Medicare advantage plans 2021: Medicare insurance beneficiaries have the option of receiving their Part A and Part B Medicare insurance benefits through a private Medicare Advantage plan. Since 2011, the federal government has required Medicare Advantage insurance plans to cap out-of-pocket spending, and these plans may provide additional insurance benefits or reduced cost-sharing compared to traditional Medicare insurance.

They are also permitted to limit provider networks, may require prior authorization for certain services, and sometimes carry an additional premium on top of the monthly Part B premium all Medicare beneficiaries pay. This brief provides current information about Medicare Advantage premiums, cost sharing, out-of-pocket limits, and supplemental insurance benefits, as well as trends over time.

Two companion analyses examine trends in Medicare Advantage enrollment and Medicare Advantage plans’ star ratings and federal spending under the quality bonus program.

Nearly two-thirds of Medicare Advantage enrollees pay no supplemental premium (other than the Part B premium) in 2021

In 2021, 89% of individual Medicare Advantage insurance plans offer prescription drug insurance coverage (MA-PDs), and most Medicare Advantage insurance enrollees (90%) are in plans that include this prescription drug insurance coverage.

Nearly two-thirds of beneficiaries in individual Medicare Advantage insurance plans with prescription drug coverage (65%) pay no premium for their insurance plan, other than the Medicare Part B premium ($148.50 in 2021). However, 15% of beneficiaries in individual MA-PDs (2.6 million enrollees) pay at least $50 per month, including 5% who pay $100 or more per month, in addition to the monthly Part B premium.

The MA-PD premium includes both the cost of Medicare-covered Part A and Part B benefits and Part D prescription drug insurance coverage. Among the one-third of all enrollees in an individual MA-PD who pay a premium for their insurance plan (6.0 million enrollees), the average premium is $60 per month. Altogether, including those who do not pay a premium, the average individual MA-PD enrollee pays $21 per month in 2021.

Premiums paid by Medicare Advantage enrollees have declined slowly since 2015

Average Medicare Advantage Prescription Drug (MA-PD) premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month.

Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage insurance enrollment, corresponding to the broader availability of these insurance plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by insurance plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage (and averages $12 for just the Part D portion of covered benefits).

Nearly two-thirds (60%) of Medicare Advantage insurance enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

Slightly more than half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional Medicare for a 6-day hospital stay

Medicare insurance Advantage plans have the flexibility to modify cost-sharing for most services, subject to limitations. Total Medicare Advantage insurance cost-sharing for Part A and B services cannot exceed cost-sharing for those insurance services in traditional Medicare insurance on an actuarially equivalent basis. Further, Medicare Advantage insurance plans may not charge enrollees higher cost-sharing than under traditional Medicare insurance for certain specific insurance services, including chemotherapy, skilled nursing facility (SNF) care, and renal dialysis services.

However, Medicare Advantage insurance plans may reduce cost-sharing as a mandatory supplemental benefit, and may use rebate dollars to do so. According to the Medicare Payment Advisory Commission (MedPAC), in 2021, about 46 percent of rebate dollars were used to lower cost-sharing for Medicare insurance services.

In the case of inpatient hospital stays, Medicare Advantage insurance plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Insurance plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day. In contrast, under traditional Medicare insurance, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,484 in 2021 (for one spell of illness) with no copayments until day 60 of an inpatient stay (assuming no supplemental insurance coverage that covers some or all of the deductible).

In 2021, virtually all Medicare Advantage insurance enrollees (99%) would pay less than the traditional Medicare insurance Part A hospital deductible for an inpatient stay of 3 days, and these enrollees would pay $747 on average (Figure 3). But slightly more than half of all Medicare Advantage insurance enrollees (53%) would pay more than they would under traditional Medicare insurance (with its $1,484 deductible) for stays of 6 or more days, with an average cost-sharing of $1,763, among those enrollees with costs above traditional Medicare insurance.

This insurance analysis does not take into account the fact that a majority of people in traditional Medicare insurance would not pay the deductible if hospitalized because they have supplemental insurance coverage, although those with Medigap insurance or retiree health would have the additional cost of a monthly premium. However, 5.6 million beneficiaries in traditional Medicare insurance have no supplemental insurance coverage and would be liable for the full Part A deductible if admitted to the hospital.

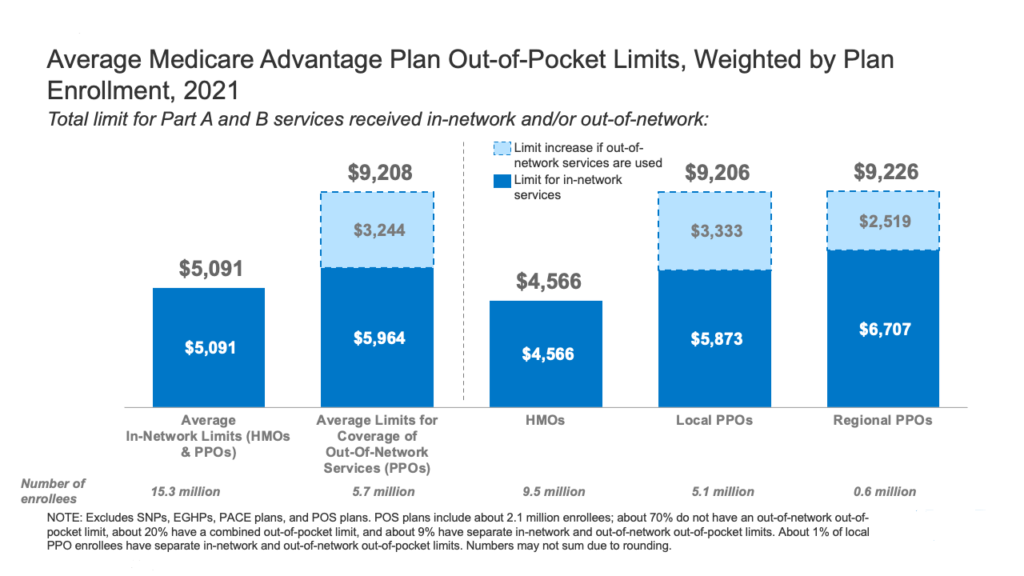

The average out-of-pocket limit for Medicare Advantage enrollees is $5,091 for in-network services and $9,208 for both in-network and out-of-network services (PPOs)

Since 2011, federal regulation has required Medicare Advantage insurance plans to provide an out-of-pocket limit for insurance services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.

These out-of-pocket limits apply to Part A and B insurance services only and do not apply to Part D spending, for which there is a separate out-of-pocket threshold of $6,550 in 2021, above which enrollees pay 5% of costs. Whether an insurance plan has only an in-network cap or a cap for in- and out-of-network services depends on the type of plan. HMOs generally only cover insurance services provided by in-network providers, whereas PPOs also cover insurance services delivered by out-of-network providers but charge enrollees higher cost-sharing for this care. The size of Medicare Advantage insurance provider networks for physicians and hospitals vary greatly both across counties and across plans in the same county.

In 2021, the weighted average out-of-pocket limit for Medicare Advantage insurance enrollees is $5,091 for in-network services and $9,208 for in-network and out-of-network services combined. For enrollees in HMOs, the average out-of-pocket (in-network) limit is $4,566. Enrollees in HMOs are generally responsible for 100% of costs incurred for out-of-network care. However, HMO point of service (POS) plans allow out-of-network care for certain services, though it typically costs more than in-network insurance coverage. For local and regional PPO enrollees, the average out-of-pocket limit for both in-network and out-of-network services is $9,206, and $9,226, respectively.

The average out-of-pocket limit for in-network insurance services has generally trended down from 2017 but increased slightly between 2020 to 2021. The average in-network limit for HMOs increased from $4,925 in 2020 to $5,091 in 2021. The average combined in- and out-of-network limit for PPOs increased from $8,828 in 2020 to $9,208 in 2021.

Most Medicare Advantage enrollees have access to some benefits not covered by traditional Medicare in 2021 and special needs plan (SNP) enrollees have greater access to certain benefits

Medicare Advantage insurance plans may provide extra (“supplemental”) benefits that are not available in traditional Medicare insurance. The cost of these benefits may be covered using rebate dollars (which may include bonus payments) paid by CMS to private insurance plans. In recent years, the rebate portion of federal payments to Medicare Advantage insurance plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020.

Plans can also charge additional premiums for such insurance benefits. Beginning in 2019, Medicare Advantage insurance plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental insurance benefits must still be considered “primarily health-related” but CMS expanded this definition, so more items and services are available as supplemental insurance benefits.

Most enrollees in individual Medicare Advantage insurance plans (those generally available to Medicare beneficiaries) are in plans that provide access to eye exams and/or glasses (99%), hearing exams/and or aids (97%), telehealth services (94%), dental care (94%), and a fitness benefit (93%). Similarly, most enrollees in SNPs are in plans that provide access to these benefits. This analysis excludes employer-group health plans because employer insurance plans do not submit bids, and data on supplemental insurance benefits may not be reflective of what employer insurance plans actually offer.

Though these insurance benefits are widely available, the scope of specific services varies. For example, a dental insurance benefit may include preventive services only, such as cleanings or x-rays, or more comprehensive insurance coverage, such as crowns or dentures.

Insurance plans also vary in terms of cost-sharing for various insurance services and limits on the number of services covered per year and many impose an annual dollar cap on the amount the plan will pay toward covered services.

Enrollees in SNPs have more access to certain insurance benefits compared to enrollees in individual insurance plans, such as over the counter drug insurance benefits (97% vs 79%); transportation (88% vs 37%); a meal benefit (73% vs 55%) and in-home support services (14% vs 7%). However, there is no publicly available data on how frequently supplemental insurance benefits are utilized by enrollees or the amounts they pay out-of-pocket for these services.

As of 2020, Medicare Advantage insurance plans have been allowed to include telehealth insurance benefits as part of the basic benefit package – beyond what was allowed under traditional Medicare insurance prior to the public health emergency. These insurance benefits are considered “telehealth” in the figure above, even though their cost may not be covered by either rebates or supplemental premiums.

fAdditionally, Medicare Advantage insurance plans may also offer supplemental telehealth benefits via remote access technologies and/or telemonitoring services, which can be used for those services that do not meet the insurance requirements for coverage under traditional Medicare or the requirements for additional telehealth insurance benefits (such as the requirement of being covered by Medicare insurance Part B when provided in-person).

The majority of enrollees in both individual insurance plans and SNPs have access to remote access technologies (70% and 79%, respectively), but just 5% of enrollees in individual insurance plans and 6% of enrollees in SNPs have access to telemonitoring services.