“Securing Your Health Future with Medigap Plans Maryland.”

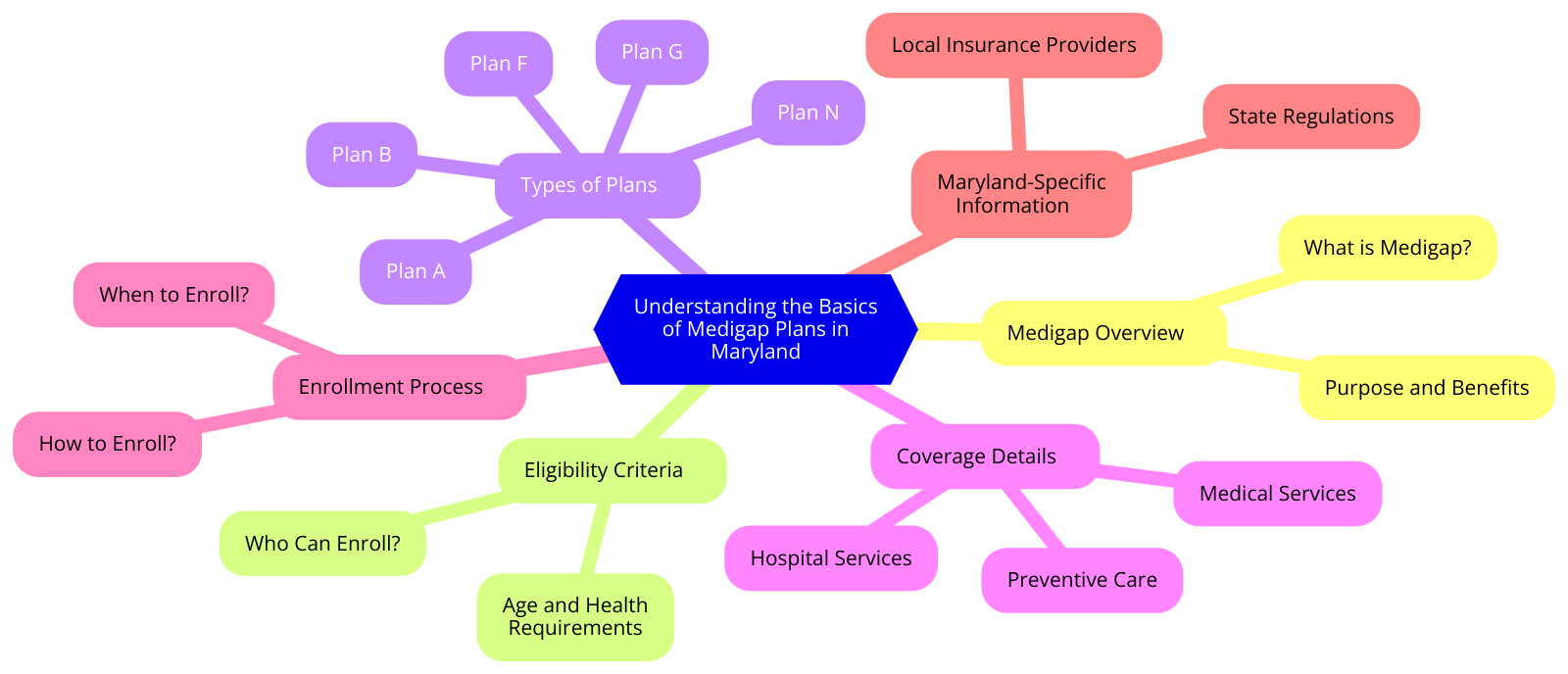

Understanding the Basics of Medigap Plans in Maryland

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history and diverse culture, Maryland is also home to a population that values health and wellness. As such, it’s no surprise that Medigap plans have become an essential part of the healthcare landscape in this state.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare. It’s like the missing piece of a jigsaw puzzle, the final note in a symphony, or the last stroke of a masterpiece painting. It completes the picture, ensuring that Maryland residents have comprehensive health coverage that meets their unique needs.

Medicare, while a valuable resource, doesn’t cover everything. It’s like a safety net with a few holes. You can rely on it to catch you when you fall, but there might be a few bumps and bruises along the way. That’s where Medigap comes in. It patches up those holes, providing coverage for out-of-pocket costs like deductibles, co-payments, and coinsurance.

Imagine standing on the shores of the Chesapeake Bay, watching the sun set over the water. The sky is a canvas of colors, from deep purples and blues to vibrant oranges and pinks. But as beautiful as the scene is, it’s not complete without the lighthouse standing tall in the distance, guiding ships safely to shore. That’s what Medigap is – a beacon of light in the complex world of healthcare, guiding Maryland residents towards financial security and peace of mind.

But just as every sunset is unique, so too are the needs of each individual. That’s why there are ten different Medigap plans available in Maryland, each with its own set of benefits. Some provide basic coverage, while others offer more comprehensive protection. It’s like choosing between different flavors of Maryland’s famous crab cakes – each one is delicious in its own way, but the best one for you depends on your personal tastes and dietary needs.

Choosing a Medigap plan is a journey, and like any journey, it’s best undertaken with a map and a clear destination in mind. It’s about understanding your healthcare needs, assessing your financial situation, and exploring your options. It’s about standing at the crossroads and choosing the path that leads to the best possible future.

And while the journey may seem daunting, remember that you’re not alone. There are resources available to help you navigate the complexities of Medigap plans. From state health departments to private insurance advisors, there are experts ready to guide you, like a compass pointing you in the right direction.

So, as you embark on this journey, take a moment to appreciate the beauty of Maryland, from the bustling streets of Baltimore to the tranquil shores of the Chesapeake Bay. Let it inspire you, fuel your determination, and remind you of why health coverage is so important. Because at the end of the day, Medigap is more than just insurance. It’s a commitment to your health, your future, and the beautiful state you call home.

In the grand tapestry of life, health is the thread that weaves everything together. And with Medigap, Maryland residents can ensure that this thread remains strong and vibrant, allowing them to live their lives to the fullest. So, here’s to health, to life, and to the journey ahead. Here’s to Medigap plans in Maryland.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Top 10 Medigap Plans Available in Maryland

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history and diverse culture, Maryland is also home to a thriving community of seniors who are living their golden years with grace and vitality. One of the key factors contributing to their quality of life is the availability of excellent healthcare options, particularly Medigap plans.

Medigap, also known as Medicare Supplement Insurance, is a type of health insurance that fills in the “gaps” in Original Medicare coverage. It provides an extra layer of financial protection by covering costs like deductibles, co-payments, and coinsurance. In Maryland, there are ten Medigap plans available, each offering a unique blend of benefits designed to meet the diverse needs of its senior population.

Imagine the peace of mind that comes with knowing that Plan A, the most basic of all Medigap plans, covers your Part A hospital coinsurance and provides an additional 365 days of coverage after Medicare benefits are exhausted. It’s like a safety net, always there to catch you when you need it the most.

Then there’s Plan B, which not only covers everything that Plan A does but also takes care of your Part A deductible. It’s like having a trusted friend who steps in to help when the going gets tough.

Plan C is like a protective shield, covering almost all of your out-of-pocket costs. It includes everything from Plan B, plus coverage for your Part B deductible, skilled nursing facility care coinsurance, and even emergency care during foreign travel.

Plan D, on the other hand, is like a sturdy bridge, helping you cross over potential financial pitfalls. It offers all the benefits of Plan C, except for the Part B deductible.

Plan F is the most comprehensive of all Medigap plans. It’s like a fortress, providing complete coverage for all Medicare-approved costs not covered by Part A and Part B. It’s the only plan that covers Part B excess charges, which are the extra charges that some doctors and hospitals can legally charge over and above the Medicare-approved amount.

Plan G is like a beacon of light, guiding you safely through the complexities of healthcare costs. It offers all the benefits of Plan F, except for the Part B deductible.

Plan K is like a steady hand, offering partial coverage for many costs and a safety net for catastrophic expenses. It covers 50% of several key costs and provides full coverage once you’ve spent a certain amount out-of-pocket in a calendar year.

Plan L is similar to Plan K, but it covers 75% of several key costs. It’s like a comforting presence, always there to provide support when you need it.

Plan M is like a reliable companion, covering 50% of your Part A deductible and fully covering several other key costs.

Finally, Plan N is like a sturdy umbrella, providing a wide range of coverage and requiring only small copayments for certain office visits and emergency room trips.

In the end, the choice of a Medigap plan is a deeply personal one, influenced by factors such as your health status, budget, and lifestyle. But no matter which plan you choose, you can rest assured that you’re not alone. In Maryland, you’re part of a community that values the health and well-being of its seniors. And that’s something truly inspiring.

How to Choose the Right Medigap Plan in Maryland

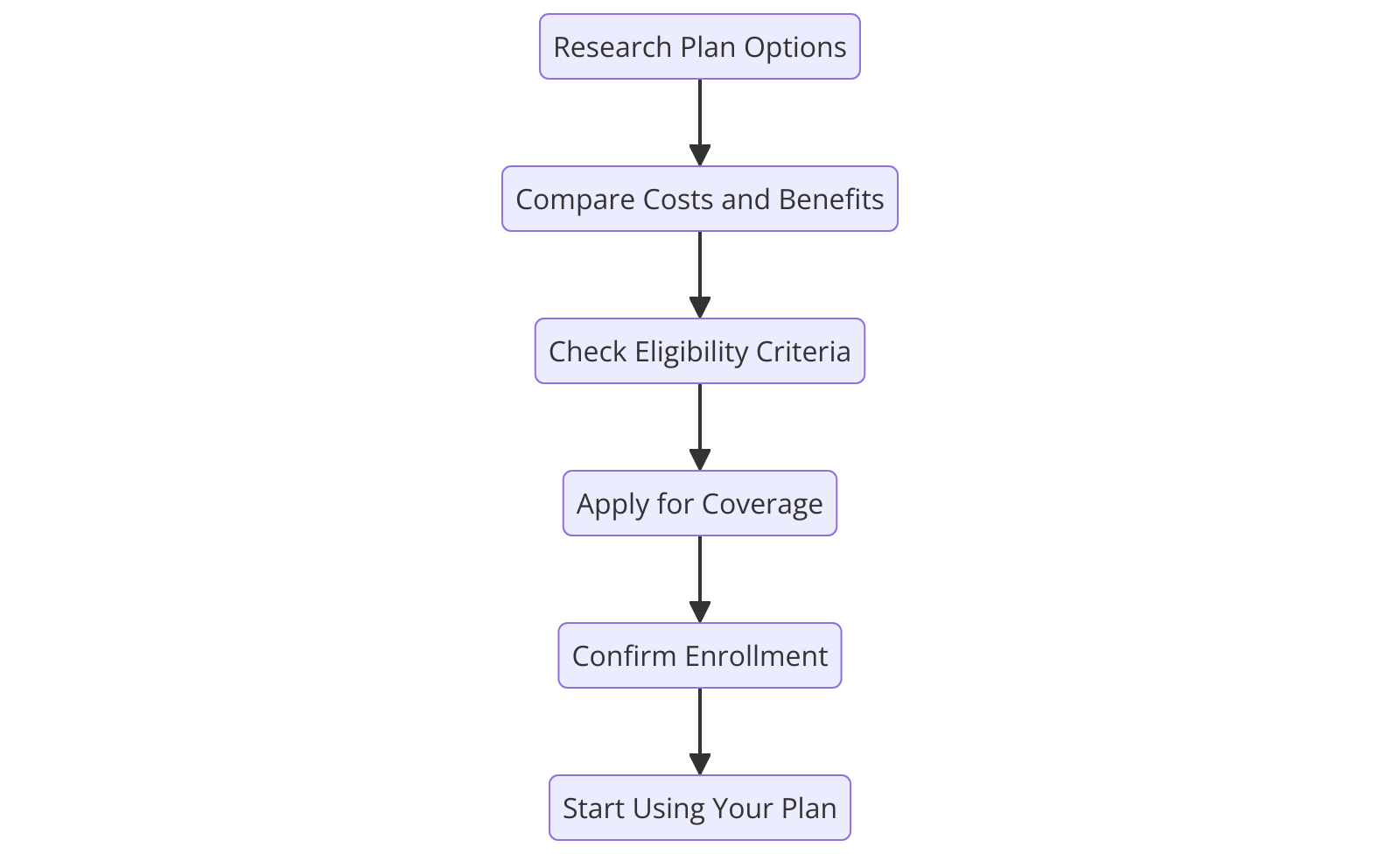

Choosing the right Medigap plan in Maryland is like embarking on a journey. It’s a journey that requires careful planning, thoughtful consideration, and a clear understanding of your destination. It’s a journey that, when navigated correctly, can lead to a future of health, security, and peace of mind.

Imagine standing at the edge of a vast, beautiful landscape. This landscape represents the world of Medigap plans available to you in Maryland. Each plan is like a path winding through the landscape, each with its own unique features and benefits. Your task is to choose the path that will lead you to your desired destination: a future where your healthcare needs are met, your financial resources are protected, and your peace of mind is assured.

The first step in this journey is to understand your own health needs. Like a seasoned traveler preparing for a trip, you need to pack your bag with the right supplies. In this case, your supplies are the healthcare services you need now and anticipate needing in the future. Do you have a chronic condition that requires regular doctor visits? Do you take prescription medications? Do you anticipate needing hospital care or skilled nursing facility care? These are the types of questions you need to ask yourself as you prepare for your journey.

Once you’ve packed your bag, the next step is to survey the landscape of Medigap plans. Each plan offers a different combination of benefits, and it’s important to understand what each one offers. Some plans cover only the basics, like Part A coinsurance and hospital costs. Others offer more comprehensive coverage, including Part B coinsurance, Part A deductible, and even foreign travel emergency coverage. As you survey the landscape, look for the paths that offer the coverage you need.

But choosing the right path isn’t just about finding the one that leads to your desired destination. It’s also about finding the one that you can navigate comfortably. This is where cost comes into play. Each Medigap plan comes with a monthly premium, and it’s important to choose a plan that fits within your budget. Remember, the most expensive plan isn’t necessarily the best one for you. The best plan is the one that offers the coverage you need at a price you can afford.

Finally, as you stand at the edge of the landscape, ready to embark on your journey, remember that you’re not alone. There are resources available to help you navigate the world of Medigap plans. The Maryland Department of Aging, for example, offers a free, unbiased health insurance counseling program that can help you understand your options and make an informed decision.

Choosing the right Medigap plan in Maryland is a journey. It’s a journey that requires careful planning, thoughtful consideration, and a clear understanding of your destination. But it’s also a journey that can lead to a future of health, security, and peace of mind. So take a deep breath, step forward, and embark on your journey. The right Medigap plan is out there, waiting for you to discover it.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Benefits of Medigap Plans for Maryland Residents

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history, diverse culture, and the famous blue crabs, Maryland is also home to a thriving community of seniors who are living their golden years with grace and vitality. One of the key factors contributing to their peace of mind and quality of life is the security provided by Medigap plans.

Medigap, as the name suggests, is designed to fill in the gaps left by Original Medicare. It’s like the hero that swoops in to save the day when you’re faced with unexpected medical costs that could otherwise shake your financial stability. Imagine standing on the edge of a cliff, the wind of uncertainty howling around you, and then feeling a firm safety net snap into place beneath you. That’s what having a Medigap plan feels like. It’s the assurance that you won’t fall into a financial abyss due to unforeseen medical expenses.

Medigap plans in Maryland offer a variety of benefits that are tailored to meet the unique needs of its residents. They cover copayments, coinsurance, and deductibles that Medicare Parts A and B do not cover. It’s like having a trusted friend who steps in to share the burden when the weight of healthcare costs becomes too heavy to bear alone.

Moreover, Medigap plans offer the freedom to choose your healthcare providers. There’s something incredibly empowering about having the liberty to select the doctors and hospitals that you trust, without worrying about network restrictions. It’s like being the captain of your own ship, navigating the vast ocean of healthcare with confidence and control.

But the benefits of Medigap plans for Maryland residents extend beyond the financial aspect. They also provide coverage for medical care when you travel outside the United States. Imagine the peace of mind knowing that whether you’re exploring the romantic streets of Paris, or basking in the tropical sun of the Caribbean, you’re covered if a medical emergency arises. It’s like having a protective shield that follows you around the globe, ensuring your safety and well-being.

In addition, some Medigap plans also cover excess charges, which are the extra costs that doctors can charge over and above what Medicare will pay. It’s like having a guardian angel who steps in to protect you from unexpected charges, ensuring that your budget remains intact.

In the grand tapestry of life, the golden years should be a time of relaxation and enjoyment, free from the worry of unexpected medical costs. Medigap plans offer Maryland residents the opportunity to live their retirement years with the peace of mind they deserve. They provide a safety net, a trusted friend, a protective shield, and a guardian angel, all rolled into one.

So, as the sun sets over the Chesapeake Bay, painting the sky with hues of gold and crimson, the seniors of Maryland can rest easy. They know that with their Medigap plans, they are well-equipped to face whatever health challenges may come their way. They can continue to enjoy their crab cakes and football games, their community events and family gatherings, secure in the knowledge that they are protected. That’s the beauty and the benefit of Medigap plans for Maryland residents.

Comparing Medigap Plans in Maryland: A Comprehensive Guide

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history and diverse culture, Maryland is also home to a thriving community of seniors who are living their golden years with grace and vitality. However, as we age, healthcare becomes an increasingly important aspect of our lives. In Maryland, Medicare provides a safety net for seniors, but it doesn’t cover everything. This is where Medigap plans come into play, filling in the gaps left by Medicare and providing peace of mind for Maryland’s seniors.

Imagine standing on the shores of the Chesapeake Bay, watching the sun rise over the water. The sky is painted with hues of pink and orange, and the air is filled with the sound of waves gently lapping against the shore. This is a moment of tranquility, a moment of peace. Now, imagine experiencing this moment without the worry of unexpected medical expenses. This is the peace of mind that Medigap plans can provide.

Medigap plans, also known as Medicare Supplement Insurance, are designed to cover the costs that Medicare doesn’t. These can include copayments, coinsurance, and deductibles, as well as services that Medicare doesn’t cover at all. In Maryland, there are ten standardized Medigap plans available, each offering a different level of coverage. The key to finding the right plan is to compare them carefully, considering your individual healthcare needs and budget.

Think of it as a journey. You’re setting out on a path, armed with a map and a compass. The map is your guide to the different Medigap plans, showing you what each one covers. The compass is your personal healthcare needs, pointing you in the direction of the plan that best suits you. As you navigate this path, you’ll encounter various landmarks – the copayments, coinsurance, and deductibles that each plan covers. You’ll also come across the services that Medicare doesn’t cover, like medical care when you travel outside the U.S. These are the gaps that Medigap plans can fill.

As you journey through the landscape of Medigap plans, you’ll find that each one has its own unique features. Some offer comprehensive coverage, filling in almost all the gaps left by Medicare. Others provide a more basic level of coverage, focusing on the most common out-of-pocket costs. There are also plans that strike a balance between coverage and cost, offering a range of benefits at a moderate premium. The beauty of this journey is that you have the freedom to choose the path that best suits you.

In the end, the goal is to find a Medigap plan that allows you to live your golden years with peace of mind, knowing that you’re covered for the unexpected. It’s about standing on the shores of the Chesapeake Bay, watching the sun rise, and knowing that you’re prepared for whatever the day may bring. It’s about living your life to the fullest, without the worry of unexpected medical expenses. This is the promise of Medigap plans in Maryland.

So, embark on this journey with confidence. Compare the different Medigap plans, consider your healthcare needs, and choose the plan that best suits you. Remember, this is your journey, and you have the power to shape it. With the right Medigap plan, you can live your golden years with peace of mind, enjoying all the beauty that Maryland has to offer.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Role of Medigap Plans in Maryland’s Healthcare System

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history and diverse culture, Maryland is also a beacon of hope in the realm of healthcare, thanks to the role of Medigap plans in the state’s healthcare system.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare coverage. It’s like the hero in a story, stepping in when the protagonist is in dire straits, offering a helping hand to those who need it most. In Maryland, this hero is not just a concept, but a reality that has transformed the lives of countless residents, ensuring they receive the healthcare they need without the burden of overwhelming costs.

Imagine a world where you don’t have to worry about the financial implications of an unexpected health issue. A world where you can focus on recovery, rather than the mounting medical bills on your kitchen table. This is the world that Medigap plans are striving to create in Maryland. They are the safety net, catching Maryland residents when they fall, and providing a cushion of financial security.

Medigap plans in Maryland are like the stars in the night sky, each one unique, offering different benefits to suit the diverse needs of the state’s residents. From Plan A, which covers basic benefits, to Plan N, which offers a more comprehensive coverage, there is a Medigap plan for everyone. It’s like a symphony, each plan playing its part to create a harmonious melody of healthcare coverage.

But the role of Medigap plans in Maryland’s healthcare system goes beyond just providing financial security. They are also a catalyst for change, driving improvements in the quality of healthcare services. With Medigap plans, healthcare providers are incentivized to offer the best care possible, knowing that their services will be adequately compensated. It’s a win-win situation, benefiting both the residents of Maryland and the healthcare providers.

Moreover, Medigap plans are a testament to the power of choice. They empower Maryland residents to take control of their healthcare, allowing them to choose the plan that best fits their needs and budget. It’s like being the captain of your own ship, navigating the vast ocean of healthcare with confidence and peace of mind.

In the grand tapestry of Maryland’s healthcare system, Medigap plans are the threads that hold everything together. They weave a safety net of financial security, drive improvements in healthcare quality, and empower residents with choice. They are the unsung heroes, working behind the scenes to ensure that every Maryland resident has access to the healthcare they need.

So, as the sun sets over the Chesapeake Bay, casting a golden glow over the state of Maryland, we can rest easy knowing that Medigap plans are there, ready to step in when we need them most. They are more than just insurance plans; they are a beacon of hope, a symbol of security, and a testament to the power of choice. They are the heroes of Maryland’s healthcare system, and for that, we are eternally grateful.

Navigating the Enrollment Process for Medigap Plans in Maryland

As the sun rises over the Chesapeake Bay, painting the Maryland sky with hues of pink and orange, another day begins. A day filled with possibilities, opportunities, and decisions. One such decision that may be on the horizon for many Maryland residents is the choice to enroll in a Medigap plan. This decision, while seemingly daunting, can be navigated with grace and ease, much like a sailboat gliding through the bay’s calm waters.

Medigap, also known as Medicare Supplement Insurance, is a type of health insurance that fills in the “gaps” left by Original Medicare. It covers out-of-pocket costs such as deductibles, copayments, and coinsurance, providing a safety net for those unexpected health care expenses that can often catch us off guard.

