“Make the Right Choice for Your Health: Compare Medicare Supplement and Medicare Advantage Plans!”

Exploring the Pros and Cons of Medicare Supplement vs. Medicare Advantage

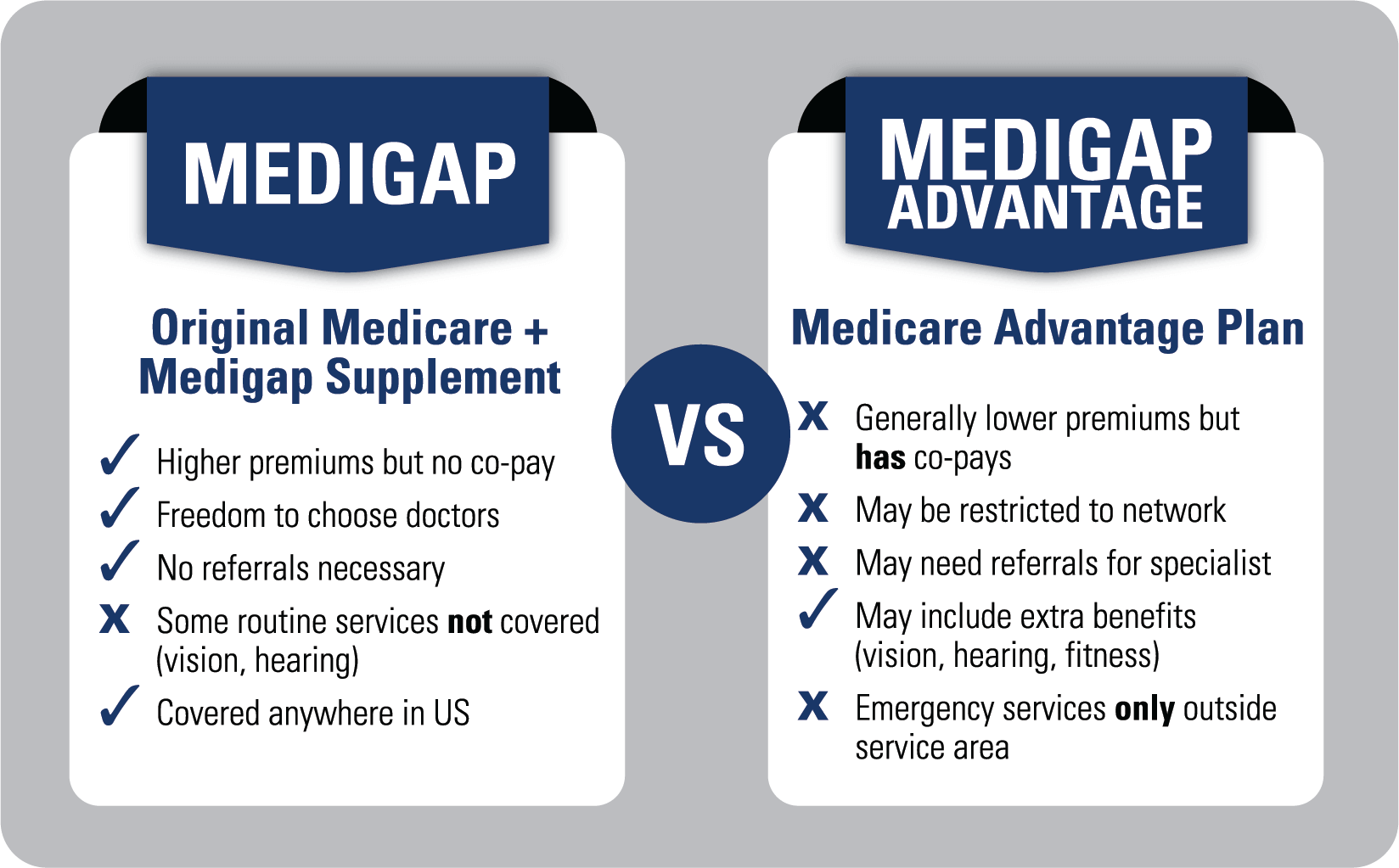

When it comes to choosing between Medicare Supplement and Medicare Advantage, it can be a difficult decision. Both plans offer different benefits and drawbacks, so it’s important to understand the pros and cons of each before making a decision.

Medicare Supplement plans are designed to help cover the gaps in Original Medicare. These plans provide coverage for things like copayments, coinsurance, and deductibles. They also offer coverage for medical services that Original Medicare doesn’t cover, such as emergency care outside of the United States. The biggest benefit of Medicare Supplement plans is that they offer more comprehensive coverage than Original Medicare. However, they can be more expensive than Medicare Advantage plans.

Medicare Advantage plans are an alternative to Original Medicare. These plans are offered by private insurance companies and provide coverage for the same services as Original Medicare. The biggest benefit of Medicare Advantage plans is that they often offer additional benefits, such as vision and dental coverage. They also tend to be more affordable than Medicare Supplement plans. However, they may not cover all of the services that Original Medicare does, and they may have more restrictions on which doctors and hospitals you can use.

When it comes to choosing between Medicare Supplement and Medicare Advantage, it’s important to consider your individual needs and budget. Medicare Supplement plans offer more comprehensive coverage, but they can be more expensive. Medicare Advantage plans are often more affordable, but they may not cover all of the services that Original Medicare does. Ultimately, the decision is up to you.

Find Medicare Plans in 3 Easy Steps

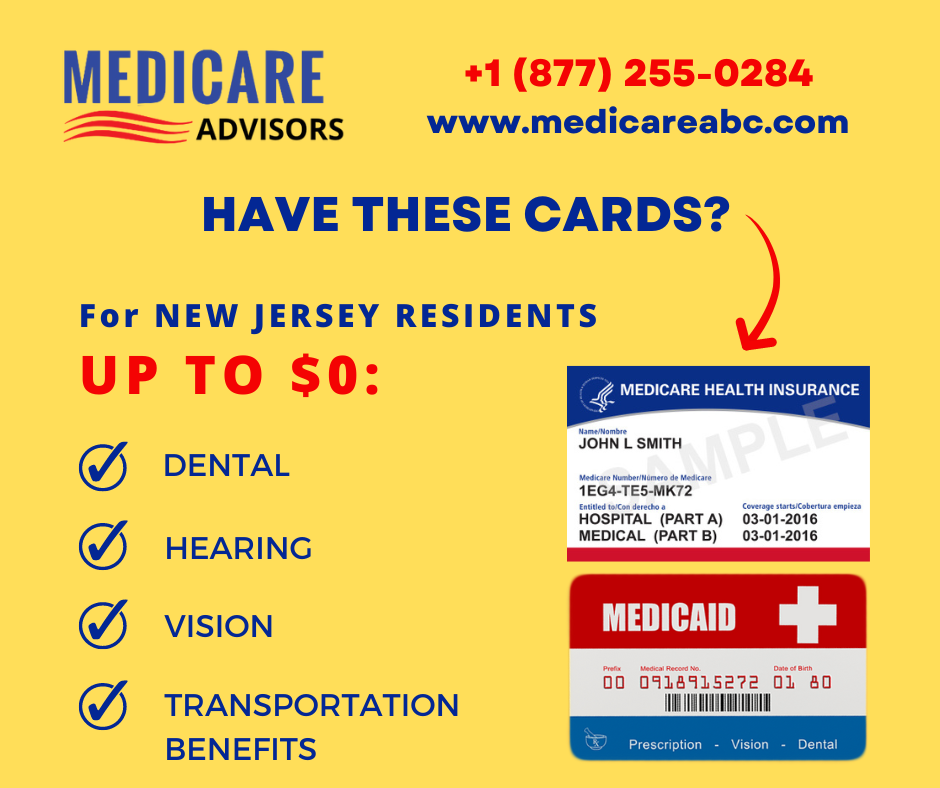

We can help get up to $0 monthly premium Medicare plans

Comparing the Cost of Medicare Supplement vs. Medicare Advantage

When it comes to choosing the right health insurance plan for you, it can be a daunting task. With so many options available, it can be hard to know which one is best for you. One of the most important decisions you will have to make is whether to choose a Medicare Supplement or a Medicare Advantage plan.

Both Medicare Supplement and Medicare Advantage plans offer coverage for medical expenses, but they differ in how they are structured and how much they cost. Medicare Supplement plans are designed to supplement your Original Medicare coverage, while Medicare Advantage plans are an alternative to Original Medicare.

When it comes to cost, Medicare Supplement plans tend to be more expensive than Medicare Advantage plans. Medicare Supplement plans are sold by private insurance companies and the premiums can vary depending on the plan you choose. Medicare Advantage plans, on the other hand, are offered by private insurance companies and the premiums are typically lower than those of Medicare Supplement plans.

When it comes to coverage, Medicare Supplement plans offer more comprehensive coverage than Medicare Advantage plans. Medicare Supplement plans cover most of the same services as Original Medicare, including hospital stays, doctor visits, and prescription drugs. Medicare Advantage plans, however, may have more limited coverage and may not cover all of the services that Original Medicare does.

Ultimately, the decision of whether to choose a Medicare Supplement or a Medicare Advantage plan comes down to your individual needs and budget. If you are looking for comprehensive coverage and are willing to pay a higher premium, then a Medicare Supplement plan may be the right choice for you. If you are looking for more affordable coverage and are willing to accept a more limited range of services, then a Medicare Advantage plan may be the better option.

Understanding the Coverage Differences Between Medicare Supplement and Medicare Advantage

When it comes to choosing a Medicare plan, it can be confusing to understand the differences between Medicare Supplement and Medicare Advantage. Both plans offer coverage for medical expenses, but they do so in different ways. Here’s a breakdown of the coverage differences between the two plans.

Medicare Supplement plans are designed to supplement Original Medicare. These plans help cover some of the out-of-pocket costs associated with Original Medicare, such as deductibles, coinsurance, and copayments. Medicare Supplement plans do not include prescription drug coverage, so you may need to purchase a separate Part D plan.

Medicare Advantage plans, on the other hand, are an alternative to Original Medicare. These plans are offered by private insurance companies and provide coverage for hospital and medical expenses. Most Medicare Advantage plans also include prescription drug coverage, so you don’t need to purchase a separate Part D plan.

The coverage differences between Medicare Supplement and Medicare Advantage plans can be confusing. But understanding the differences can help you make an informed decision about which plan is right for you. With Medicare Supplement plans, you’ll have more flexibility in choosing your doctors and hospitals, but you’ll need to purchase a separate Part D plan for prescription drug coverage. With Medicare Advantage plans, you’ll have access to prescription drug coverage, but you may have fewer choices when it comes to doctors and hospitals.

No matter which plan you choose, it’s important to understand the coverage differences between Medicare Supplement and Medicare Advantage. Knowing the differences can help you make an informed decision about which plan is right for you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Different Types of Medicare Supplement and Medicare Advantage Plans

When it comes to Medicare, there are a variety of options available to help you get the coverage you need. From Medicare Supplement plans to Medicare Advantage plans, there are a variety of plans to choose from. Understanding the differences between these plans can help you make the best decision for your health care needs.

