Medicare Advantage plans are known to be all-in-one but why is this? Let’s Find out. Part C or also known as Medicare Advantage is known as a bundle plan because it is a combination of parts A, B, and C. Most plans also include Part D, this would be known as Medicare Advantage Part D or MAPD. Medicare Advantage is provided by private insurance companies. Within these companies, there are different Medicare Advantage Plans. Let’s Go over them:

- SNP: Special Needs Plan

- PFFS: Private Fee-for-Service

- PPO: Preferred Provider Organization

- HMO: Health Maintenance Organization

It is very important to comprehend that there are different forms of policies when it comes to Medicare Advantage Plans. Your expenses and encounters while getting clinical treatment will differ relying upon the kind of Medicare Advantage plan you have.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Here are the most well-known plans that might be accessible in your vicinity:

SNP: Special Needs Plan

A Special Needs Plan, is a type of Medicare Advantage Plan that is provided to a member who has a specific illness. An SNP is responsible for adapting its benefits for a person’s needs in terms of medical providers and medications among other aspects.

Who uses an SNP Plan?

Depending on the condition that the individual has, there are three types of Special Needs Plan:

- D-SNP: Dual Special Needs Plan: People who have Medicare and Medicaid can apply for an SNP plan but it will be a Dual Special Needs Plan, dual since it uses both Medicare and Medicaid.

- C-SNP: Chronic Special Needs Plan :Someone who has a chronic condition such as Diabetes Mellitus, Autoimmune disorders, cancer among others can apply for a C-SNP plan.

- I-SNP: Institutional Special Needs Plan :An individual who needs to be in long-term care or need care from a nursing home would acquire an I-SNP plan.

Read More: What is the best Medicare Supplement Insurance Plan

PFFS – Private Fee For Service

The PFFS Plan is responsible for determining how much it pays its doctors, hospitals among other providers. At the end of acquiring the service, in addition, it determines how much you have to pay out of pocket. Depending on the providers and the plan, your out of pockets costs may vary in this type of policy.

Key Points to Keep In Mind with a PFFS Plan:

- Not all of the plans include prescription coverage.

- The PFFS plan is only one of the few plans that allow you to enroll in a separate prescription drug plan.

- If your providers are out of network, they have the decision not to see you even if you have been at their office before.

- You only pay the copayment established by the plan for the service you are looking for.

PPO: Preferred Provider Organization

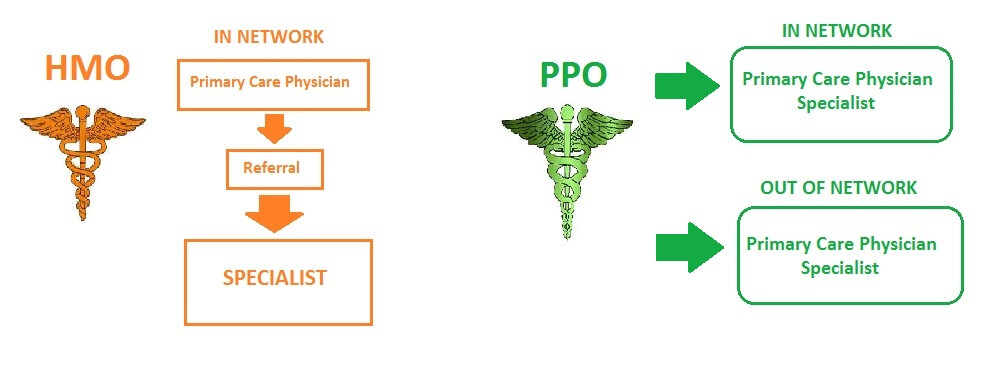

The PPO Plan is a Provider Organization that has contracts with physicians, hospitals to create a network of participating medical providers. You can utilize specialists, emergency clinics, and suppliers outside of the organization but it will have additional costs. In order to have minimal healthcare costs, it is important that you see doctors within the network.

In a PPO plan, it is not required to choose a Primary Care Physician and you do not need a referral in order to see a specialist. In addition to this, most of the time prescriptions are covered by the PPO plan.

Read More: Difference between PPO and HMO Health Insurance Plans

HMO: Health Maintenance Organization

The HMO Plan is a health insurance plan that requires you to visit the doctors within the network of doctors who are contracted with the HMO plan. Being a member of an HMO plan means that you have to pick a primary care doctor. This means that your primary doctor is responsible for your healthcare and also responsible for giving referrals for a patient to see a specialist.

Having an HMO plan means that the client will have lower out-of-pocket costs when it comes to health needs. However, if you have no referral from your primary doctor it is highly likely that you will pay 100% for the services provided by the specialist. Unless it is an emergency, in this case the plan will pay.

HMO Does not Cover

- Out of Network Visits

- Non-Emergency Hospital Visits outside of coverage area

Now that you have a better understanding of what each Medicare Advantage Policy has to cover, it is important to know what are the advantages and disadvantages of Medicare Advantage Plans.

Advantages of Medicare Advantage Plans:

- Distinct Coverage Options

Instead of just having Original Medicare, you will have additional benefits such as dental and vision and prescription drugs depending on the medicare advantage plan chosen.

- Lower Costs

It helps cover for the 20% Medicare does not cover. In addition to this, you may qualify for $0 monthly premium plans

- Coordinated Care

Medicare Advantage plans embrace coordinated medical aid. This suggests that your aid suppliers actively communicate to coordinate your care between differing kinds of aid services and medical specialties. This ensures you’ve got a aid team and helps avoid excess expenses and problems like medication interactions.

- Personalized Plans

If you have a chronic illness or a disease there are plans that designed specifically for you. For example, someone who has a diabetes melilites qualifies to be enrolled in a C-SNP plan or known as Chronic Special Needs Plan. If someone has Medicaid and Medicare they qualify to be enrolled in a DSNP or Dual Special Need Plan.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Disadvantages of a Medicare Advantage Plan:

- Limited Providers

If you choose to be an HMO plan, this means that your network of providers will be more limited since you will need a referral to see other specialists. Unlike a PPO plan in which you can see in network and out of network. However, even when you have a PPO it is recommended to see in network providers since the out of pocket cost will be lower.

- Choosing a Plan can be Complex

Since there are many plans in the market, it may be difficult to choose a plan that best suits your needs. Our agents can help make the process of choosing a plan more simple.

- Specific State Coverage

If you are enrolled in a Medicare Advantage Plan and you move from your area of service there is a possibility that your plan will not function in the area that you are moving

Medicare Advantage plans are a great way of having all-in-one benefits. Our agents can help you through the process of choosing a Medicare Advantage plan that best suits your health needs. They will guide you through the process of explaining what each plan has to offer and making sure you are satisfied with your plan election. Have any additional questions about Medicare Advantage plans? Give us a call 1-877-255-0284 for more information.

Read Also: