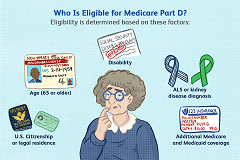

Medicare Part D is available to anyone in the following situations:

- If you have Medicare Part A or B, regardless of health condition or income.

- If you are 65 years old. In most cases, you must first register when you turn 65. If you do not enroll in Prescription Coverage when you first become eligible, you may have to pay a late fee that will be added to your monthly installments for as long as you have Part D coverage.

- If you qualify for additional assistance. Medicare beneficiaries who qualify for additional assistance can receive additional coverage that reduces Part D expenses.

What are the 4 phases of Medicare part D coverage?

There are four phases of coverage with Prescription Medication Plan enrollment. Understanding these stages is important, especially if you need high-cost drugs:

Stage 1 – Annual Deductible

Starts: with your first prescription in the year under the plan.

You pay the full cost of your prescriptions until your spending reaches your discount amount. For example , if your plan is $ 0 deductible, you can go straight to the next stage. Keep in mind that some discounts may only apply to drugs at certain levels, which means that you may not have any discount if you do not take any medications at these levels. No payments are made for your monthly installment or for medications at levels that do not apply to the deductible to reach the deductible.

Once you reach your annual discount amount, you will enter the second stage.

Stage 2 – Initial Coverage

Starts: Immediately if your plan does not have a deductible. Or, when the prescription payments you’ve made are equal to the deductible in your plan.

Your plan pays for a portion of every prescription drug you buy, as long as that drug is covered in the plan formulary (List of Included Medicines). You pay the other portion, which is either a co-payment (a specified dollar amount) or a co-insurance (a percentage of the drug’s cost). The amount you pay will depend on the tier level assigned to your drug. This stage ends when the amount that you and your plan spent on covered drugs equals the initial coverage limit set by Medicare for that year. In 2021, that limit was $ 4,130. Your monthly installment payments are not calculated to reach this limit.

Note: You may be able to reduce your costs at this point by choosing lower-level medications that address your diagnosis. Oftentimes, generic drugs treat the same diagnosis, but they may be less expensive than their brand-name options. Talk to your prescriber to find out what other options may work for you.

Stage 3 – Coverage Gap

Starts: When you and your plan collectively spend $ 4,130 on Covered Medicines.

Not everyone will get into the coverage gap (also referred to as a “donut hole”). In the coverage gap, the plan is temporarily limited in how much it can pay for your medication. If you enter the gap, you’ll pay 25% of the plan cost for the covered branded drugs and 25% of the plan cost for the covered generic drugs.

Keep in mind that while the percentage you pay for brand-name drugs is lower, the price for that drug may be much higher than the generic option. Calculate how much you owe each to see which one provides the best costs for you.

You exit the coverage gap when the total out-of-pocket cost for covered drugs (not including premiums) reaches $ 6,550. The cost you pay out of pocket is calculated by adding all of the following together: annual deduction, co-insurance, and co-payments from the entire plan year, and what you paid for medications in the coverage gap (including the deductible amounts you didn’t pay at that point).

Stage 4 – Catastrophic Coverage

Starts: when your personal costs reach $ 6,550 on covered medicines.

After your out-of-pocket cost is $ 6,550, you step out of the gap and have catastrophic coverage. In the catastrophic phase, you’ll pay a reduced co-insurance amount or a copayment (determined by Medicare) for all of the prescription medications you’re taking. This means that the plan and the government pay the rest – about 95% of the cost. It will remain in this phase until the end of the plan year.

Read More: Medicare Part D Deductible Costs

Medicare Part D Plans: Costs and Benefits

There are two types of Medicare Part D plans (prescription drug plans or PDP plans). If you have a genuine Medicare program (or the PFFS / MSA types of the Medicare Advantage Plan), you have the option to use a standalone Part D plan. Part D plans are run by private companies certified by Medicare.

Alternatively, if you are enrolled in other types of Medicare Advantage Plans, you can use a Medicare Prescription Drug Plan (MAPD) with a prescription drug plan as part of Medicare Advantage.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medicare Part D Rights

If you have a Medicare prescription drug plan or a Medicare prescription drug plan, you have the right to:

- Receive a “Coverage Determination” – a written explanation from your plan of your benefits, including how to cover your medications, your medication costs, any coverage requirements (such as drugs that require prior authorization from the plan, and the requirements for making coverage exceptions)

- Request exceptions to medications that your plan guide doesn’t cover.

- Request exceptions to waive the plan’s coverage rules (such as pre-authorization).

- Order a smaller amount of the higher-cost medication if you or the prescriber thinks you cannot take any of the lower-cost drugs for the same condition.

Read More: