“Switching Medigap Policies: Your Pathway to Better Health Coverage.”

Understanding the Process of Switching Medigap Policies

Switching Medigap policies can seem like a daunting task, but it doesn’t have to be. With a little understanding and a dash of inspiration, you can navigate this process with ease and confidence.

Imagine standing at the edge of a vast ocean, the waves lapping at your feet. You’re about to embark on a journey, a voyage across the sea of healthcare. Your ship is your Medigap policy, your compass is your understanding of the process, and your destination is a policy that better suits your needs.

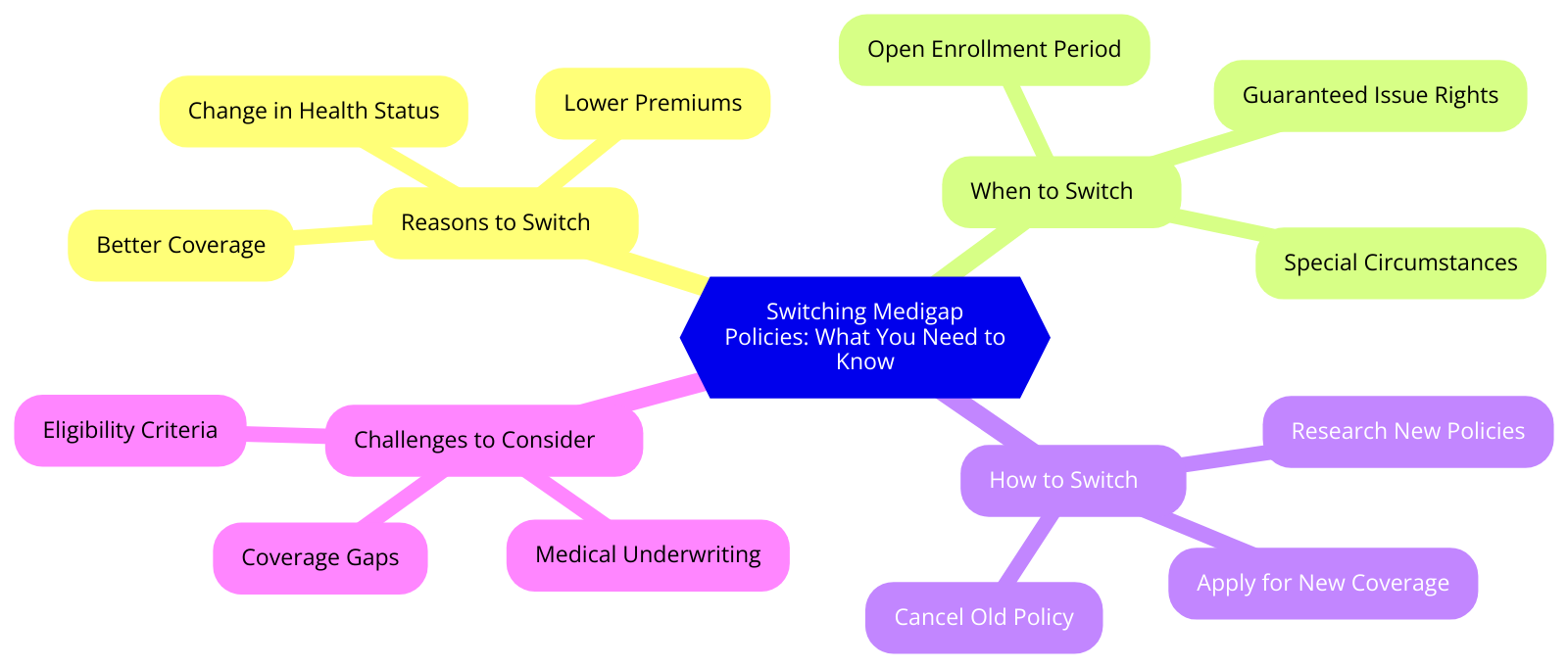

The first step in this journey is understanding why you might want to switch policies. Perhaps your current policy doesn’t cover certain healthcare services you need, or maybe you’re paying for benefits you don’t use. Like a seasoned sailor adjusting their course to the changing winds, you too can adjust your Medigap policy to better fit your healthcare needs.

Now, let’s set sail and delve into the process of switching Medigap policies. The open enrollment period is your first port of call. This six-month window, which begins on the first day of the month in which you’re 65 or older and enrolled in Medicare Part B, is the ideal time to switch policies. During this period, you have the guaranteed right to buy any Medigap policy sold in your state, regardless of your health status.

However, if you’ve missed this window, don’t despair. Like a lighthouse guiding ships through the night, certain special rights, known as Medigap protections or guaranteed issue rights, can guide you through the process. These rights may allow you to buy a Medigap policy outside of the open enrollment period, even if you have health problems.

As you navigate through the process, it’s important to remember that you can’t switch from your Medicare Advantage Plan to a Medigap policy unless you return to Original Medicare. Think of it as a one-way ticket; once you’ve embarked on the journey with a Medicare Advantage Plan, you can’t turn the ship around and sail back to a Medigap policy.

Now, let’s talk about the cost. Just as every ship has its price, so does every Medigap policy. The cost can vary widely depending on the policy and the company selling it. It’s crucial to weigh the benefits against the cost, just as a sailor would balance the weight of their cargo against the capacity of their ship.

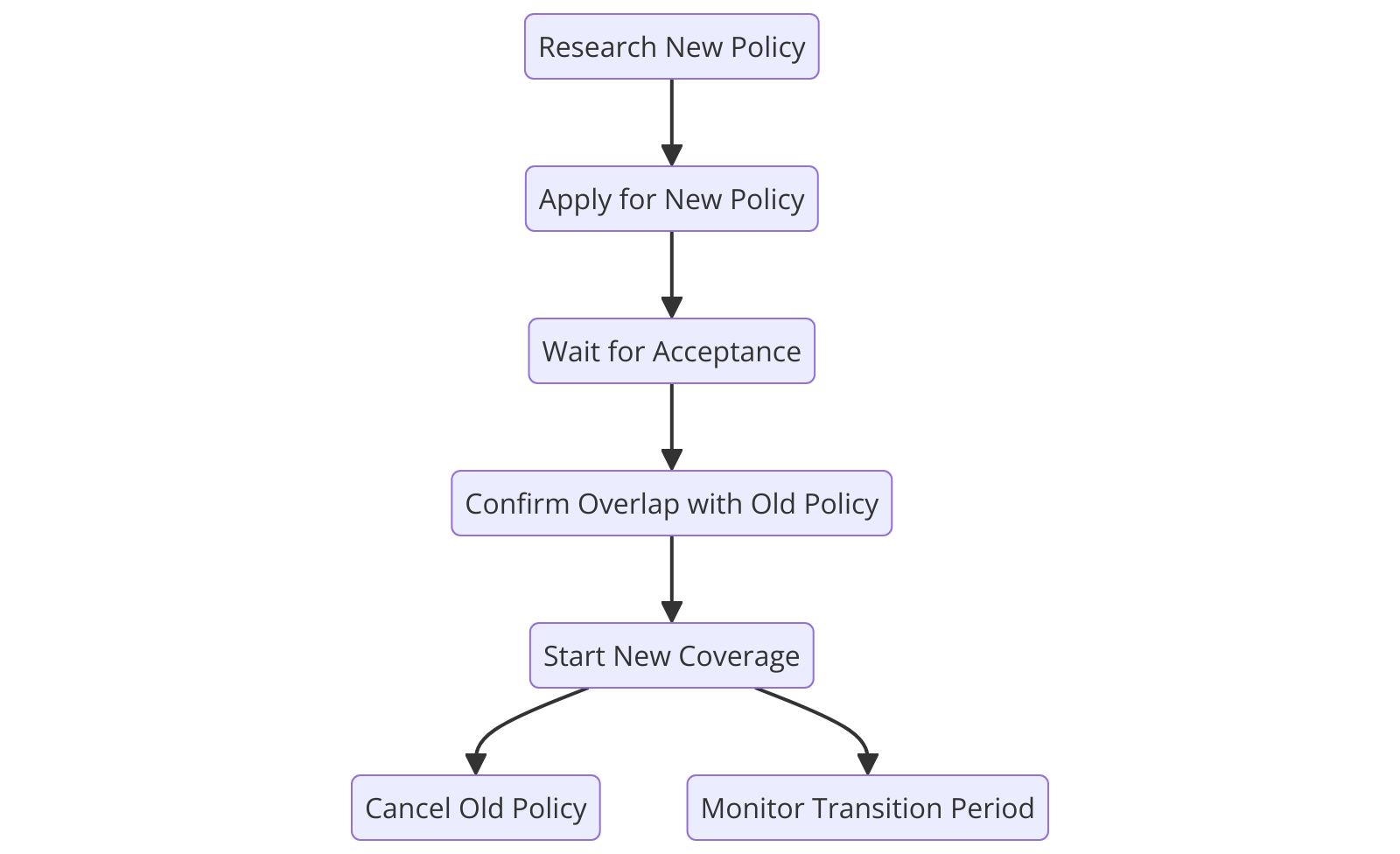

Finally, before you switch policies, make sure to apply for the new policy and get accepted before you cancel your old one. This is your safety net, your lifeboat in the vast sea of healthcare. It ensures that you won’t be left without coverage if your application for the new policy is denied.

Switching Medigap policies is a journey, a voyage across the sea of healthcare. It can be daunting, but with understanding and inspiration, you can navigate it with ease and confidence. So, set your course, adjust your sails, and embark on your journey. The sea of healthcare awaits, and a policy that better suits your needs is on the horizon.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Top Reasons to Consider Switching Your Medigap Policy

Switching Medigap policies may seem like a daunting task, but it’s a decision that could potentially save you money and provide you with better health coverage. It’s a journey that requires careful consideration, but with the right mindset and information, it can be a smooth and rewarding process.

Imagine a world where you’re not burdened by high medical costs, where you have the freedom to choose your healthcare providers, and where you’re covered for health services that are not included in your original Medicare plan. This is the world that a well-chosen Medigap policy can offer you. However, like any journey, there may come a time when you need to change your course.

One of the top reasons to consider switching your Medigap policy is to save money. Over time, premiums can increase, and you may find yourself paying more than you initially anticipated. If you find a policy that offers the same benefits at a lower cost, it might be time to make a switch. It’s like finding a shortcut on a long journey – it saves you time and energy, and gets you to your destination faster.

Another reason to consider switching is if your health needs have changed. As we journey through life, our health can take unexpected turns. You may develop new health conditions or your existing ones may worsen. In such cases, you may need a Medigap policy that offers more comprehensive coverage. It’s like packing an extra jacket for a journey – you may not need it at the start, but it can be a lifesaver when the weather changes.

You may also want to switch your Medigap policy if you’re not satisfied with your current insurance company. Perhaps their customer service is not up to par, or they’re not as reliable as you thought. In such cases, switching to a different company can provide you with peace of mind. It’s like choosing a different travel companion for your journey – someone who is reliable, supportive, and makes the journey more enjoyable.

Lastly, you may want to switch your Medigap policy if you move to a different state. Not all Medigap policies are available in all states, and the cost and coverage can vary. If you move, you may find a policy that is better suited to your needs and budget in your new location. It’s like finding a new path on your journey – one that leads to new experiences and opportunities.

Switching Medigap policies is not a decision to be taken lightly. It requires careful consideration and research. But remember, it’s your journey, and you have the power to choose the path that best suits your needs. Don’t be afraid to explore new paths, to seek out better options, and to make changes when necessary.

In the end, the goal is to find a Medigap policy that provides you with the best possible coverage at the most affordable price. It’s about finding a policy that supports you on your health journey, that provides you with peace of mind, and that allows you to focus on living your life to the fullest. So, take the leap, consider switching your Medigap policy, and embark on a new journey towards better health coverage.

How to Switch Medigap Policies Without Losing Coverage

Switching Medigap policies can seem like a daunting task, but it doesn’t have to be. With the right knowledge and a dash of courage, you can navigate this process smoothly, ensuring you don’t lose coverage during the transition. Let’s embark on this journey together, inspired by the belief that everyone deserves the best healthcare coverage possible.

Imagine standing at the edge of a cliff, the wind whipping your hair, the sea crashing against the rocks below. You’re about to take a leap of faith, to dive into the unknown. That’s what switching Medigap policies can feel like. But fear not, for just as a seasoned cliff diver knows the right moment to leap, you too can master the art of switching Medigap policies without losing coverage.

Firstly, it’s important to understand why you might want to switch policies. Perhaps you’ve found a policy that offers better benefits, or maybe your current policy’s premiums have become too expensive. Whatever the reason, it’s crucial to remember that change is a natural part of life. Just as a caterpillar must transform into a butterfly, so too must your Medigap policy evolve to meet your changing needs.

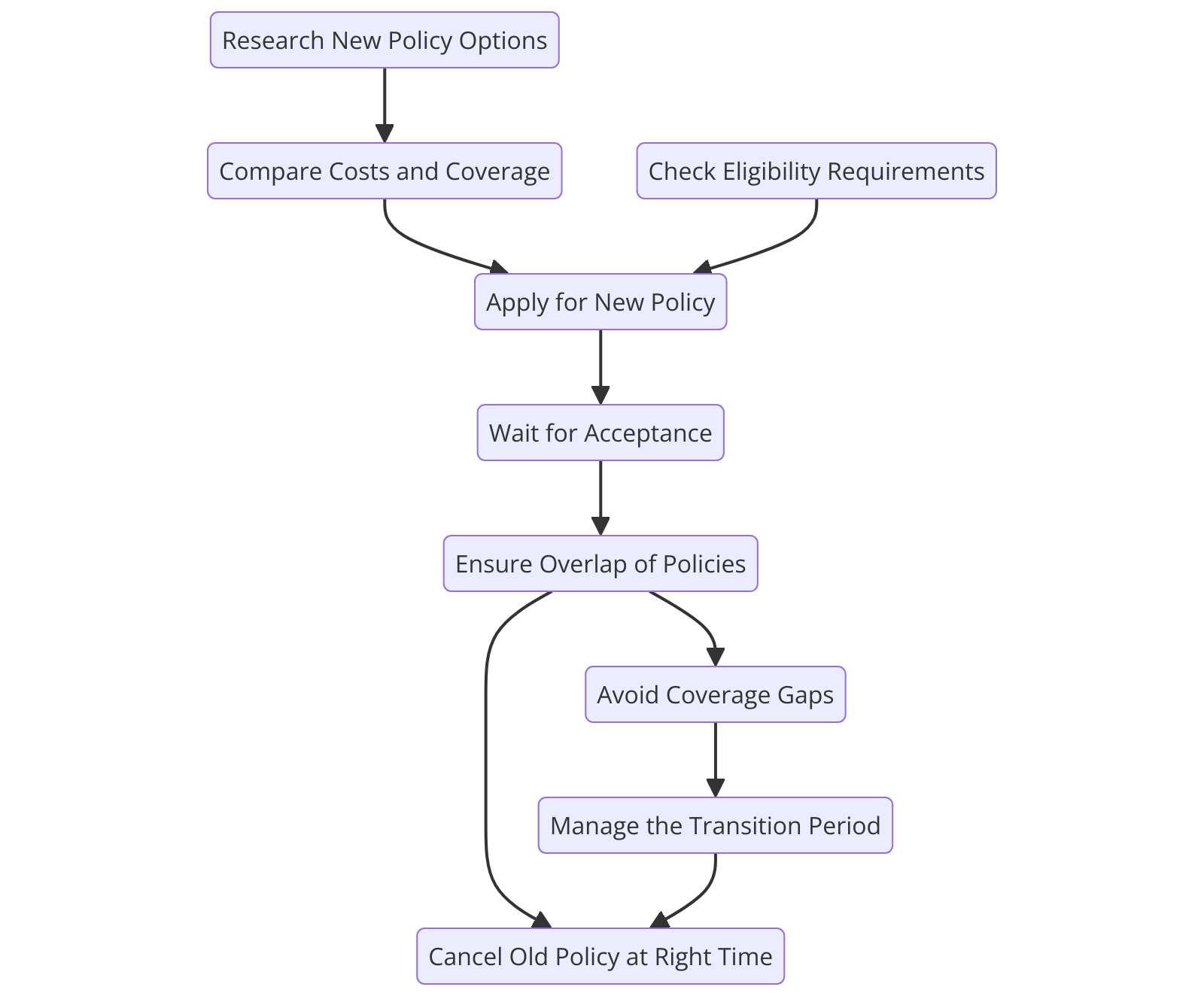

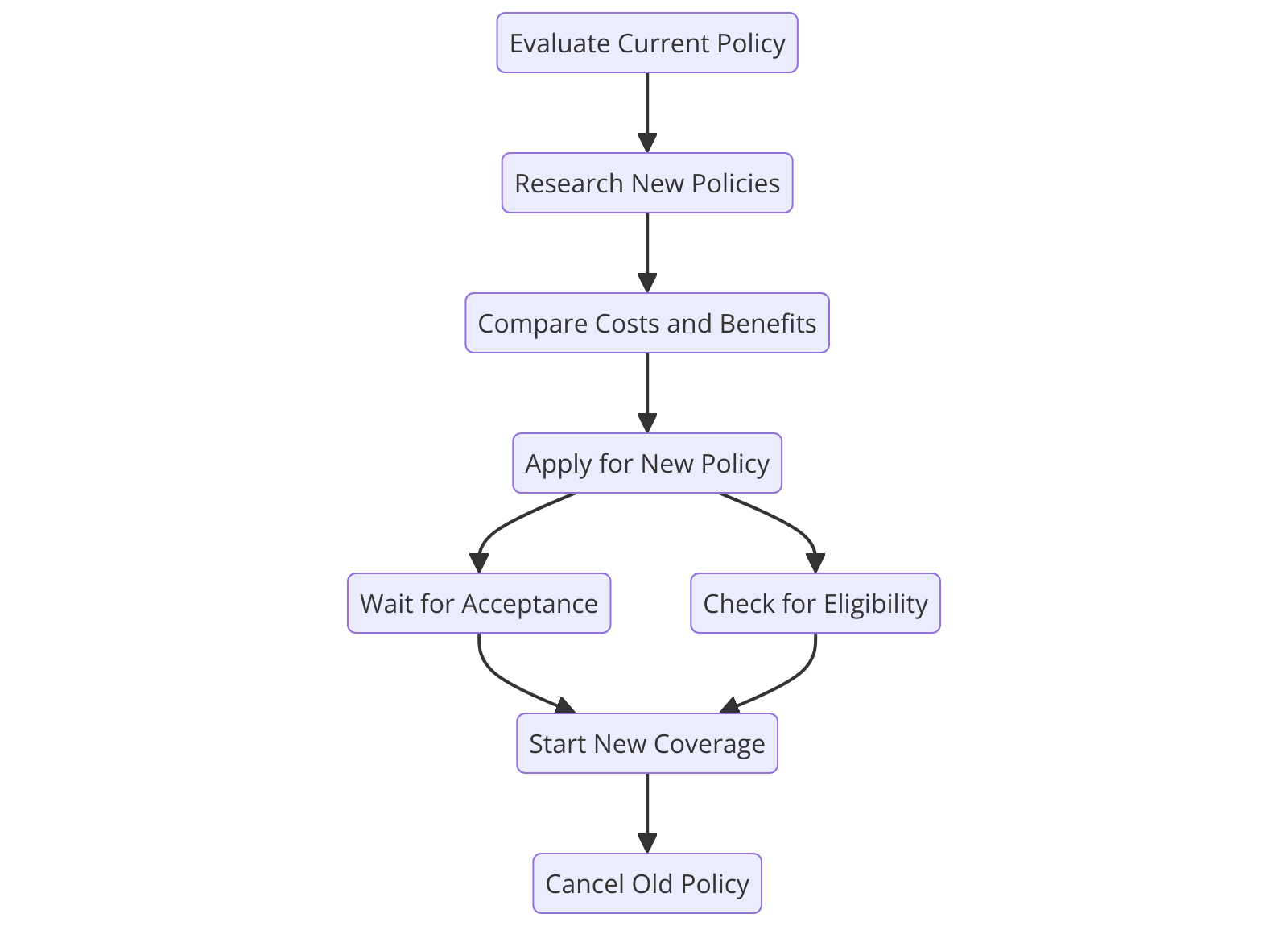

Now, let’s delve into the process of switching policies. It’s akin to crossing a river: you need to ensure you have a solid footing on both banks before you make the leap. In the world of Medigap policies, this means ensuring you’re eligible to switch. Generally, you have a one-time “trial right” or “free look period” during which you can switch to a different Medigap policy without penalty. This period usually lasts for 30 days from the day you start your new policy.

Next, you need to apply for the new policy before canceling your old one. This is like securing a safety net before performing a high-wire act. If your application is denied, you’ll still have your old policy to fall back on. Once your new policy is confirmed, you can then cancel your old policy. It’s a delicate balancing act, but with careful planning, you can ensure you’re never left without coverage.

But what if you’re past the trial right period? Well, just as a seasoned sailor knows how to navigate stormy seas, you too can navigate the potentially choppy waters of switching Medigap policies outside of the trial right period. You may have to answer medical questions and undergo underwriting. However, if you’re in good health and live in a state that has continuous open enrollment or guaranteed issue rights for Medigap policies, you may still be able to switch without losing coverage.

Switching Medigap policies is a journey, one that requires courage, knowledge, and careful planning. But remember, every journey begins with a single step. So take that step, embrace the change, and secure the healthcare coverage you deserve. After all, life is too short to settle for anything less than the best. So, go ahead, take the leap, and switch your Medigap policy. You’ve got this!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Pros and Cons of Switching Medigap Policies

Switching Medigap policies can be likened to navigating a labyrinth. It’s a journey filled with twists and turns, with the potential for both rewards and pitfalls. But, like any great adventure, it’s one that can be embarked upon with confidence and courage, armed with the right knowledge and understanding.

Medigap, also known as Medicare Supplement Insurance, is a policy that helps cover the costs that Medicare doesn’t, such as copayments, coinsurance, and deductibles. It’s a safety net, a buffer against the unexpected, and a beacon of reassurance in the often tumultuous sea of healthcare. However, there may come a time when you feel the need to switch your Medigap policy. Perhaps you’re seeking a plan with better benefits, or maybe you’re looking for a more affordable premium. Whatever the reason, it’s a decision that should not be taken lightly.

On the one hand, switching Medigap policies can open up a world of possibilities. It’s an opportunity to tailor your healthcare coverage to your evolving needs and circumstances. It’s a chance to take control of your health and wellbeing, to ensure that you’re getting the best possible care at the best possible price. It’s a step towards empowerment, towards taking charge of your own destiny.

Moreover, switching Medigap policies can also lead to significant savings. By shopping around and comparing different plans, you may be able to find a policy that offers the same benefits at a lower cost. It’s like finding a hidden treasure in the vast ocean of healthcare options, a gem that can lighten the financial burden and bring peace of mind.

However, like any journey, switching Medigap policies also comes with its share of challenges. One of the main hurdles is the medical underwriting process. If you switch to a new Medigap policy outside of your open enrollment period or guaranteed issue rights, you may be subject to medical underwriting. This means that the insurance company can use your medical history to decide whether to accept your application and how much to charge you. It’s a potential stumbling block, a hurdle that can make the path to a new policy more difficult.

Additionally, switching Medigap policies can also lead to a loss of benefits. If you switch from a Medigap policy to a Medicare Advantage Plan, you may not be able to switch back if you change your mind. It’s a risk, a gamble that can have lasting consequences.

In the end, the decision to switch Medigap policies is a personal one, a choice that should be made with careful consideration and thoughtful deliberation. It’s a journey that requires courage and determination, but one that can also lead to great rewards. It’s a testament to the power of choice, to the ability to shape our own destiny. So, whether you’re considering switching Medigap policies or are happy with your current plan, remember that you have the power to make the best decision for your health and wellbeing. After all, it’s not just about navigating the labyrinth of healthcare, it’s about finding the path that leads to the best possible care.

Key Factors to Consider When Switching Medigap Policies

Switching Medigap policies can be likened to navigating a labyrinth. It’s a journey filled with twists and turns, but with the right guidance, you can find your way to a policy that better suits your needs. It’s a journey that requires careful consideration, a keen eye for detail, and a deep understanding of your health needs. But fear not, for every journey begins with a single step, and this article is your first step towards a successful switch.

Imagine standing at the entrance of the labyrinth, ready to embark on your journey. The first key factor to consider is your reason for switching. Are you dissatisfied with your current policy? Perhaps you’re seeking better benefits, lower costs, or a policy that better aligns with your current health status. Whatever your reason, let it be your guiding light as you navigate the labyrinth. It will help you stay focused and ensure that your new policy meets your needs.

As you delve deeper into the labyrinth, you’ll encounter the second key factor: the timing of your switch. In the world of Medigap policies, timing is everything. There’s a six-month Medigap open enrollment period that starts the month you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning you can buy any Medigap policy sold in your state, regardless of your health status. If you miss this window, you may face medical underwriting and potentially higher costs. So, keep a keen eye on the calendar and make your move at the right time.

As you navigate the twists and turns of the labyrinth, you’ll come across the third key factor: the cost of the new policy. Medigap policies are standardized, but their costs are not. They can vary widely from one insurance company to another. So, don’t let the cost be an afterthought. Instead, let it be a compass guiding you towards a policy that not only meets your health needs but also fits your budget.

Finally, as you approach the end of the labyrinth, you’ll face the fourth key factor: the reputation of the insurance company. In the labyrinth of Medigap policies, not all paths lead to a reliable insurance company. Some may lead to companies with poor customer service or questionable financial stability. So, do your homework. Research the company’s reputation, check their financial ratings, and read reviews from other policyholders. Let this information be your map, leading you to a company that you can trust.

Switching Medigap policies is indeed a journey, but it’s a journey worth taking. It’s a journey that can lead you to better health coverage, lower costs, and greater peace of mind. So, take that first step. Consider these key factors, navigate the labyrinth, and find your way to a Medigap policy that better suits your needs. Remember, every journey begins with a single step, and this article is your first step towards a successful switch. So, step forward with confidence, and let your journey begin.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Impact of Switching Medigap Policies on Your Healthcare

Switching Medigap policies can be likened to navigating a ship through uncharted waters. It’s a journey filled with uncertainty, but also one that holds the promise of better horizons. The impact of this switch on your healthcare can be profound, and it’s a decision that should be made with careful consideration and a clear understanding of the potential outcomes.

Imagine standing at the helm of your ship, the vast ocean of healthcare options stretching out before you. The wind of change is blowing, and you’re considering setting a new course by switching your Medigap policy. This decision, like adjusting your sails, can significantly alter your journey. It can lead to smoother seas with better coverage and lower costs, or it can steer you into rough waters with unexpected expenses and gaps in coverage.

The first ripple you might encounter when switching Medigap policies is the potential for improved coverage. Just as a skilled sailor uses the wind to their advantage, a well-chosen Medigap policy can help you navigate the often turbulent seas of healthcare. It can fill in the gaps left by Medicare, covering costs such as copayments, coinsurance, and deductibles. By switching to a policy that better suits your needs, you can ensure that you’re adequately protected against the financial storms that can accompany serious health issues.

However, just as every sea has its dangers, so too does the process of switching Medigap policies. One potential pitfall is the risk of higher premiums. While a new policy might offer better coverage, it could also come with a higher price tag. It’s important to weigh the potential benefits against the costs, just as a sailor must balance the risk and reward of a new course.

Another potential hazard is the loss of guaranteed issue rights. These rights, which are typically granted during your Medigap open enrollment period, protect you from being denied coverage or charged higher premiums due to health issues. If you switch policies outside of this period, you might lose these protections, leaving you vulnerable to the whims of the insurance market.

Despite these potential challenges, switching Medigap policies can also bring a sense of empowerment. Just as a sailor takes control of their destiny by setting a new course, you can take charge of your healthcare by choosing a policy that better meets your needs. This decision can bring peace of mind, knowing that you’re prepared for whatever healthcare challenges lie ahead.

In the end, the impact of switching Medigap policies on your healthcare is much like the impact of changing course on a sea voyage. It can bring new opportunities, but it also comes with risks. It’s a decision that requires careful consideration, a clear understanding of the potential outcomes, and a willingness to navigate the unknown.

So, as you stand at the helm of your healthcare journey, consider your options carefully. Weigh the potential benefits and risks, and make the decision that’s right for you. Remember, you’re the captain of your ship, and the course you set can lead to smoother seas, better coverage, and a more secure healthcare future.

Navigating the Challenges of Switching Medigap Policies

Switching Medigap policies can feel like navigating a labyrinth. It’s a journey filled with twists and turns, unexpected challenges, and the occasional dead end. But like any great adventure, it’s also an opportunity for growth, learning, and ultimately, triumph.

Imagine standing at the entrance of this labyrinth, armed with nothing but your determination and a desire for better health coverage. The walls are high and the path ahead is unclear. But you take a deep breath, step forward, and begin your journey.

The first challenge you encounter is understanding the rules of the game. Medigap policies, also known as Medicare Supplement Insurance, are designed to fill the gaps in Original Medicare coverage. But not all Medigap policies are created equal. They vary in cost, benefits, and eligibility requirements. And while you can switch Medigap policies at any time, there are certain periods when it’s easier to do so.

You might feel overwhelmed at first, but don’t despair. Remember, every great journey begins with a single step. Start by educating yourself about the different types of Medigap policies and their benefits. Consult with a trusted advisor or use online resources to compare policies. Knowledge is your compass in this labyrinth, guiding you towards the right decision.

As you delve deeper into the labyrinth, you’ll encounter the challenge of timing. The best time to switch Medigap policies is during your Medigap Open Enrollment Period, which begins on the first day of the month you’re 65 or older and enrolled in Medicare Part B. During this six-month period, you have guaranteed issue rights, meaning insurance companies can’t deny you coverage or charge you more due to pre-existing conditions.

But what if you’ve missed this golden opportunity? Fear not, for there are other paths to explore. You might qualify for a Special Enrollment Period or guaranteed issue rights under certain circumstances, such as if your Medigap insurance company goes bankrupt or misleads you.

The labyrinth may seem daunting, but remember, it’s not a race. It’s a journey of discovery and self-empowerment. Take your time to understand your options and make informed decisions.

As you navigate the twists and turns of the labyrinth, you’ll encounter the challenge of cost. Medigap policies can be more expensive than other types of health insurance. But don’t let this deter you. Instead, see it as an opportunity to reassess your budget and prioritize your health. After all, investing in your health is one of the best investments you can make.

Finally, after overcoming these challenges, you’ll reach the heart of the labyrinth: the decision to switch. This is a moment of triumph, a testament to your resilience and determination. But it’s also a moment of reflection. Ask yourself: Does this new policy meet my health needs? Is it affordable? Is it worth the switch?

Switching Medigap policies is not just about finding better health coverage. It’s about embarking on a journey of self-discovery, learning, and growth. It’s about overcoming challenges and emerging stronger. So, step into the labyrinth with courage and determination. You have the power to navigate its twists and turns and find the right Medigap policy for you. And remember, every step you take is a step towards better health and a brighter future.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

A Comprehensive Guide to Switching Medigap Policies

Switching Medigap policies can seem like a daunting task, but it doesn’t have to be. With the right knowledge and guidance, you can navigate this process with ease and confidence. So, let’s embark on this journey together, shedding light on the path to a more suitable Medigap policy that aligns with your needs.

Imagine standing at the edge of a vast ocean, the waves representing the myriad of Medigap policies available to you. It’s easy to feel overwhelmed, but remember, every great journey begins with a single step. Your first step is understanding why you might want to switch policies. Perhaps your health needs have changed, or you’re not satisfied with your current policy’s cost. Maybe you’ve found another policy that offers benefits more suited to your lifestyle. Whatever your reasons, they are valid and important.

Now, let’s dive into the ocean, fearlessly navigating the waves. It’s crucial to know that the best time to switch Medigap policies is during your 6-month Medigap open enrollment period. This period starts the month you’re 65 or older and enrolled in Medicare Part B. During this time, you have a ‘guaranteed issue right,’ meaning you can switch policies without worrying about medical underwriting. However, if you miss this window, don’t despair. You can still switch policies, but you may have to answer health questions, and there’s a chance you could be denied coverage based on your health.

As we swim deeper, let’s explore the different types of Medigap policies. There are ten standardized Medigap policies, labeled A through N, each offering different benefits. It’s like finding a treasure chest filled with different jewels, each one unique and valuable in its own way. Take your time to examine each policy, understanding the benefits it offers, and how it aligns with your health needs and budget.

Now, imagine reaching a crossroads in the ocean, where currents from different directions meet. This is where you decide whether to switch from a Medigap policy to a Medicare Advantage Plan. It’s a significant decision, as these plans are quite different. While Medigap policies supplement your Original Medicare benefits, Medicare Advantage Plans are an alternative way to get your Medicare benefits. They often include benefits not covered by Original Medicare, like vision, hearing, and dental. However, they also have different costs and restrictions. It’s like choosing between two different paths, each leading to a different adventure.

As we near the end of our journey, let’s talk about the process of switching policies. It’s like docking your boat after a long voyage. You’ll need to apply for the new policy and wait for approval before canceling your old policy. It’s important not to cancel your old policy before you’re approved for the new one, to avoid any gaps in coverage.

Finally, we’ve reached the shore, the end of our journey. But remember, switching Medigap policies is not a one-time event. It’s an ongoing process, as your health needs and budget may change over time. So, keep exploring, keep learning, and keep striving for a policy that best suits your needs.

Switching Medigap policies can seem like a vast, overwhelming ocean. But with the right knowledge and guidance, you can navigate it with ease and confidence. So, take that first step, dive in, and embark on your journey to a more suitable Medigap policy.

Switching Medigap Policies: What You Need to Know

Switching Medigap policies can seem like a daunting task, but it doesn’t have to be. With the right knowledge and a little bit of courage, you can navigate this process with ease and confidence. After all, your health is your wealth, and ensuring you have the best possible coverage is a crucial step in safeguarding it.

Imagine standing at the edge of a vast ocean, the waves lapping at your feet. The ocean represents the world of Medigap policies, vast and seemingly endless. Each wave that rolls in is a new policy, each one different from the last. It can be overwhelming, but remember, you are the captain of your ship. You have the power to navigate these waters and find the policy that best suits your needs.

The first step in switching Medigap policies is understanding why you might want to make a change. Perhaps your current policy doesn’t cover certain health care costs that have become necessary for you. Maybe you’re paying for benefits you don’t need. Or, it could be that you’re simply not satisfied with your current insurance company. Whatever the reason, identifying it clearly will help guide your journey through the sea of policies.

Next, it’s important to know that the best time to switch Medigap policies is during your Medigap open enrollment period. This six-month period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed right to buy any Medigap policy sold in your state, regardless of your health status. It’s like having a golden ticket, a key that unlocks all the doors in front of you.

However, if you miss this window, don’t despair. You may still be able to switch policies, but you’ll likely need to go through medical underwriting. This means the insurance company will review your medical history and could charge you more or deny coverage based on your health. It’s like sailing into rougher waters, but with a sturdy ship and a good map, you can still reach your destination.

