Navigating Medicare can feel like trying to understand a mystery novel with missing pages. But don’t worry; at Medicare Advisors Insurance Group LLC, we’ve got your back! Today we’re tackling Medicare Creditable Coverage for 2025, and by the end of this, you’ll know exactly what you need to keep Uncle Sam and your health care squared away.

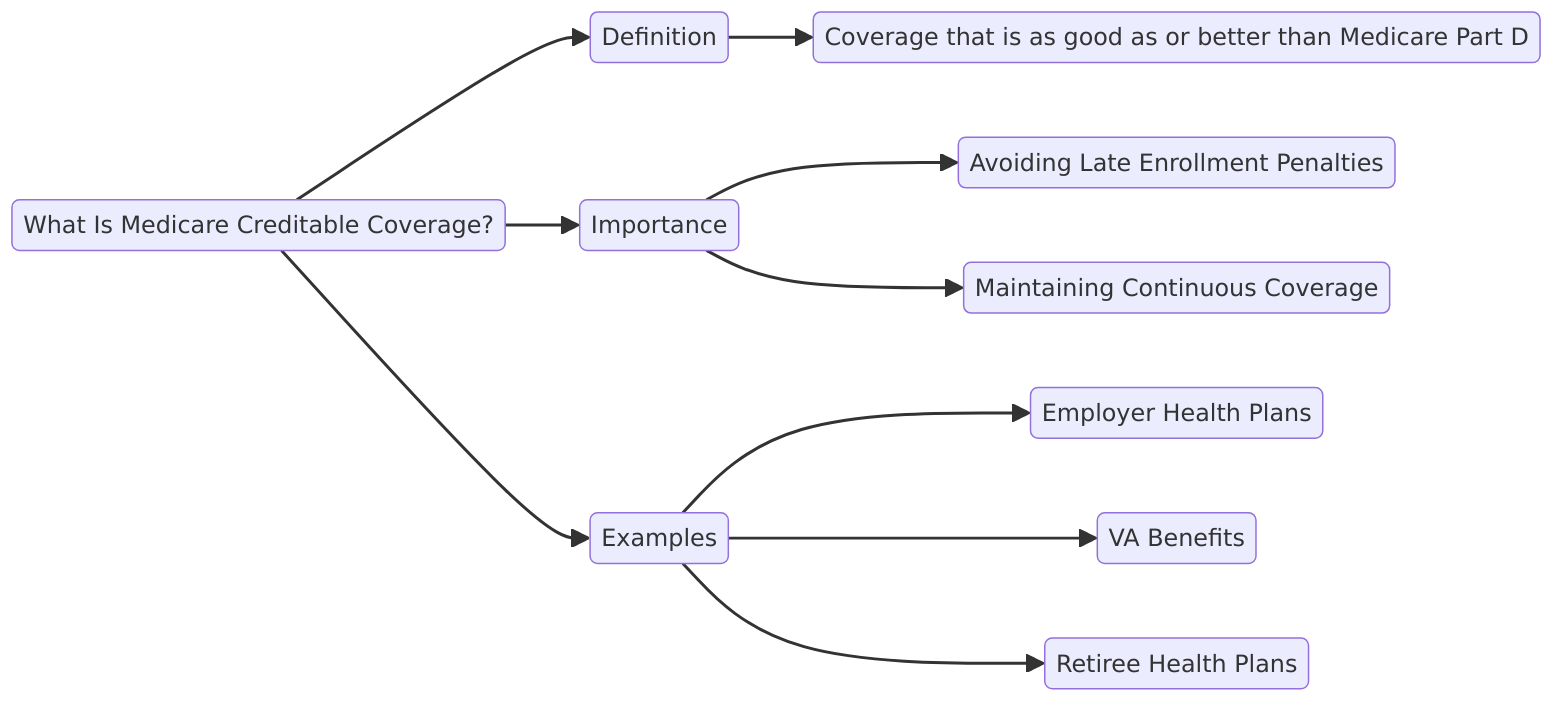

What Is Medicare Creditable Coverage?

Medicare creditable coverage is pretty much insurance that’s as good (or better) than Medicare’s prescription drug coverage (also known as Part D). If you have insurance that qualifies as “creditable” you won’t have to pay penalties when you enroll in Medicare later.

Now you might be thinking: “Great! But how do I know if my current coverage is creditable?” Good question! Insurance providers will typically send out notices, usually by September 30 each year letting you know if your coverage qualifies. Make sure to keep an eye on that letter – it’s more important than your pizza coupons.

Types of Creditable Coverage

Not all coverage is created equal. Here’s a breakdown of what types usually qualify as creditable:

- Employer/Union Health Insurance – If you’re still working past age 65 or covered under your spouse’s plan it might be creditable. But hey don’t assume anything! Always check with HR or your plan provider.

- TRICARE (for military folks) – This is typically creditable coverage so no worries here if you’re in the armed forces. Hooah!

- Veterans Health Care – Also usually counts as creditable.

- COBRA – Now here’s where it gets tricky. If you’re hanging on to COBRA after leaving a job just know it might not be creditable. Best to double-check before rolling the dice.

- Individual Health Insurance Plans – Some ACA (Affordable Care Act) plans may qualify as creditable but not always. You’ll want to check with your insurer.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Creditable Coverage Matters

If you don’t have creditable coverage and don’t enroll in Part D during your Initial Enrollment Period (IEP), you could be hit with a late enrollment penalty. The penalty is basically Medicare’s way of saying “Hey, you should’ve signed up earlier!” and it’ll stick with you for as long as you have Part D. Yup – that’s forever.

Henry Beltran, the owner of Medicare Advisors Insurance Group LLC, shares his personal insight:

“I’ve seen folks get hit with these penalties when they thought their insurance was enough. It’s crucial to know if your plan is creditable before waving goodbye to your enrollment window.”

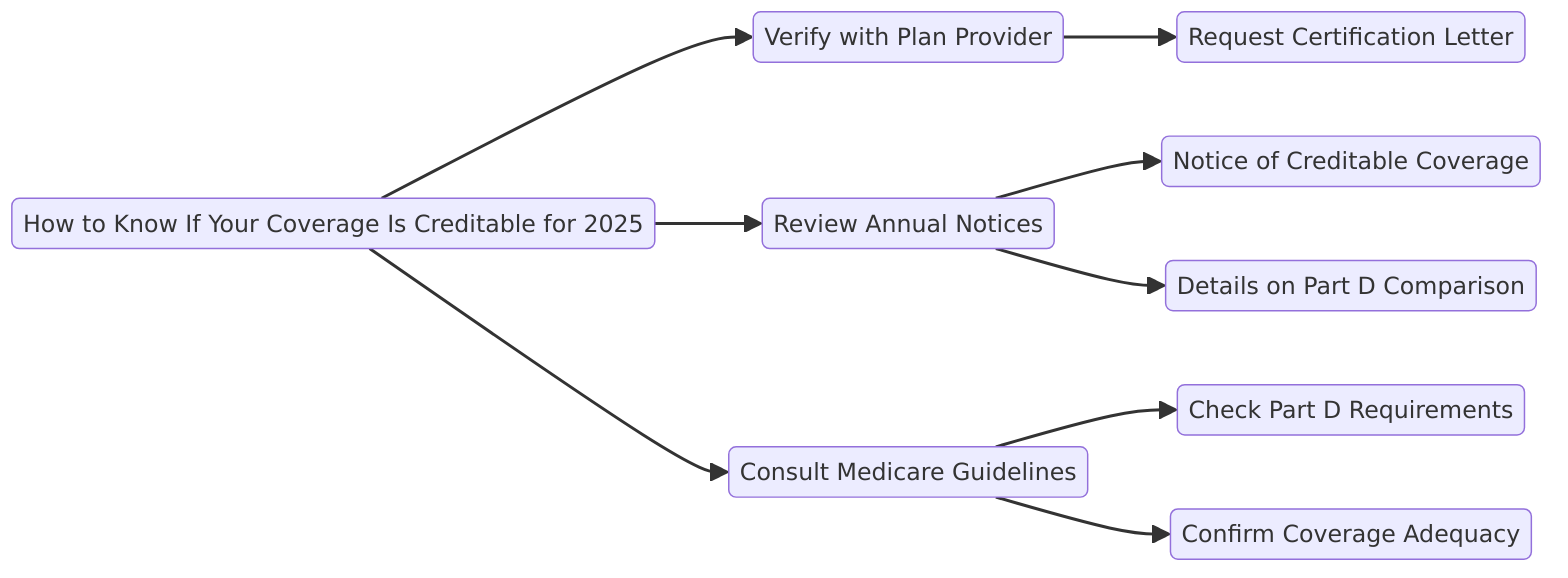

How to Know If Your Coverage Is Creditable for 2025

Look for the Creditable Coverage Notice

Your provider must send you a notice annually. If you didn’t get one, time to give them a call (or send a polite yet strongly worded email). Trust me no one likes surprise penalties.

Can I Lose Creditable Coverage Status?

You bet. Some plans can change from year to year. Just because your insurance was creditable in 2024 doesn’t mean it’s a lock for 2025. Review that letter, people!

Important Dates to Remember

- October 15 – December 7, 2025: This is your Medicare Open Enrollment Period (OEP). If you find out your coverage isn’t creditable this is the time to join a Medicare drug plan (Part D).

- September 30, 2025: Deadline for your provider to send your Creditable Coverage notice.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Happens If I Don’t Have Creditable Coverage?

Alright here’s the fun part. If your coverage isn’t creditable and you delay enrolling in Medicare Part D you’ll face a penalty. The penalty equals 1% of the national base premium for every month you were without creditable coverage after your Initial Enrollment Period.

Example: Let’s say you go without creditable coverage for 12 months. That’s a 12% penalty added to your Part D premium every month. Ouch!

Medicare Creditable Coverage and Common Misconceptions

“But I Have Health Insurance, Isn’t That Enough?”

Nope! Just having health insurance doesn’t mean you’re safe from the penalty. You need prescription drug coverage that meets or exceeds Medicare’s standard.

“My Employer’s Plan Will Cover Me, Right?”

Probably, but not always. Some employer plans may offer limited drug coverage, so don’t assume it’s creditable unless you’ve checked.

“I’ll Just Wait Until I’m Sick to Get Medicare”

Wrong move, buddy! If you delay enrolling in Medicare or Part D without creditable coverage, you’ll not only pay higher premiums, but you could face coverage gaps when you need it most.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Are the Drawbacks?

Now let’s get into some of the not-so-awesome stuff about Medicare creditable coverage. Every car comes with its own quirks and Medicare is no different.

- Employer Coverage Changes: Employers can change health plans faster than your favorite coffee shop runs out of oat milk. It’s your responsibility to check if that shiny new plan still counts as creditable.

- COBRA Confusion: COBRA coverage might seem like it has everything you need but it’s not always creditable for Part D. Think of COBRA like an old car: sure, it runs but would you trust it for a cross-country road trip? Maybe not.

- Penalties Are Forever: That 1% penalty for every month without creditable coverage? Yeah, Medicare doesn’t forget. It’s like getting a parking ticket that follows you for the rest of your life.

“I’ve seen penalties hit hard and trust me once it’s added you’ll be paying it for as long as you’re on Medicare Part D,” says Henry Beltran.

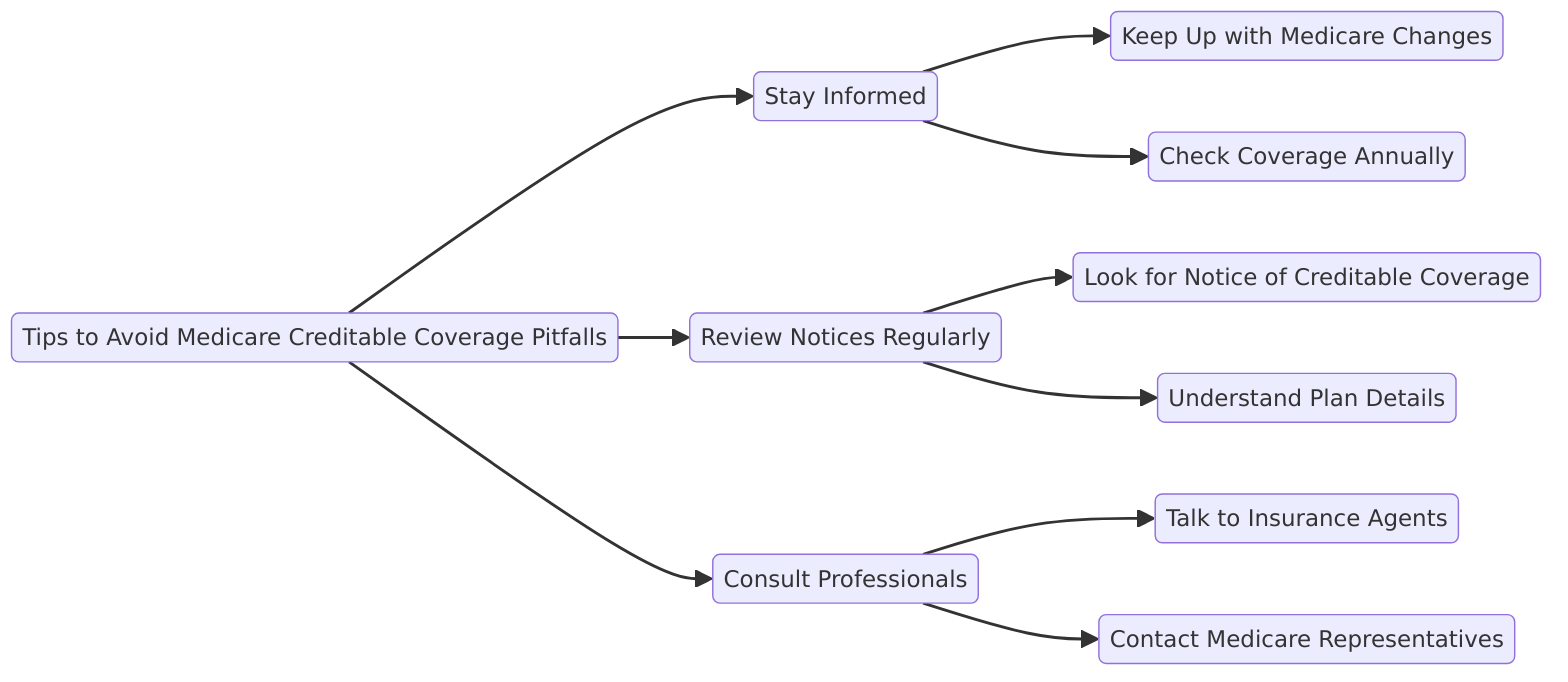

Tips to Avoid Medicare Creditable Coverage Pitfalls

- Check Your Notice Every Year: Just because your plan was good last year doesn’t mean it’s still up to snuff. Insurance changes and so should your expectations.

- Don’t Wait: Don’t be a procrastinator! If you find out your coverage isn’t creditable take action before the Open Enrollment Period ends.

- Ask for Help: Feeling lost? That’s why we’re here. At Medicare Advisors Insurance Group LLC, we’re just a phone call away.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts: Medicare Creditable Coverage 2025

In conclusion, making sure you have Medicare creditable coverage for 2025 is a no-brainer if you want to avoid penalties and get the coverage you need. Whether you’re staying on employer insurance or thinking about transitioning to Medicare drug plans make sure your coverage is creditable.

As Henry Beltran puts it: “Medicare might seem overwhelming but with the right advice you can navigate it smoothly without losing any benefits.”

So keep that notice in hand and if in doubt give us a call. We’re always ready to help you steer clear of those penalties and get the best out of your Medicare coverage.