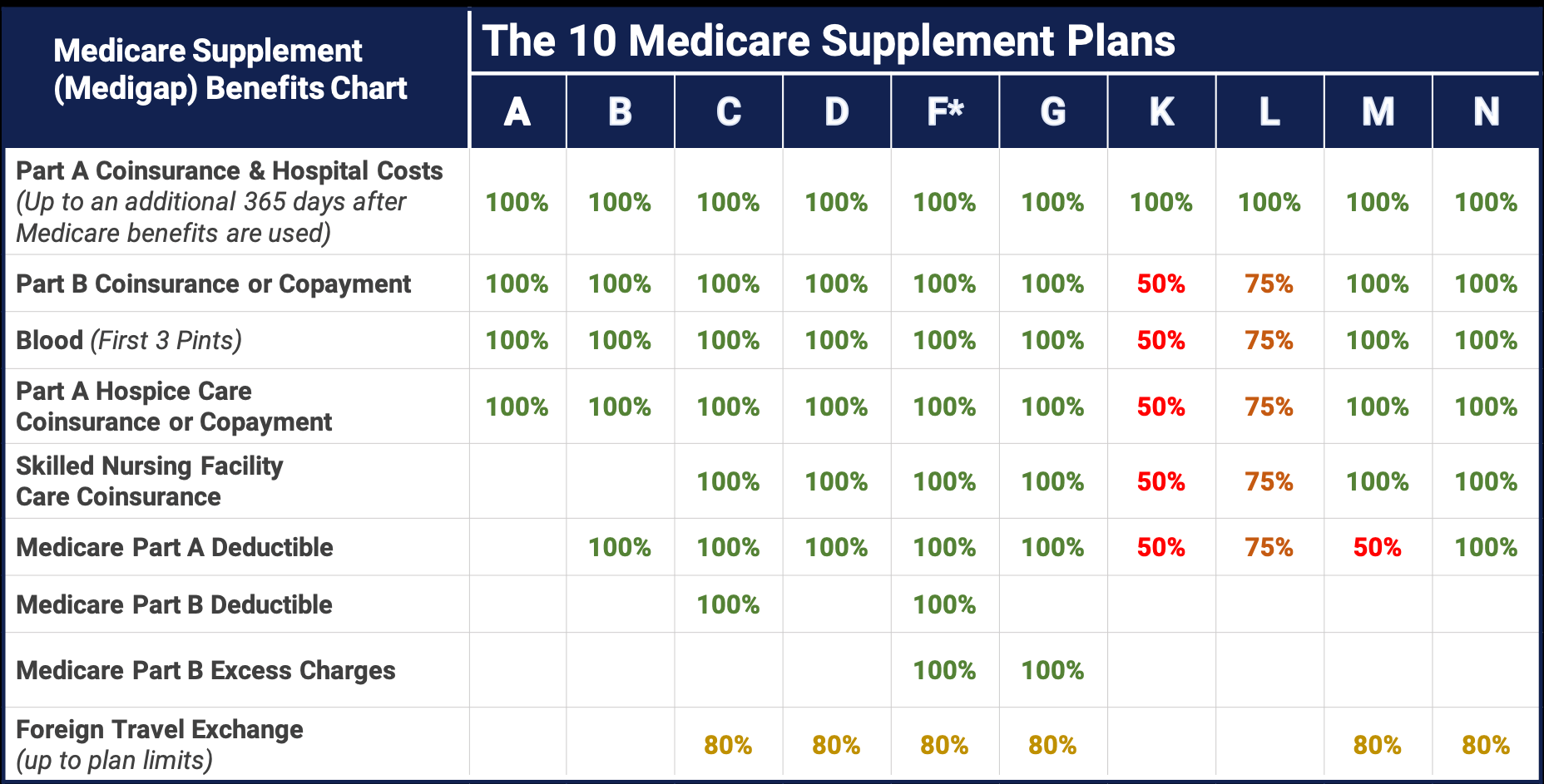

Medicare Supplement plans are designed to help cover the gaps in Original Medicare. These plans are offered by private insurance companies and can help cover the costs of deductibles, coinsurance, and copayments. Medicare Supplement plans are standardized, meaning they offer the same coverage regardless of the insurance company you choose.

Medicare Advantage plans are offered by private insurance companies and are an alternative to Original Medicare. These plans provide the same coverage as Original Medicare, but may also include additional benefits such as vision, hearing, and dental coverage. Medicare Advantage plans may also have lower out-of-pocket costs than Original Medicare.

No matter which type of plan you choose, it’s important to understand the coverage and costs associated with each plan. Doing your research and comparing plans can help you make the best decision for your health care needs. With the right plan, you can get the coverage you need and the peace of mind that comes with it.

Examining the Eligibility Requirements for Medicare Supplement and Medicare Advantage

Are you considering signing up for Medicare Supplement or Medicare Advantage? It’s important to understand the eligibility requirements for each plan before making a decision.

Medicare Supplement plans are available to anyone who is enrolled in Medicare Part A and Part B. You must also live in the state where the plan is offered. Medicare Supplement plans are standardized, meaning they offer the same benefits regardless of where you live.

Medicare Advantage plans are available to anyone who is enrolled in Medicare Part A and Part B. You must also live in the service area of the plan you choose. Medicare Advantage plans are not standardized, so the benefits and costs can vary depending on the plan you choose.

When it comes to eligibility requirements, both Medicare Supplement and Medicare Advantage plans have their advantages. Medicare Supplement plans are standardized, so you know exactly what you’re getting. Medicare Advantage plans offer more flexibility, allowing you to choose a plan that best fits your needs.

No matter which plan you choose, it’s important to understand the eligibility requirements before signing up. Knowing the requirements can help you make an informed decision and ensure that you get the coverage you need.

Exploring the Benefits of Medicare Supplement vs. Medicare Advantage

When it comes to choosing the right health insurance plan for you, it can be a daunting task. With so many options available, it can be difficult to know which one is best for you. Two of the most popular options are Medicare Supplement and Medicare Advantage. Both of these plans offer different benefits and can be beneficial in different ways.

Medicare Supplement plans are designed to supplement your original Medicare coverage. These plans provide additional coverage for things like copayments, coinsurance, and deductibles. They also cover some medical services that are not covered by original Medicare, such as vision and hearing care. Medicare Supplement plans are typically more expensive than Medicare Advantage plans, but they offer more comprehensive coverage.

Medicare Advantage plans are an alternative to original Medicare. These plans are offered by private insurance companies and provide coverage for the same services as original Medicare. However, they often include additional benefits such as vision and hearing care, prescription drug coverage, and even dental coverage. Medicare Advantage plans are typically less expensive than Medicare Supplement plans, but they may not cover as many services.

When deciding between Medicare Supplement and Medicare Advantage, it is important to consider your individual needs and budget. Medicare Supplement plans offer more comprehensive coverage, but they can be more expensive. Medicare Advantage plans are typically less expensive, but they may not cover as many services. Ultimately, the best plan for you will depend on your individual needs and budget.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Understanding the Different Types of Medicare Supplement and Medicare Advantage Plans

When it comes to Medicare, there are a lot of options to choose from. It can be overwhelming to try to figure out which plan is right for you. That’s why it’s important to understand the different types of Medicare Supplement and Medicare Advantage plans.

Medicare Supplement plans are designed to help cover the gaps in Original Medicare. These plans are offered by private insurance companies and can help cover things like copayments, coinsurance, and deductibles. They can also provide coverage for certain services that Original Medicare doesn’t cover, like vision and hearing care.

Medicare Advantage plans are offered by private insurance companies and are an alternative to Original Medicare. These plans provide all of the same coverage as Original Medicare, plus additional benefits like vision and hearing care, prescription drug coverage, and more.

It’s important to understand the differences between these two types of plans so you can make an informed decision about which one is right for you. Medicare Supplement plans are typically more expensive than Medicare Advantage plans, but they can provide more comprehensive coverage. Medicare Advantage plans are usually less expensive, but they may not cover as much as a Medicare Supplement plan.

No matter which type of plan you choose, it’s important to do your research and make sure you understand the coverage and costs associated with each plan. With the right information, you can make an informed decision about which plan is best for you.

Exploring the Different Types of Medicare Supplement and Medicare Advantage Plans

When it comes to Medicare, there are a variety of options available to help you get the coverage you need. From Medicare Supplement plans to Medicare Advantage plans, there are a variety of plans to choose from. Understanding the differences between these plans can help you make the best decision for your health care needs.

Medicare Supplement plans are designed to help cover the gaps in Original Medicare. These plans are offered by private insurance companies and can help cover the costs of deductibles, coinsurance, and copayments. Medicare Supplement plans are standardized, meaning they offer the same coverage regardless of the insurance company you choose.

Medicare Advantage plans are offered by private insurance companies and are an alternative to Original Medicare. These plans provide the same coverage as Original Medicare, but may also include additional benefits such as vision, hearing, and dental coverage. Medicare Advantage plans may also have lower out-of-pocket costs than Original Medicare.

No matter which type of plan you choose, it’s important to understand the coverage and costs associated with each plan. Doing your research and comparing plans can help you make the best decision for your health care needs. With the right plan, you can get the coverage you need and the peace of mind that comes with it.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Different Types of Medicare Supplement and Medicare Advantage Plans

When it comes to Medicare, there are a variety of options available to help you get the coverage you need. From Medicare Supplement plans to Medicare Advantage plans, there are a variety of plans to choose from. Understanding the differences between these plans can help you make the best decision for your health care needs.

Medicare Supplement plans are designed to help cover the gaps in Original Medicare. These plans are offered by private insurance companies and can help cover the costs of deductibles, coinsurance, and copayments. Medicare Supplement plans are standardized, meaning they offer the same coverage regardless of the insurance company you choose.

Medicare Advantage plans are offered by private insurance companies and are an alternative to Original Medicare. These plans provide the same coverage as Original Medicare, but may also include additional benefits such as vision, hearing, and dental coverage. Medicare Advantage plans may also have lower out-of-pocket costs than Original Medicare.

No matter which type of plan you choose, it’s important to understand the coverage and costs associated with each plan. Doing your research and comparing plans can help you make the best decision for your health care needs. With the right plan, you can get the coverage you need and the peace of mind that comes with it.