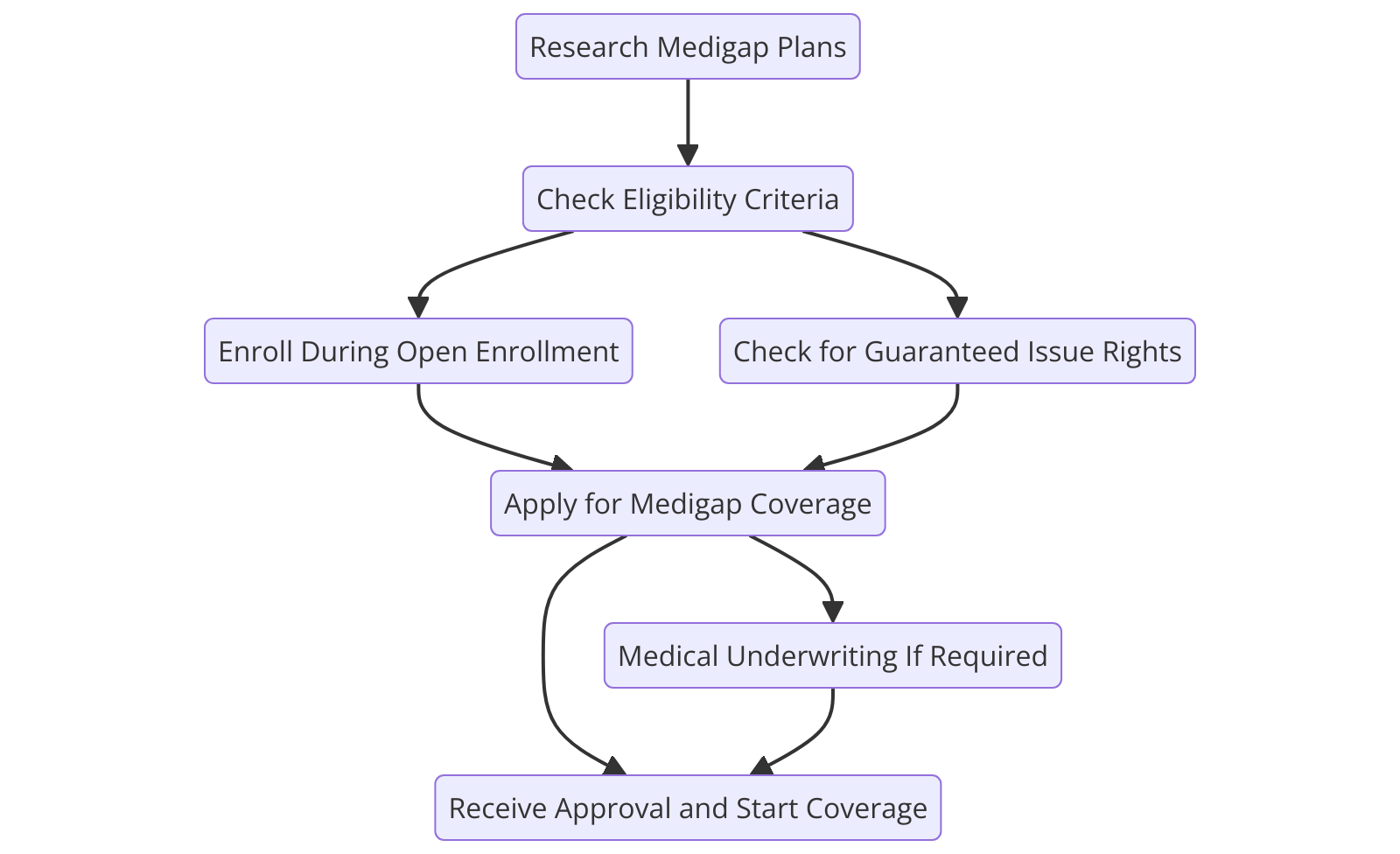

The journey to enrolling in a Medigap plan in Maryland begins with understanding your eligibility. If you’re a Maryland resident who is already enrolled in Medicare Part A and Part B, you’re on the right track. The next step is to decide when to enroll. The best time to embark on this journey is during your Medigap Open Enrollment Period, a six-month window that begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B.

As you navigate this process, it’s important to remember that you’re not alone. Just as a lighthouse guides ships safely to shore, there are resources available to guide you through the enrollment process. The Maryland Department of Aging and the State Health Insurance Assistance Program (SHIP) are two such beacons of guidance, offering free, unbiased advice to help you make an informed decision.

Choosing a Medigap plan is like choosing a path through a beautiful Maryland forest. There are many routes to take, each offering its own unique view. In Maryland, there are ten standardized Medigap plans to choose from, each labeled with a different letter from A to N. Each plan offers a different combination of benefits, allowing you to choose the path that best suits your health care needs and budget.

As you journey through the forest of Medigap plans, it’s important to remember that while the scenery may change, the path remains the same. This means that regardless of the insurance company, the benefits of each Medigap plan are standardized. A Plan G from one company will offer the same basic benefits as a Plan G from another. This allows you to focus on other factors such as cost, customer service, and company reputation when choosing your plan.

Enrolling in a Medigap plan in Maryland is a journey, not a destination. It’s a process that requires careful consideration, thoughtful decision-making, and a willingness to seek guidance when needed. But with each step, you’re moving closer to a future where unexpected health care costs are less of a worry, and peace of mind is more of a reality.

So as the sun sets over the Maryland horizon, casting a golden glow over the landscape, take a moment to reflect on your journey. The decision to enroll in a Medigap plan is a significant one, but it’s also a decision that can lead to greater financial security and peace of mind. And that’s a destination worth striving for.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Cost Analysis of Medigap Plans in Maryland

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history and diverse culture, Maryland is also home to a thriving community of seniors who are living their golden years with grace and vitality. However, as with any stage of life, aging comes with its own set of challenges, one of which is navigating the complex world of healthcare. Enter Medigap plans, a beacon of hope in the often confusing landscape of medical insurance.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare coverage. It’s like a trusted friend who steps in when you need a little extra help. But like any good friend, it’s important to understand the cost of this relationship. So, let’s embark on a journey of cost analysis of Medigap plans in Maryland, a journey that will illuminate the path to making informed decisions about your healthcare coverage.

Imagine standing at the edge of the Chesapeake Bay, watching the sun rise over the horizon. The first rays of light represent Medicare Part A and B, the foundation of your healthcare coverage. They cover hospital stays, doctor visits, and other basic healthcare needs. But as the day progresses, you notice areas of shadow where the sunlight doesn’t reach. These shadows represent the gaps in Medicare coverage, areas such as copayments, coinsurance, and deductibles. This is where Medigap plans come into play, like a lighthouse guiding you through the shadows.

Now, let’s dive into the heart of our cost analysis. In Maryland, there are ten standardized Medigap plans, each represented by a letter from A to N. Each plan offers a different level of coverage, and consequently, comes with a different cost. The cost of a Medigap plan is influenced by several factors, including the plan’s benefits, the insurance company offering the plan, your age, and your health status.

For instance, Plan A, the most basic Medigap plan, typically has the lowest monthly premium. However, it also offers the least amount of coverage. On the other hand, Plan F, which covers all the gaps in Medicare coverage, typically has a higher monthly premium. It’s like choosing between a small, cozy cottage and a large, luxurious mansion. Both have their charm, but the mansion comes with a higher price tag.

However, the cost of a Medigap plan is not just about the monthly premium. It’s also about the peace of mind that comes from knowing you’re covered when you need it most. It’s about the freedom to focus on living your best life, rather than worrying about unexpected medical bills. It’s about the security of knowing that, no matter what health challenges you may face, you have a safety net to catch you.

In conclusion, the cost analysis of Medigap plans in Maryland is not just a dry, mathematical exercise. It’s a journey of discovery, a journey that can lead you to a place of financial security and peace of mind. So, as you stand on the shores of the Chesapeake Bay, watching the sun set over the horizon, remember this: the cost of a Medigap plan is not just a number. It’s an investment in your health, your happiness, and your future. And that, dear reader, is priceless.

