Are you turning 65 soon or are you already there? If so, you may be eligible for Medicare coverage. Understanding this complex healthcare system can be overwhelming, but fear not! We are here to guide you through the ins and outs of Medicare and help you make the most of your benefits.

Medicare is a federal health insurance program primarily for people aged 65 and older, but it also covers certain younger individuals with disabilities. It consists of different parts that cover hospital stays, medical services, prescription drugs, and more. Navigating these various components can be confusing, which is why it’s essential to have a solid grasp of how Medicare works.

Whether you’re a newcomer to Medicare or have been a beneficiary for some time, it’s crucial to understand the options available to you. Knowing the basics of Medicare coverage can help you make informed decisions about your healthcare and ensure that you receive the care you need.

Medicare is divided into four main parts: Parts A, B, C, and D. Part A covers hospital stays, skilled nursing care, hospice care, and some home healthcare services. Part B covers medical services such as doctor visits, outpatient care, and preventive services. Part C, also known as Medicare Advantage, offers an alternative way to receive your Medicare benefits through private insurance plans. Finally, Part D provides prescription drug coverage.

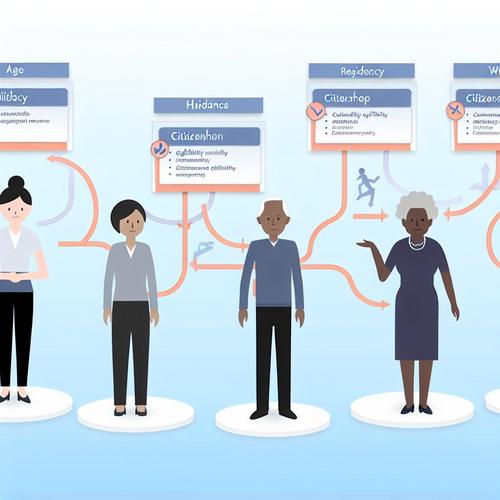

Understanding your Medicare eligibility is the first step in unlocking the benefits of this program. Whether you’re automatically enrolled or need to sign up, it’s essential to know when and how to take advantage of your Medicare coverage.

As you explore your Medicare options, keep in mind that each part of the program has different costs and coverage levels. Working with expert Medicare advisors can help you navigate these complexities and find the best plan for your needs. With their guidance, you can maximize your Medicare coverage and ensure that you have access to quality healthcare.

So, whether you’re preparing to enroll in Medicare for the first time or looking to switch plans, understanding your coverage is key. Our team of experienced advisors is here to help you make sense of the Medicare maze and find a plan that works for you.

Stay tuned for more insights on Medicare eligibility, benefits, and how to make the most of your coverage. With the right information and support, you can confidently navigate the world of Medicare and secure the healthcare you deserve.

Understanding Your Medicare Eligibility

Hey there! So, you’re probably wondering about your Medicare eligibility, right? Well, let me break it down for you in a simple and easy-to-understand way.

First things first, Medicare is a federal health insurance program for people who are 65 or older, as well as for certain younger individuals with disabilities. So, if you fall into one of these categories, you may be eligible for Medicare coverage.

Now, let’s talk about the different parts of Medicare. There’s Medicare Part A, which covers hospital stays, skilled nursing facility care, hospice care, and some home health care. Then, there’s Medicare Part B, which covers doctor visits, outpatient care, medical supplies, and preventive services.

You may also have heard about Medicare Part C, also known as Medicare Advantage, which is offered by private insurance companies approved by Medicare. This type of plan combines Parts A and B, and often includes prescription drug coverage as well.

Lastly, there’s Medicare Part D, which covers prescription drugs. This is an optional benefit that you can add to your original Medicare coverage, or you can get it through a Medicare Advantage plan that includes drug coverage.

Now, when it comes to your Medicare eligibility, it’s important to know that most people are automatically enrolled in Medicare Part A when they turn 65, if they’re already receiving Social Security benefits. However, you’ll need to sign up for Part B if you’re not receiving Social Security benefits yet, and there are certain enrollment periods to keep in mind.

Keep in mind that if you’re still working and have employer-sponsored health coverage, you may have different options when it comes to Medicare enrollment. It’s always a good idea to talk to an expert Medicare advisor to help you navigate through the process and make the best decision for your individual needs.

So, there you have it – a quick overview of Medicare eligibility and the different parts of Medicare. If you have any questions or need more information, don’t hesitate to reach out to our team of knowledgeable advisors who are here to help you every step of the way.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Understanding Your Medicare Eligibility

Hey there! Are you wondering if you’re eligible for Medicare coverage? Well, you’re in the right place because we’re here to help you navigate the ins and outs of Medicare eligibility.

