“Securing your health future in the Hoosier State with Medigap Plans Indiana.”

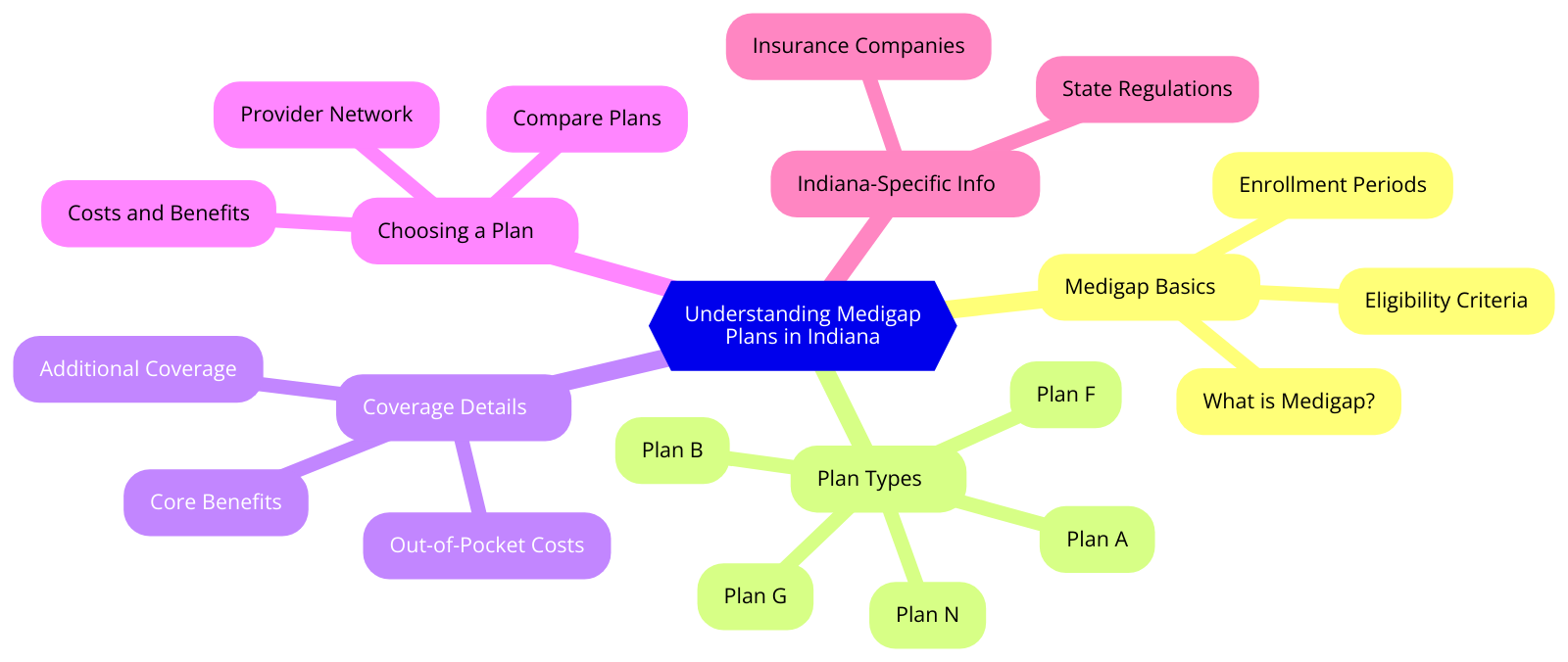

Understanding Medigap Plans in Indiana

In the heartland of America, where the cornfields sway under the vast blue skies and the spirit of the Midwest is as strong as the steel in its factories, the people of Indiana are making a choice. A choice that speaks to their resilience, their wisdom, and their commitment to taking care of their own. This choice is about Medigap plans, a beacon of hope in the complex world of healthcare.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare. It’s like the missing piece of a jigsaw puzzle, the final note in a symphony, or the last stroke of a masterpiece. It completes the picture, ensuring that Hoosiers, as the residents of Indiana are affectionately known, are not left with unexpected medical bills that could disrupt their peace of mind.

Medicare, the federal health insurance program, is a lifeline for many, especially those aged 65 and above. But like any lifeline, it has its limitations. It doesn’t cover everything. There are deductibles, co-payments, and other out-of-pocket costs that can add up to a significant amount. That’s where Medigap comes in, stepping up to cover these costs like a trusted friend, always there when you need it.

In Indiana, there are ten standardized Medigap plans, each identified by a letter from A to N. Each plan offers a different level of coverage, like different shades of a color, each with its own unique hue. Some plans cover more, some less, but all are designed with the same goal in mind – to provide Hoosiers with the peace of mind they deserve.

Choosing a Medigap plan is like choosing the right tool for the job. It requires understanding your needs, your budget, and your health conditions. It’s not a decision to be taken lightly, but neither is it a decision to be feared. It’s a decision that empowers you, giving you control over your healthcare and your future.

The beauty of Medigap plans is their simplicity. They don’t change based on where you live or which insurance company you choose. A Plan G in Indianapolis is the same as a Plan G in Fort Wayne. This consistency, this reliability, is a testament to the spirit of Indiana, a state known for its stability and its steadfastness.

But perhaps the most inspiring aspect of Medigap plans is what they represent – a commitment to taking care of each other. In a world that can often seem divided, Medigap plans are a reminder that we are all in this together. They are a testament to the belief that everyone deserves access to quality healthcare, regardless of their age or their income.

So, as the sun sets over the Indiana plains, casting long shadows over the fields and the farms, the people of Indiana can rest easy. They know that they have made a wise choice, a choice that reflects their values and their vision for the future. They have chosen Medigap, a beacon of hope in the complex world of healthcare, a testament to their resilience, their wisdom, and their commitment to taking care of their own. And in doing so, they have not only secured their own future but also contributed to the strength and the unity of their great state.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Choose the Right Medigap Plan in Indiana

Choosing the right Medigap plan in Indiana is like embarking on a journey through a labyrinth of options. It’s a quest that requires courage, wisdom, and a keen sense of discernment. But fear not, for this journey is not one you must undertake alone. With the right guidance and a clear understanding of your needs, you can navigate this maze with confidence and emerge victorious, armed with a Medigap plan that perfectly suits your needs.

Imagine standing at the entrance of this labyrinth, armed with a map that outlines the ten different Medigap plans available in Indiana. Each plan, labeled from A to N, offers a unique combination of benefits designed to fill the gaps in your Original Medicare coverage. Some plans offer comprehensive coverage, while others focus on specific areas of need. The key to choosing the right plan is understanding your health needs and financial capabilities.

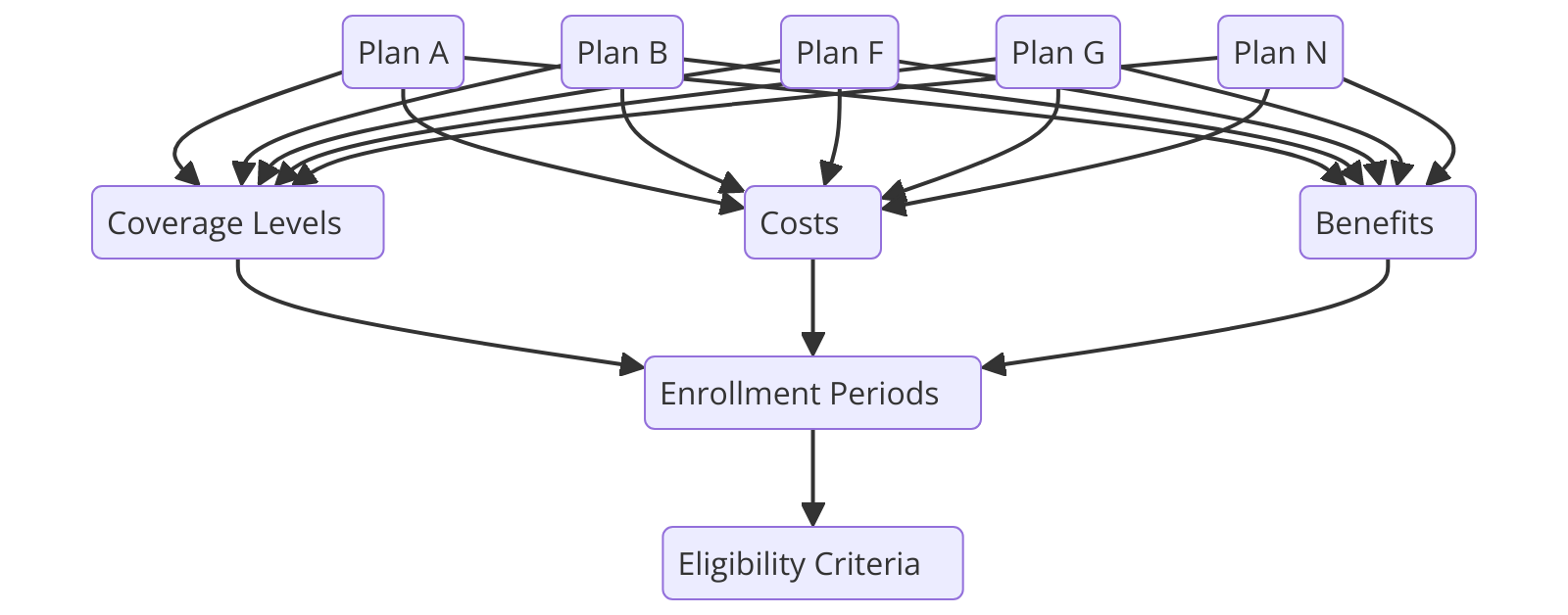

As you step into the labyrinth, you’ll notice that each Medigap plan has its own path. Some paths are straight and narrow, offering basic benefits like coverage for Part A hospital coinsurance and Part B outpatient coinsurance. These are the paths of Plans A and B, ideal for those who want a simple, straightforward supplement to their Original Medicare.

Other paths are more winding and complex, offering a wider range of benefits. These are the paths of Plans C, D, F, G, M, and N. They offer additional coverage for skilled nursing facility care, Part A and B deductibles, and even foreign travel emergencies. These plans are perfect for those who want more comprehensive coverage and are willing to pay a higher premium.

As you navigate the labyrinth, you’ll also encounter the path of Plan F, the only Medigap plan that offers coverage for Part B excess charges. This is a unique path, ideal for those who frequently visit doctors who do not accept Medicare assignment and charge up to 15% more than the Medicare-approved amount.

But remember, the journey to choosing the right Medigap plan is not just about understanding the different paths. It’s also about understanding yourself. It’s about taking a deep, introspective look at your health needs, lifestyle, and budget. It’s about asking yourself important questions. How often do I visit the doctor? Do I have any chronic conditions? Do I travel abroad frequently? How much can I afford to pay in premiums?

As you ponder these questions, you’ll find yourself drawing closer to the center of the labyrinth, where the perfect Medigap plan awaits. And when you finally reach the center, you’ll find that the journey was worth it. For you’ll emerge not just with a Medigap plan, but with peace of mind, knowing that you’re protected against unexpected medical costs.

Choosing the right Medigap plan in Indiana is indeed a journey. But it’s a journey that can be navigated with confidence and clarity. So, step into the labyrinth, armed with knowledge and guided by introspection. And remember, the journey is not just about reaching the destination. It’s about the lessons learned, the wisdom gained, and the peace of mind achieved along the way.

The Benefits of Medigap Plans for Indiana Residents

In the heartland of America, nestled between the Great Lakes and the Ohio River, lies the beautiful state of Indiana. Known for its vibrant cities, serene countryside, and the legendary Indianapolis 500, Indiana is a place where the old meets the new, where tradition intertwines with innovation. But beyond its scenic beauty and cultural richness, Indiana is also a place where the well-being of its residents is a top priority. This commitment to health and wellness is evident in the availability of Medigap plans for Indiana residents.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare. It’s like the missing piece of a jigsaw puzzle, completing the picture of comprehensive health coverage. For Indiana residents, Medigap plans offer a safety net, a beacon of hope, ensuring that they are not left in a lurch when faced with unexpected medical expenses.

Imagine a serene evening by the White River, the setting sun painting the sky in hues of orange and pink. Suddenly, a medical emergency strikes, casting a shadow over the tranquil scene. In such a situation, the last thing you want to worry about is whether your Medicare coverage is enough. This is where Medigap steps in, like a trusted friend, ready to lend a helping hand in times of need.

Medigap plans in Indiana offer a range of benefits that go beyond basic Medicare coverage. From covering copayments and deductibles to providing coverage for medical care during foreign travel, Medigap plans are like a safety blanket, providing comfort and security. They ensure that Indiana residents can focus on what truly matters – their health and recovery, rather than fretting over medical bills.

But the benefits of Medigap plans for Indiana residents extend beyond financial security. They also offer peace of mind, a priceless commodity in today’s fast-paced world. Knowing that you have a safety net in place can alleviate stress and anxiety, contributing to overall well-being. After all, health is not just about physical wellness, but mental and emotional well-being too.

Moreover, Medigap plans offer the freedom to choose. Indiana residents can select from a variety of plans, each offering different levels of coverage. This flexibility allows individuals to choose a plan that best suits their needs and budget, ensuring that they are not paying for unnecessary coverage. It’s like choosing the perfect outfit – one that fits just right, enhancing your confidence and comfort.

In the end, the benefits of Medigap plans for Indiana residents can be summed up in one word – empowerment. They empower individuals to take control of their health and finances, to make informed decisions, and to live life on their own terms. They are a testament to Indiana’s commitment to its residents, a reflection of the state’s ethos of care and community.

So, as the sun sets over the Indiana horizon, painting the sky in hues of hope and promise, remember that with Medigap, you are not alone. You have a safety net, a trusted friend, ready to lend a helping hand in times of need. And that, dear Indiana residents, is the true beauty of Medigap plans – they offer not just coverage, but care, not just security, but serenity. They are not just a plan, but a promise – a promise of a healthier, happier, and more secure tomorrow.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Comparing Different Medigap Plans in Indiana

In the heartland of America, nestled between the Great Lakes and the Ohio River, lies the beautiful state of Indiana. Known for its vibrant cities, serene countryside, and the iconic Indianapolis 500, Indiana is a place where life is lived to the fullest. But to truly enjoy all that Indiana has to offer, one must have peace of mind, and that includes having the right health coverage. Enter Medigap plans in Indiana, a beacon of hope for those seeking comprehensive health insurance coverage.

Medigap, also known as Medicare Supplement Insurance, is a type of health insurance that fills in the “gaps” in Original Medicare coverage. It’s like the missing piece of a puzzle, completing the picture of your healthcare coverage. But with so many different Medigap plans available in Indiana, how do you choose the one that’s right for you? It’s like standing at the crossroads of a Hoosier cornfield, with multiple paths stretching out before you. Each path leads to a different destination, and each destination has its own unique charm.

The first step in your journey is understanding the different types of Medigap plans. There are ten standardized Medigap plans available in Indiana, each labeled with a different letter from A to N. Each plan offers a different combination of benefits, allowing you to choose the one that best fits your needs. It’s like picking the perfect ear of corn from a bountiful Indiana harvest. You examine each one carefully, looking for the one that’s just right for you.

Plan A, for example, is the most basic Medigap plan. It covers your Part A hospital coinsurance and provides an additional 365 days of hospital coverage after your Medicare benefits are used up. It’s like a sturdy Indiana barn, providing basic shelter and protection from the elements.

Plan F, on the other hand, is the most comprehensive Medigap plan. It covers all the gaps in your Original Medicare coverage, including your Part B outpatient deductible and excess charges. It’s like a luxurious Indiana farmhouse, providing all the comforts and conveniences you could ever need.

But choosing the right Medigap plan isn’t just about comparing benefits. It’s also about finding a plan that fits your budget. Just as you wouldn’t buy a sprawling Indiana estate if you’re on a shoestring budget, you shouldn’t choose a Medigap plan that you can’t afford. Fortunately, there are Medigap plans available at various price points, making it possible for everyone to find a plan that fits their budget.

