If you’re checking out Aetna Medicare PPO plans, you’re in the right place. We’re here to break down exactly what these plans cover, and we’ll throw in a few quirks along the way—the good, the not-so-good, and a little humor to keep it light. At Medicare Advisors Insurance Group LLC, we’ve helped lots of folks understand their Medicare options, so let’s make sense of what Aetna Medicare PPO brings to the table.

So What Exactly is Aetna Medicare PPO?

Aetna Medicare PPO—short for Preferred Provider Organization—is a type of Medicare Advantage plan. With this, you get access to a network of doctors, hospitals, and other healthcare providers. But here’s the cool part—you don’t need referrals to see specialists, and you can visit doctors outside the network if you want—though it’ll probably cost more if you do.

What Does Aetna Medicare PPO Actually Cover?

Aetna Medicare PPO plans cover a lot of different healthcare services—here are the main ones:

- Hospital Stays: If you’ve ever had to stay overnight at a hospital, you know it’s no luxury vacation. Thankfully, Aetna’s PPO plan helps cover those stays.

- Doctor Visits: Want to see a doctor? No problem. Aetna PPO lets you visit any doctor, but if they’re in-network, you’ll pay less.

- Prescription Drugs: If you’re on meds, some Aetna PPO plans include Part D coverage for prescriptions. Just be ready for the occasional “Sorry, we need prior approval” situation. It happens.

- Preventive Services: Stuff like annual check-ups, screenings, and vaccines are covered—these help keep bigger health problems at bay.

- Vision: Need an eye exam or glasses? Aetna PPO has got you covered, though let’s be real—you’re not getting designer frames.

- Dental: Some plans help with basic dental work like cleanings and X-rays, but if you need a crown or something more serious, there might be some extra costs.

- Hearing: Hearing tests and sometimes discounts on hearing aids are included. Now you’ll hear that TV just fine.

The Catch—A Few Drawbacks to Know About

While Aetna Medicare PPO has plenty of perks, it’s not perfect. Here are a few things that might give you a chuckle—or maybe make you groan.

Higher Costs for Out-of-Network Care

You can see any doctor you want, but if they’re not in Aetna’s network, get ready for a bigger bill. Henry Beltran, owner of Medicare Advisors Insurance Group LLC, puts it best—“It’s like going to a fancy steakhouse expecting fast food prices. Yeah, that’s not happening.”

Prior Authorizations—Ugh

Sometimes you’ll need approval before certain treatments are covered, which can feel like extra hoops to jump through. Henry jokes, “It’s like packing for a trip and realizing last minute that you forgot your passport. You’re not going anywhere without it.”

Premiums and Extra Costs

Sure, the monthly premiums might look low, but there can be hidden costs—like deductibles, co-pays, or out-of-network fees. Life loves to sneak in surprises, right?

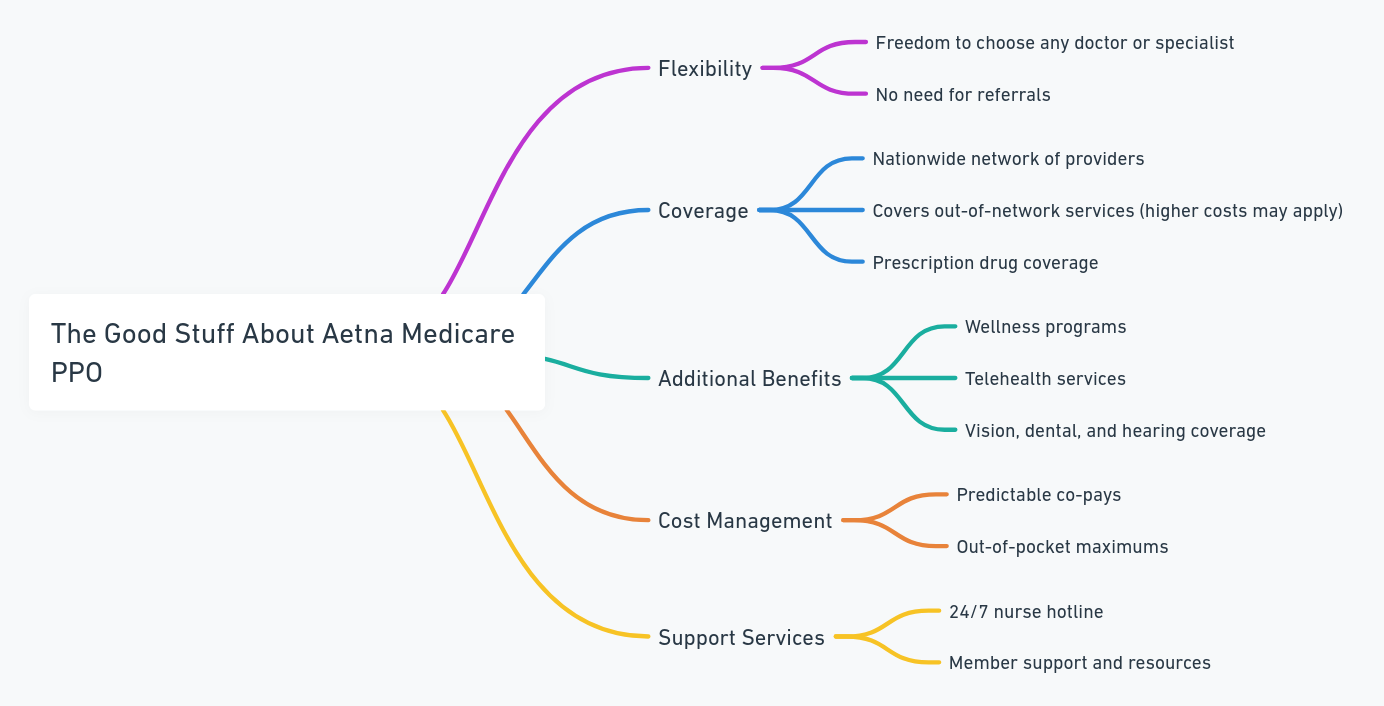

The Good Stuff About Aetna Medicare PPO

Even with a few quirks, Aetna Medicare PPO plans come with some great benefits. Here are a few reasons why people love ’em:

Choose Your Own Providers

No need for a referral to see a specialist—just go see who you need when you need them. It’s a bit of freedom that’s hard to beat.

Nationwide Coverage

Love to travel? Aetna PPO plans cover you wherever you go across the U.S.—whether you’re relaxing in Florida or hiking in the mountains. Just don’t forget your insurance card.

Prescription Drug Coverage

For those who take meds regularly, Aetna’s Part D prescription drug coverage could save you some serious cash.

Over-the-Counter (OTC) Perks

Some Aetna plans give you allowances for over-the-counter items—things like bandages, pain relievers, and vitamins. Henry describes this benefit as “It’s like a health fairy giving you little gifts here and there.”

Vision, Dental, and Hearing Benefits

You get more than just basic healthcare—Aetna plans often include extra benefits for things like eye exams, dental check-ups, and hearing aids. It’s the small stuff that can make a big difference.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How Does Aetna Medicare PPO Compare to Other Plans?

Wondering how Aetna compares to other Medicare plans? Here’s a quick look:

- HMO (Health Maintenance Organization): HMO plans are usually stricter—you need to stay in-network and get referrals. PPO gives you more freedom, but you’ll pay for it.

- Medicare Supplement (Medigap): Medigap plans help cover out-of-pocket costs, but they usually come with higher premiums and don’t cover prescription drugs.

How to Pick the Right Plan

Here’s a simple checklist to help you decide if Aetna PPO is right for you:

- Are your doctors in-network? You’ll pay less if they are.

- Do you travel a lot? If yes, Aetna PPO’s nationwide coverage might be a good fit.

- Need specialist care? No referrals required with PPO—you can get the care you need faster.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Henry’s Final Thoughts

According to Henry Beltran from Medicare Advisors Insurance Group LLC, “Choosing the right plan is all about what works for you. If you want flexibility with your healthcare providers and don’t mind paying a bit more, Aetna PPO could be perfect. But if you’re trying to keep costs low, an HMO might make more sense. Just make sure you know what you’re signing up for!”

So, while no plan is perfect, Aetna Medicare PPO has a lot of solid benefits. Just be ready for those out-of-network surprises—like finding a few extra charges on your bill when you least expect it!