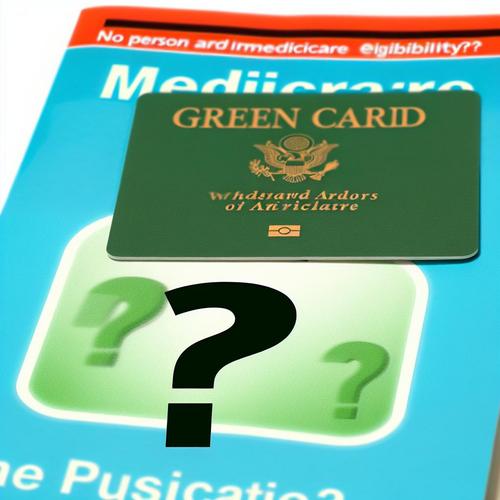

Are you a Green Card holder wondering about your eligibility for Medicare? Let’s dive into the details!

Green Card holders, also known as lawful permanent residents, have the privilege of living and working in the United States permanently. But when it comes to healthcare coverage, navigating the system can be a bit confusing. That’s where understanding Medicare comes into play.

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, as well as certain younger individuals with disabilities or specific medical conditions. It consists of different parts that cover various medical services, such as hospital stays, doctor visits, prescription drugs, and more.

Now, you might be wondering, can Green Card holders enroll in Medicare? The answer is yes! As long as you meet certain criteria, you are eligible to enroll in Medicare and access its benefits. However, there are important factors to consider before making any decisions.

Factors such as your residency status, work history, and immigration status can impact your eligibility and coverage options under Medicare. It’s crucial to understand how these factors affect your healthcare options as a Green Card holder.

But fret not! Medicare Advisors are here to help you navigate the complexities of Medicare and find the best coverage options for your unique situation. With their expertise and guidance, you can make informed decisions about your healthcare needs and ensure you have the coverage that suits you best.

Why choose Medicare Advisors as your insurance broker? Well, they have a team of knowledgeable advisors who specialize in Medicare and can provide personalized assistance tailored to your specific circumstances. They will walk you through the process, answer your questions, and help you choose a Medicare plan that meets your needs and budget.

So, if you’re a Green Card holder looking to enroll in Medicare or explore your coverage options, don’t hesitate to reach out to Medicare Advisors. Their dedicated team is ready to assist you every step of the way and ensure you have the healthcare coverage you deserve.

Remember, your health is invaluable, and having the right insurance coverage is essential to ensure you receive the care you need. Contact Medicare Advisors today and take the first step towards securing your health and well-being.

Understanding the Medicare Program

So, you’ve heard about Medicare, but what exactly is it? Well, let me break it down for you in simple terms. Medicare is a federal health insurance program that provides coverage for people who are 65 years and older, as well as certain younger individuals with disabilities. It’s like a safety net that helps you cover your healthcare costs as you age or if you have a qualifying disability.

Medicare is made up of different parts, each covering different aspects of healthcare. Let me give you a quick rundown:

- Medicare Part A: This part helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Medicare Part B: Part B covers medical services like doctor visits, outpatient care, medical supplies, and preventive services.

- Medicare Part C: Also known as Medicare Advantage, Part C combines Part A and Part B coverage and often includes prescription drug coverage as well.

- Medicare Part D: This part is all about prescription drug coverage. It helps you pay for medications that you need to stay healthy.

Each part plays a key role in keeping you healthy and covered when it comes to your healthcare needs. And the great thing about Medicare is that you have choices. You can decide which parts of Medicare you want to enroll in, depending on your needs and preferences. It’s all about finding the right fit for you!

Now, I know it can all sound a bit overwhelming, but don’t worry. There are experts out there who can help guide you through the Medicare maze and help you make informed decisions about your healthcare coverage. Whether you’re new to Medicare or looking to make changes to your current plan, these professionals can provide you with valuable advice and support.

So, if you have questions or need assistance navigating the Medicare program, don’t hesitate to reach out to a Medicare advisor. They have the knowledge and experience to help you understand your options and choose a plan that meets your healthcare needs and budget.

Remember, your health is priceless, and having the right insurance coverage can give you peace of mind knowing that you’re taken care of. Let the experts help you make the most of your Medicare benefits and ensure that you have the coverage you need to stay healthy and happy!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Can Green Card Holders Enroll in Medicare?

Hey there! So you’re a Green Card holder and wondering if you can enroll in Medicare, right? Well, you’ve come to the right place! Let’s dive into this topic and get you the information you need.

First things first, Medicare is a federal health insurance program that provides coverage for individuals who are 65 years old or older, as well as certain younger people with disabilities. It’s a vital program that helps millions of Americans access the healthcare they need.

Now, let’s talk about Green Card holders. If you have a Green Card, also known as a Permanent Resident Card, you may be eligible for Medicare. However, there are certain factors to consider before enrolling.

- Residency Requirement: In general, Green Card holders must have lived in the United States for at least five years to be eligible for Medicare. If you meet this requirement, you may be able to enroll in Medicare when you turn 65.

- Work History: Another important factor is your work history. If you or your spouse has worked and paid Medicare taxes for at least 10 years, you may be eligible for premium-free Part A coverage.

- Immigration Status: Your immigration status can also affect your eligibility for Medicare. It’s important to consult with immigration and healthcare experts to understand how your specific situation may impact your ability to enroll in Medicare.

As you can see, there are several factors to consider when it comes to Green Card holders enrolling in Medicare. It’s important to do your research and seek advice from knowledgeable professionals to ensure you make the right decision for your healthcare needs.

Remember, Medicare is a complex program with different parts and coverage options. By taking the time to understand your eligibility and options, you can make informed decisions that will benefit your health and well-being in the long run.

So, if you’re a Green Card holder and thinking about enrolling in Medicare, don’t hesitate to reach out to experts who can guide you through the process. Your health is important, and having the right coverage can make a world of difference.

Stay informed, stay healthy, and remember that you have the power to make the best choices for your healthcare. You’ve got this!

Have you recently obtained your Green Card and are wondering if you’re eligible for Medicare coverage? It’s a common question among new Green Card holders who are navigating the U.S. healthcare system for the first time. Let’s dive into some factors to consider when seeking Medicare coverage as a Green Card holder.

1. **Residency Status**: One of the key factors determining Medicare eligibility for Green Card holders is their residency status. In most cases, Green Card holders must have lived in the United States for at least five continuous years to qualify for Medicare benefits. This requirement helps ensure that individuals have established a permanent residency in the country before accessing government-funded healthcare services.

2. **Medicare Enrollment Period**: As a Green Card holder, it’s important to be aware of the Medicare enrollment period. Typically, individuals are eligible to enroll in Medicare during a seven-month period that begins three months before their 65th birthday and ends three months after. However, if you are eligible for Medicare due to a disability, there may be different enrollment periods to consider. Understanding these timelines is crucial to avoid any gaps in health insurance coverage.

3. **Medicare Plan Options**: Green Card holders have the option to enroll in Original Medicare (Part A and Part B) or choose a Medicare Advantage plan (Part C) offered by private insurance companies. Each plan has its own benefits and costs, so it’s essential to carefully evaluate your healthcare needs and budget before selecting a plan. Additionally, Green Card holders may also qualify for Medicare Supplement Insurance (Medigap) to help cover out-of-pocket expenses not covered by Original Medicare.

4. **Income and Resources**: Some Green Card holders may be eligible for financial assistance through Medicare savings programs, such as the Qualified Medicare Beneficiary (QMB) program, which helps cover Medicare premiums, deductibles, and co-insurance costs for individuals with limited income and resources. Eligibility for these programs is based on income and asset limits, so it’s important to explore all available options to reduce healthcare expenses.

5. **Consulting a Medicare Advisor**: Navigating the complexities of Medicare eligibility and enrollment can be overwhelming, especially for Green Card holders who are new to the U.S. healthcare system. Seeking guidance from a Medicare advisor can help clarify your options, answer any questions you may have, and assist you in finding a personalized Medicare plan that meets your healthcare needs and financial situation.

In conclusion, understanding the factors that impact Medicare coverage for Green Card holders is essential for making informed decisions about your healthcare options. By considering residency status, enrollment periods, plan options, financial assistance programs, and seeking expert advice from a Medicare advisor, you can navigate the Medicare system with confidence and secure the healthcare coverage you need.

Now that you have a better understanding of the factors to consider when seeking Medicare coverage as a Green Card holder, don’t hesitate to reach out to Medicare Advisors for personalized guidance and support on your Medicare journey. They have the expertise and resources to help you find the right Medicare plan that fits your needs and preferences. Don’t wait any longer – secure your healthcare coverage today!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Expert Advice from Medicare Advisors

So, you’re a Green Card holder and you’re considering enrolling in Medicare. It can be overwhelming to navigate the ins and outs of the Medicare program on your own, especially with the added complexity of being a permanent resident. That’s where Medicare Advisors come in!

Medicare Advisors are experts in helping individuals like you understand your Medicare options and find the right coverage for your specific needs. They have a deep understanding of the Medicare program and can provide personalized guidance to ensure you make informed decisions about your healthcare coverage.

