Limited Income and Resources

What’s the Low-Income Subsidy (LIS)? Lowering prescription drug expenses for those on Medicare is made possible by the Low-Income Subsidy (LIS). How can I help people get the LIS? People who may be eligible for the LIS can be found and enrolled by working with our partners, and we encourage local organizations to spread the […]

Medicare Out-of-Pocket Costs You Should Expect to Pay

Individuals 65 and older, as well as some people with impairments, are eligible for Medicare. However, it’s not without its drawbacks, like as convoluted regulations and occasionally hefty out-of-pocket expenses. Out-of-pocket costs for Medicare are as follows: Premiums. Deductibles and coinsurance. Hospital stays. Supplemental insurance. Prescription drug coverage. Late-enrollment penalties. Medical services that aren’t covered. […]

Medicare Social Security

Medicare is a health-insurance program for persons over the age of 65 in the United States. People under the age of 65, such as those with disabilities or those who have irreversible renal failure, may be eligible for Medicare. The program assists with healthcare costs, but it does not cover all medical expenses or most […]

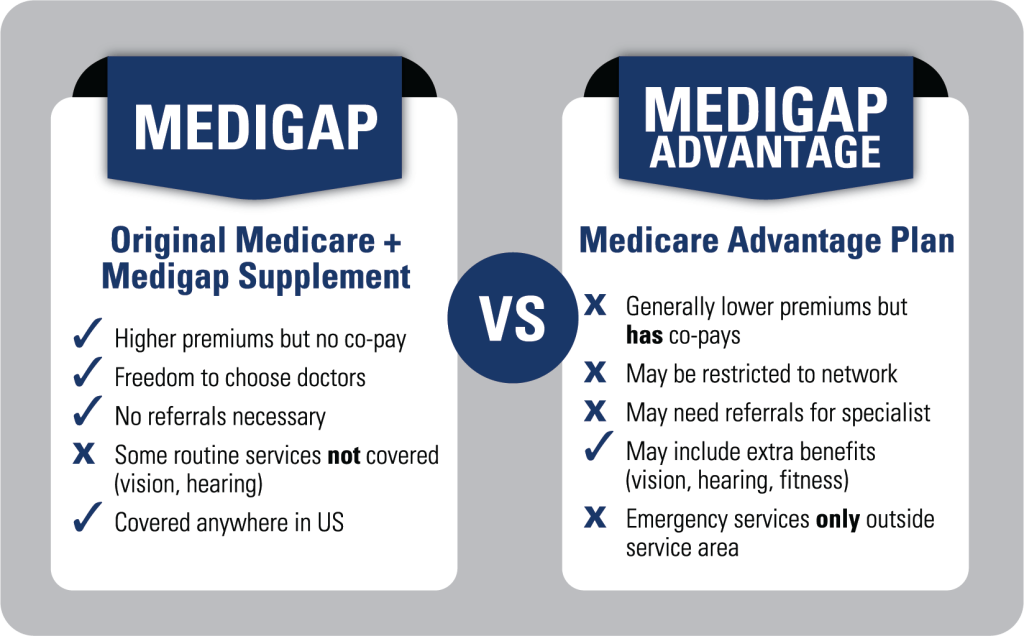

Medicare Advantage vs. Medicare Supplement Plans

You may be unsure which Medicare plan is appropriate for you if you are enrolling in Medicare or changing plans. You must first choose between a Medicare Advantage plan and a Medicare Supplement plan when deciding which plan to enroll in. The differences between Medicare Advantage and Medicare Supplement plans are numerous. As a result, […]

Medicare Part B: What Does Medicare Part B Cover?

Medicare Part B Original Medicare Part B (medical insurance) provides medical services and supplies that are medically essential to treat your health condition. Outpatient treatment, preventive services, ambulance services, and durable medical equipment are all examples of this. If a doctor orders them to treat your disease, it also covers part-time or intermittent home health […]

Do You Lose Medicare if You Move Out of the Country?

You have to be a U.S. citizen or permanent legal resident to qualify for Medicare, but you don’t have to live here. Do You Lose Medicare If You Move Out Of The Country: Most individuals are aware that when they go on vacation in a foreign nation, Medicare normally does not follow them. Only if […]

What to know about COBRA and Medicare

COBRA is a law that allows people to keep their employer-provided health insurance if they quit their job. It can sometimes be used in conjunction with Medicare. COBRA continuing coverage assists people who have lost their employer-sponsored health insurance, whereas Medicare plans often cover persons over the age of 65. COBRA and Medicare may be […]

Medicare and the Marketplace

Do you have health insurance through the Health Insurance Marketplace, but you’ll soon be eligible for Medicare? You’re probably concerned about the future of your insurance. We’re here to help you negotiate this shift in your health-care demands while avoiding unnecessary spending. Are Obamacare and Medicare the Same? Obamacare and Medicare are not the same […]

HMO plan vs PPO

What’s the Difference Between an HMO and a PPO? It’s nice to have options. When it comes to health insurance, you may choose from a variety of options. HMO and PPO are two common varieties you’ll come across. Network size, ability to see specialists, fees, and out-of-network coverage are all differences between HMO (Health Maintenance […]

Medicare Part D Private Insurance

https://medicareabc.com/wp-content/uploads/2022/02/medicare-part-D-Private-insurance.mp4 Prescription drug coverage is available to Medicare beneficiaries. This plan reimburses you for a portion of your pharmaceutical costs. If you have Original Medicare, you can enroll in a Medicare Part D plan. You can also enroll in a Medicare Advantage plan that covers prescription drugs. Drug insurance may not seem necessary if you […]