Finally, it’s important to remember that the best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. This six-month period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this period, you have a guaranteed right to buy any Medigap plan sold in your state, regardless of your health status. It’s like an Indiana sunrise, offering a fresh start and unlimited possibilities.

In the end, choosing the right Medigap plan is a personal decision. It’s about finding the plan that meets your needs, fits your budget, and gives you peace of mind. It’s about charting your own course through the Indiana cornfields, confident in the knowledge that you’re protected, no matter what lies ahead. So take the time to explore your options, ask questions, and make an informed decision. After all, your health is your most valuable asset, and it deserves the best protection possible.

The Cost of Medigap Plans in Indiana

In the heartland of America, where the cornfields sway in the breeze and the spirit of the Midwest is as strong as the steel forged in its factories, there lies the great state of Indiana. A place where the people are as warm as the summer sun and as resilient as the limestone that forms its bedrock. But even in this bastion of strength and endurance, the specter of healthcare costs can cast a long shadow. This is where Medigap plans in Indiana come into play, offering a beacon of hope in the face of rising medical expenses.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare coverage. It’s like the missing piece of a jigsaw puzzle, the final note in a symphony, or the last stroke of a masterpiece painting. It completes the picture, ensuring that Hoosiers are not left with a financial burden that could overshadow their golden years.

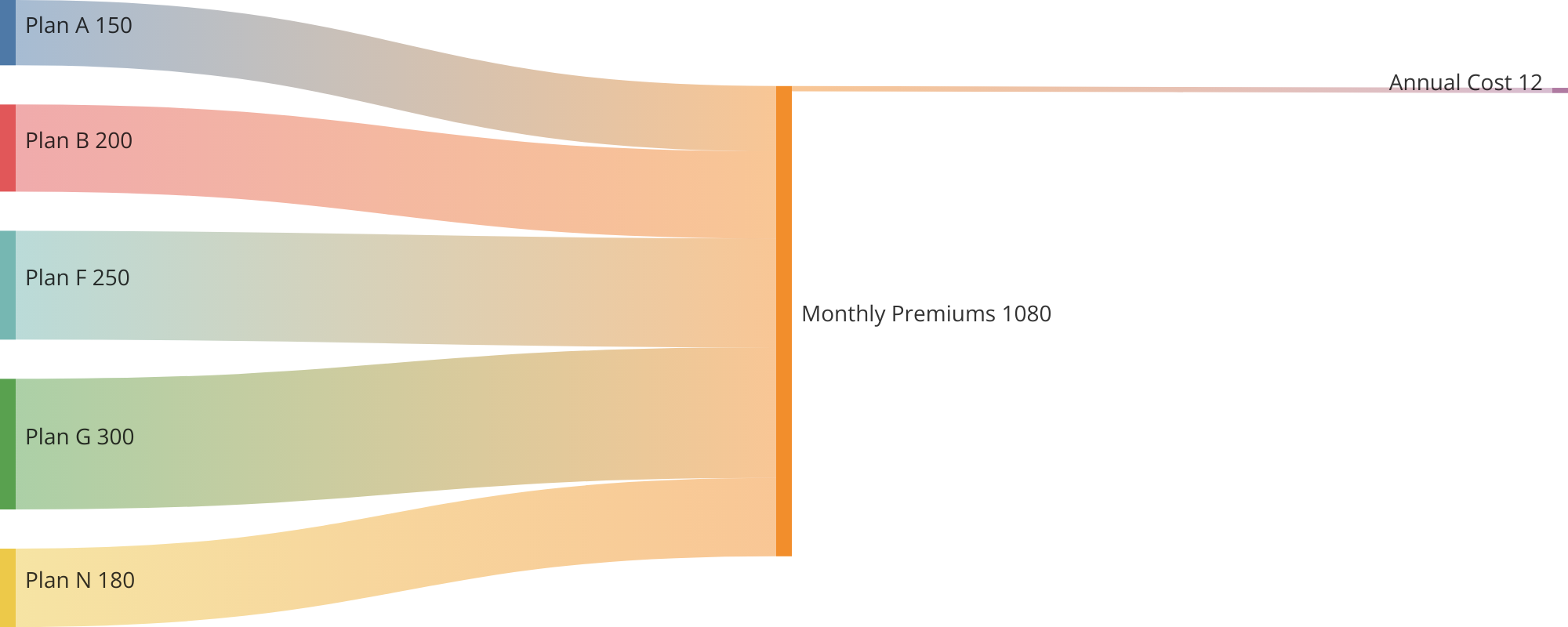

The cost of Medigap plans in Indiana, like the rhythm of a well-played jazz tune, varies based on several factors. The type of plan chosen, the insurance company providing the coverage, and the individual’s health status all play a part in determining the final cost. Yet, amidst this variation, one thing remains constant: the promise of peace of mind.

Imagine standing at the edge of Lake Michigan, watching the sun set over the water. The sky is ablaze with hues of orange, pink, and purple, and the world seems to hold its breath in the face of such beauty. That’s the kind of tranquility Medigap plans can offer. The knowledge that, no matter what health challenges may come, you have a safety net to fall back on.

The cost of Medigap plans in Indiana may seem like a daunting figure at first glance. But when weighed against the potential out-of-pocket expenses for medical care, it’s like comparing the height of a cornstalk to the towering majesty of the Indiana Statehouse. The value of the peace of mind that comes with knowing you’re covered far outweighs the monthly premium.

Moreover, the cost of Medigap plans in Indiana is not a fixed figure set in stone, like the sculptures that adorn the Soldiers and Sailors Monument. It’s a number that can be influenced by shopping around, comparing rates, and choosing a plan that fits your needs and budget. It’s a number that can be managed, much like the way Hoosiers have managed to carve out a vibrant, thriving state in the heart of the Midwest.

In the end, the cost of Medigap plans in Indiana is not just about dollars and cents. It’s about the freedom to enjoy the fruits of a lifetime of labor without the worry of unexpected medical costs. It’s about the ability to explore the rolling hills of Brown County in the fall, to cheer on the Pacers or the Colts without the nagging concern of healthcare expenses.

So, as the sun sets over the Wabash River and the stars begin to twinkle in the Hoosier sky, remember this: the cost of Medigap plans in Indiana is an investment. An investment in peace of mind, in financial security, and in the freedom to enjoy all the beauty and joy that this great state has to offer.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Enrollment Process for Medigap Plans in Indiana

In the heartland of America, where the cornfields sway in the breeze and the spirit of the Midwest is as strong as the steel forged in its factories, the people of Indiana are taking control of their healthcare future. They are embracing the power of Medigap plans, a beacon of hope in the often confusing world of healthcare. The enrollment process for Medigap plans in Indiana is a journey, a path to peace of mind and security. It’s a story of empowerment, of taking the reins and steering towards a future where healthcare worries are a thing of the past.

Imagine a world where you’re not left wondering how you’ll cover the costs of your healthcare. A world where you’re not left scrambling to find a way to pay for the medical services you need. This is the world that Medigap plans can help create. These plans are designed to fill in the gaps left by Medicare, covering costs that Medicare doesn’t, like copayments, coinsurance, and deductibles. It’s like having a safety net, ready to catch you when life throws a curveball your way.

The journey to this world begins with understanding the enrollment process. In Indiana, the best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. This six-month period starts on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed right to buy any Medigap policy sold in Indiana, regardless of your health status. It’s a golden opportunity, a window of time when the doors are wide open, inviting you to step through and embrace the security that Medigap plans offer.

But what if that window has closed? Fear not, for the journey doesn’t end there. While it’s true that outside of your Medigap Open Enrollment Period, insurance companies are allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy, there are still paths to follow. There are certain situations, known as guaranteed issue rights, where insurance companies must sell you a Medigap policy, even if you have health problems.

The enrollment process may seem daunting, but it’s a journey worth taking. It’s a path that leads to a future where you’re not left wondering how you’ll cover your healthcare costs. It’s a journey of empowerment, of taking control of your healthcare future. And it’s a journey that you don’t have to take alone. There are resources available, guides to help you navigate the twists and turns of the enrollment process.