When you work with Medicare Advisors, you’ll have access to a team of knowledgeable professionals who can answer all your questions and address any concerns you may have. They can help you understand the different parts of Medicare, such as Part A (hospital insurance) and Part B (medical insurance), as well as other options like Medicare Advantage and Medigap plans.

One of the key benefits of working with Medicare Advisors is that they can help you navigate the eligibility requirements for Green Card holders seeking Medicare coverage. They can guide you through the enrollment process and make sure you meet all the necessary criteria to qualify for Medicare benefits.

Furthermore, Medicare Advisors can help you compare different Medicare plans and find one that fits your budget and healthcare needs. They can explain the costs associated with each plan, including premiums, deductibles, and copayments, so you can make an informed decision about your coverage.

By working with Medicare Advisors, you can feel confident that you’re making the best choices for your healthcare coverage. They can provide expert advice and support throughout the enrollment process, ensuring that you have the information you need to make the right decisions for your health and well-being.

So, if you’re a Green Card holder looking to enroll in Medicare, don’t hesitate to reach out to Medicare Advisors for expert guidance and personalized support. With their help, you can navigate the complexities of the Medicare program with ease and find the coverage that’s right for you.

Remember, when it comes to your health, it’s important to have the right information and guidance to make informed decisions. Let Medicare Advisors be your trusted partner in navigating the Medicare program and finding the coverage that meets your needs.

Reach out to Medicare Advisors today to get started on your journey to Medicare coverage. Your health and well-being are too important to leave to chance – trust the experts at Medicare Advisors to help you make the best choices for your healthcare needs!

Are you feeling overwhelmed by the many options available for Medicare coverage? Look no further – Medicare Advisors is here to help you navigate through the complexities of choosing the right plan for your needs!

Why Choose Medicare Advisors as Your Insurance Broker

Let me tell you why Medicare Advisors stands out from the rest. Our team of experienced and knowledgeable advisors are here to guide you every step of the way in finding the perfect Medicare plan for you. We understand that the world of insurance can be confusing, but we are here to simplify the process for you.

When you choose Medicare Advisors, you can rest assured that you are in good hands. Our advisors have a deep understanding of the Medicare program and can provide you with expert advice tailored to your specific needs. We take the time to listen to your concerns and answer any questions you may have, ensuring that you feel confident in your decision.

At Medicare Advisors, we believe in putting our clients first. We prioritize your health and well-being, and we are dedicated to helping you find a Medicare plan that fits your lifestyle and budget. We work with top insurance companies to offer you a wide range of options, so you can choose the plan that best meets your needs.

Our commitment to excellence sets us apart from other insurance brokers. We go above and beyond to provide personalized service and support, making sure that you are satisfied with your Medicare plan. With Medicare Advisors, you can trust that you are getting the best possible coverage at the best possible price.

So why wait? Contact Medicare Advisors today and let us help you find the perfect Medicare plan for you. Our team is ready to assist you in any way we can, so you can have peace of mind knowing that your health and well-being are in good hands. Don’t hesitate – reach out to us now and take the first step towards a healthier, happier future!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Are you a Green Card holder looking to enroll in Medicare but feeling overwhelmed by all the options and information out there? Look no further than Medicare Advisors, your go-to source for personalized and expert advice on all things Medicare!

Why Choose Medicare Advisors as Your Insurance Broker?

At Medicare Advisors, we understand the complexities of the Medicare program and how it can be even more challenging for Green Card holders to navigate. That’s why our team of dedicated advisors is here to help you every step of the way, from understanding your eligibility to finding the right Medicare plan that suits your needs and budget.

- Personalized Guidance: Our advisors take the time to understand your unique situation and healthcare needs, so we can tailor a Medicare plan that works best for you. We’re here to answer all your questions and provide you with the information you need to make an informed decision.

- Expertise: With years of experience in the insurance industry, our team of advisors is well-versed in all things Medicare. We stay up-to-date on the latest changes and updates to ensure that you have the most accurate and relevant information at your fingertips.

- Advocacy: We are your advocate when it comes to navigating the complex world of Medicare. We work on your behalf to find the best Medicare plan that meets your needs and budget, so you can rest assured that you’re getting the coverage you deserve.

- Support: From enrollment to claims assistance, our team is here to support you throughout your Medicare journey. We’re just a phone call away whenever you need help or have any questions about your coverage.

Choosing Medicare Advisors as your insurance broker means having a dedicated team of professionals who are committed to helping you make the best decision for your healthcare needs. We take the guesswork out of Medicare enrollment and empower you to make informed choices that will benefit you in the long run.

So why stress over Medicare when you can partner with Medicare Advisors for a seamless and stress-free experience? Contact us today to schedule a personalized consultation and let us guide you towards a Medicare plan that fits your needs and lifestyle. Your healthcare journey starts here!