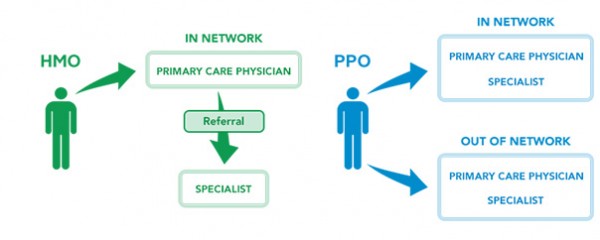

Are you shopping for proper Medicare health insurance? – If yes, you will probably find tons of health plans at different costs. So, how can you make a choice? You must understand each plan, comparing the details such as costs, deductibles, coverage, and more. The health insurance marketplace is full of a variety of choices with unique features and choosing can be a burden. Each insurance company provides common types such as HMOs and PPOs. Are you familiar with these plans? – What is the Difference between PPO and HMO Health Insurance Plans? Let’s start!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What is an HMO health insurance plan?

HMO, also known as Health Maintenance Organization, is a major type of Managed Care Plans. Basically, it is an organization that provides coverage for a certain list of specialists and doctors that work with HMO only. This type of insurance provider offers a wide range of services and benefits at a monthly or annual fee. In this case, premiums are much lower than in traditional health insurance.

With an HMO Health Insurance Plan you get:

- A primary care physician (PCP) handles your case and directs you to other specialists on time of need. In most cases, you will need a referral before you can visit a specialist.

- Coverage for prescribed medications, laboratory tests, health screenings, cancer screenings, X-rays, and more.

- Screenings mammograms don’t need referrals

- Coverage for prenatal and well-baby care

- Doctor visits for the ones in your HMO network

- The least paperwork to fill when comparing to other health insurance plans

- Some out-of-network services such as emergency care and dialysis

Some rules for HMO subscribers:

- In some cases, HMO subscribers must be living or working in the network’s area to be eligible

- If a subscriber receives urgent care out of the network’s area, the plan may cover the expenses

- Any subscriber receiving a non-emergency plan out of the network’s area will pay out-of-pocket expenses

- There are low deductibles or no deductibles at all (You’re charged co-payments for each doctor visit, prescription, or test)

- The co-payments range between $5, $10, and $20 per services, making it affordable for most families

- If your PCP leaves the HMO network, you will be notified to choose another one within the network

- If you choose a doctor or certain facility out-of-network, you will pay the full bill

Read More : What is the best Medicare Supplement Insurance Plan

What is a PPO health insurance plan?

PPO, also known as Preferred Provider Organization, is a health plan that offers a broad network of doctors and health facilities. Of course, you will pay less when using providers within the network’s coverage. Unlike HMO, you can visit any in-network physical or facility without the need for a referral from a PCP. PPO plans are popular among many families and employers due to their flexibility, efficiency, and low out-of-pocket expenses.

With a PPO Health Insurance Plan you get:

- Freedom to choose your healthcare provider more than HMO plans with no referrals

- Subscribers can use out-of-network services but will pay more for it

- Comprehensive coverage and a wide range of health providers (hospitals, physicians, healthcare professionals, and more)

- Higher cost than HMO plans, yet more flexibility

- A high value in case of emergencies

Some rules for PPO subscribers:

- You can negotiate the fees with the provider regarding the medical services

- There is a customary fee determined for out-of-network benefits. In case of exceeding the limit, the coverage will not apply and you will pay the excess charges

- You will pay an annual deductible before the company starts to cover your medical expenses

- For certain services, you will have to pay co-payments between $10 and $30 or a specific percentage of the bill

- You will go through more paperwork in this plan especially when seeking an out-of-network service

- There is no coverage if you use a health provider or doctor that isn’t in your network

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

HMO vs PPO: which is better?

There is no correct answer to this question indeed. It totally depends on the subscriber’s preference. Both plans offer the subscribers specialist care and a range of health care services. If you’re seeking more flexibility, PPO will be your perfect match. On the other hand, HMO plans are ideal if you seek lower monthly premiums and less out-of-pocket costs. If you travel a lot and have any kind of chronic disease, PPO coverage is better. If you in continuous need of specialist care, the HMO plan is more suitable.

The two programs offer an extensive number of healthcare services. However, in HMO plans, a primary care physician must provide a referral to a certain specialist. PPO plans have higher premiums in exchange for the flexibility and broader choices of doctors and hospitals. Besides, HMO plans usually don’t have deductibles but PPO plans do have deductibles. In many cases, participants prefer HMO insurance plans for their affordability despite the PPO’s popularity. So, cost or convenience?

What is the final choice? – In this section, we are going to state the main differences between both plans:

Cost Analysis

With PPO, you pay higher premiums for the flexibility and freedom, encompassing a large range of healthcare services. With HMO, you get to pay much lower premiums, but once you step out of your network, there is zero coverage.

Claim Forms

With PPO, you may have to pay out-of-network providers first and then, file a claim to the insurance company. With HMO, there is no need to claim forms as your insurance company pays healthcare providers directly.

Covered Services

In most cases, the covered services are the same. But, you have to check your company first because they may vary according to the company and chosen plan.

Prescriptions

With HMO, the prescription coverage is limited, and also the pharmacy must be located within the plan’s network. With PPO, you can fill a prescription at any place, but with additional expenses for an out-of-network pharmacy location.

