“Secure Your Future with When: Change Your Medicare Supplement Plan Today!”

When is the Best Time to Change Medicare Supplement Plans?

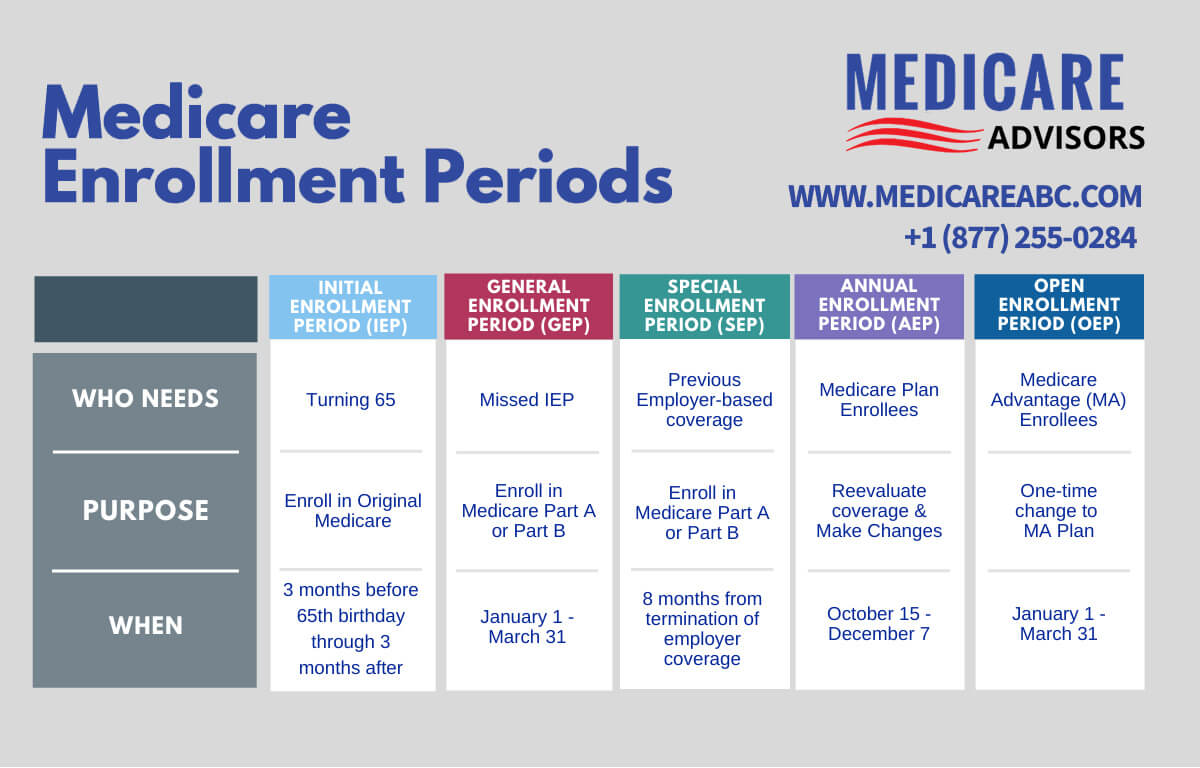

When it comes to changing Medicare Supplement plans, timing is everything. The best time to switch plans is during the annual open enrollment period, which runs from October 15th to December 7th each year. During this time, you can switch plans without having to answer any health questions or provide proof of insurability.

If you need to switch plans outside of the open enrollment period, you may be able to do so if you have a qualifying event, such as a move to a new state or a change in your health status. However, you may be required to answer health questions and provide proof of insurability.

No matter when you decide to switch plans, it’s important to compare your options carefully. Make sure to look at the coverage, premiums, and other factors to find the plan that best meets your needs.

By taking the time to research your options and make an informed decision, you can ensure that you have the right Medicare Supplement plan for your needs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Compare Medicare Supplement Plans Before Making a Change

Making a change to your Medicare Supplement plan can be a daunting task. With so many options available, it can be difficult to know which plan is right for you. Fortunately, there are a few simple steps you can take to compare Medicare Supplement plans and make an informed decision.

First, you’ll want to make sure you understand the different types of Medicare Supplement plans. There are 10 different plans, each with its own set of benefits. Knowing the differences between the plans can help you narrow down your choices.

Next, you’ll want to compare the costs of the plans. Different plans have different premiums, deductibles, and copayments. Make sure you understand the costs associated with each plan before making a decision.

You’ll also want to compare the coverage offered by each plan. Different plans cover different services, so make sure you understand what is and isn’t covered by each plan.

