Medigap Plan N is a relatively recent Medigap plan. It was created when the plans were renormalized in 2010. That said, it certainly gained strength as one of the increasingly popular options among Medigap plans. Plan N is a scheme that offers a lower premium in exchange for a portion of the cost sharing (i.e. the costs borne by the insured). As with all Medigap plans, it is important to remember the basics of Medigap insurance. First, plans are federally standardized. Therefore, a plan N with one company will be identical to a plan N with another company.

They are not allowed to add or withdraw benefits from the Medigap coverage table. In addition to standardizing coverage, claims payments are also made. They are managed by Medicare’s automated crossover system. Finally, all physicians/hospitals receiving Medicare will take any Medigap plan. There are no networks for Medigap plans.

So what does Plan N cover, how does it work, and the best Medigap plan for you?

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Does Medigap Plan N Cover?

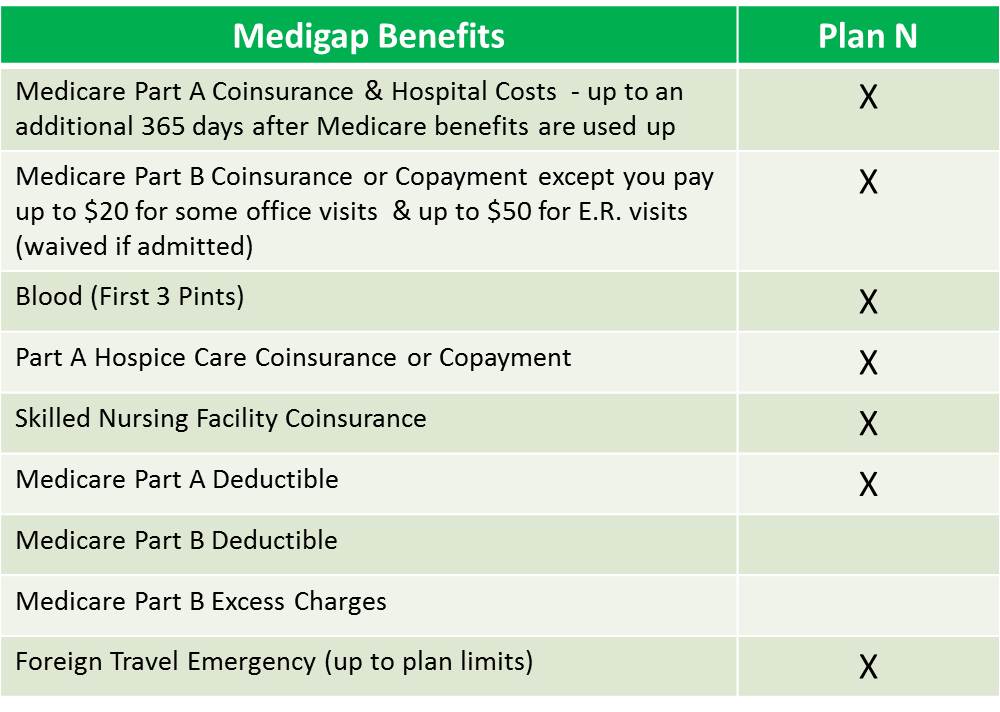

First of all, let’s look at what Medigap Plan N covers. Usually this is one of the weakest Medigap options, because it has a share of the costs. But this can certainly be a good deal in some areas and situations. It is probably easier to talk about it from the point of view of what plan N DOES NOT COVER. It does not cover the Part B deductible of medicare (currently $198/year by 2020). In addition, it does not cover all Part B co-insurance; if you have Plan N, you are responsible for copayment fees of up to $20 per medical visit and $50 in the emergency room.

Finally, it does not cover overloads under Part B of medicare. Part B Excess fees apply when a physician does not accept the medicare payment schedule as a full payment. They are allowed to charge up to 15% above the health payment schedule. Tinsurancehere are few states where this is forbidden (more about this later).

So what does Plan N cover:

- Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergency

Therefore, with Plan N, there is more uncertainty about your total costs than in other plans, such as Plan G or Plan F. That being said, Plan N premiums are usually US$15 to 30 USD per month lower than Plan G premiums and may be $50 per month lower than Plan F premiums. So if you don’t go much to F. Doctor’s premiums can make sense to you.

How Does Medigap Plan N Work?

Medigap Plan N is a standardized Medigap plan. As such, it operates in the same way as Plan F, Plan G and other plans. All claims are automated and paid through the Medicare Crossover System. There is no involvement of the insured person in the claims process, except in rare cases. However, this is obviously a higher cost sharing with Plan N. In Medigap Plan N, you must first pay the deductible. The way this works normally is for you to go to the doctor and have your doctor apply for medicare.

Once medicare responds that you have not reached the deductible, your doctor will charge you up to $80 per calendar year. If you have reached the franchise, they will charge you the amount of copay. In some cases, once established, they will charge your copay at the time of service, but usually this is done after the application has been filed with Medicare.

You can, of course, go to any physician/hospital nationally if you have Plan N. As long as a doctor accepts medicare, they will also accept your Medigap plan.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Is Medigap Plan N a Good Deal for You?

Plan N can be a particularly good option for those who are healthy or for those who do not go much to the doctor. You can see the premium savings you will receive by using Plan N, subtracting the deductible and adding as many cocountries as you would have in an average year. The only variable is Part B. Excess costs. You can usually call your primary physician or other physicians whom you visit regularly to find out if they are accepting the “mission” of medicare. If this is not the case, it means they can charge for these overcharges.

So it’s a good idea if you’re considering N. Another consideration that many people don’t realize is that you must be “medically eligible” to change the Medigap plans after your first 65 year open enrolment period. Contrary to the popular misconception, there is no annual registration period that allows you to change plans. You can change your Medigap plan at any time, but you need to answer medical questions and qualify to do so.

This is important to understand because, if you choose Medigap Plan N, you should feel comfortable in the long run. If your state of health changes, you may not be able to switch to one of the other plans.callout11 There are many companies that now offer this diet, as it has become a viable alternative for some people. It is advisable to compare costs extensively with a broker or by calling each company, as costs can vary up to 50% for the same coverage. If you have any questions about this information or would like to speak to someone, please contact us (form on the right on this page) or call us at 1(877)255-0284

Our site also contains more specific information about the plans, which you can review here: