What Is Medicare Part A & B e : All You Want To Know About Original Medicare Part A And B Coverage

Have you heard the term Medicare Part A or Part B before? – You might have! But, do you know what is Medicare in the first place?! Medicare is a federal health insurance program that pays for a wide range of health care services. Similar to Social Security, any U.S citizen can be eligible by working and paying taxes for a specific period. Even if they didn’t work long enough, they can still enroll and pay extra premiums. Once you sign up, Medicare enrolls you in two parts; Medicare Part A & Part B. But, what is Medicare Part A & B? – Let’s find out!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

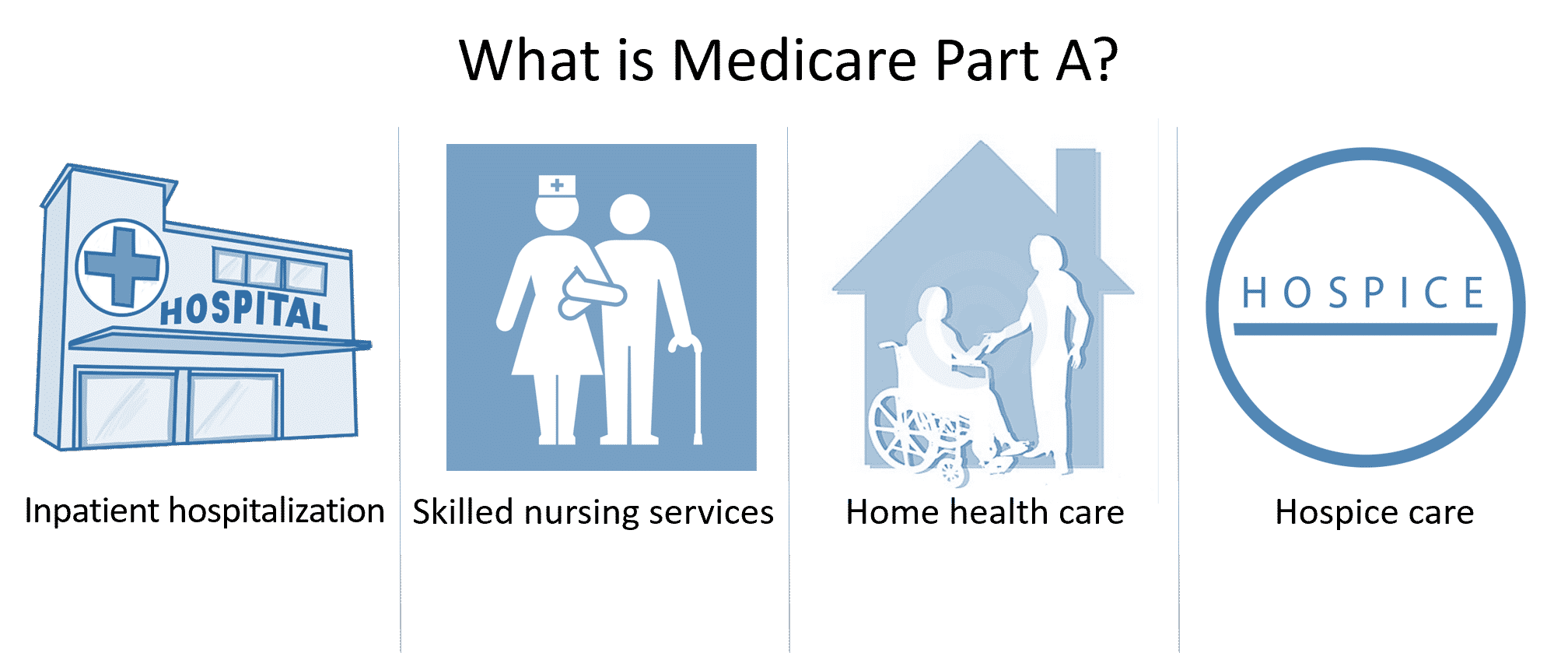

At First, What Is Medicare Part A?

When you sign up for Medicare, you’re automatically enrolled in Medicare Part A. Medicare Part A is typically Hospital Insurance, meaning that it covers any hospitalization expenses. Most American citizens, in addition to permanent U.S residents, are eligible to enroll in Medicare Part A with a free premium. However, if you don’t qualify, you can enroll after paying a premium of either $259 or $471 per month. These fees depend on the amount of Medicare taxes that you or your spouse paid during your working period.

What Does Medicare Part A (Hospital Insurance) Cover?

- Inpatient hospital stays

- Skilled nursing care

- Hospice care

- Limited home health care services

- Mental health care

- Medications that are part of your inpatient treatment

Inpatient Hospital Care

Do you need hospitalization after a stroke? Do you need some rehabilitation time in a nursing home after a sudden illness? Do you need some nursing care after having a broken hip? – Medicare Part A covers all these services for the first 60 days of your hospital stay. But, you must know that there are a few exceptions! For example, Medicare Part A won’t cover a private room in a hospital unless it is a necessity. It also doesn’t cover private-duty nursing, 24/7 home care, meals, or special personal items such as shampoo or razors.

Limited Home Health Care Services

Medicare Part A may include home health care services, according to your doctor’s prescriptions and orders. Home health care benefits may or may not cover the following:

- Durable medical equipment (Covered under Medicare Part B and you pay only 20% of the expenses)

- Physical therapy

- Skilled nursing care

- Speech-language pathology services (SLP)

- Health aide services as part-time or at specific discontinuous times

- Occupational therapy (OT)

Medicare Part A covers all the home care expenses if a Medicare-certified home health agency, as well as a doctor, certifies that you’re homebound. According to Medicare, you:

Must not be able to leave your house or it requires drastic efforts to leave your house

Cannot leave your house without aid, specific equipment, or transportation

Skilled Nursing Care

Medicare Part A covers skilled nursing facility in case you’re admitted to hospital for the same or related illness. You must stay in the hospital for a minimum of three days to qualify for a skilled nursing facility. A Medicare-certified facility must order this specific care to be qualified.

- Skilled Nursing Care Includes The Following:

- Semi-private room

- Skilled nursing services

- Rehabilitation services (If your condition requires)

- Medical social services

- Medications received during the skilled nursing facility period

- Any medical supplies or equipment needed during the skilled nursing facility period

- Ambulance transportation (If any service is not provided at the skilled nursing facility)

Hospice Care

To be eligible for hospice care, your doctor must state that you have a terminal illness and you’ve only 6 months or less to live. The aim of hospice care service is comfort-focused to relieve the pain, not curing the disease. In this benefit, you must agree to give up on any curative treatments. A Medicare-certified facility must approve of hospice care and you receive this caring service at home.

Hospice Care Service Includes The Following:

- Physical therapy

- Occupational therapy

- Durable medical equipment

- Medical supplies

- Hospice aide services

- Pain relief medications

- Inpatient care for a short time

- Homemaker services

- Nursing care

- Social services

- Spiritual counseling

When Do I Pay Medicare Part A Premium?

If you’re qualified for Social Security retirement benefits, you will be enrolled automatically in Medicare Part A and the benefits start the first day of your 65th birthday month. If not, you will have to enroll in Medicare Part A manually and this must occur during your Initial Enrollment Period. This period encompasses seven months; 3 months before your birthday, your birthday month, and 3 months after your birthday.

If you missed your enrollment period, you will have to wait until the next one, which takes place from January 1 until March 31). Remember that if you’re not qualified for premium-free Medicare Part A and haven’t enrolled when you’re eligible, you will pay a late-enrollment penalty (up to 10% for your monthly premium and twice the amount of time when you didn’t have Part A). If someone is 65 and still working, they may be able to postpone enrolling and have no penalty depending on employer size and also until the employer insurance expires.

Initial Enrollment Period In Medicare Part A

If you’re disabled, you can enroll in Medicare Part A after you receive Social Security disability benefits for 24 months. (Medicare Part A benefits start in the 25th month)

If you have Lou Gehrig disease, you will receive Medicare Part A benefits at the same month you will receive Social Security disability benefits.