Finally, you’ll want to compare the customer service offered by each plan. Different plans have different customer service policies, so make sure you understand how each plan handles customer service before making a decision.

By taking the time to compare Medicare Supplement plans, you can make an informed decision and choose the plan that best meets your needs.

What to Consider Before Switching Medicare Supplement Plans

Switching Medicare Supplement plans can be a great way to save money and get the coverage you need. But before you make the switch, there are a few things you should consider.

First, make sure you understand the differences between the plans. Each plan offers different levels of coverage, so it’s important to compare the plans side-by-side to make sure you’re getting the coverage you need.

Second, consider the cost. Different plans have different premiums, so make sure you’re getting the best value for your money.

Third, consider the provider network. Different plans have different networks of providers, so make sure you’ll still be able to see your current doctor if you switch plans.

Fourth, consider the customer service. Different plans have different levels of customer service, so make sure you’re comfortable with the customer service you’ll be getting.

Finally, make sure you understand the enrollment process. Different plans have different enrollment processes, so make sure you understand what’s required before you make the switch.

Switching Medicare Supplement plans can be a great way to save money and get the coverage you need. But before you make the switch, make sure you understand the differences between the plans, consider the cost, provider network, customer service, and enrollment process. Doing your research and taking the time to compare plans can help you make the best decision for your needs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Choose the Right Medicare Supplement Plan for Your Needs

When it comes to choosing the right Medicare Supplement Plan for your needs, it can be a daunting task. With so many options available, it can be difficult to know which plan is best for you. Here are some tips to help you make the right decision.

1. Understand Your Needs: Before you start shopping for a Medicare Supplement Plan, it’s important to understand your needs. Consider your current health, any pre-existing conditions, and any medications you take. This will help you determine which plan is best for you.

2. Compare Plans: Once you know your needs, it’s time to compare plans. Look at the coverage offered by each plan and compare it to your needs. Make sure the plan covers the services you need and that it fits within your budget.

3. Consider Your Options: There are several different types of Medicare Supplement Plans available. Consider the different options and decide which one is best for you.

4. Talk to an Expert: If you’re still unsure which plan is best for you, it’s a good idea to talk to an expert. A Medicare specialist can help you understand the different plans and make sure you choose the right one for your needs.

Choosing the right Medicare Supplement Plan for your needs can be a difficult decision. However, by understanding your needs, comparing plans, considering your options, and talking to an expert, you can make sure you choose the right plan for you.

What are the Benefits of Changing Medicare Supplement Plans?

Changing Medicare Supplement Plans can be a great way to save money and get the coverage you need. Here are some of the benefits of switching plans:

1. Lower Premiums: By switching plans, you may be able to find a plan with lower premiums. This can help you save money on your monthly expenses.

2. Better Coverage: Different plans offer different levels of coverage. By switching plans, you may be able to find a plan that offers better coverage for your specific needs.

3. More Flexibility: Some plans offer more flexibility than others. By switching plans, you may be able to find a plan that offers more options for coverage and customization.

4. Improved Service: Different plans offer different levels of customer service. By switching plans, you may be able to find a plan with better customer service and more helpful representatives.

Changing Medicare Supplement Plans can be a great way to save money and get the coverage you need. With the right plan, you can get the coverage you need at a price you can afford.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What are the Risks of Changing Medicare Supplement Plans?

Changing Medicare Supplement Plans can be a daunting task, but it doesn’t have to be. While there are risks associated with switching plans, there are also many benefits that can come with making the switch. Here are some of the risks associated with changing Medicare Supplement Plans:

1. Increased Premiums: One of the biggest risks of changing Medicare Supplement Plans is that you may end up paying more for your coverage. Different plans have different premiums, so it’s important to compare plans and make sure you’re getting the best deal.

2. Reduced Coverage: Another risk of changing Medicare Supplement Plans is that you may end up with reduced coverage. Different plans offer different levels of coverage, so it’s important to make sure you’re getting the coverage you need.

3. Loss of Benefits: When you switch plans, you may also lose certain benefits that you had with your previous plan. Make sure to read the fine print and understand what benefits you may be losing when you switch plans.

4. Increased Out-of-Pocket Costs: When you switch plans, you may also end up with higher out-of-pocket costs. Make sure to compare plans and understand what your out-of-pocket costs may be before making the switch.

Changing Medicare Supplement Plans can be a great way to get the coverage you need at a price you can afford. However, it’s important to understand the risks associated with making the switch before you do so. Make sure to compare plans and understand what you may be losing or gaining before making the switch.

How to Avoid Mistakes When Changing Medicare Supplement Plans

Changing Medicare Supplement plans can be a daunting task, but it doesn’t have to be. With a few simple steps, you can avoid making costly mistakes and ensure that you get the coverage you need.

1. Do your research. Before you make any changes to your Medicare Supplement plan, take the time to research your options. Compare plans and coverage levels to make sure you’re getting the best deal.

2. Talk to an expert. If you’re unsure about which plan is right for you, talk to a Medicare expert. They can help you understand the different plans and coverage levels and make sure you’re making the right decision.

3. Read the fine print. Make sure you read and understand all the details of your new plan before you sign up. Pay special attention to any exclusions or limitations that may apply.

4. Ask questions. Don’t be afraid to ask questions if you don’t understand something. It’s better to ask now than to be surprised later.

5. Get it in writing. Make sure you get a written copy of your new plan and keep it in a safe place. This will help you remember the details and make sure you’re getting the coverage you need.

By following these steps, you can avoid making costly mistakes when changing Medicare Supplement plans. With a little bit of research and preparation, you can make sure you get the coverage you need.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What to Do if You Have Questions About Changing Medicare Supplement Plans

If you have questions about changing your Medicare Supplement plan, don’t worry – you’re not alone! There are plenty of resources available to help you make an informed decision. Here are a few tips to get you started:

1. Talk to your current Medicare Supplement plan provider. They can provide you with information about your current plan and any changes that may be available.

2. Contact your state’s Department of Insurance. They can provide you with information about different Medicare Supplement plans and help you compare them.

3. Speak with a Medicare counselor. A Medicare counselor can help you understand your options and make an informed decision.

4. Research online. There are plenty of websites that provide information about Medicare Supplement plans and can help you compare different plans.

5. Ask your doctor or healthcare provider. They may be able to provide you with information about different plans and help you make an informed decision.

Changing your Medicare Supplement plan can be a daunting task, but with the right resources and information, you can make an informed decision that’s right for you.

How to Find the Best Medicare Supplement Plan for Your Situation

Finding the best Medicare Supplement Plan for your situation can be a daunting task. With so many options available, it can be difficult to know which plan is right for you. Fortunately, there are a few steps you can take to make sure you find the best plan for your needs.

First, you should assess your current health care needs. Consider any chronic conditions you may have, as well as any medications you take regularly. Knowing what your health care needs are will help you narrow down your options and find the plan that best fits your needs.

Next, you should compare the different plans available. Look at the coverage each plan offers and compare the premiums, deductibles, and copayments. Make sure to read the fine print and understand what is and isn’t covered.

Finally, you should talk to a Medicare specialist. A Medicare specialist can help you understand the different plans and make sure you’re getting the best coverage for your needs. They can also answer any questions you may have and help you make an informed decision.

By taking the time to assess your needs, compare plans, and talk to a Medicare specialist, you can be sure you’re getting the best Medicare Supplement Plan for your situation. With the right plan, you can rest assured that you’re getting the coverage you need at a price you can afford.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What to Know About Medicare Supplement Plan Open Enrollment Periods

Medicare Supplement Plan Open Enrollment Periods are an important time for those who are enrolled in Medicare. During this period, you can make changes to your coverage, switch plans, and even enroll in a new plan. Here’s what you need to know about this important time.

First, you should know that the Medicare Supplement Plan Open Enrollment Periods are different from the regular Medicare Open Enrollment Periods. During the regular Medicare Open Enrollment Periods, you can make changes to your coverage, switch plans, and even enroll in a new plan. However, during the Medicare Supplement Plan Open Enrollment Periods, you can only make changes to your coverage and switch plans. You cannot enroll in a new plan during this time.

Second, you should know that the Medicare Supplement Plan Open Enrollment Periods are typically shorter than the regular Medicare Open Enrollment Periods. The Medicare Supplement Plan Open Enrollment Periods usually last for three months, while the regular Medicare Open Enrollment Periods last for six months.

Third, you should know that the Medicare Supplement Plan Open Enrollment Periods are usually held in the fall. This is because the Medicare Supplement Plans are typically released in the fall, and the Open Enrollment Periods are held shortly after.

Finally, you should know that the Medicare Supplement Plan Open Enrollment Periods are a great time to review your coverage and make sure that you have the best plan for your needs. During this time, you can compare plans and make sure that you are getting the best coverage for your money.

The Medicare Supplement Plan Open Enrollment Periods are an important time for those who are enrolled in Medicare. During this period, you can make changes to your coverage, switch plans, and even enroll in a new plan. Make sure to take advantage of this time to review your coverage and make sure that you have the best plan for your needs.