Introduction to Aetna Medicare Advantage Plans

Welcome to Your New Healthcare Chapter

Are you nearing the age of 65 or managing a disability and feeling overwhelmed by the myriad of healthcare options available to you? You’re not alone. At Medicare Advisors Insurance Group LLC, we understand that stepping into the world of Medicare can seem daunting. But what if there was a way to not only simplify this journey but also enhance your quality of life?

Enter Aetna Medicare Advantage plans.

Henry Beltran, the visionary leader of our group, often shares an insight that resonates deeply with many: “Choosing the right Medicare Advantage plan isn’t just about medical coverage—it’s about securing a happier healthier future.” This isn’t just talk. At Aetna, the focus is on crafting plans that fit like a glove to your personal healthcare needs, providing peace of mind and comprehensive benefits.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Consider Medicare Advantage?

Medicare Advantage plans or Part C as its known formally go beyond the basic coverage of Original Medicare offering a basket of additional benefits. Have you ever imagined a healthcare plan that not only looks after your medical needs but also covers dental vision and hearing care? What if this plan could also offer wellness programs designed specifically for seniors and people with disabilities?

Imagine More – Get More

- Dental Coverage: Regular check-ups that keep those pearly whites shining.

- Vision Care: From glasses to eye exams your eyesight is in expert hands.

- Hearing Services: Comprehensive hearing aids and tests because every conversation matters.

With Aetna Medicare Advantage the idea is simple: more coverage more services more peace of mind. And who wouldn’t want that?

The Emotional Touch

When you choose an Aetna Medicare Advantage plan you’re not just a policy number; you’re part of a community that cares. Imagine a service that not only knows your healthcare needs but anticipates them. From helping you manage chronic conditions to providing 24/7 access to healthcare professionals via telehealth services Aetna is by your side.

Henry often says “Our clients aren’t just looking for healthcare; they’re looking for a way to continue enjoying life without the heavy burden of medical worries.” And indeed many of our clients find just that – a partner in Aetna.

Why Wait?

Now imagine a day without health worries where you are free to enjoy life’s simple pleasures all because your healthcare plan has got you covered comprehensively. That’s the promise of Aetna Medicare Advantage. Ready to take the next step towards a worry-free healthy future?

Understanding Aetna Medicare Advantage

What Is Aetna Medicare Advantage?

As we navigate through the sea of healthcare options, Aetna Medicare Advantage stands out as a beacon for those seeking more than just basic coverage. But what exactly is it? In essence, Medicare Advantage plans, also known as Part C, are an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies like Aetna and are approved by Medicare.

Key Features of Aetna Medicare Advantage

- Comprehensive Coverage: Combines Part A (hospital insurance), Part B (medical insurance), and often Part D (prescription drug coverage).

- Additional Benefits: Includes services not covered by Original Medicare such as dental, vision, and hearing aids.

- Personalized Plan Options: Offers a variety of plans tailored to different health needs and budgets.

Who Offers These Plans?

Medicare Advantage plans are offered by private insurers who have a contract with Medicare. Aetna, one of the leading providers, has built a reputation for comprehensive plans that cater specifically to the needs of seniors and people with disabilities.

How Does It Compare to Traditional Medicare?

Here’s where it gets interesting. While Traditional Medicare covers many health care costs, it typically does not cover all expenses. For instance:

- Traditional Medicare: You get basic health coverage but still pay for deductibles, copayments, and other fees.

- Medicare Advantage: Most plans cover these extra costs and offer additional benefits. However, you’re usually restricted to a network of doctors and facilities.

Potential Drawback: If you love visiting a doctor who’s as popular as your favorite café and he’s not in the network, you might need to switch to someone less known—think of it as trying a new coffee blend; you might be pleasantly surprised.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Choose Aetna’s Plans?

Choosing a Medicare Advantage plan from Aetna isn’t just about health insurance. It’s about choosing a partner in your health journey. As Henry Beltran says, “At Aetna, we don’t just cover you; we care for you.” This commitment to care is evident in how Aetna designs its plans around the needs of its members, particularly those who require a bit more from their healthcare provider.

Benefits That Matter

Let’s break down why these benefits can be a game-changer:

- Dental Coverage: Because every smile matters and so does having the freedom to enjoy apples or a steak without second thoughts.

- Vision Care: See the world more clearly, whether it’s reading the fine print in your favorite book or spotting a friend across the park.

- Hearing Services: Never miss another word in conversations or whispers from your grandchildren.

Funny Aside: Just remember, while Aetna covers hearing aids, it can’t make your grandkids speak any less fast!

Rethink Your Medicare Choices

With Aetna Medicare Advantage, you’re not just signing up for a health plan—you’re choosing a pathway to a healthier, fuller life. Are you ready to step up your health care game and live your golden years with fewer worries and more laughter?

Tailored Benefits of Aetna Medicare Advantage for Seniors and People with Disabilities

More Than Just Medical Coverage

When choosing a Medicare Advantage plan, it’s crucial to consider how a plan caters specifically to your lifestyle and health needs. Aetna Medicare Advantage goes beyond the basics, offering benefits that impact everyday life, especially for seniors and people with disabilities. But what exactly makes these plans stand out?

Comprehensive Benefits Designed for You

Key Benefits of Aetna Medicare Advantage

- Dental Coverage: Keep your smile bright without worrying about the costs of dental care.

- Vision Care: From glasses to eye exams, ensure your vision is at its best.

- Hearing Services: High-quality hearing aids and tests are readily accessible.

These are more than just perks; they’re essential components of your well-being.

Why These Benefits Matter

Imagine maintaining your health without these additional benefits. Sure, you’d survive, but it’s like using a flip phone in a smartphone era — not quite the best tool for the job!

Highlighted Drawback: While these added benefits are fantastic, remember, they are tied to specific networks. So, if you’re the type who prefers seeing any specialist across the country, you might find this a bit limiting. Think of it as having a VIP pass but only to certain venues.

Catering to Specific Needs

Aetna understands that each individual’s health needs are unique, particularly for those managing chronic conditions or disabilities. That’s why they offer:

- Wellness Programs: Tailored programs that support your ongoing health and wellness goals.

- Telehealth Services: Access to healthcare professionals from the comfort of your home.

Humorous Twist: With telehealth, you can discuss your symptoms with a doctor while still in your pajamas. Talk about a modern house call!

Going Beyond the Standard

It’s not just about handling today’s needs but also preparing for what might come. As Henry Beltran, our leader, wisely puts it, “We’re not just planning for today. We’re securing your health for tomorrow.” This forward-thinking approach is why many choose Aetna Medicare Advantage.

Are You Getting All You Deserve?

Here’s a quick checklist to consider:

- Are your current medical and wellness needs fully met?

- Do you have access to the specialized services you need?

- Is there more you could be getting from your Medicare plan?

Remember: Choosing a plan is about finding the perfect balance between coverage, convenience, and cost.

Comparing Aetna Medicare Advantage Plans: Finding Your Perfect Fit

Choosing the Right Plan for You

When it comes to selecting a Medicare Advantage plan, think of it like picking out a new car. You want one that’s not only reliable and comfortable but also fits your lifestyle and budget. With Aetna Medicare Advantage, you have options aplenty, but how do you determine which plan is the chauffeur to your health journey’s luxury vehicle?

