Medicare eligibility can be a confusing and overwhelming topic for many individuals. It’s essential to understand the requirements and qualifications to ensure you are making informed decisions about your healthcare coverage. Let’s break down the basics of Medicare eligibility so you can navigate this process with confidence and clarity.

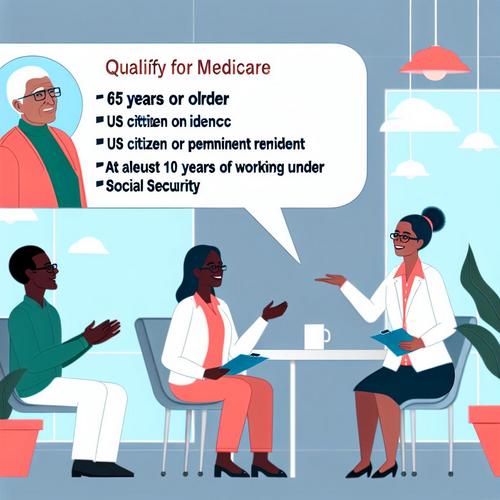

First and foremost, you must be a U.S. citizen or a legal permanent resident of at least five continuous years to qualify for Medicare. This is a fundamental requirement that sets the foundation for your eligibility status. Additionally, you need to be 65 years old or older to enroll in Medicare, unless you have a qualifying disability or medical condition that allows you to access Medicare benefits earlier.

Understanding the various parts of Medicare, such as Part A (hospital insurance) and Part B (medical insurance), is crucial in determining your eligibility for specific coverage options. Each part plays a vital role in providing comprehensive healthcare benefits, so it’s essential to assess your individual needs and circumstances to determine the appropriate coverage for you.

If you have worked and paid Medicare taxes for at least ten years, you are generally eligible for premium-free Part A coverage. However, if you do not meet this requirement, you may still be eligible for Medicare by paying a premium for Part A coverage.

It’s important to note that Medicare eligibility can vary based on certain medical conditions or disabilities. Individuals with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) may qualify for Medicare regardless of age. These exceptions highlight the flexibility and inclusivity of the Medicare program to accommodate individuals with unique healthcare needs.

Navigating the intricacies of Medicare eligibility can be challenging, which is why seeking guidance from experts in the field is highly recommended. Medicare advisors have the knowledge and experience to help you understand the nuances of Medicare eligibility and assist you in making informed decisions about your healthcare coverage.

By working with Medicare advisors, you can gain valuable insights and personalized recommendations tailored to your specific circumstances. Whether you are approaching retirement age or dealing with a medical condition that requires immediate attention, Medicare advisors can provide the guidance and support you need to unlock your Medicare eligibility.

In conclusion, understanding Medicare eligibility is essential for securing the healthcare coverage you need as you age. By familiarizing yourself with the requirements and qualifications for Medicare, you can make informed decisions about your healthcare options and ensure you have access to the necessary benefits. Remember, reaching out to Medicare advisors for expert guidance can make the process smoother and more manageable. Don’t hesitate to seek assistance and explore your Medicare eligibility today!

Why You Need Expert Guidance from Medicare Advisors

Hey there! Are you feeling a little overwhelmed by the whole Medicare process? Don’t worry, you’re not alone. Navigating the world of Medicare eligibility and choosing the right plan can be confusing and stressful. That’s where Medicare advisors come in to save the day!

Medicare advisors are like your personal guides through the maze of Medicare options. They are experts in the field, with a wealth of knowledge about all things Medicare. Whether you’re just turning 65 and becoming eligible for Medicare for the first time, or you’re looking to switch plans during the annual enrollment period, Medicare advisors are your go-to resource for guidance and support.

So, why do you need expert guidance from Medicare advisors? Here are a few reasons:

- Complexity: Let’s face it, Medicare can be complicated. With different parts, plans, and coverage options, it’s easy to get lost in the details. Medicare advisors can break down the information for you in a way that’s easy to understand, so you can make informed decisions about your healthcare.

- Personalized Recommendations: Everyone’s healthcare needs are different. Medicare advisors can assess your individual situation and help you find a plan that fits your specific needs and budget. They’ll take the time to listen to your concerns and preferences, ensuring that you get the coverage that’s right for you.

- Save Time and Effort: Researching Medicare plans on your own can be time-consuming and overwhelming. With the help of Medicare advisors, you can streamline the process and get personalized recommendations without all the hassle. They’ll do the legwork for you, so you can focus on what matters most – your health.

By working with Medicare advisors, you can feel confident knowing that you have a trusted partner by your side, guiding you every step of the way. They’ll help you navigate the Medicare landscape with ease, answering your questions and providing expert advice along the way.

Remember, when it comes to Medicare, knowledge is power. By seeking guidance from Medicare advisors, you can make informed decisions about your healthcare and ensure that you have the coverage you need to stay healthy and happy.

So, if you’re feeling lost in the world of Medicare, don’t hesitate to reach out to Medicare advisors for expert guidance and support. They’re here to help you unlock your Medicare eligibility and find the best plan for your needs. Trust me, you’ll be glad you did!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Hey there! So, you may be wondering why you need expert guidance from Medicare advisors, right? Well, let me break it down for you in a friendly and engaging way.

When it comes to navigating the world of Medicare, it can be a bit overwhelming. There are so many options, plans, and rules to consider. That’s where Medicare advisors come in to save the day!

Medicare advisors are like your personal tour guides through the Medicare maze. They have the knowledge and expertise to help you understand all the ins and outs of Medicare eligibility and coverage options. Plus, they can tailor their advice to suit your unique needs and preferences.

So, what are the benefits of working with Medicare advisors?

- Expertise: Medicare advisors are trained professionals who specialize in Medicare. They know the system inside and out, so you can trust their advice.

- Personalized Guidance: Everyone’s health and financial situation is different. Medicare advisors can help you find a plan that fits your specific needs and budget.

- Saves Time and Effort: Researching Medicare options on your own can be time-consuming and confusing. Medicare advisors make the process easy and stress-free.

- Maximize Benefits: Medicare advisors can help you make the most of your Medicare benefits and ensure you’re getting the coverage you deserve.

With all these benefits, it’s clear that working with Medicare advisors is a smart move. They can help you unlock your Medicare eligibility and find the best plan for your needs. So why go it alone when you can have expert guidance by your side?

Next time you’re feeling lost or confused about Medicare, remember that Medicare advisors are here to help. They’ll guide you through the process with ease and expertise, so you can make informed decisions about your healthcare coverage.

Don’t hesitate to reach out to Medicare advisors for personalized assistance. They’re just a phone call or email away, ready to answer all your questions and provide the support you need. Trust me, you’ll be glad you did!

So, you’re ready to unlock your Medicare eligibility and make the most of your healthcare options. That’s where Medicare Advisors come in! These knowledgeable professionals are here to guide you through the process and help you find the best plan for your needs.

How Medicare Advisors Can Help Unlock Your Medicare Eligibility

When it comes to navigating the complexities of Medicare eligibility, having an expert by your side can make all the difference. Medicare Advisors are well-versed in the ins and outs of Medicare, so they can help you understand the eligibility requirements and determine if you qualify for coverage.

Whether you’re turning 65 and becoming eligible for Medicare for the first time, or you have a qualifying disability that makes you eligible for Medicare before age 65, Medicare Advisors can help you figure out which parts of Medicare you’re eligible for and how to enroll in the right plan.

Medicare Advisors are up-to-date on the latest rules and regulations surrounding Medicare eligibility, so they can provide you with accurate information and help you avoid any pitfalls that could delay or complicate the enrollment process.

The Benefits of Working with Medicare Advisors

- Personalized Guidance: Medicare Advisors can provide you with personalized guidance tailored to your specific needs and circumstances.

- Expert Advice: With their in-depth knowledge of Medicare, Medicare Advisors can offer expert advice and answer any questions you may have.

- Save Time and Effort: Navigating Medicare eligibility on your own can be time-consuming and confusing. By working with a Medicare Advisor, you can save time and effort.

- Peace of Mind: Knowing that you have a knowledgeable professional on your side can give you peace of mind as you navigate the Medicare enrollment process.

So, if you’re ready to unlock your Medicare eligibility and find the best plan for your needs, don’t hesitate to reach out to Medicare Advisors for assistance. They can help simplify the process and ensure that you get the coverage you deserve.

Stay informed and make the most of your Medicare eligibility with the help of Medicare Advisors. Don’t navigate the complexities of Medicare alone – enlist the expertise of Medicare Advisors today!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Welcome back! Let’s dive into finding the best Medicare plan for your needs with the help of Medicare Advisors. Navigating the world of Medicare can be overwhelming, but with the guidance of experts, you can find a plan that fits your unique situation perfectly.

How Medicare Advisors Can Help

Medicare Advisors are knowledgeable professionals who specialize in helping individuals like you understand and choose the right Medicare plan. They have the expertise and experience to guide you through the complex process of selecting a plan that meets your specific healthcare needs.

Personalized Assistance

One of the key benefits of working with Medicare Advisors is that they offer personalized assistance tailored to your individual circumstances. They take the time to understand your healthcare needs, budget, and preferences in order to recommend the best plan for you.

- Medicare Advisors can help you compare different plans and coverage options to find one that aligns with your healthcare needs.

- They can provide valuable insights on the costs associated with each plan, helping you make an informed decision that suits your budget.

- Medicare Advisors can also assist you in understanding the benefits and limitations of each plan, ensuring you have all the information you need to make the right choice.

Expert Guidance

Working with Medicare Advisors gives you access to expert guidance and support throughout the entire process. They can answer your questions, address your concerns, and provide you with the information you need to make confident decisions about your healthcare coverage.