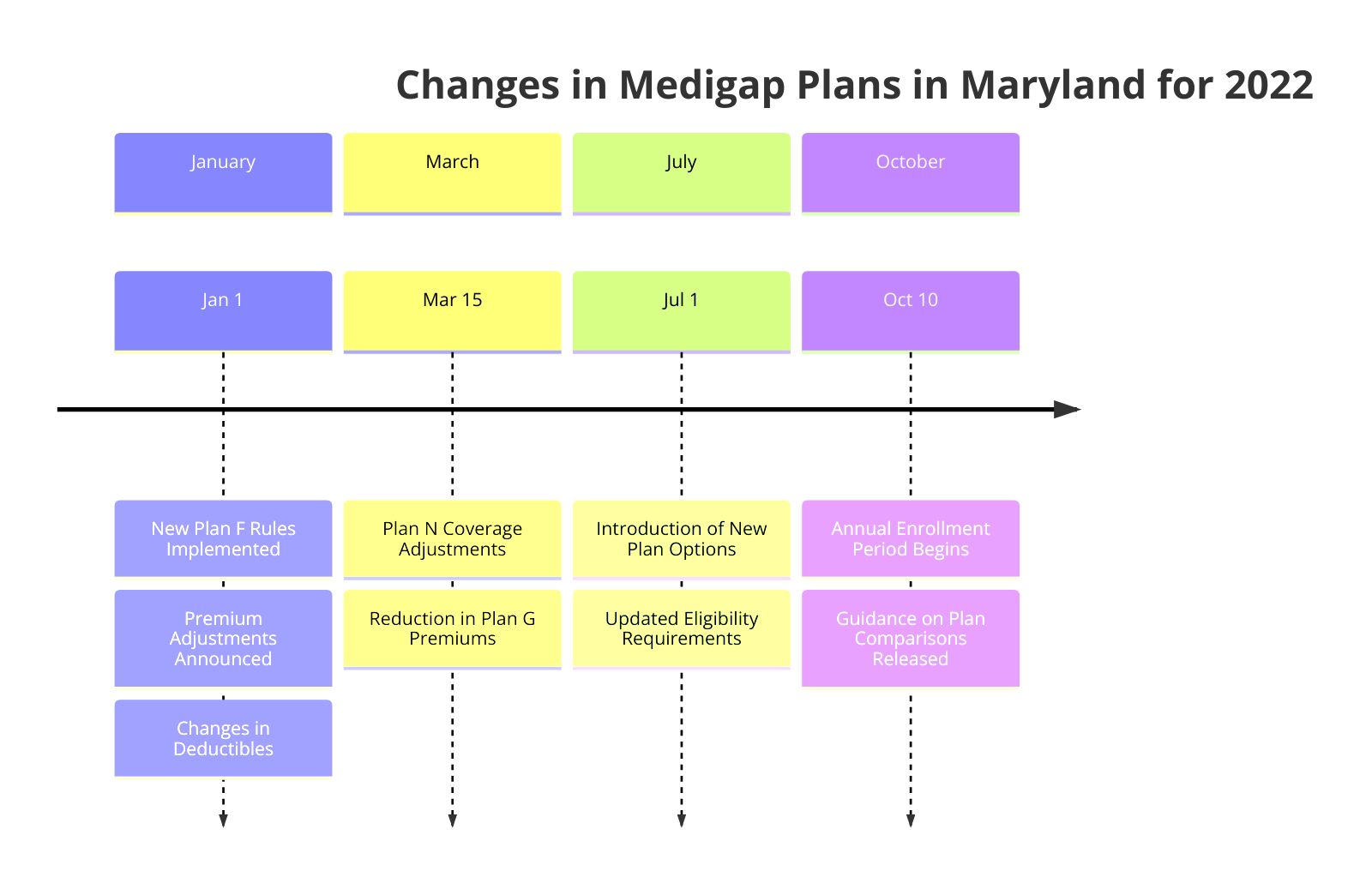

Changes in Medigap Plans in Maryland: What You Need to Know

As the sun rises over the Chesapeake Bay, painting the Maryland sky with hues of pink and orange, it brings with it a new day filled with possibilities. Among these possibilities is the chance to secure your future health needs with Medigap plans. Medigap, also known as Medicare Supplement Insurance, is a beacon of hope for many Maryland residents. It fills the gaps in Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. But like the changing tides of the bay, Medigap plans in Maryland have seen some significant changes.

Imagine standing on the shores of the bay, watching the waves roll in. Each wave is different, just like each year brings different changes to Medigap plans. In 2020, a significant wave of change swept over the Medigap landscape. The most notable change was the discontinuation of Plan F and Plan C for new Medicare beneficiaries. These plans, once popular for their comprehensive coverage, are no longer available to those who became eligible for Medicare on or after January 1, 2020.

But don’t let this change dishearten you. Just as the sun continues to rise, new opportunities continue to emerge. Plan G, which is similar to Plan F but requires you to pay the Part B deductible, has risen in popularity. It’s like the resilient Maryland blue crab, adapting and thriving amidst changes.

As we move further into 2021, another wave of change is on the horizon. The Maryland Insurance Administration has approved a 5.3% average increase in Medigap premiums. This might seem like a storm brewing over the bay, but remember, every cloud has a silver lining. The increase in premiums is a reflection of the rising healthcare costs and an effort to ensure that Medigap plans can continue to provide the valuable coverage that beneficiaries rely on.

In the face of these changes, it’s important to remember that the essence of Medigap remains the same. It’s like the iconic Maryland lighthouse, standing firm amidst the changing tides, guiding you safely through your healthcare journey. Medigap continues to offer a variety of plans, each with different levels of coverage, allowing you to choose a plan that best fits your needs and budget.

As you navigate these changes, remember that you’re not alone. Just as the Maryland community comes together to celebrate the annual Preakness Stakes, resources are available to help you understand and navigate the changes in Medigap plans. The Maryland State Health Insurance Assistance Program (SHIP) offers free, unbiased, and confidential assistance to Maryland residents with Medicare and their families.

So, as the sun sets over the Maryland horizon, painting the sky with hues of purple and gold, take a moment to reflect on the changes in Medigap plans. Embrace these changes as opportunities for growth and adaptation. Remember, the beauty of Maryland isn’t just in its breathtaking sunrises and sunsets, but in its resilience and adaptability. And just like Maryland, you too can adapt and thrive amidst the changes in Medigap plans. After all, change is the only constant, and with change comes the promise of a new dawn, filled with hope and possibilities.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medigap Plans in Maryland: A Solution for Senior Healthcare

In the heart of the United States, nestled between the rolling hills and the sparkling waters of the Chesapeake Bay, lies the beautiful state of Maryland. Known for its rich history and vibrant culture, Maryland is also home to a growing population of seniors who are seeking a secure and comfortable retirement. As they navigate the golden years of their lives, one of the most pressing concerns for these seniors is healthcare. Enter Medigap plans in Maryland, a beacon of hope and a solution for senior healthcare.

Medigap, as the name suggests, is designed to fill the gaps left by Medicare. While Medicare provides a solid foundation, it doesn’t cover everything. There are deductibles, co-pays, and other out-of-pocket expenses that can quickly add up, creating a financial burden for seniors. This is where Medigap plans come into play, stepping in to cover these costs and providing seniors with the peace of mind they deserve.

Imagine a safety net, woven with threads of compassion and understanding, ready to catch you when you need it most. That’s what Medigap plans in Maryland offer. They are not just insurance policies; they are a promise of security, a commitment to the well-being of seniors, and a testament to the value we place on their lives and their health.

The beauty of Medigap plans lies in their flexibility. They come in various forms, each designed to cater to different needs and budgets. Whether you need extensive coverage for a chronic condition or just a little extra help with routine care, there’s a Medigap plan for you. It’s like having a tailor-made suit, cut and stitched to fit you perfectly, ensuring you look and feel your best.

But the benefits of Medigap plans in Maryland go beyond the financial aspect. They also offer seniors the freedom to choose their healthcare providers, allowing them to seek treatment from the doctors and hospitals they trust. It’s about empowering seniors, giving them control over their healthcare decisions, and ensuring they receive the best possible care.

Moreover, Medigap plans provide a sense of stability. With a Medigap plan, seniors can rest easy knowing that their healthcare costs are predictable and manageable. It’s like having a lighthouse guiding you through the stormy seas of healthcare expenses, ensuring you reach the shore safely.

In the end, Medigap plans in Maryland are more than just insurance. They are a lifeline for seniors, a tool for financial stability, and a means to maintain their health and independence. They are a testament to Maryland’s commitment to its senior citizens, reflecting the state’s belief in the dignity and worth of every individual.

So, as the sun sets over the Chesapeake Bay, painting the sky with hues of orange and pink, seniors in Maryland can rest easy. They know they are not alone in their journey. They have Medigap plans standing by their side, ready to step in when needed, ensuring they can enjoy their golden years with peace of mind and security.

In the grand tapestry of life, Medigap plans in Maryland are a vibrant thread, weaving a story of care, compassion, and commitment. They are a solution for senior healthcare, a beacon of hope, and a promise of a secure and comfortable retirement. And for the seniors of Maryland, that’s a promise worth holding onto.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What is a Medigap plan in Maryland?

Answer: A Medigap plan in Maryland is a supplemental insurance policy that helps cover the costs not covered by Original Medicare, such as deductibles, copayments, and coinsurance.

2. Question: How many Medigap plans are available in Maryland?

Answer: In Maryland, there are 10 standardized Medigap plans available, labeled A, B, C, D, F, G, K, L, M, and N.

3. Question: Can anyone in Maryland get a Medigap plan?

Answer: Anyone in Maryland who is enrolled in Medicare Part A and Part B is eligible to purchase a Medigap plan.

4. Question: When can I enroll in a Medigap plan in Maryland?

Answer: The best time to enroll in a Medigap plan in Maryland is during your Medigap Open Enrollment Period, which starts the first month you’re 65 or older and enrolled in Part B.

5. Question: Are all Medigap plans in Maryland the same?

Answer: While all Medigap plans are standardized and offer the same basic benefits, some offer additional benefits. The cost can also vary between insurance companies.

6. Question: Does Medigap cover prescription drugs in Maryland?

Answer: No, Medigap plans in Maryland do not cover prescription drugs. You would need to enroll in a separate Medicare Part D plan for that coverage.

7. Question: Can I switch Medigap plans in Maryland?

Answer: Yes, you can switch Medigap plans in Maryland, but you may have to go through medical underwriting and your acceptance is not guaranteed.

8. Question: How much does a Medigap plan cost in Maryland?

Answer: The cost of Medigap plans in Maryland can vary based on the plan type and the insurance company. It can range from around $100 to over $300 per month.

9. Question: Are Medigap plans in Maryland renewable?

Answer: Yes, Medigap policies in Maryland are guaranteed renewable as long as you pay your premiums on time.

10. Question: Can I have both a Medigap plan and a Medicare Advantage plan in Maryland?

Answer: No, it’s illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you’re switching back to Original Medicare.