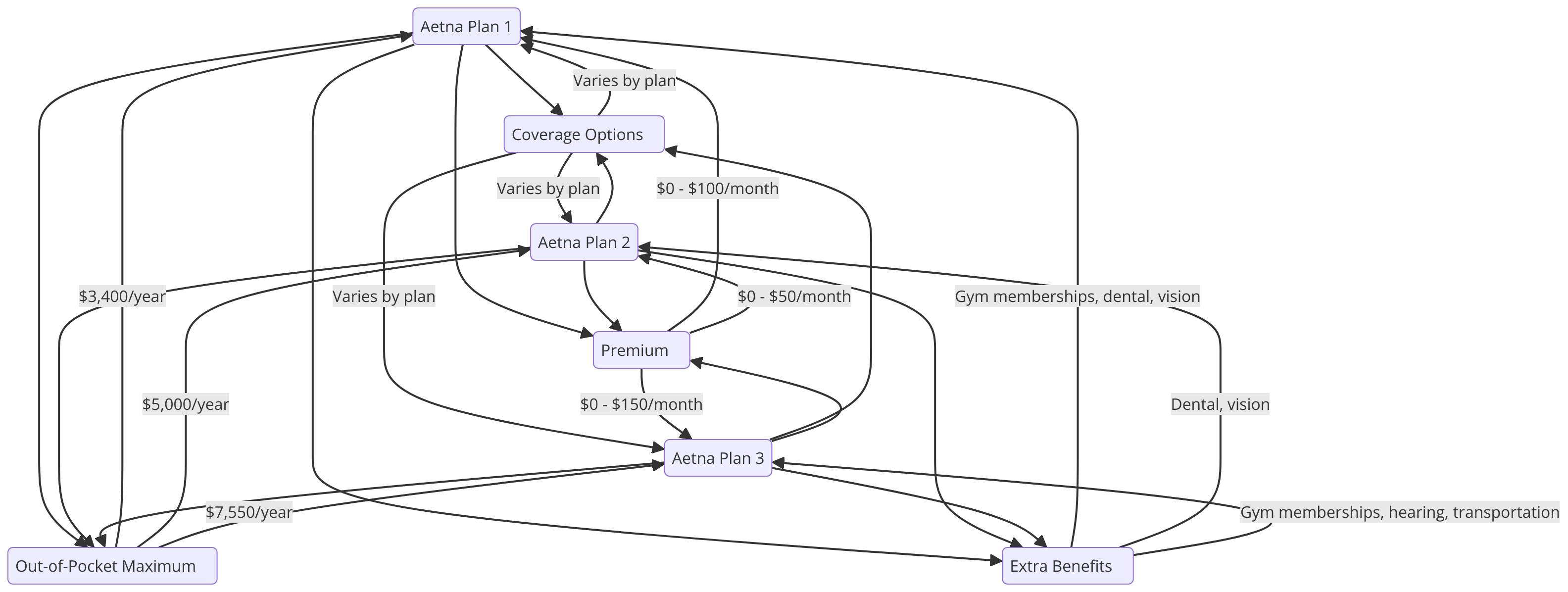

Overview of Aetna’s Plan Options

Aetna offers a variety of Medicare Advantage plans, each designed to meet different health needs and financial situations. Let’s break down these options to help you steer in the right direction:

Key Plan Types

- HMO Plans: High coordination among your healthcare providers ensures you receive comprehensive care.

- Plus: Lower out-of-pocket costs.

- Minus: You need to stick to your network, so no off-roading with out-of-network doctors.

- PPO Plans: More flexibility with a broader network of providers.

- Plus: Freedom to visit any doctor that accepts Medicare.

- Minus: Typically comes with higher premiums. Think of it as paying extra for premium gas.

- Special Needs Plans (SNPs): Tailored for individuals with specific diseases or characteristics.

- Plus: Customized care for specific conditions.

- Minus: Eligibility requirements are strict, akin to a members-only club.

What Should You Consider When Choosing?

Choosing the right Aetna Medicare Advantage plan involves weighing several factors:

- Healthcare Needs: Are you looking for basic coverage or something more comprehensive due to chronic health issues?

- Budget: How much are you willing to spend monthly on premiums?

- Doctor and Facility Preferences: Do you have specific doctors or hospitals you prefer to visit?

Decision-Making Tips

- List Your Must-Haves: Like choosing a car with must-have features, list what you absolutely need in a healthcare plan.

- Consider Future Health Needs: Just as a car needs to perform well into the future, choose a plan that can handle potential health changes.

- Consult with an Advisor: Sometimes, you need a co-pilot. Talk to a Medicare advisor to help navigate the options.

Humorous Twist: Just remember, while choosing a plan might feel like trying to solve a Rubik’s cube blindfolded, with the right information, you’ll find it’s more like fitting the last puzzle piece perfectly in place.

Why It Matters

Henry Beltran, owner of Medicare Advisors Insurance Group LLC, often highlights, “The right Medicare Advantage plan can change your life. It’s about finding a balance between coverage, cost, and care.” Your choice affects not only your health and wallet but also your peace of mind.

How to Enroll in Aetna Medicare Advantage: A Step-by-Step Guide

Navigating Your Way to Enrollment

Embarking on the journey to enroll in an Aetna Medicare Advantage plan can feel a bit like starting a new adventure—exciting yet a tad overwhelming. Fear not! We’re here to guide you through the forest of paperwork and timelines with ease. Think of us as your GPS to Medicare enrollment.

Step-by-Step Enrollment Process

Navigating the enrollment process requires understanding the key steps and timelines involved. Let’s simplify it:

1. Check Your Eligibility

- Who’s Eligible? Generally, if you’re 65 or older, or under 65 with certain disabilities, and you’re already enrolled in Medicare Part A and Part B, you’re in the club!

- Humorous Twist: Eligibility isn’t like trying to get into a trendy nightclub—it’s more straightforward!

2. Understand the Enrollment Periods

- Initial Enrollment Period (IEP): This is when you first become eligible for Medicare. It lasts 7 months, starting 3 months before your 65th birthday and ending 3 months after.

- Annual Election Period (AEP): From October 15 to December 7 each year. This is the time to jump ship from Original Medicare to a Medicare Advantage plan or switch between plans.

- Special Enrollment Periods (SEP): For life changes like moving or losing current coverage. The rules here are as flexible as yoga instructors, so take advantage if life throws you a curveball!

3. Choose Your Plan

- What to Consider: Look at factors like out-of-pocket costs, provider networks, and additional benefits. Don’t just look at the shiny brochure—dig deeper!

- Decision Tip: Think of picking a plan like choosing a new car. It might look great from the outside, but you need to check under the hood!

4. Enroll

- How to Enroll: You can enroll through the Aetna website, over the phone, or even in person through a licensed insurance agent.

- Keep in Mind: Double-check your application before submitting. A typo might not just be embarrassing; it could delay your coverage!

5. Confirmation and Next Steps

- What Happens After Enrollment? You’ll receive a confirmation and your new Aetna Medicare Advantage card.

- Start Date: Coverage usually starts on the first day of the month after you sign up.

Quote from Henry Beltran: “Taking the first step towards enrolling in Medicare Advantage is like setting sail on a voyage towards better health. We’re here to make sure you have all the right navigational tools.”

Real Stories from Real People: The Impact of Aetna Medicare Advantage

Every Story Matters

At Medicare Advisors Insurance Group LLC, we believe that behind every policy is a person with a story. Choosing the right Medicare Advantage plan can seem like a daunting decision, but sometimes, hearing firsthand experiences can make all the difference. Here, we share real-life testimonials from Aetna Medicare Advantage members who found not just coverage but care and community.

Hear From Our Members

The Stories That Define Us

- John’s Journey with Diabetes Management

- Challenge: Managing diabetes with regular Medicare was a balancing act.

- Solution: Aetna’s SNP plan tailored for diabetic care.

- Outcome: Better health monitoring, less stress about costs.

- John’s Words: “It’s like having a safety net. I know Aetna’s got my back, which lets me focus on living my life, not just my condition.”

- Susan’s Sight-Saving Story

- Challenge: Susan needed frequent eye exams and feared losing her sight.

- Solution: Comprehensive vision benefits under her Aetna plan.

- Outcome: Regular screenings, early detection of potential issues.

- Susan’s Reflection: “Seeing clearly is a gift that my Aetna plan helps me keep.”

- Mark’s Move to Better Mobility

- Challenge: Mark’s mobility issues were limiting his independence.

- Solution: Access to physical therapy and specialized equipment through Aetna.

- Outcome: Improved mobility, enhanced quality of life.

- Mark’s Thoughts: “Thanks to Aetna, every step I take feels steadier and more confident.”

Why These Stories Matter

Vivid Imagery: Imagine the relief and joy these members felt, knowing their health is supported at every turn. It’s like finding an umbrella in a downpour—a simple tool, but oh so crucial when you need it.

Drawbacks? Sure, not every plan is a perfect fit out of the box. Like finding an old hat that doesn’t quite fit anymore, sometimes adjustments are necessary. The key is finding a plan that can adapt with you as your needs change.

Quote from Henry Beltran: “These stories aren’t just testimonials; they are the heartbeat of what we do. Every story shared is another life we’ve helped secure, and that is why we never stop striving to provide the best care possible.”

Navigating Challenges with Aetna Medicare Advantage: Your Questions Answered

Overcoming Common Challenges

Transitioning to or managing a Medicare Advantage plan can come with its hurdles, akin to learning to dance—it’s all about finding the right steps and rhythm. At Medicare Advisors Insurance Group LLC, we’ve compiled the most common challenges faced by our members and offer you solutions and support to keep you twirling smoothly through your healthcare experience.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Frequently Asked Questions and Troubleshooting Tips

Understanding Your Coverage

- Challenge: Figuring out what is and isn’t covered can sometimes feel like trying to solve a crossword puzzle without any clues.

- Solution: Aetna provides clear documentation and customer support to demystify your benefits.

- Tip: Always double-check before a procedure to ensure it’s covered. It’s better to be safe than sorry!

Dealing with Network Restrictions

- Challenge: Found the perfect specialist, but they’re not in your network? It’s like swiping right and finding out they’re from another continent.

- Solution: Aetna offers extensive networks, but if you need to see someone outside, talk to us about possible exceptions or consider a PPO plan for more flexibility.

- Tip: Think of your network like your favorite coffee shop; it might not have every coffee out there, but it’s got plenty of great options.

Managing Prescriptions

- Challenge: Keeping track of multiple prescriptions can be as tricky as herding cats.

- Solution: Aetna’s pharmacy management tools and support make it easier to get your meds on time and at the best available price.

- Tip: Use Aetna’s online tools to manage your prescriptions—it’s like having a personal assistant for your meds!

Handling Claims and Appeals

- Challenge: Navigating claims or appeals might remind you of that time you tried assembling furniture without the manual.

- Solution: Our customer service team is here to guide you through the process step-by-step.

- Tip: Keep all your healthcare receipts and documents organized. Think of it as keeping your family recipes in order—they’re precious and always needed at some point!

Quote from Henry Beltran: “We know that questions don’t stop after you enroll, and neither does our support. Our commitment is your peace of mind.”

Enhancing Your Experience

At Medicare Advisors Insurance Group LLC, we understand that sometimes, you might face a few bumps on your healthcare journey. That’s why we are committed to providing not just answers but solutions that make your experience as seamless as possible.

Why Staying Informed Matters

Educate Yourself: The more you know, the better you can navigate. Stay Proactive: Regular check-ins with your plan can prevent surprises. Seek Help: Never hesitate to reach out. We’re here to assist, not just in good times, but especially when challenges arise.

Embracing Aetna Medicare Advantage: A Conclusion to Your Search for Comprehensive Care

Securing a Healthier, Happier Future

Choosing the right Medicare Advantage plan is more than a mere decision about healthcare—it’s about choosing a path that leads to a fulfilling and secure future. At Medicare Advisors Insurance Group LLC, we’ve journeyed through the various facets of Aetna Medicare Advantage plans, from the extensive benefits to personalized care, and the robust support system designed to cater specifically to seniors and people with disabilities.

Why Aetna Medicare Advantage?

Let’s recap why Aetna stands out as a prime choice for your Medicare needs:

Broad Coverage and Specialized Care

- Comprehensive benefits that extend beyond basic medical care to include dental, vision, and hearing aids.

- Tailored plans that address specific health conditions with specialized care networks.

Empowered Living

- Enhanced independence through wellness programs and preventive care that keep you active and engaged.

- Peace of mind with telehealth services and 24/7 access to medical professionals.

Community and Support

- A network of care that feels like family, with personalized service and support that anticipates your needs.

- Resources at your fingertips, making it easy to manage your health and stay informed.

A Few Considerations

- Network restrictions: Like having a favorite ice cream shop that’s a bit out of the way, sometimes the best options require a little extra effort (or travel).

- Plan changes: Adapting to new plans can be like updating to the latest smartphone—initially tricky, but ultimately rewarding.

Quote from Henry Beltran: “Our mission at Medicare Advisors Insurance Group LLC isn’t just to offer Medicare plans; it’s to empower lives through thoughtful, comprehensive healthcare solutions that meet the evolving needs of our community.”

Your Next Steps

As we conclude this guide, remember that choosing a Medicare Advantage plan is a significant but manageable decision. Here are a few steps to take next:

- Review Your Options: Reflect on what you’ve learned and revisit your healthcare priorities.

- Ask Questions: Reach out to us with any concerns. No question is too small, especially when it comes to your health.

- Enroll with Confidence: When you’re ready, enroll in a plan that fits, knowing you’ve made an informed choice.

Conclusion: Beyond Coverage—A Commitment to Care

At Medicare Advisors Insurance Group LLC, we believe that your golden years should be rich with health and happiness. Aetna Medicare Advantage plans offer more than just healthcare coverage; they provide a community and a partnership that supports your best life. It’s not just about living longer; it’s about living better, with every need met and every concern addressed.

Are you ready to step into a brighter, healthier future? Let us help you navigate your options and find the plan that’s just right for you. Because at Medicare Advisors, your health is our priority, and your well-being is our biggest reward. Let’s embark on this journey together, with Aetna by our side.