When considering a new policy, it’s crucial to compare benefits and costs. Just like every wave in the ocean is unique, so is every Medigap policy. Some might offer benefits that others don’t, and costs can vary widely. Take your time to review each policy carefully. It’s like scanning the horizon with a telescope, searching for the best route forward.

Finally, once you’ve found a new policy that meets your needs, you can apply. But remember, don’t cancel your old policy until you’re sure the new one is in place. It’s like ensuring you have a lifeboat before you leave your ship.

Switching Medigap policies is a journey, one that requires courage and determination. But with the right knowledge, you can navigate this process with confidence. So, stand tall, captain. The ocean of Medigap policies is vast, but you have the power to navigate it. You have the power to ensure your health is well protected. And that, dear reader, is a voyage worth embarking on.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Financial Implications of Switching Medigap Policies

Switching Medigap policies can be likened to navigating a labyrinth. It’s a journey filled with twists and turns, and the potential for unexpected surprises. However, with the right guidance and a clear understanding of the financial implications, this journey can be less daunting and more of an enlightening adventure.

Imagine standing at the entrance of this labyrinth, armed with the knowledge that Medigap policies, also known as Medicare Supplement Insurance, are designed to fill in the gaps left by Original Medicare. These gaps include out-of-pocket costs like deductibles, copayments, and coinsurance. Now, you’re considering switching your Medigap policy. Perhaps you’ve found a policy that offers better benefits, or maybe you’re simply not satisfied with your current insurer. Whatever the reason, it’s essential to understand the financial implications of this decision.

As you step into the labyrinth, the first thing you encounter is the issue of timing. In the world of Medigap policies, timing is everything. The best time to buy or switch policies is during your Medigap Open Enrollment Period. This six-month period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning insurance companies can’t use medical underwriting. They can’t charge you more because of health problems or refuse to sell you a policy. However, if you decide to switch policies after this period, you may face higher premiums or even denial of coverage based on your health status.

Venturing deeper into the labyrinth, you come across the concept of cost. Medigap policies are standardized, meaning they offer the same basic benefits, but they do not all cost the same. Insurance companies may charge different premiums for the same policy. Therefore, switching to a new policy might mean paying a higher premium, even if the benefits are the same. It’s crucial to weigh the potential benefits against the increased cost.

As you navigate the twists and turns, you encounter the issue of coverage. Some Medigap policies offer benefits not covered by others, such as coverage while you travel outside the U.S. If you switch from a policy that offers this benefit to one that doesn’t, you may end up paying more out-of-pocket costs if you need medical care while traveling.

Finally, as you approach the end of the labyrinth, you come face-to-face with the reality of waiting periods. If you switch to a new Medigap policy, there may be a waiting period before coverage for pre-existing conditions begins. This could result in higher out-of-pocket costs if you need treatment for those conditions during the waiting period.

Emerging from the labyrinth, you’re now armed with a deeper understanding of the financial implications of switching Medigap policies. It’s a journey that requires careful consideration and planning. But remember, every journey, no matter how complex, is an opportunity for growth and learning. So, embrace the adventure of navigating the Medigap policy labyrinth. With knowledge as your compass, you can make informed decisions that will lead to a secure and healthy future.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Q: What is a Medigap policy?

A: A Medigap policy is a supplemental insurance policy sold by private companies to cover costs not covered by Medicare, such as deductibles, co-payments, and health care if you travel outside the U.S.

2. Q: Can I switch Medigap policies?

A: Yes, you can switch Medigap policies, but it may be subject to medical underwriting unless you have guaranteed issue rights.

3. Q: What are guaranteed issue rights?

A: Guaranteed issue rights are rights you have in certain situations when insurance companies must offer you certain Medigap policies. In these situations, an insurance company can’t deny you a policy, or place conditions on a policy, like charging you more due to existing health problems.

4. Q: When can I switch Medigap policies?

A: You can switch Medigap policies at any time, but if you apply outside of your open enrollment period or a special enrollment period, you may be subject to medical underwriting.

5. Q: What is medical underwriting?

A: Medical underwriting is a process used by insurance companies to determine your health status when you’re applying for insurance, to decide whether to offer you a policy, at what price, and with what exclusions or limits.

6. Q: Can I switch from a Medicare Advantage Plan to a Medigap policy?

A: Yes, you can switch from a Medicare Advantage Plan to a Medigap policy if you return to Original Medicare within the first year of joining.

7. Q: Can I have more than one Medigap policy?

A: No, it’s illegal for anyone to sell you more than one Medigap policy.

8. Q: What if I have a complaint about my Medigap policy?

A: If you have a complaint about your Medigap policy, you can contact your State Insurance Department.

9. Q: Can I switch Medigap policies if I have a pre-existing condition?

A: Yes, but if you apply outside of your open enrollment period or a special enrollment period, the insurance company may be able to refuse to cover your out-of-pocket costs for these pre-existing health problems for up to 6 months.

10. Q: What happens if I drop my Medigap policy and later decide I want it back?

A: If you drop your Medigap policy and later decide you want it back, you may not be able to get the same policy, or any Medigap policy, unless you have a guaranteed issue right or are within your 6-month Medigap open enrollment period.