If you suffer from an end-stage renal disease and require dialysis treatment, you will receive Medicare Part A benefits on the first day of the fourth month of your treatment. Make sure to enroll manually if you’re under 65.

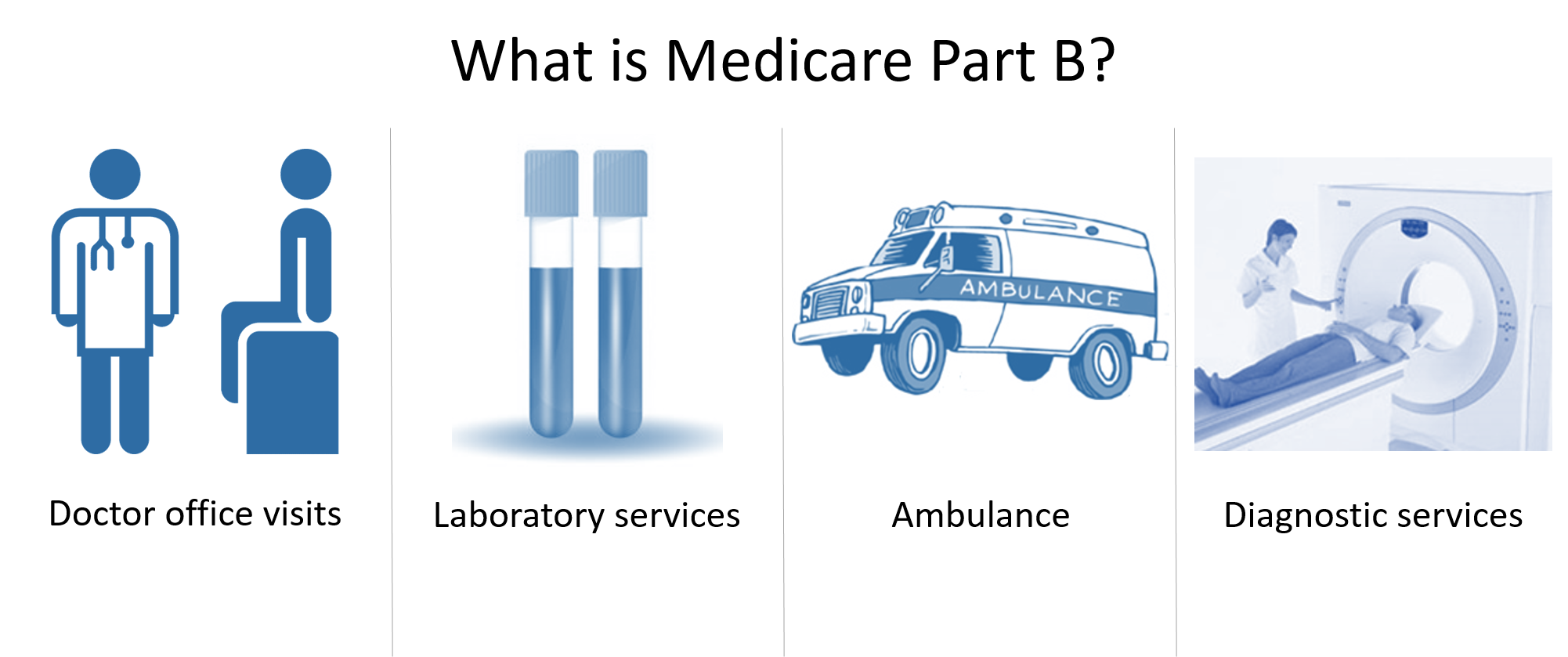

What Is Medicare Part B Insurance?

Medicare part B is typically medical insurance and it is part of Original Medicare. If you’re eligible for premium-free Medicare Part A, you can enroll in Medicare Part B and pay the monthly premium. If you’re covered under an employer group plan, you can postpone your enrollment until the coverage ends. Afterwards, you will have an eight-month enrollment period to sign up for Medicare Part B without penalty. If you’re in the Medicare Advantage plan, you can get Medicare Part A & B coverage through a Medicare-contracted health insurance company.

Medicare Part B Coverage Options

- Medical services and supplies that are prescribed specially for your health condition

- Outpatient care

- Ambulance services

- Office visits

- Diabetes screenings

- Chemotherapy

- Flu shots

- Durable medical equipment (wheelchairs, walkers, and more)

- Preventive services (check-ups, patient counseling, screenings, and more

- Physical therapy if necessary for your health condition

- Home health care and rehabilitation services (part-time or at specific discontinuous times)

What Services Aren’t Covered In Medicare Part B?

- Nursing home care for more than 100 days

- Routine foot care

- Dental care

- Hearing tests

- Cosmetic surgeries

- Any health care outside of the U.S

- Personal care (bathing, dressing, etc.)

- Vision services

How Much Does Medicare Part B Cost?

The premium of Medicare Part B must be paid on a monthly basis. You can pay this premium if you get benefits from Social Security, the Office of Personnel Management, or the Railroad Retirement Board. Otherwise, you will get a bill to pay. You must pay a premium of $148.50; however, there are federal programs to help you if you have a low income. Like Medicare Part A, if you don’t enroll when you’re first eligible, you will pay a late enrollment penalty.

How To Enroll In Medicare Part B

If you’re not enrolled automatically in Medicare Part B, you can sign up through the Social Security website or at the Social Security office. Also, you can call 1-800-772-1213 from 8 am until 7 pm according to the U.S time zone from Monday to Friday.

To enroll, you need these documents:

A proof that you’re eligible for Medicare

- Age

- Citizenship

- Income history

- Military service

- Social Security number

- Date & birthplace

If you’re not a U.S citizen, you can present proof of legal residency, including a Permanent Resident Card and admission-departure record if available. If you were born outside of the U.S, you must present citizenship proof such as a U.S passport or U.S consular report of birth.

Can I Sign Up For Medicare Part B Online?

Yes, you can sign up online for Medicare Part B through the Social Security website (www.socialsecurity.gov). You will need to fill out an application, providing any needed documents. Make sure to check Social Security and be ready with the required documents before enrollment.

Eligibility For Medicare Part A & Part B

You can get premium-free Medicare Part A at 65 if:

- You enjoy some retirement benefits from Social Security

- You’re already eligible for Social Security but haven’t filed for it yet

- You or your spouse had a government job that covered Medicare

- You worked 10 years in the United States and you and/or your spouse paid for Medicare taxes, you qualify with premium free

You can get premium-free Medicare Part A under 65 if:

- You have End-Stage Renal Disease (under specific conditions)

- You got Social Security disability benefits for 24 months

Medicare Part A And B Premiums And Deductibles

- Here are the premiums and deductibles for Medicare Part A & B in 2021 to check:

Medicare Part A & B Deductibles In 2021

For Part A: Before Medicare pays anything for hospital or skilled nursing facility coverage, you need to pay around $1,484. This deductible isn’t per year, but per benefit.

So, what is the benefit period?

– It is the period you spend as an inpatient in a hospital or skilled nursing facility. This period ends when you don’t get any of these services for 60 days in a row. If you’re admitted to a hospital or skilled nursing facility again within the same year, you will have to pay another deductible amount.

For Part B: You will have to pay around $203 as a deductible amount and after that, you pay only 20% of the amount of the covered services.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medicare Part A & B Premiums In 2021

For Part A: If you worked long enough, you may be qualified for premium-free Medicare Part A. Otherwise, you will pay the following:

You will pay $259 if you paid taxes while working 30-39 quarters

You will pay $471 if fewer than 30 quarters

For Part B: You will need to pay $148.50/month for Medicare Part B coverage. You need to check this amount because if you have an income of more than a certain amount, your premium will be higher.

Are You Ready To Enroll?

Now that we’ve covered everything about Medicare Part A & B, you are totally aware of all the important aspects and services. Medicare isn’t confusing at all. But, with so much information to understand, it can be overwhelming. If you have any questions, don’t hesitate to contact us at 1-877-255-0284 for more information about Medicare. Our team at Medicare ABC will make sure to study your case, talk about your options, and help you make the proper decision. So, are you ready to enroll in Medicare?!