You may be unsure which Medicare plan is appropriate for you if you are enrolling in Medicare or changing plans. You must first choose between a Medicare Advantage plan and a Medicare Supplement plan when deciding which plan to enroll in.

The differences between Medicare Advantage and Medicare Supplement plans are numerous. As a result, it’s critical to do your homework and fully comprehend how each plan type works before making a decision. You are not alone in your quest for knowledge, and we are here to assist you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What is the Difference Between Medicare Advantage and Medicare Supplements?

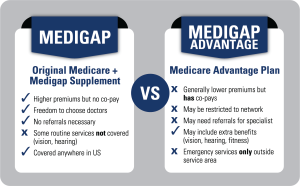

When you enroll in a Medicare Advantage plan, it becomes your primary source of coverage, while Medicare Supplement plans pay supplementary to Original Medicare. For the Medicare Advantage plan in which you enroll to take on your coverage needs for the calendar year, Medicare pays a specific sum to the carrier.

Those new to Medicare may observe that there is a lot of advertising for Medicare Advantage plans and little to no advertising for Medicare Supplement plans. The difference in profit margins between Medicare Advantage and Medicare Supplement plans is the reason behind this.

One plan type will be more fit for your needs than the other, depending on your lifestyle, budget, and medical coverage requirements.

Medicare Advantage plans are sold and administered by private insurance firms. For Medicare beneficiaries, these plans serve as primary coverage. These private insurance companies are compensated by Medicare for taking on your risk.

These plans may also have a regional network of doctors and hospitals, implying that the plan’s coverage will not follow you around. Furthermore, your present doctor may refuse to accept the plan as insurance.

Medicare Advantage programs are required to provide the same benefits as Original Medicare and may include additional benefits. These extra perks, however, differ from one plan to the next. In exchange for a lower monthly premium, you agree to pay higher out-of-pocket expenditures in the form of cost-sharing when you enroll in a Medicare Advantage plan. Prescription drug coverage is frequently included in Medicare Advantage plans. While not all Medicare Advantage HMO and PPO plans include prescription coverage, the vast majority of these plans do.

How Are Medicare Supplement Plans Different?

Private insurance businesses also provide Medicare Supplement (Medigap) coverage. Regardless of carrier, they must include the same coverage. The remaining cost-sharing that you would be responsible for if you were only enrolled in Original Medicare is covered by Medicare Supplement plans.

Medicare Supplement plans allow you to budget ahead of time. Because all plans offer the same benefits, you’ll always know how much you’ll have to pay out of pocket. There is no network of doctors to which you must adhere if you are enrolled in a Medicare Supplement plan. In all 50 states and territories, you can get coverage from any doctor or hospital that takes Original Medicare.

Furthermore, in jurisdictions where they are permitted, some Medigap plans, such as Medicare Supplement Plan G, pay excess charges. You won’t have to pay anything extra if the doctor doesn’t accept Medicare assignments because your Medigap plan covers you.

Which is Better: Medicare Advantage vs. Medicare Supplement?

There is no one-size-fits-all Medicare plan. As a result, the ideal coverage for you is the one that suits your healthcare needs the best.

If you want complete assurance and predictability with your healthcare but are willing to pay higher premiums in exchange for lower out-of-pocket costs, Medicare Supplement plans are the ideal alternative. Medicare Advantage plans, on the other hand, are the best choice if you want to save money on monthly premiums while also receiving additional benefits and don’t mind paying additional out-of-pocket fees at the doctor’s office.

Medicare Supplement plans are always our first choice for overall convenience and dependability. However, we understand that this isn’t the case for everyone. Regardless of plan type, our goal is to present you with the greatest options available.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How Do I Choose Between Medicare Advantage and Medicare Supplement Plans?

Do you want predictable prices, the freedom to see any doctor you want, skip referrals, and travel with peace of mind? You’re looking for Medicare Supplement plans if you answered yes.

Are you willing to accept a reduced monthly premium and additional benefits in exchange for unpredictably high copayments, limited doctor networks, and referrals? If you answered yes, Medicare Advantage might be a good fit for you.

Working with agents has the advantage of ensuring that whichever solution you select is the best for you.