Meta Title: What Happens to Your Coverage If You Travel with Medicare Advantage?

Meta Description: Learn how Medicare Advantage coverage works when you travel. Get expert guidance from Medicare Advisors at medicareabc.com.

Traveling during retirement should feel exciting—not stressful. But if you’re enrolled in a Medicare Advantage plan, you might wonder what happens to your coverage when you leave your home state. Understanding how travel affects your benefits is essential before you pack your bags.

At Medicare Advisors, we help beneficiaries across New Jersey and New York make confident decisions about their Medicare coverage. Let’s break down exactly what happens to your coverage if you travel with Medicare Advantage.

Understanding Medicare Advantage Coverage Basics

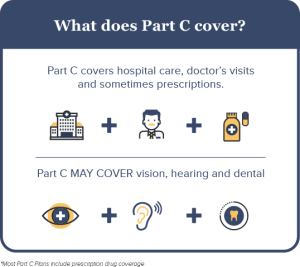

Medicare Advantage (also called Part C) is an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare. They typically include:

- Hospital coverage (Part A)

- Medical coverage (Part B)

- Often prescription drug coverage (Part D)

- Extra benefits like dental, vision, and hearing

However, Medicare Advantage plans usually operate within provider networks such as HMOs or PPOs. That network structure is what makes travel coverage different from Original Medicare.

You can review official Medicare guidance about plan types at the Medicare.gov plan overview page.

Emergency Coverage While Traveling

The good news: All Medicare Advantage plans must cover emergency and urgent care anywhere in the United States.

If you experience:

- A sudden illness

- An unexpected injury

- A medical emergency

Your plan will cover emergency care even if you’re outside your service area.

This protection applies nationwide. You are not restricted to your local network during emergencies.

What About Routine Care Outside Your Service Area?

This is where it becomes important to understand your specific plan type.

HMO Plans

Health Maintenance Organization (HMO) plans generally:

- Require you to use in-network providers

- Do NOT cover routine care outside your service area

- Require referrals for specialists

If you travel outside your state and need non-emergency treatment, it likely won’t be covered unless you return home.

PPO Plans

Preferred Provider Organization (PPO) plans offer more flexibility:

- You can see out-of-network providers

- You may pay higher costs

- Coverage may still apply outside your home state

If you travel frequently, a PPO may provide better flexibility.

The Centers for Medicare & Medicaid Services (CMS) explains network rules in more detail at CMS.gov.

Traveling for Extended Periods (Snowbirds)

Many retirees split time between states, especially during winter months. If you stay outside your plan’s service area for more than six months, your plan may:

- Consider you permanently relocated

- Require you to enroll in a new plan

- Trigger a Special Enrollment Period

If you’re a snowbird spending winters in Florida or Arizona while living in New Jersey or New York, plan selection becomes especially important.

At Medicare Advisors, we help clients compare plans that better accommodate multi-state living.

International Travel and Medicare Advantage

Medicare Advantage plans are not required to cover care outside the United States. However:

- Some plans offer limited international emergency coverage

- Coverage rules vary by plan

- Reimbursement limits may apply

If you plan to travel internationally, it’s important to review your Evidence of Coverage document carefully.

Can You Switch Plans If You Travel Frequently?

Yes. Depending on your situation, you may qualify for:

- Annual Enrollment Period (October 15 – December 7)

- Medicare Advantage Open Enrollment (January 1 – March 31)

- Special Enrollment Periods (if relocating)

If travel flexibility is important to you, we can evaluate whether:

- A PPO plan

- Original Medicare with a Medigap plan

- A nationwide network plan

would better fit your lifestyle.

Key Questions to Ask Before Traveling

Before you leave, consider:

- Does my plan cover urgent care nationwide?

- What happens if I need follow-up care?

- Am I staying outside my service area for more than six months?

- Does my plan offer international emergency benefits?

- What are my out-of-network costs?

A quick coverage review before travel can prevent unexpected medical bills.

How Medicare Advisors Can Help

As a trusted Medicare insurance broker serving New Jersey and New York, Medicare Advisors provides:

- Personalized plan comparisons

- Network flexibility analysis

- Snowbird coverage planning

- PPO vs HMO evaluation

- Prescription drug coverage review

We don’t just enroll you—we help you understand how your coverage works in real-life situations like travel.

Visit us at https://medicareabc.com/

Call us at +1 (877) 255-0284

Email: info@mymedicareadvisors.com

Our licensed agents are ready to review your plan and make sure your coverage supports your lifestyle.

Frequently Asked Questions

Does Medicare Advantage cover me in another state?

Yes, for emergencies and urgent care anywhere in the U.S. Routine care depends on your plan type.

Can I see a doctor outside my network while traveling?

Only if you have a PPO plan. HMO plans typically require in-network providers.

What if I live in two states during the year?

You may need to enroll in a plan based in your primary residence state. Extended stays can trigger a Special Enrollment Period.

Does Medicare Advantage cover international travel?

Some plans offer limited emergency coverage abroad, but benefits vary by plan.

Should I switch to Original Medicare if I travel often?

It depends on your travel habits and healthcare needs. We can help compare options.

Travel with confidence. If you’re unsure how your Medicare Advantage plan works outside your home area, connect with Medicare Advisors today and get expert guidance tailored to your situation.