Exceptions

With HMO, you can have a referral exception in case of emergencies or visits to an obstetrician or gynecologist (in-network visits)

Read More: What is Medicare Part A & B | 2021 Full Guide

Does Medicare have PPO and HMO options?

Yes, actually, PPO and HMO insurance plans are types of Medicare Advantage Plans (Part C).

Eligibility of Preferred Provider Organization PPO and Health Maintenance Organization HMO

Like Original Medicare, to enroll in PPO or HMO, you must be eligible for Medicare in the first place.

- You must be 65 years old or older

- You must be a U.S citizen or have a legal residence for at least five years

- You must have Medicare Part A & B

- If you’re younger than 65 years old, you must have End-Stage renal disease or disability

Before enrollment:

Before you enroll in any Medicare Plan, you must study all the details, including costs, benefits, and disadvantages to make the right choice. Let’s dive into the different features of both HMO and PPO to help you understand both plans.

What are the advantages of HMOs? “Health Maintenance Organization”

- Low monthly premiums

- May or may not include deductibles

- Low out-of-pocket expenses

- No claims to be filed

- In-network coverage except in case of emergencies or if the healthcare isn’t available in the HMO plan

- A primary care physician is responsible for your condition and manages your care

Disadvantage of HMO

- You must stay in the plan’s network unless it is an emergency

- If your PCP leaves the network, you will need to choose another one

Types of HMOs

- Staff Model HMO

The Staff Model plan is the most limited HMO plan. HMO directly assigns certain providers and no coverage is available for out-of-network providers. In this model, physicians are paid a fixed salary no matter how many HMO patients they see.

- Group Model HMO

HMO hires one or more medical groups of physicians to provide medical services to HMO subscribers. The patient can choose anyone in the group and get his service covered by HMO. There is more flexibility in choosing the facility or doctor according to the group’s size.

- Network Model HMO

This model is the most popular type of HMO plans, in which certain groups of providers offer special rates to HMO subscribers. In this model, providers have the freedom to join and leave HMO plans. So, make sure to check which providers are included under your network and which aren’t.

What is covered by the Health Maintenance Organization insurance plan?

An HMO plan offers coverage for a certain list of doctors, hospitals, facilities, and physicians inside the network. This list offers lower rates for HMO subscribers, meeting the highest quality standards. Just make sure to see a provider under HMO coverage to enjoy the given benefits. Otherwise, there is no coverage for out-of-network services. Also, dental and vision coverage is available in HMO insurance plans.

Are HMOs cheaper than PPOs?

Yes, HMO plans offer much lower premiums than PPOs, attracting more families and citizens.

Advantages of PPO “Preferred Provider Organization”

- More flexibility

- More convenience when choosing in-network or out-of-network health provider

- No referral is needed to any specialist even out-of-network specialists

- PPO can’t charge higher than Original Medicare in some care services such as dialysis, skilled nursing facility, chemotherapy, and more

Disadvantages of PPO

- Higher monthly premiums than HMO plans

- Higher out-of-pocket expenses than HMO plans

- You have no primary care physician to manage your care. You will be totally responsible for this

- PPO charges high co-payments for durable medical equipment, inpatient hospital care, and home healthcare

What is covered by PPO “Preferred Provider Organization”?

PPO insurance plans cover a wide network of participating doctors, hospitals, and facilities. You can use out-of-network benefits easily at additional costs. You may enjoy some additional benefits, including vision, dental, and hearing care.

How to enroll in an HMO or PPO plan?

- Call your State Health Insurance Assistance Program to check the availability of HMOs or PPOs in your area

- Check medicare.gov/plan-compare/ to compare between the different plans

- Check if you can enroll online and in this case, fill out the enrollment form using your Medicare number

- Call Medicare or the plan directly to enroll

- Contact us at 1-877-255-0284 and we will help you throughout the entire steps

Making your decision!

HMO or PPO? – Well, it depends!

Now, you probably know the Difference between PPO and HMO Health Insurance Plans, right?! HMO and PPO are both powerful plans of Medicare Advantage plan, offering major discounts on health plans to their subscribers. But, to choose the most convenient plan, you must understand the major differences first, which are the cost, size of network, out-of-network coverage, and ability to see healthcare specialists. Once you identify your condition and budget, you will be able to choose.

Choosing the right insurance plan will give you peace of mind. At Medicare ABC, our specialists are here to help you compare the plans and that’s a good place to start. We also teach all about the other Medicare Part C plans, including PFFS, SNP, and HMO-POS. Don’t hesitate and call us NOW!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

FAQs

What are (EPO and POS)?

EPO and POS are the less-known health insurance plans. EPO, also known as Exclusive Provider Organization, is much like HMO, offering in-network coverage for doctors and hospitals (except in emergencies). EPO is less flexible than PPO but offers lower much lower monthly premiums.

POS, also known as Point of Service, is some sort of hybrid plan, combining both HMO and PPO plans. Like HMO, you need a referral from PCP to see a specialist, and like PPO, you get out-of-network coverage at additional fees.

Do doctors prefer HMO or PPO?

When comparing, the PPO plan always wins. For many doctors, HMO plans pay poorly, encouraging them to go for PPO.

Is United Healthcare HMO or PPO?

United Health care offers extensive health programs to U.S citizens, including Medicare beneficiaries. So, yes, HMO and PPO (which are types of Medicare Advantage Plan) are provided by United Healthcare.