What Medicare Advantage Plans Does Humana Offer? Medicare Advantage (Medicare Part C) is another way to obtain original health insurance benefits, Parts A and B Medicare Advantage plans cover everything that original health insurance covers (plus hospital care, but still covered by Part A). They are available in Medicare approved private insurance companies such as Humana. Many of Humana’s Medicare Advantage plans offer coverage beyond Part A and Part B benefits to help you manage your health care costs. For example, Humana’s Medicare Advantage plans usually include part d prescription drug coverage.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Humana also offers health plans that you can add to your Humana Medicare Advantage plans. These additional plans may include benefits such as vision and routine dental care or fitness programs. The availability of these additional benefits may vary.

If you are looking at your health plan options, you can consider one of Humana’s Medicare Advantage plans available in your area of service. Please note that not all Humana Medicare Advantage packages may be available in all regions, and rewards and plan details may vary depending on where you live.

What types of Medicare Advantage plans are available from Humana?

Humana is a private insurance company that has entered into a contract with Medicare to offer benefits to its members. Here are some of the types of Medicare Advantage plans offers Humana, but again, not all types of plans may be available where you live.

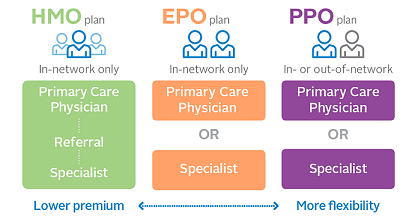

- Health Maintenance Organization (HMO) Plan Advantage of human health insurance. HMO plans typically offer more predictable health care expenses than other Humana Medicare Advantage plans, but you usually need to get all of your routine health care from network providers (however, the necessary emergency care is covered even if you receive this care outside the network, however). A primary care provider you select from the plan network monitors your care and may need a referral to consult a specialist. The HMO Humana Gold Plus plan includes part d prescription drug coverage. Direct costs can be lower with an HMO than for other types of Medicare Advantage plans.

- Preferred Provider Organization Plans (OPP) Advantage of Human Health Insurance (OPP) *. APPs are more flexible than HMOs; you can see any provider who accepts health insurance and agrees to bill for the plan, and you don’t need to choose a primary care provider. Many HumanaShop PPO encourage you to use providers in your plan’s network by offering lower health care costs when you stay on the network. In many cases, you also get part d prescription drug coverage with PPO. OPPs offer a balance between flexibility and cost reduction at the expense.

- Humana Medicare Advantage Private Paid Packages (FFP). Humana Gold Choice PFFS plans allow you to consult any provider that accepts health insurance and plan terms, giving you maximum flexibility, especially if you travel frequently. Some PPHS plans have networks, and you can save money by using a provider within the plan’s network. Many PPHS plans offer medicare part d prescription coverage in addition to all the benefits of the original medicare plan (with the exception of palliative care, which is still covered by Part A of medicare). It is important to note that not all providers will accept the terms of payment under the Medicare Advantage PFFS plan, even though they generally accept the allocation of medicare. You can ask if the provider agrees to these terms before receiving treatment, in order to avoid any financial liability for the total cost of your care.

- You must continue to pay your Part B premium when you are enrolled in a Medicare Advantage plan (from Humana or an insurance company) plus any additional monthly premiums required by your plan. Co-countries, co-insurance amounts, deductibles and premiums may vary depending on the type of plan and where they are located.

Read More: Difference between PPO and HMO Health Insurance Plans

Can I get routine vision or dental care with a Medicare Advantage plan from Humana?

Some Humana Medicare Advantage plans include coverage for common dental and vision services, such as cleanings and annual examinations. Humana also offers optional additional benefits that can be added to your Humana Medicare Advantage plan at any time of the year in most cases. Humana offers several different additional benefits plans, although these plans can only be added to some Humana Medicare Advantage plans and availability may vary:

- Humana MyOptionsm dental plans cover 100% of routine care in the network, plus partial coverage for major dental services — the amount of coverage depends on the Humana MyOptionSM Dental plan you subscribe to. Limits on annual benefits may apply.

- Humana MyOptionSM Vision plans cover a free routine annual eye exam if you go to an EyEMed Select network provider. Plans provide partial coverage of prescription lenses and frames, or contact lenses.

- Human MyOptionSM Fitness Plans, which include the Silver Sneakers program. This program gives you access to fitness classes and exercise equipment (details vary according to plan).

Again, not all additional benefit options may be offered in all areas or combined with each type of Humana Medicare Advantage plan. There may be an additional bonus for any optional benefits package you select. You can compare Humana Medicare Advantage plans in your community whenever you want, just fill in your postal code where it is listed at the top of this page.

*Off-grid or non-contractual suppliers are not required to treat Preferred Supplier Organization (OPP) plan members except in cases of emergency. To decide whether we will cover an off-grid service, we recommend that you, or your provider, ask us for a prior decision from the organization before receiving the service. Please call our customer service number or consult your Proof of Coverage for more information, including cost-sharing that applies to off-grid services.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and an independent medicare part d prescription plan with Medicare contract. Registration for a Humana Medicare plan depends on the renewal of the contract. This information is not a complete description of the benefits. Contact the plan for more information. Limitations, co-payments and restrictions may apply. Participant benefits, premiums and/or cost-sharing] may vary on January 1 of each year.

You must continue to pay the Health Insurance Part B premium.

The [Form, Pharmacy Network and/or Supplier Network] may change at any time. You will receive a notification if necessary.

Humana’s pharmacy network offers limited access to preferential cost-sharing pharmacies in urban areas of < AL, CA, CT, DC, DE, IA, IL, IN, KY, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NH, NY, OH, OR, PA, RI, SC, SD, TN, VA, VT, WA, WI, WV; AZ CT, DE, HI, HE, MA, MD, ME, MI, MN, MO, MT, NH, NH, NJ, NY, OH, GOLD, PA, PR, RI, VT, WA, WV “WV”; and < AK, IA, MN, MT, ND, NE, SD, VT, WY > rural areas. The < ND >extremely limited number of preferred cost-sharing pharmacies in urban areas in the following states:; < DE, MA, MD, ME, MI, MN, MS, ND, NY, OH, SC, and VT> suburban areas of < MT and ND > : and rural areas: the lower costs announced in our documentation plan for these pharmacies are not available at pharmacy you use. For up-to-date information about pharmacies in our network, including pharmacies with a preferred cost sharing, please call <1-800-281-6918 (TTY: 711) > Customer Service or consult the online pharmacy directory at Humana.com.

Humana MyOption Optional Additional Benefits (OSB) are available only to members of certain Humana Medicare Advantage (MA) plans. Members of Humana plans offered by the OSB can register with the OSB throughout the year. Benefits may change on January 1 of each year.

This website and its content are for informational purposes only. Nothing on the site should ever be used as a substitute for professional medical advice. You should always consult your doctor about the diagnosis or treatment of a health problem, including decisions about the right medication for your condition, as well as before performing a specific exercise or eating routine.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Read More: