Exploring the Benefits of Medicare Part C Coverage

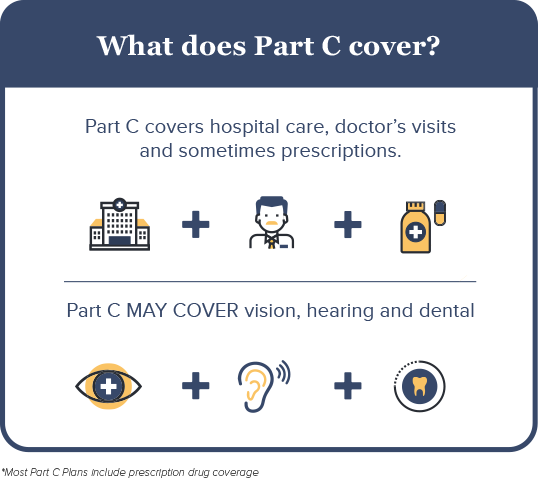

What Does Medicare Part C Cover? Medicare Part C coverage is a great way to get the most out of your health care. With Part C, you can get the same coverage as Original Medicare, plus additional benefits. Here are just a few of the benefits you can enjoy with Part C coverage:

1. More Choice: With Part C, you can choose from a variety of plans that offer different levels of coverage. This means you can find a plan that fits your needs and budget.

2. Lower Out-of-Pocket Costs: Part C plans often have lower out-of-pocket costs than Original Medicare. This means you can save money on your health care expenses.

3. Coverage for Prescription Drugs: Many Part C plans include coverage for prescription drugs. This can help you save money on your medications.

4. Access to Specialists: Part C plans often provide access to specialists, such as cardiologists and oncologists. This can help you get the care you need quickly and easily.

5. Preventive Care: Part C plans often cover preventive care, such as annual check-ups and screenings. This can help you stay healthy and catch any potential health issues early.

With all these benefits, it’s easy to see why Medicare Part C coverage is a great option for many people. If you’re looking for a way to get the most out of your health care, Part C may be the right choice for you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Does Medicare Part C Cover for Prescription Drugs?

Medicare Part C, also known as Medicare Advantage, is a great way to get comprehensive coverage for your prescription drugs. With Medicare Part C, you can get coverage for both generic and brand-name drugs, as well as over-the-counter medications. This coverage is provided through private insurance companies that contract with Medicare.

When you enroll in Medicare Part C, you will receive a prescription drug plan that covers your medications. This plan will include a list of covered drugs, as well as the cost of each drug. You may also be able to get additional coverage for certain drugs, such as those used to treat chronic conditions.

In addition to covering your prescription drugs, Medicare Part C also covers preventive care services, such as annual physicals and screenings. This coverage can help you stay healthy and avoid costly medical bills.

Medicare Part C is a great way to get comprehensive coverage for your prescription drugs. With this coverage, you can get the medications you need to stay healthy and avoid costly medical bills.

How Does Medicare Part C Work with Other Insurance Plans?

Medicare Part C, also known as Medicare Advantage, is a great way to supplement your existing health insurance plan. It works with other insurance plans to provide additional coverage for medical expenses, such as doctor visits, hospital stays, and prescription drugs.

When you enroll in Medicare Part C, you are still enrolled in Original Medicare (Parts A and B). However, you also have the option to choose a private health insurance plan that works with Medicare. These plans are offered by private insurance companies and provide additional coverage for medical expenses.

The way Medicare Part C works with other insurance plans is that it acts as a supplement to your existing coverage. It pays for services that are not covered by your other insurance plan, such as vision and dental care. It also helps to reduce your out-of-pocket costs for medical expenses.

When you enroll in Medicare Part C, you will be required to pay a monthly premium. This premium is in addition to the premiums you pay for your other insurance plans. However, the amount you pay for Medicare Part C may be lower than the amount you pay for your other insurance plans.

Medicare Part C also offers additional benefits, such as coverage for preventive care and prescription drugs. It also provides coverage for emergency care and hospital stays.

Overall, Medicare Part C is a great way to supplement your existing health insurance plan. It helps to reduce your out-of-pocket costs for medical expenses and provides additional coverage for services that are not covered by your other insurance plans.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Are the Different Types of Medicare Part C Plans?

Medicare Part C plans, also known as Medicare Advantage plans, are a great way to get comprehensive coverage for your healthcare needs. These plans are offered by private insurance companies and provide coverage for hospital stays, doctor visits, prescription drugs, and more. There are several different types of Medicare Part C plans available, each with its own unique benefits and features.

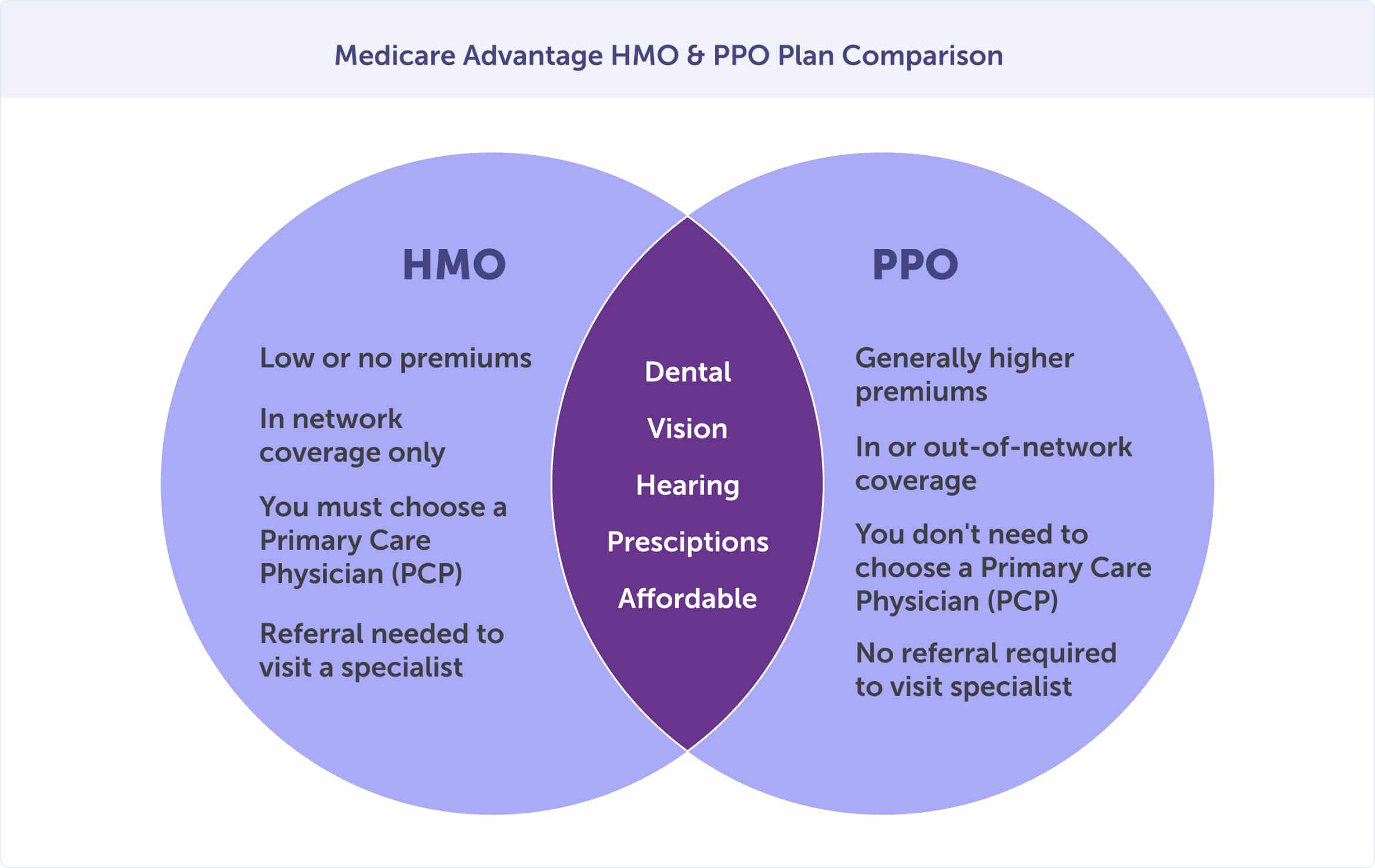

1. HMO Plans: Health Maintenance Organization (HMO) plans are the most common type of Medicare Part C plan. These plans typically require you to use a network of providers and hospitals, and you may need to get a referral from your primary care doctor in order to see a specialist.

2. PPO Plans: Preferred Provider Organization (PPO) plans are similar to HMO plans, but they offer more flexibility. You can see any provider in the network, and you don’t need a referral to see a specialist.

3. PFFS Plans: Private Fee-for-Service (PFFS) plans allow you to see any provider that accepts the plan’s terms and conditions. You don’t need to use a network of providers, and you don’t need a referral to see a specialist.

4. SNP Plans: Special Needs Plans (SNP) are designed for people with specific health needs, such as those with chronic conditions or disabilities. These plans provide extra benefits and services tailored to meet the needs of those with special health care needs.

No matter which type of Medicare Part C plan you choose, you can rest assured that you’ll have comprehensive coverage for your healthcare needs.

What Are the Eligibility Requirements for Medicare Part C?

If you’re looking for a comprehensive health insurance plan that covers more than just hospital and medical expenses, then Medicare Part C may be the right choice for you. To be eligible for Medicare Part C, you must meet the following requirements:

• You must be enrolled in both Medicare Part A and Part B.

• You must live in the service area of a Medicare Part C plan.

• You must not have End-Stage Renal Disease (ESRD).

• You must not have a Medicare Advantage plan through another provider.

• You must not have a Medigap policy.

• You must not have any other type of health insurance coverage.

If you meet all of these requirements, then you may be eligible for Medicare Part C. With Medicare Part C, you can enjoy comprehensive coverage that includes hospital and medical expenses, as well as prescription drug coverage, vision and dental care, and more. So don’t wait – find out if you’re eligible for Medicare Part C today!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Are the Costs Associated with Medicare Part C Coverage?

Medicare Part C coverage, also known as Medicare Advantage, is a great way to get comprehensive health coverage. It combines the benefits of Medicare Parts A and B with additional coverage, such as vision, hearing, and dental care. However, there are costs associated with this coverage that you should be aware of before signing up.

The first cost associated with Medicare Part C coverage is the monthly premium. This is the amount you pay each month to keep your coverage active. The amount of the premium varies depending on the plan you choose and the area you live in.

In addition to the monthly premium, you may also have to pay a deductible. This is the amount you must pay out-of-pocket before your coverage kicks in. The amount of the deductible varies depending on the plan you choose.

You may also have to pay copayments or coinsurance for certain services. Copayments are a fixed amount you pay for a service, while coinsurance is a percentage of the cost of the service. The amount of the copayment or coinsurance varies depending on the plan you choose.

Finally, you may have to pay an out-of-pocket maximum. This is the most you will have to pay out-of-pocket for covered services in a year. Once you reach this amount, your plan will cover all of your costs for the rest of the year.

These are the costs associated with Medicare Part C coverage. Be sure to consider all of these costs when choosing a plan to make sure you get the coverage that best fits your needs and budget.

What Are the Advantages of Medicare Part C Over Traditional Medicare?

Medicare Part C, also known as Medicare Advantage, offers a number of advantages over traditional Medicare. Medicare Part C plans provide comprehensive coverage, including hospitalization, doctor visits, prescription drugs, and preventive care. These plans also offer additional benefits such as vision, hearing, and dental coverage, as well as access to a wide network of providers.

Medicare Part C plans are often more affordable than traditional Medicare. These plans typically have lower premiums and out-of-pocket costs, making them a great option for those on a budget. Additionally, many Medicare Part C plans offer additional benefits such as gym memberships, transportation services, and discounts on over-the-counter medications.

Medicare Part C plans also provide more flexibility than traditional Medicare. These plans allow you to choose your own doctor and hospital, and you can switch plans at any time. This means you can find a plan that best fits your needs and budget.

Finally, Medicare Part C plans offer more personalized care. These plans often provide access to care coordinators who can help you manage your health care needs. They can also help you find the right specialists and coordinate care between providers. This can be especially helpful for those with complex medical needs.

Overall, Medicare Part C offers a number of advantages over traditional Medicare. These plans provide comprehensive coverage, are often more affordable, offer more flexibility, and provide personalized care. For those looking for an alternative to traditional Medicare, Medicare Part C is a great option.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Are the Disadvantages of Medicare Part C?

Medicare Part C, also known as Medicare Advantage, is a popular option for those looking for additional coverage beyond what is offered by Original Medicare. However, there are some drawbacks to this type of coverage that should be considered before enrolling.

First, Medicare Part C plans often have higher out-of-pocket costs than Original Medicare. This includes copayments, coinsurance, and deductibles. Additionally, these plans may have limited provider networks, meaning that you may not be able to see the doctor or hospital of your choice.

Another disadvantage of Medicare Part C is that it does not cover all of the services that Original Medicare does. This includes services such as hospice care, long-term care, and some preventive services. Additionally, some plans may have annual limits on the amount of coverage they provide.

Finally, Medicare Part C plans may have additional restrictions and requirements that can be difficult to understand. For example, some plans may require prior authorization for certain services or may have limits on the number of visits you can make to a doctor in a given year.

Overall, Medicare Part C can be a great option for those looking for additional coverage beyond what is offered by Original Medicare. However, it is important to understand the potential drawbacks of this type of coverage before enrolling.

How Can I Find the Best Medicare Part C Plan for Me?

Finding the best Medicare Part C plan for you can be a daunting task. But with a little research and some savvy shopping, you can find the plan that best fits your needs. Here are some tips to help you find the best Medicare Part C plan for you:

1. Research your options. Take the time to research the different Medicare Part C plans available in your area. Compare the coverage, cost, and other features of each plan to determine which one is the best fit for you.

2. Consider your needs. Think about your current and future health care needs. Consider any pre-existing conditions you may have, as well as any medications you take regularly. This will help you narrow down your choices and find the plan that best meets your needs.

3. Compare costs. Cost is an important factor when choosing a Medicare Part C plan. Compare the premiums, deductibles, and copayments of each plan to determine which one is the most cost-effective for you.

4. Ask questions. Don’t be afraid to ask questions about the plans you’re considering. Contact the insurance companies or your local Medicare office to get answers to any questions you may have.

By taking the time to research your options and compare costs, you can find the best Medicare Part C plan for you. With a little effort, you can find the plan that best fits your needs and budget.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Are the Most Common Questions People Have About Medicare Part C Coverage?

1. What is Medicare Part C coverage?

2. How does Medicare Part C coverage differ from Original Medicare?

3. What types of services are covered under Medicare Part C?

4. What are the costs associated with Medicare Part C coverage?

5. How do I enroll in Medicare Part C coverage?

6. What are the benefits of Medicare Part C coverage?

7. Are there any restrictions or limitations on Medicare Part C coverage?

8. What is the difference between Medicare Part C and Medicare Advantage plans?

9. How do I find a Medicare Part C plan that meets my needs?

10. What is the difference between Medicare Part C and Medigap plans?