First things first, let’s break it down. In general, you’re eligible for Medicare if you’re 65 years old or older. But what if you’re under 65? Don’t worry, you may still qualify for Medicare if you have certain disabilities or medical conditions, such as end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

Now, you might be thinking, “How do I know if I qualify?” That’s where our expert Medicare advisors come in. They can walk you through the eligibility requirements and help you determine if you meet the criteria for Medicare coverage.

But wait, there’s more! Did you know that even if you’re not a U.S. citizen, you may still be eligible for Medicare if you meet certain residency requirements? That’s right – Medicare isn’t just for American citizens. Our advisors can assist you in understanding these requirements and guide you through the process of enrolling in Medicare.

So, what are you waiting for? Reach out to our team of knowledgeable Medicare advisors to learn more about your eligibility for Medicare coverage. They’ll be happy to answer any questions you may have and provide you with personalized guidance to help you unlock your Medicare benefits.

Remember, understanding your Medicare eligibility is the first step towards accessing the healthcare coverage you deserve. Let our experts guide you through the process and make sure you’re on the right track to maximizing your Medicare benefits.

Don’t let confusion or uncertainty hold you back from getting the Medicare coverage you need. Contact us today to get started on your Medicare journey – we’re here to support you every step of the way!

How to Unlock Your Medicare Coverage with Our Advisors

So, you’ve reached the point where you’re ready to dive into the world of Medicare. Congratulations! This is a big step toward ensuring your health and well-being as you age. But, navigating the complex world of Medicare can be overwhelming, to say the least. That’s where our expert Medicare advisors come in to help guide you through the process and unlock all the coverage options available to you.

When you work with our team of experienced advisors, you can rest assured that you’re in good hands. We understand that every individual has unique healthcare needs, and we’re here to tailor our services to fit your specific situation. Whether you’re just turning 65 and becoming eligible for Medicare for the first time, or you’re looking to switch plans to better suit your changing needs, our advisors have the knowledge and expertise to help you navigate the process seamlessly.

One of the first steps in unlocking your Medicare coverage is to assess your current healthcare needs and budget. Our advisors will sit down with you to discuss your medical history, current medications, preferred doctors and hospitals, and any other factors that may impact your Medicare plan selection. By taking the time to understand your individual needs, we can help you choose a plan that not only meets your healthcare needs but also fits within your budget.

Next, our advisors will help you compare the different Medicare plans available to you. With so many options out there, it can be overwhelming to try and decipher which plan is the best fit for you. Our advisors will break down the differences between Original Medicare, Medicare Advantage, and Medicare Supplement plans, and help you understand the pros and cons of each. We’ll walk you through the various coverage options, costs, and provider networks so that you can make an informed decision about which plan is right for you.

Once you’ve chosen a Medicare plan, our advisors will assist you with the enrollment process. We’ll make sure that you understand the deadlines and requirements for enrolling in Medicare, and we’ll guide you through the application process step by step. Our goal is to make the enrollment process as smooth and stress-free as possible so that you can start enjoying the benefits of Medicare coverage without any unnecessary hassles.

At the end of the day, our advisors are here to make your transition to Medicare as seamless as possible. We’ll work with you every step of the way to ensure that you understand your coverage options, find the best plan for your needs, and enroll in Medicare with confidence. So, why wait? Unlock your Medicare coverage today with the help of our expert advisors!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Are you feeling overwhelmed by the countless Medicare plan options available? Let us help you navigate through the maze and find the best Medicare plan for your specific needs. Our team of expert advisors at Brand Medicare Advisors is here to guide you every step of the way.

Finding the Best Medicare Plan for Your Needs

When it comes to choosing a Medicare plan, it’s important to consider your individual healthcare needs and budget. With so many different options available, it can be challenging to determine which plan is the right fit for you. That’s where our advisors come in to simplify the process and help you make an informed decision.

Our team will take the time to understand your unique healthcare requirements and financial situation. We will analyze your prescription drug needs, preferred doctors and hospitals, and any additional coverage you may be looking for. By taking all of these factors into account, we can recommend a Medicare plan that meets your specific needs.

Comparing Different Medicare Plans

With our expertise and knowledge of the Medicare landscape, we will compare the various plan options available to you. Whether you’re interested in Original Medicare, Medicare Advantage, or a Medigap plan, we will provide you with a detailed comparison of the benefits, costs, and coverage options for each plan.

Our goal is to ensure that you have all the information you need to make an informed decision about your Medicare coverage. We will answer any questions you may have and provide guidance on choosing the plan that best suits your needs and preferences.

Personalized Recommendations

At Brand Medicare Advisors, we understand that every individual has unique healthcare needs. That’s why our advisors offer personalized recommendations tailored to your specific requirements. We will work closely with you to find a Medicare plan that provides comprehensive coverage at a price point that fits your budget.

By working with our team of expert advisors, you can rest assured that you are making the best choice for your Medicare coverage. We will empower you with the knowledge and resources you need to unlock the full potential of your Medicare benefits.

Don’t let the complexities of Medicare overwhelm you. Contact Brand Medicare Advisors today and let us help you find the best Medicare plan for your needs.

Finding the Best Medicare Plan for Your Needs

So, you’ve finally reached that golden age where you’re eligible for Medicare. Congratulations! Now comes the fun part – figuring out which Medicare plan is the best fit for your unique healthcare needs. Don’t worry, we’re here to help guide you through the process.

Choosing a Medicare plan can be overwhelming with all the options available, but fear not, our team of expert advisors are here to make the process as smooth as possible. We understand that everyone’s healthcare needs are different, which is why we take the time to get to know you and your specific requirements.

When it comes to finding the best Medicare plan for your needs, there are a few key factors to consider:

- Healthcare Coverage: Consider your current health status and any potential future health concerns. Do you have any specific medical conditions that require specialized care? Make sure the plan you choose provides coverage for the services you need.

- Prescription Drugs: If you take prescription medications regularly, it’s important to choose a plan that covers your specific medications at an affordable cost. Look for a plan with a comprehensive prescription drug coverage.

- Costs and Premiums: Evaluate your budget and determine how much you can afford to pay for Medicare coverage. Compare premiums, deductibles, and out-of-pocket costs to find a plan that fits within your financial means.

- Provider Network: Make sure the plan you choose includes your preferred healthcare providers in its network. If you have a specific doctor or hospital you prefer, check to see if they accept the plan you’re considering.

Once you’ve considered these factors, our team of Medicare advisors will work with you to compare different Medicare plans and help you choose the one that best meets your needs. We’ll break down the complex jargon and help you understand the fine print so you can make an informed decision.

Our goal is to ensure that you have the peace of mind knowing that you have the right Medicare coverage tailored to your individual needs. We’ll walk you through the process step by step, answering any questions you may have along the way.

Don’t let the overwhelming number of Medicare plans deter you from finding the perfect fit for your healthcare needs. With our expert guidance and support, we’ll help you navigate the Medicare maze and unlock the best plan for you.

So, sit back, relax, and let us do the heavy lifting. Finding the best Medicare plan for your needs doesn’t have to be a daunting task when you have the right team by your side.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Choose Brand Medicare Advisors

So, you’re on the hunt for the perfect Medicare plan. With so many options out there, it can feel overwhelming trying to navigate through the complex world of healthcare coverage. That’s where Brand Medicare Advisors come in – your trusted partners in finding the best Medicare plan tailored to your unique needs.

But why should you choose Brand Medicare Advisors over other options? Here are a few reasons why we stand out:

1. Expertise and Experience

Our team of knowledgeable advisors has years of experience in the healthcare industry. We know the ins and outs of Medicare coverage, and we stay up-to-date on the latest changes and updates. When you work with us, you can trust that you’re in good hands.

2. Personalized Service

At Brand Medicare Advisors, we understand that one size does not fit all when it comes to healthcare. That’s why we take the time to get to know you and your specific needs. Whether you have a pre-existing condition, are looking for prescription drug coverage, or simply want to maximize your benefits, we’ll tailor a plan that works for you.

3. Simplified Process

We know that the world of healthcare can be confusing. That’s why we’re here to simplify the process for you. Our advisors will walk you through each step, explaining your options in a clear and understandable way. We’ll take the guesswork out of choosing a Medicare plan and make the process as smooth as possible.

4. Ongoing Support

Our relationship doesn’t end once you’ve chosen a Medicare plan. We’re here for you every step of the way, providing ongoing support and assistance. Whether you have questions about your coverage, need help with a claim, or simply want to review your options, we’re just a phone call away.

5. Peace of Mind

Choosing a Medicare plan is a big decision, and it’s natural to feel overwhelmed. But with Brand Medicare Advisors by your side, you can rest easy knowing that you have a dedicated team supporting you every step of the way. We’ll handle the details so you can focus on what’s important – your health and well-being.

So, why settle for anything less than the best when it comes to your healthcare coverage? Choose Brand Medicare Advisors and experience the difference that personalized service and expertise can make. Get in touch with us today and take the first step towards unlocking the perfect Medicare plan for you.