By leveraging their expertise, you can rest assured that you are making a well-informed decision that is in your best interest. Medicare Advisors have a deep understanding of the Medicare system and can help you navigate the complexities of choosing a plan with ease.

Peace of Mind

Choosing a Medicare plan is a significant decision that can have a lasting impact on your healthcare and financial well-being. With the help of Medicare Advisors, you can have peace of mind knowing that you have made the right choice for your healthcare needs.

They will guide you through the process, answer your questions, and provide you with the support you need to make the best decision for your situation. With their assistance, you can feel confident that you are on the right track to finding a Medicare plan that meets your needs and gives you the coverage you deserve.

Don’t hesitate to reach out to Medicare Advisors for personalized assistance in finding the best Medicare plan for your needs. They are here to help you every step of the way, ensuring you have the support and guidance you need to make an informed decision about your healthcare coverage.

How Medicare Advisors Make the Enrollment Process Easy

So, you’ve learned about Medicare eligibility and you’re ready to take the next step – enrolling in a Medicare plan. But the enrollment process can seem daunting and overwhelming, with so many options and decisions to make. This is where Medicare advisors come in to make your life easier!

Medicare advisors are like your personal guides through the maze of Medicare plans and options. They have the expertise and knowledge to help you navigate through the enrollment process smoothly and efficiently. Here’s how they can make the process easy for you:

- Expert Guidance: Medicare advisors are trained professionals who understand the ins and outs of the Medicare system. They can provide you with expert guidance on the different types of Medicare plans available, helping you make an informed decision based on your unique needs and circumstances.

- Personalized Recommendations: Medicare advisors can assess your individual healthcare needs and recommend the best Medicare plan for you. They take into account factors like your budget, health conditions, and prescription medication requirements to find a plan that suits you best.

- Save Time and Effort: With a Medicare advisor by your side, you don’t have to spend hours researching and comparing different Medicare plans on your own. They do all the legwork for you, saving you time and effort so you can focus on other important things in your life.

- Answer Your Questions: Medicare advisors are there to answer all your questions and address any concerns you may have about Medicare plans. They can explain complex insurance terms in simple language and help you understand the benefits and coverage of each plan.

- Assistance with Paperwork: Enrolling in a Medicare plan involves a lot of paperwork and documentation. Medicare advisors can help you fill out the necessary forms and ensure that everything is submitted correctly and on time, reducing the chances of any delays or errors.

Enrolling in a Medicare plan is a significant decision that can greatly impact your healthcare and financial well-being. With the help of Medicare advisors, you can make this process stress-free and hassle-free. They are there to support you every step of the way, from selecting the right plan to completing the enrollment paperwork.

So, if you want to make the enrollment process easy and smooth, don’t hesitate to reach out to Medicare advisors. Their expertise and guidance can make a world of difference in finding the best Medicare plan for your needs. Contact them today and take the first step towards securing your healthcare coverage for the future!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Contact Medicare Advisors Today for Personalized Assistance

Are you feeling overwhelmed or confused about navigating the complex world of Medicare? Do you find yourself unsure of where to turn for reliable and trustworthy guidance? Look no further! Medicare Advisors are here to offer you personalized assistance and support every step of the way.

Our team of experienced and knowledgeable advisors are dedicated to helping you understand your Medicare options and find the best plan to suit your unique needs. We understand that the Medicare enrollment process can be daunting, but with our expert guidance, you can rest assured that you are in good hands.

When you contact Medicare Advisors, you can expect to receive personalized attention tailored to your specific situation. We take the time to listen to your concerns, answer any questions you may have, and provide you with clear and concise information to help you make informed decisions about your healthcare coverage.

Whether you are new to Medicare or looking to make changes to your current plan, our advisors are here to assist you every step of the way. We will work with you to identify your healthcare needs, explore your options, and find the best plan that fits your budget and lifestyle.

One of the key benefits of working with Medicare Advisors is that we have access to a wide range of Medicare plans from top insurance providers. This means that we can help you compare different options, understand the benefits and costs of each plan, and ultimately choose the one that best meets your needs.

Furthermore, our advisors stay up-to-date on the latest changes and updates to Medicare regulations, so you can trust that you are receiving the most current and accurate information available. We are here to demystify the Medicare process and simplify the enrollment process for you.

Don’t let the complexities of Medicare overwhelm you. Contact Medicare Advisors today to take the first step towards securing the healthcare coverage you deserve. Our friendly and professional team is here to guide you through the process and ensure that you have peace of mind knowing that your healthcare needs are taken care of.

So why wait? Reach out to Medicare Advisors today and let us help you unlock your Medicare eligibility and find the best plan for your needs. With our personalized assistance, you can navigate the world of Medicare with confidence and ease. Your health and well-being are our top priority, and we are here to support you every step of the way.