Medicare Surprises, Three Medicare Surprises No One Told You: Medicare surprises can catch you unsuspecting if you are not prepared for them. Most people do not study or think about Medicare until they start approaching their 65th birthday. For this reason, in addition to the abundance of misinformation about Medicare, there are several surprises most people discover as they approach their 65th birthday. Medicare can be a welcome relief for many people who are 65 years old, especially if you have paid high premiums for your health insurance in recent years. But here are three surprises about Medicare that you may not know before you do some research and understand Medicare.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medicare Surprises #1: IT’S NOT FREE.

Of course, you paid health insurance for your entire working life in the form of payroll deductions. Surely, the federal government has securely stored your money in a bank somewhere to be used to “give” you Medicare when you are 65 years old, right? Medicare has a cousin. Well, not exactly. Part A of health insurance (hospital) is currently premiums free, provided you have worked 10 years and paid in the “system”.

However, there is a premium for Part B. Currently, the standard health insurance Part B premium is $148.50 per month (by 2021), although the exact premium you will pay is determined somewhere by your income. If you fall into a higher income category, you may be responsible for the IRMAA. In addition, if you fall into a lower-income class, you may be eligible for Part B.

Read More: I’m turning what do I need to do for Medicare?

Medicare Surprises #2: IT DOES NOT COVER EVERYTHING

Health insurance is certainly full coverage — in fact, more than 75% of people who are “very satisfied”, according to a 2016 study by the Kaiser Family Foundation. That said, some of these 75 percent have some form of supplementary insurance or supplementary plan (s) for Medicare. Health insurance, in itself, does not have 100% full coverage. Surprises to Medicare – How to Get Health Coverage Conversely, Medicare has deductibles and co-payments that are not covered by traditional Medicare.

If you have a health insurance plan “only” and there are no other types of supplementary or group coverage, you are responsible for a Part A deductible ($1484 for the 2021 benefit period), a Part B deductible ($203 per year by 2021) and unlimited co-insurance of 20%. The word “without limits” is the keyword of the previous sentence because it represents unlimited medical expenses if you have high medical bills.

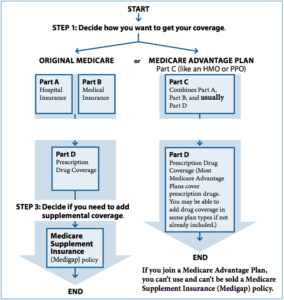

This is also why a large number of people (about 25%) acquire Medigap plans. Another quarter of the population, in general, and based on 2019 figures, is enrolled in a Medicare Advantage plan. These figures do not include or do not represent another quarter of those eligible for Medicare and Medicaid.

Read More: Getting Medicare Under the Age of 65

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medicare Surprises #3: IT IS NOT A ONE-TIME DECISION

This Medicare surprise catches you unsuspecting. Most people spend hours making their Medicare decisions before they turn 65. So they think they’re done for the rest of their lives. True, you can do it this way, but it is not financially wise to do it. Some types of plans change over time: Part D prescription plans, in particular, which may have radical costs and changes to annual forms.

Others, like Medigap, never change coverage, but they can change premiums over time. If you use a “set up and forget” methodology when it comes to Medicare, you will almost certainly pay too much when you are 70 years old. The best way to do this is to periodically review your plan options (each year or biannual normally works best) to ensure that you have the best offers available for your particular needs (is Plan G better than Plan F?). A good independent broker should contact you proactively or stay in touch with you to help you.

Medicare surprises are not out of the ordinary, but rather common, because most people do not think about Medicare until it’s time to get it. These are three frequent surprises that people receive when they reach the golden age of 65.

Medicare ABC is a leading independent Medicare insurance agency for people aged 65 and who go to health insurance. If you have any questions about this, you can contact us online or call us at 1(877)0255-0284.

Read More: