Mail Order vs Local Pharmacy: What Works Best for Part D Users?

When managing your Medicare Part D prescription coverage, one of the most common decisions is choosing between mail-order pharmacies and local pharmacies. Both offer convenience

The Centers for Medicare & Medicaid Services (CMS) released Medicare part A deductible 2022 and Medicare part b deductible 2022 and also released premiums, and coinsurance amounts for the original Medicare Part A and Part B programs, as well as the 2022 original Medicare Part D income-related monthly adjustment amounts, on November 12th, 2021.

We can help get up to $0 monthly premium Medicare plans

Original Medicare Part B covers outpatient hospital services, physician services, durable medical equipment, certain home health services, and a variety of additional medical and health services not covered by Part A.

The Social Security Act determines the initial Medicare Part B deductible, premium, and coinsurance amounts each year. By 2022, the standard monthly premium for original Medicare Part B subscribers will be $170.10, up to $21.60 from $148.50 in 2021. In 2022, the annual deductible for original Medicare Part B members will be $233, an increase of $30 over the previous year’s cost of $203 in 2021.

The increases in the Original Medicare Part B premium and deductible for 2022 are due to the following factors:

Medicare Open Enrollment for 2022 began on October 15, 2021, and ended on December 7, 2021. Seniors with original Medicare can evaluate 2022 coverage alternatives between Original Medicare, Medicare Advantage, and Part D prescription medication plans during this period. In addition to the recently disclosed prices and cost-sharing information for 2022 Medicare Advantage and Part D plans, the Fee-for-Service Medicare premiums and cost-sharing information provided today will help seniors understand all of their original Medicare coverage options for the coming year. Charges and covered benefits for Medicare insurance health and drug plans may change from year to year, so seniors with original Medicare insurance should review their coverage options yearly to determine which options best match their health needs.

Low-income seniors and individuals with disabilities may be eligible for financial assistance from the Medicare Savings Programs (MSPs) to aid with their original Medicare insurance expenses. Only about half of eligible seniors are registered in the Medicare Savings Programs, which assist millions of seniors to get high-quality health care at a lower cost. For those who fulfill the eligibility requirements, Medicare Savings Programs (MSPs) can help pay Medicare premiums as well as coinsurance, deductibles, and copayments. Signing up for The Medicare Savings Program (MSP) gives seniors peace of mind about their Medicare payments, allowing them to use that money toward other necessities like housing, food, and transportation. Seniors with Medicare who want to learn more about the programs can go to https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/medicare-savings-programs.

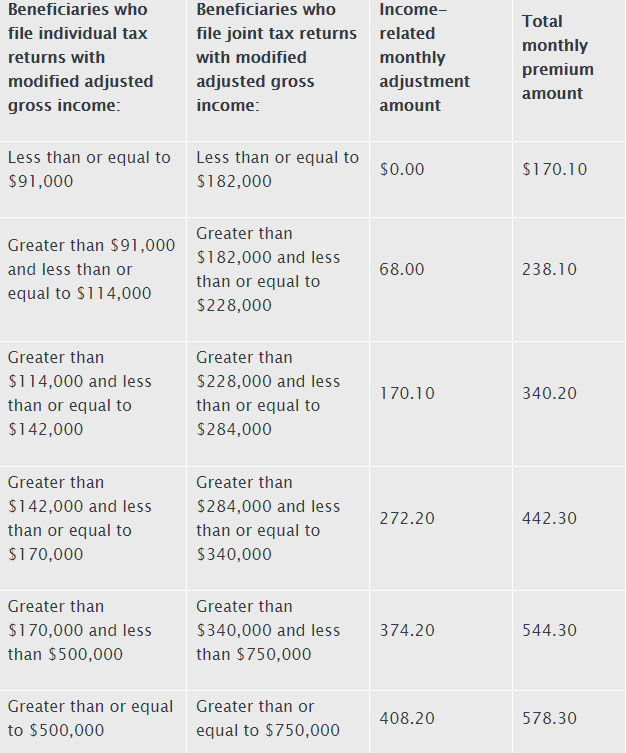

Since 2007, a beneficiary’s monthly Medicare Part B premium has been determined by his or her income. Around 7% of seniors with original Medicare Part B are affected by these income-related monthly adjustment rates. The following table shows the total Medicare Part B premiums for high-income beneficiaries in 2022:

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses, with modified adjusted gross income: | Income-related monthly adjustment amount | Total monthly premium amount |

Less than or equal to $91,000 | $0.00 | $170.10 |

Greater than $91,000 and less than $409,000 | 374.20 | 544.30 |

Greater than or equal to $409,000 | 408.20 | 578.30 |

Medicare Part A Premium and Deductible

Inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation, and some home health care services are all covered by Medicare Part A. Since they have at least 40 quarters of Medicare-covered employment, nearly all Medicare beneficiaries do not have a Part A premium.

In 2022, the Medicare Part A inpatient hospital deductible, which members must pay if admitted to the hospital, will be $1,556, up $72 from $1,484 in 2021. The Part A inpatient hospital deductible pays for the first 60 days of Medicare-covered inpatient hospital care during a benefit period. In 2022, beneficiaries must pay $389 per day for the 61st through 90th days of a hospitalisation in a benefit period (up from $371 in 2021), and $778 per day for lifetime reserve days (up from $742 in 2021). In 2022 ($185.50 in 2021), the daily coinsurance for beneficiaries in skilled nursing facilities for days 21 through 100 of extended care services in a benefit period will be $194.50 ($185.50 in 2021).

Part A Deductible and Coinsurance Amounts for Calendar Years 2021 and 2022 | ||

2021 | 2022 | |

Inpatient hospital deductible | $1,484 | $1,556 |

Daily coinsurance for 61st-90th Day | $371 | $389 |

Daily coinsurance for lifetime reserve days | $742 | $778 |

Skilled Nursing Facility coinsurance | $185.50 | $194.50 |

Enrollees aged 65 and above with less than 40 quarters of coverage, as well as some disabled people, pay a monthly cost to voluntarily enroll in Medicare Part A. Individuals who have had at least 30 quarters of coverage or who are married to someone who has had at least 30 quarters of coverage can purchase Part A at a lower monthly premium rate of $274 in 2022, up $15 from 2021. Certain uninsured elderly people with less than 30 quarters of coverage and disabled people who have exhausted all other options will pay the full price, which will be $499 per month in 2022, up to $28 from 2021.

Visit https://www.federalregister.gov/public-inspection for more information on the 2022 Medicare Parts A and B premiums and deductibles (CMS-8077-N, CMS-8078-N, CMS-8079-N).

Since 2011, a beneficiary’s monthly Medicare Part D premium has been determined by his or her income. Approximately 8% of Seniors with Medicare Part D are affected by these income-related monthly adjustment rates. These people will have to pay a monthly adjustment based on their income in addition to their Part D premium. Part D premiums vary by plan, with around two-thirds paid directly to the plan and the rest deducted from Social Security benefit checks. All of the income-related monthly adjustment amounts for Part D are taken from Social Security benefits. The following table shows the 2022 Part D income-related monthly adjustment levels for high-income beneficiaries:

Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-related monthly adjustment amount |

Less than or equal to $91,000 | Less than or equal to $182,000 | $0.00 |

Greater than $91,000 and less than or equal to $114,000 | Greater than $182,000 and less than or equal to $228,000 | 12.40 |

Greater than $114,000 and less than or equal to $142,000 | Greater than $228,000 and less than or equal to $284,000 | 32.10 |

Greater than $142,000 and less than or equal to $170,000 | Greater than $284,000 and less than or equal to $340,000 | 51.70 |

Greater than $170,000 and less than $500,000 | Greater than $340,000 and less than $750,000 | 71.30 |

Greater than or equal to $500,000 | Greater than or equal to $750,000 | 77.90 |

The following are the premiums for high-income beneficiaries who are married and lived with their spouse at any point during the taxable year but file a separate return:

Beneficiaries who are married and lived with their spouses at any time during the year, but file separate tax returns from their spouses, with modified adjusted gross income: | Income-related monthly adjustment amount |

Less than or equal to $91,000 | $0.00 |

Greater than $91,000 and less than $409,000 | 71.30 |

Greater than or equal to $409,000 | 77.90 |

###

We can help get up to $0 monthly premium Medicare plans

Medicare federal government website.

When managing your Medicare Part D prescription coverage, one of the most common decisions is choosing between mail-order pharmacies and local pharmacies. Both offer convenience

Medicare beneficiaries often discover that Original Medicare (Part A and Part B) doesn’t cover everything they need. This is where Medicare Part C (Medicare Advantage)

Choosing the right Medicare broker in New Jersey can make a major difference in finding the best Medicare plan for your health needs and budget.

For many Medicare beneficiaries, prescription drug coverage is essential — and so is avoiding unnecessary penalties. Medicare Part D comes with rules that can financially

Making the switch from Original Medicare to a Medicare Advantage plan (Part C) in New Jersey can give beneficiaries more benefits, lower out-of-pocket costs, and

At Medicare Advisors, your information is kept completely confidential and is safeguarded as confidential patient information in accordance with federal HIPAA regulations. It will never be shared or distributed.

STEP 1 – After submitting your data through our site, it is securely transmitted to our internal client data portal.

STEP 2 – Only the agents you work with have access to your data.</p >

STEP 3 – Regardless of whether you sign up for a policy through us or not, we keep strict internal and external safeguards around your personal data. Your data never leaves our systems for any reason.