“Discover Security and Peace of Mind: The Top 5 Medicare Supplement Plans for Your Health and Wellness.”

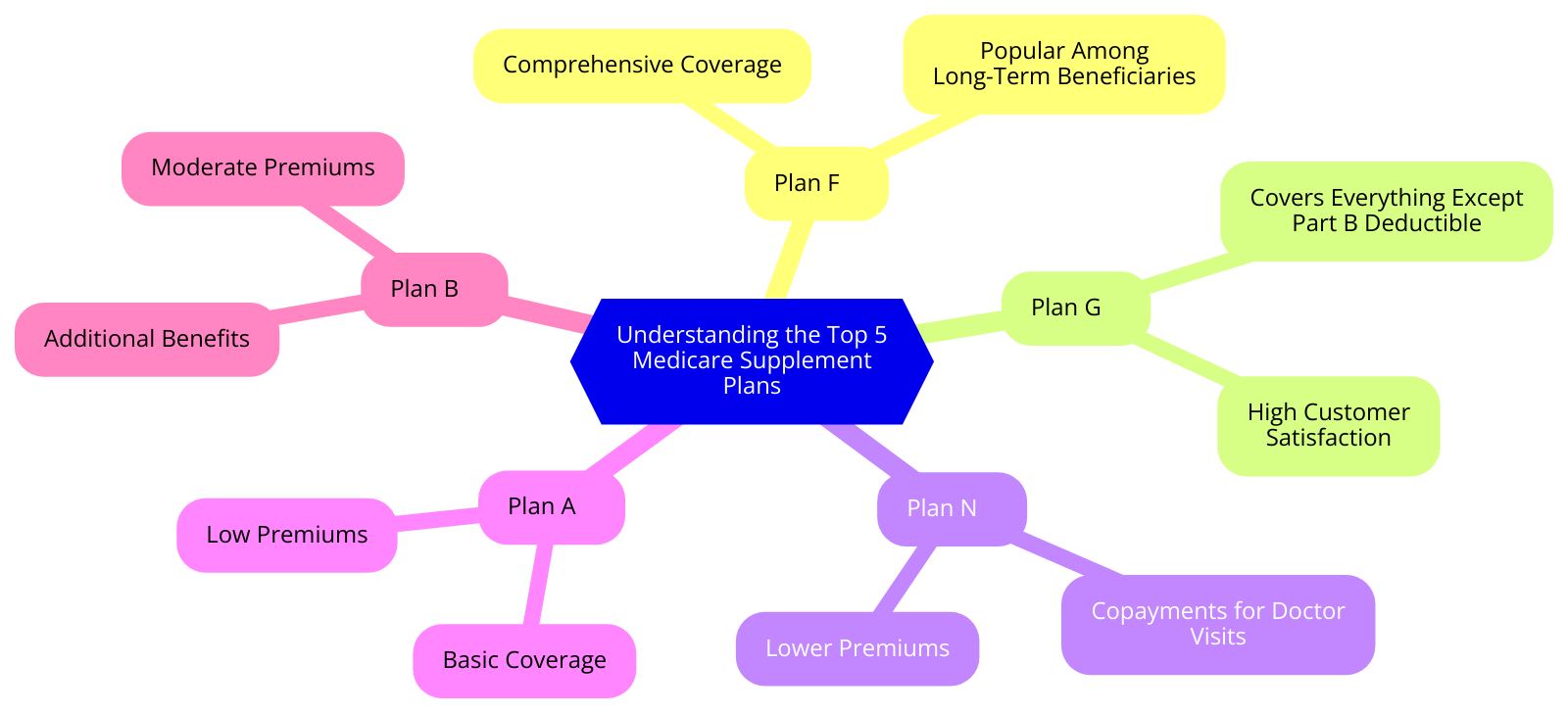

Understanding the Top 5 Medicare Supplement Plans

As we journey through life, we are often reminded of the importance of health and wellness. It’s a universal truth that our health is our wealth, and as we age, this becomes even more apparent. One of the ways we can ensure our health is well taken care of is through Medicare Supplement Plans. These plans, also known as Medigap, are policies designed to fill in the gaps left by Original Medicare coverage. They are the safety nets that catch us when we fall, providing us with the peace of mind that we are covered in times of need. Let’s embark on a journey to understand the top five Medicare Supplement Plans that are making waves in the healthcare industry.

First on our list is the Plan F, often referred to as the “Cadillac” of Medigap plans. It’s the most comprehensive plan, covering all the gaps left by Original Medicare. From Part A hospital and coinsurance costs to Part B deductibles, Plan F has got you covered. It’s like a warm blanket on a cold winter’s night, providing comfort and assurance that you are fully protected. However, it’s important to note that as of 2020, Plan F is no longer available to new Medicare beneficiaries.

Next, we have Plan G, the rising star in the world of Medicare Supplement Plans. It’s almost identical to Plan F, with the only difference being that it does not cover the Part B deductible. However, its lower premiums often make it a more cost-effective choice. It’s like the younger sibling of Plan F, stepping up to take its place and proving its worth in the process.

The third plan on our list is Plan N. This plan is a popular choice for those who are comfortable with a little out-of-pocket cost. It covers most of the same benefits as Plan G but requires a small copayment for some office visits and emergency room trips. It’s like a trusty old friend, reliable and consistent, always there when you need it.

Our fourth contender is Plan K. This plan is for those who believe in sharing the load. It covers 50% of many costs not covered by Original Medicare, including Part A hospital coinsurance and hospice care. It’s like a team player, always ready to step in and share the burden of healthcare costs.

Finally, we have Plan L. This plan is similar to Plan K but covers 75% of the costs. It’s like a big brother to Plan K, offering a little more support and coverage.

In the end, choosing a Medicare Supplement Plan is like choosing a travel companion for the journey of life. You want someone reliable, supportive, and ready to step in when the road gets rough. Whether it’s the comprehensive coverage of Plan F, the cost-effectiveness of Plan G, the reliability of Plan N, the shared responsibility of Plan K, or the increased support of Plan L, there’s a plan out there that’s just right for you. So, as you navigate the path of life, remember that with the right Medicare Supplement Plan, you’re never alone. You have a companion that’s ready to walk with you every step of the way, ensuring your health and wellness are well taken care of.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

A Comprehensive Guide to the Top 5 Medicare Supplement Plans

As we journey through the golden years of our lives, it’s essential to have a reliable health care plan that can provide us with the peace of mind we need. Medicare, a federal health insurance program, is a beacon of hope for many seniors. However, it doesn’t cover all health care costs, which is where Medicare Supplement Plans, also known as Medigap, come into play. These plans fill in the “gaps” left by Medicare, ensuring that you’re well-covered for any health-related eventuality. Let’s embark on an enlightening journey through the top five Medicare Supplement Plans that can help you live your best life.

First on our list is Plan F, often hailed as the most comprehensive Medigap plan. It covers all the gaps left by Medicare, including Part A and Part B deductibles, coinsurance, and excess charges. It’s like a warm, comforting blanket that wraps you up and protects you from unexpected medical costs. However, as of 2020, Plan F is no longer available to new Medicare beneficiaries. But don’t worry, there’s another plan that’s just as comprehensive.

Enter Plan G, the new champion of comprehensive coverage. It’s almost identical to Plan F, with one small difference – it doesn’t cover the Part B deductible. But don’t let that deter you. The Part B deductible is relatively small, and the lower premiums of Plan G often make up for it. It’s like a trusty shield, guarding you against high out-of-pocket costs.

Next up is Plan N, a popular choice for those who want comprehensive coverage but don’t mind a small copayment for some office visits and emergency room trips. It’s like a sturdy boat, navigating you safely through the choppy waters of health care costs.

Plan K is a unique plan that covers 50% of most costs, making it a good choice for those who want some coverage but are willing to share the costs. It’s like a loyal companion, walking by your side and sharing the burden of health care costs.

Finally, we have Plan L, which covers 75% of most costs. It’s a step up from Plan K, offering more coverage for a slightly higher premium. It’s like a reliable car, driving you towards a future where you don’t have to worry about unexpected medical costs.

Choosing a Medicare Supplement Plan is like choosing a travel companion for your journey through the golden years. You want someone – or in this case, something – that’s reliable, fits your needs, and makes your journey as smooth and enjoyable as possible. Whether it’s the comprehensive coverage of Plan G, the shared costs of Plan K, or anything in between, there’s a plan out there that’s perfect for you.

Remember, the journey of a thousand miles begins with a single step. So take that step today. Explore these top five Medicare Supplement Plans, and choose the one that will make your journey through the golden years a truly golden experience. After all, you’ve worked hard all your life. Now it’s time to enjoy the fruits of your labor, secure in the knowledge that you’re well-covered for any health-related eventuality.

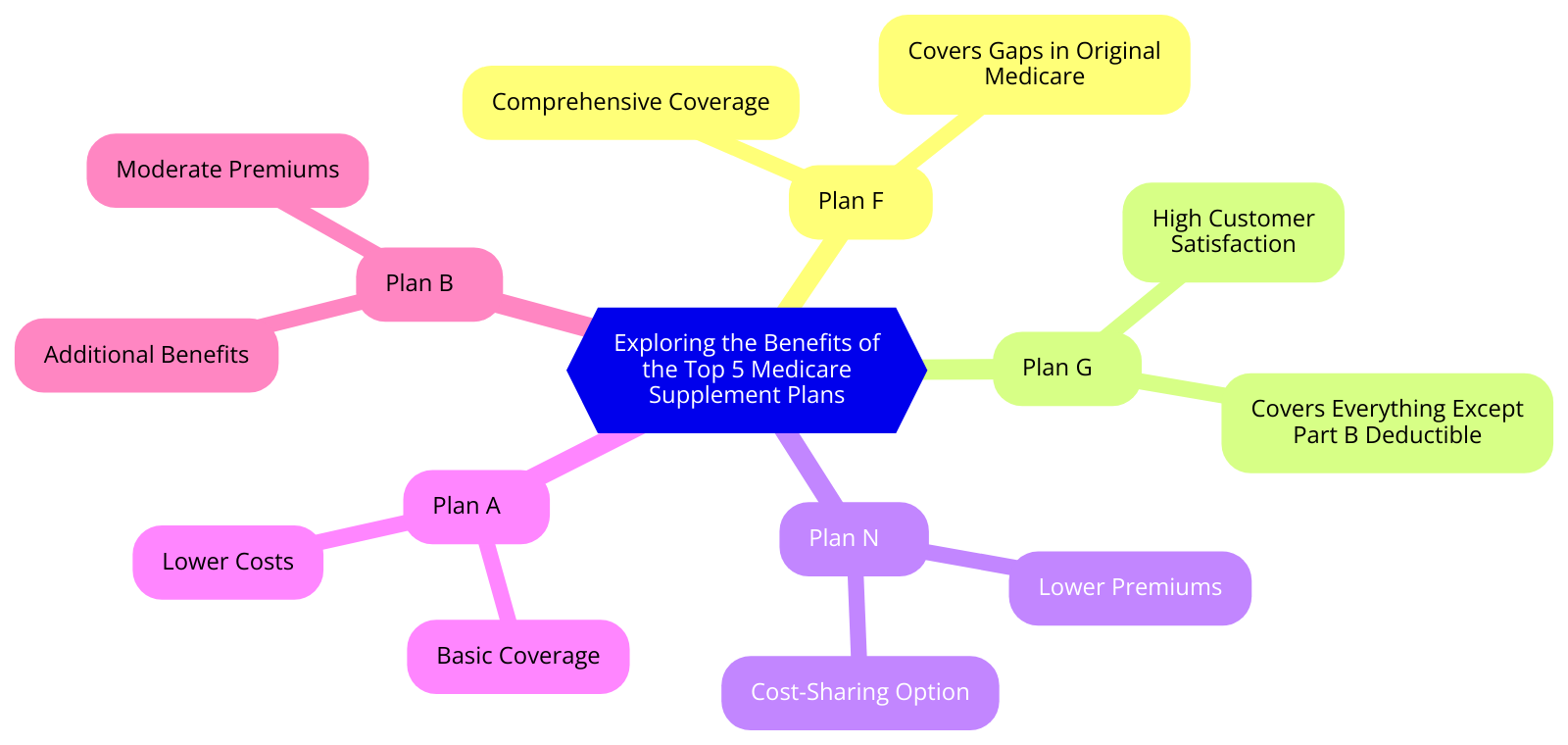

Exploring the Benefits of the Top 5 Medicare Supplement Plans

As the golden years approach, the importance of securing a robust health insurance plan becomes increasingly clear. Medicare, the federal health insurance program for people aged 65 and older, is a lifeline for many. However, it doesn’t cover everything. That’s where Medicare Supplement Plans, also known as Medigap, come into play. These plans fill in the gaps left by Medicare, ensuring that you’re not left out of pocket when it comes to your health. Let’s embark on a journey to explore the benefits of the top five Medicare Supplement Plans.

First on our list is Plan F, often hailed as the most comprehensive Medigap plan. It covers all the gaps left by Medicare Part A and Part B, including deductibles, copayments, and coinsurance. With Plan F, you can rest easy knowing that all your bases are covered. It’s like having a safety net, ready to catch you if you ever fall. However, as of 2020, Plan F is no longer available to new Medicare beneficiaries. But don’t worry, there are still plenty of excellent options available.

Next, we have Plan G, the rising star in the world of Medicare Supplement Plans. It offers almost identical coverage to Plan F, with one small difference – it doesn’t cover the Medicare Part B deductible. However, the lower premiums often make up for this. Plan G is like a trusted friend, always there to lend a helping hand when you need it most.

Third on our list is Plan N. This plan offers substantial coverage, including 100% of the Part B coinsurance costs, except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in an inpatient admission. Plan N is like a sturdy ship, navigating you safely through the stormy seas of unexpected medical costs.

Plan K is next, offering a different approach. It covers 50% of several costs, including Part A deductible and Part B coinsurance or copayment. It’s like a reliable car, getting you where you need to go without any unnecessary frills.

Finally, we have Plan L. This plan covers 75% of several costs, including Part A deductible and Part B coinsurance or copayment. It’s like a warm blanket, offering comfort and protection when you need it most.

Choosing a Medicare Supplement Plan is like choosing a travel companion for a long journey. You want someone reliable, who will be there for you when the road gets tough. Each of these plans offers unique benefits, and the best one for you depends on your individual needs and circumstances.

Remember, the journey of a thousand miles begins with a single step. So take that step today. Secure your future, protect your health, and embrace the peace of mind that comes with knowing you’re covered. After all, you’ve worked hard your whole life. Now it’s time to enjoy the fruits of your labor, without worrying about unexpected medical costs. So here’s to your health, your happiness, and your future. Here’s to finding the perfect Medicare Supplement Plan for you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Choose from the Top 5 Medicare Supplement Plans

Choosing from the top five Medicare Supplement Plans can feel like navigating a labyrinth. But fear not, for the journey through this maze can be an enlightening one, filled with the promise of a secure and healthy future. Let’s embark on this journey together, exploring the top five Medicare Supplement Plans, and how to choose the one that best suits your needs.

Firstly, we have Plan F, often referred to as the “Cadillac of Medigap plans.” This plan is the most comprehensive, covering all Medicare-approved costs not covered by Medicare Part A and Part B. It’s like a safety net, catching all those unexpected healthcare costs that can leave you feeling financially vulnerable. However, as of 2020, Plan F is no longer available to new Medicare enrollees. If you were eligible for Medicare before 2020, this plan might still be an option for you.

Next, we have Plan G, the rising star in the world of Medicare Supplement Plans. It offers nearly identical coverage to Plan F, with one small exception – it does not cover the Medicare Part B deductible. However, the lower premiums often offset this cost, making Plan G a popular choice for many.

Then there’s Plan N, the balanced choice. It offers substantial coverage at a more affordable premium than Plan F or G. With Plan N, you’ll have copayments for some office visits and emergency room trips, but these costs are relatively low. This plan is a great choice if you’re looking for a balance between cost and coverage.

Plan K is the fourth plan on our list. It covers a lower percentage of your healthcare costs but offers significantly lower premiums. This plan is ideal if you’re in good health and willing to share more of the cost when you need care. It’s like a trusty old car – it might not have all the bells and whistles, but it gets you where you need to go.

Finally, we have Plan L. This plan covers 75% of your healthcare costs, with a cap on your out-of-pocket expenses. Once you reach this cap, the plan covers 100% of your Medicare-approved costs for the rest of the calendar year. It’s like a safety valve, ensuring you’re never left in a lurch.

Choosing from these top five Medicare Supplement Plans is like choosing the right tool for a job. You need to consider your health, your budget, and your peace of mind. It’s about finding the plan that fits you like a glove, providing the coverage you need at a price you can afford.

Remember, the journey through the labyrinth of Medicare Supplement Plans is not a race. It’s a thoughtful exploration, a quest for the plan that will stand by you, offering support and security in your golden years. So take your time, weigh your options, and choose the plan that feels right for you. Because in the end, your health is your wealth, and choosing the right Medicare Supplement Plan is an investment in your future. So here’s to a future filled with health, happiness, and the peace of mind that comes from knowing you’re covered.

The Impact of the Top 5 Medicare Supplement Plans on Healthcare

As the golden hues of the sunset paint the sky, marking the end of another day, we are reminded of the inevitable passage of time. With each passing day, we inch closer to the twilight years of our lives, a period often marked by the need for enhanced healthcare. It is during these years that Medicare Supplement Plans, also known as Medigap, become our silent allies, providing us with the financial support we need to navigate the labyrinth of healthcare expenses. Let’s embark on a journey to understand the impact of the top five Medicare Supplement Plans on healthcare.

Firstly, we have Plan F, often hailed as the most comprehensive of all Medicare Supplement Plans. Like a lighthouse guiding ships through a stormy night, Plan F illuminates the path for seniors by covering all Medicare Part A and Part B deductibles, coinsurance, and excess charges. It’s like having a safety net, ensuring that no matter how high healthcare costs may soar, you are protected.

Next, we have Plan G, a close cousin of Plan F. It offers almost identical coverage, with one small exception – the Part B deductible. However, this minor difference is often overshadowed by its lower premiums, making it a popular choice among many. It’s akin to a sturdy umbrella, shielding you from the torrential downpour of unexpected medical bills.

The third plan on our list is Plan N. This plan, like a reliable compass, offers direction to those who are looking for a balance between comprehensive coverage and affordable premiums. It covers most expenses, except for Part B deductible and some small copayments. It’s a testament to the fact that you don’t always have to pay a hefty price for peace of mind.

Our fourth contender is the High-Deductible Plan F. This plan is like a treasure chest, offering the same comprehensive coverage as Plan F, but with a high deductible. It’s a perfect fit for those who are willing to pay a higher deductible in exchange for lower premiums. It’s a reminder that sometimes, taking a calculated risk can lead to significant rewards.

Finally, we have Plan K, the underdog of Medicare Supplement Plans. It covers a percentage of most Medicare-covered costs, leaving you responsible for the rest. It’s like a lifeboat, not as comfortable as a cruise ship, but it will keep you afloat when the waters get rough.

These top five Medicare Supplement Plans have revolutionized healthcare for seniors, offering them the freedom to choose a plan that best fits their needs and budget. They have transformed the daunting prospect of healthcare expenses into a manageable aspect of life. They have given seniors the confidence to face the future, knowing that they are not alone in their journey towards health and wellness.

In the grand tapestry of life, these plans are like vibrant threads, weaving a safety net for seniors, protecting them from the financial burden of healthcare costs. They are not just insurance plans; they are symbols of hope, assurance, and resilience. They are a testament to our society’s commitment to ensuring that the golden years of our lives are not tarnished by the worry of healthcare expenses. They are, indeed, the silent allies in our journey towards a healthier, happier future.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Comparing the Top 5 Medicare Supplement Plans

As we journey through the golden years of our lives, it’s essential to ensure that we have the best healthcare coverage possible. Medicare, the federal health insurance program, provides a safety net for many seniors. However, it doesn’t cover everything. That’s where Medicare Supplement Plans, also known as Medigap, come into play. These plans fill in the gaps left by Medicare, covering costs like deductibles, copayments, and coinsurance. But with so many options available, how do you choose the right one? Let’s embark on a journey to explore the top five Medicare Supplement Plans, each with its unique benefits.

First on our list is Plan F, often referred to as the “Cadillac of Medigap plans.” This plan is the most comprehensive, covering all Medicare-approved costs not covered by Medicare Part A and Part B. From hospital stays to doctor visits, Plan F ensures that you won’t have to pay a penny out of pocket. However, it’s worth noting that as of 2020, Plan F is no longer available to new Medicare enrollees. But fear not, for there are other excellent options available.

Next, we have Plan G, the rising star in the world of Medicare Supplement Plans. Like Plan F, Plan G covers almost all Medicare-approved costs. The only difference is that Plan G does not cover the Medicare Part B deductible. However, with its lower premiums, Plan G often ends up being more cost-effective than Plan F, making it an increasingly popular choice among seniors.

The third plan on our list is Plan N. This plan offers a balance between comprehensive coverage and affordable premiums. Plan N covers most Medicare-approved costs, except for the Part B deductible and some small copayments. If you’re comfortable with paying a little out of pocket and want to save on premiums, Plan N might be the perfect fit for you.

Our fourth contender is Plan K. This plan is for those who are willing to share more of the costs in exchange for lower premiums. Plan K covers 50% of most costs not covered by Medicare, except for the Part A hospital deductible, which it covers completely. If you’re in good health and don’t expect to need extensive medical care, Plan K could be an economical choice.

Last but not least, we have Plan L. Similar to Plan K, Plan L also involves cost-sharing but at a higher percentage. Plan L covers 75% of most costs not covered by Medicare. It’s a middle-ground option for those who want some cost-sharing but with more coverage than Plan K.

Choosing a Medicare Supplement Plan is like embarking on a quest for the Holy Grail of healthcare. It’s a journey filled with choices, each with its own set of benefits and costs. But remember, the goal is not to find the most expensive or the most comprehensive plan. The goal is to find the plan that fits your needs and your budget perfectly. So, take your time, weigh your options, and choose wisely. After all, your health is your wealth, and it deserves nothing but the best.

Navigating the Top 5 Medicare Supplement Plans for Seniors

Navigating the labyrinth of healthcare can be a daunting task, especially when it comes to Medicare Supplement Plans. These plans, also known as Medigap, are designed to fill in the gaps left by Original Medicare, covering costs like deductibles, copayments, and coinsurance. As you embark on this journey, let’s explore the top five Medicare Supplement Plans that can provide a beacon of hope and security for seniors.

First on our list is the Plan F, often hailed as the most comprehensive of all Medicare Supplement Plans. It’s like a knight in shining armor, ready to protect you from all out-of-pocket costs associated with Medicare Part A and Part B. From hospital stays to doctor visits, Plan F has got you covered. However, it’s worth noting that as of 2020, Plan F is no longer available to new Medicare enrollees. But fear not, for there are other champions in the arena.

Enter Plan G, the next best thing to Plan F. It’s almost identical to its predecessor, with one small exception – it doesn’t cover the Medicare Part B deductible. But don’t let this deter you. Plan G is a formidable ally, offering extensive coverage and often lower premiums than Plan F. It’s like a trusty steed, ready to carry you through the battlefield of healthcare costs.

Next up is Plan N, a popular choice for those seeking a balance between cost and coverage. It’s like a wise old sage, offering valuable protection at a more affordable price. Plan N covers most of the same expenses as Plan G, but requires a small copayment for some doctor and emergency room visits. It’s a small price to pay for the peace of mind that comes with knowing you’re protected.

The fourth contender is Plan K, a unique plan that covers 50% of many costs not covered by Original Medicare. It’s like a loyal squire, ready to support you in times of need. While it may not offer as much coverage as other plans, Plan K comes with a safety net – an out-of-pocket limit. Once you reach this limit, the plan covers 100% of your costs for the rest of the year. It’s a comforting thought, like a warm blanket on a cold night.

Last but not least, we have Plan L. Similar to Plan K, it covers 75% of many costs not covered by Original Medicare. It’s like a sturdy shield, offering more protection than Plan K but with a higher premium. However, it also comes with an out-of-pocket limit, providing an extra layer of security.

Navigating the world of Medicare Supplement Plans can feel like a quest, filled with challenges and uncertainties. But with these top five plans as your guide, you can face the journey with confidence. Each plan offers its own unique benefits, like characters in a grand tale. Whether you need a knight, a steed, a sage, a squire, or a shield, there’s a plan for you. So, step forth and embrace the adventure, knowing that you’re not alone in your quest for healthcare security. After all, every great story needs a hero, and in this tale, that hero is you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Role of the Top 5 Medicare Supplement Plans in Retirement Planning

As the golden years approach, the anticipation of retirement is often tinged with a hint of apprehension. The thought of leaving behind the hustle and bustle of a working life can be both exhilarating and daunting. One of the most significant concerns is healthcare and how to afford it without a regular income. This is where Medicare Supplement Plans, also known as Medigap, come into play. These plans are designed to fill in the gaps left by Original Medicare, ensuring that retirees can enjoy their golden years without the burden of unexpected medical costs. Let’s delve into the top five Medicare Supplement Plans and their role in retirement planning.

First on the list is Plan F, often hailed as the most comprehensive Medigap plan. It covers all the gaps left by Original Medicare, including Part A and Part B deductibles, coinsurance, and excess charges. This means that retirees who choose Plan F can enjoy their retirement without worrying about out-of-pocket medical expenses. It’s like a safety net, providing peace of mind and financial security.

Next up is Plan G, which is almost identical to Plan F, with one small difference – it does not cover the Part B deductible. However, it often comes with lower premiums, making it a cost-effective choice for those who don’t mind paying the Part B deductible out-of-pocket. It’s a testament to the fact that retirement planning doesn’t have to be a choice between financial prudence and healthcare needs.

Plan N is another popular choice among retirees. It covers most of the gaps left by Original Medicare, except for the Part B deductible and some small copayments. It’s a great choice for those who want comprehensive coverage without the higher premiums of Plan F or G. It’s like a well-balanced diet, providing just the right amount of coverage without overindulging.

The fourth plan on our list is Plan K, which covers 50% of the costs not covered by Original Medicare. It’s a budget-friendly option for those who are in good health and don’t expect to need extensive medical care during their retirement. It’s a reminder that retirement planning is not a one-size-fits-all process, but a journey that should be tailored to individual needs and circumstances.

Last but not least, we have Plan L, which covers 75% of the costs not covered by Original Medicare. It’s a middle-ground option, offering more coverage than Plan K but at a lower cost than the more comprehensive plans. It’s like a comfortable pair of shoes, providing just the right amount of support without breaking the bank.

In conclusion, the top five Medicare Supplement Plans play a crucial role in retirement planning. They provide a safety net, ensuring that retirees can enjoy their golden years without the burden of unexpected medical costs. Whether you choose the comprehensive coverage of Plan F, the cost-effectiveness of Plan G, the balance of Plan N, the budget-friendliness of Plan K, or the middle-ground option of Plan L, you can rest assured that your healthcare needs will be taken care of. After all, retirement is a time to relax and enjoy life, not to worry about medical bills. So, plan wisely, choose the right Medicare Supplement Plan, and look forward to a retirement filled with peace, joy, and good health.

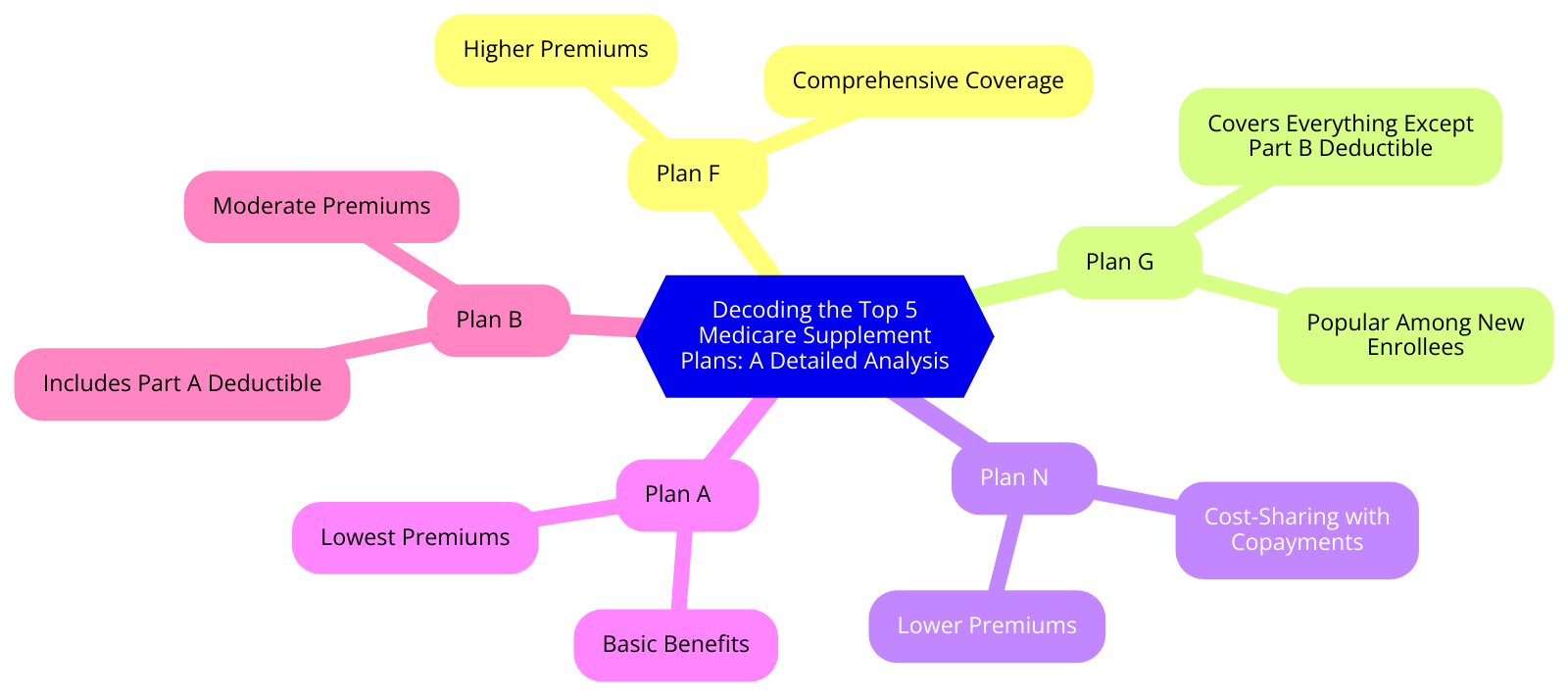

Decoding the Top 5 Medicare Supplement Plans: A Detailed Analysis

As we journey through the golden years of our lives, the importance of health care becomes increasingly apparent. It’s a time when we should be basking in the fruits of our labor, not worrying about medical bills. This is where Medicare Supplement Plans, also known as Medigap, come into play. These plans are designed to fill in the gaps left by Original Medicare, covering costs like deductibles, copayments, and coinsurance. But with so many options available, how do you choose the right one? Let’s embark on a journey to decode the top five Medicare Supplement Plans, turning the complex into the comprehensible.

First on our list is Plan F, often hailed as the most comprehensive Medigap plan. It covers all the gaps left by Original Medicare, including Part A and Part B deductibles, Part B excess charges, and even emergency medical care when you’re traveling abroad. It’s like a safety net, ensuring that no matter what health challenges you face, you’re covered. However, it’s worth noting that as of 2020, Plan F is no longer available to new Medicare beneficiaries.

Next, we have Plan G, the rising star in the world of Medigap. It offers almost the same coverage as Plan F, with one small exception – the Part B deductible. But don’t let this deter you. The annual Part B deductible is relatively small, and once it’s met, Plan G covers 100% of your Medicare Part B excess charges. It’s a small price to pay for such extensive coverage.

Third on our list is Plan N, a popular choice for those seeking a balance between cost and coverage. Plan N covers your Part A deductible and coinsurance, Part B coinsurance, and even offers partial coverage for emergency medical care abroad. However, it does not cover Part B excess charges or the Part B deductible. It’s a plan that offers peace of mind without breaking the bank.

The fourth plan we’ll explore is Plan K, a unique offering in the Medigap landscape. Plan K covers 50% of most costs, including Part A and Part B coinsurance, the first three pints of blood, and hospice care. It’s a plan that encourages you to share in the responsibility of your health care costs, offering lower premiums in return.

Finally, we have Plan L, a plan that covers 75% of most costs. Like Plan K, it includes coverage for Part A and Part B coinsurance, the first three pints of blood, and hospice care. It’s a step up from Plan K, offering a little more coverage for a slightly higher premium.

Choosing a Medicare Supplement Plan is like choosing a path for your health care journey. It’s about finding the right balance between cost and coverage, between peace of mind and personal responsibility. Whether you choose the comprehensive coverage of Plan G or the shared responsibility of Plan K, remember that the journey is yours to shape. So, take a deep breath, step forward, and embrace the golden years with confidence and courage. After all, you’ve earned it.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Future of Healthcare: The Top 5 Medicare Supplement Plans

As we journey into the future of healthcare, we find ourselves standing at the precipice of a new era. An era where the traditional boundaries of healthcare are being pushed, and the concept of Medicare is being redefined. In this brave new world, Medicare Supplement Plans, also known as Medigap, are emerging as the torchbearers of change. These plans are designed to fill in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. Let’s delve into the top five Medicare Supplement Plans that are shaping the future of healthcare.

First on our list is the Medicare Supplement Plan F. Often hailed as the most comprehensive plan, Plan F covers all the gaps in Medicare Part A and Part B. This means that it takes care of all deductibles, coinsurance, and copayments, leaving beneficiaries with virtually no out-of-pocket costs. It’s like a safety net, ensuring that no matter what health challenges you face, you’re covered.

Next up is Plan G, a close cousin of Plan F. While it offers almost identical coverage to Plan F, there’s one key difference – Plan G does not cover the Medicare Part B deductible. However, it does cover the excess charges that doctors outside of the Medicare system might charge. It’s a small trade-off, but for many, the lower premiums of Plan G make it a more attractive option.

The third plan that’s making waves is Plan N. This plan offers a balance between comprehensive coverage and lower premiums. While it doesn’t cover the Medicare Part B deductible or excess charges, it does cover the Part A deductible and coinsurance, making it a popular choice for those who want a bit of everything.

The fourth plan on our list is Plan K. This plan is a bit different from the others. It only covers 50% of most costs, but it has a yearly out-of-pocket limit. Once you reach this limit, the plan covers 100% of your costs for the rest of the year. It’s a plan that rewards patience and planning, offering a safety net for those who need it most.

Finally, we have Plan L. Similar to Plan K, Plan L covers 75% of most costs and also has a yearly out-of-pocket limit. It’s a step up from Plan K, offering a bit more coverage for a slightly higher premium.

These top five Medicare Supplement Plans are more than just insurance policies. They are a testament to the evolving nature of healthcare, a symbol of the strides we’re making towards a future where everyone has access to the care they need. They represent a shift in thinking, a move towards a more inclusive, comprehensive approach to health insurance.

As we look towards the future, these plans inspire us. They remind us that healthcare is not a privilege, but a right. They show us that no matter what challenges we face, there are solutions out there. They give us hope, and in the world of healthcare, hope is the most powerful medicine of all. So, here’s to the future of healthcare, and the Medicare Supplement Plans that are leading the way.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What is the top-rated Medicare Supplement Plan?

Answer: Plan F is often considered the top-rated Medicare Supplement Plan due to its comprehensive coverage.

2. Question: What is unique about Medicare Supplement Plan G?

Answer: Plan G is unique because it covers almost everything that Plan F does, except for the Part B deductible.

3. Question: What does Medicare Supplement Plan N cover?

Answer: Plan N covers Medicare Part A and B coinsurances, blood transfusions, Part A hospice care, skilled nursing facility care, and foreign travel emergencies.

4. Question: How does Medicare Supplement Plan K work?

Answer: Plan K covers 50% of several benefits including Part A hospice care, skilled nursing facility care, and Medicare Part B copayments.

5. Question: What is the coverage of Medicare Supplement Plan L?

Answer: Plan L covers 75% of several benefits including Part A hospice care, skilled nursing facility care, and Medicare Part B copayments.

6. Question: What is the most comprehensive Medicare Supplement Plan?

Answer: Plan F is considered the most comprehensive as it covers all deductibles, coinsurance, and copayments that Original Medicare doesn’t cover.

7. Question: What is the difference between Plan F and Plan G?

Answer: The main difference is that Plan F covers the Medicare Part B deductible, while Plan G does not.

8. Question: What is the most cost-effective Medicare Supplement Plan?

Answer: Plan N is often considered the most cost-effective due to its lower premiums and comprehensive coverage.

9. Question: What does Medicare Supplement Plan M cover?

Answer: Plan M covers 50% of the Medicare Part A deductible, full coverage of all other Part A and B coinsurances, blood transfusions, Part A hospice care, skilled nursing facility care, and foreign travel emergencies.

10. Question: What is the least comprehensive Medicare Supplement Plan?

Answer: Plan A is the least comprehensive, covering only the basics such as Medicare Part A and B coinsurances and blood transfusions.