So, to the people of Indiana, the hardworking men and women who embody the spirit of the Midwest, take that first step. Embrace the power of Medigap plans. Begin your journey towards a future where healthcare worries are a thing of the past. The path may seem long, the process may seem complicated, but the destination is worth it. A future where you’re in control, where you have the peace of mind that comes from knowing you’re covered. That’s the power of Medigap plans. That’s the power of taking control of your healthcare future.

Changes in Medigap Plans in Indiana for 2022

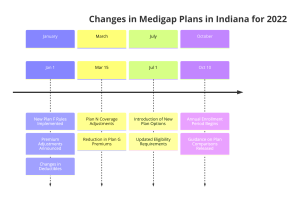

As the sun rises on a new year, it brings with it a fresh wave of changes, opportunities, and possibilities. Among these changes are the modifications to Medigap plans in Indiana for 2022. These alterations, like the shifting patterns of a kaleidoscope, are designed to better meet the needs of Indiana’s seniors, providing them with a more comprehensive safety net for their healthcare needs.

Medigap, also known as Medicare Supplement Insurance, is a beacon of hope for many seniors. It fills in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. It’s like a trusted friend, always there to lend a helping hand when you need it most.

As we step into 2022, the landscape of Medigap plans in Indiana is transforming, like a caterpillar metamorphosing into a butterfly. The changes are aimed at enhancing the coverage, making it more robust and comprehensive, and ensuring that it continues to serve as a reliable safety net for seniors.

One of the most significant changes is the discontinuation of Plan C and Plan F for new enrollees. These plans, once popular choices, have been sunsetted, like a beautiful day giving way to a starlit night. However, if you were eligible for Medicare before January 1, 2020, and already have one of these plans, you can keep it. It’s like a grandfather’s old watch, a cherished possession that you can hold onto.

In place of Plan C and Plan F, a new star has risen on the horizon – Plan G. This plan is similar to Plan F but requires you to pay the Part B deductible out of pocket. It’s like a new song with a familiar tune, offering the same comprehensive coverage with a slight twist.

Another change is the introduction of a high-deductible version of Plan G. This plan offers the same benefits as the standard Plan G but with a higher deductible and lower premium. It’s like choosing to walk a little further to enjoy a breathtaking view, a trade-off that could be worth it for those who don’t mind paying a higher deductible for lower monthly costs.

The changes in Medigap plans in Indiana for 2022 are like a new chapter in a book, bringing with them a sense of anticipation and excitement. They are designed to ensure that seniors continue to have access to the healthcare they need, without the worry of out-of-pocket costs.

As we navigate through these changes, it’s important to remember that the goal of Medigap remains the same – to provide a safety net for seniors, to be there when they need it most. It’s like a lighthouse guiding ships through a storm, a beacon of hope in the face of uncertainty.

So, as we welcome 2022, let’s embrace these changes with open arms. Let’s see them as opportunities to better meet our healthcare needs, to ensure that we continue to have the coverage we need. After all, change is the only constant in life, and with change comes the promise of something better.

In the end, the changes in Medigap plans in Indiana for 2022 are not just about insurance plans. They are about ensuring that seniors continue to have access to the healthcare they need, about providing a safety net for those who need it most. They are about hope, about the promise of a better tomorrow. And that, in itself, is something to celebrate.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medigap Plans vs. Medicare Advantage Plans in Indiana

In the heartland of America, where the cornfields sway in the breeze and the spirit of the Hoosier state is as strong as ever, there’s a conversation brewing. It’s a conversation about health, about aging, and about the choices we make to ensure our golden years are as vibrant and fulfilling as the ones that came before. It’s a conversation about Medigap plans and Medicare Advantage plans in Indiana.

Medigap and Medicare Advantage plans are two sides of the same coin, both designed to supplement the traditional Medicare coverage that so many of our seniors rely on. Yet, they are as different as the Wabash River and the Indianapolis Motor Speedway, each with its own unique features and benefits.

Medigap, as its name suggests, is designed to fill in the gaps left by traditional Medicare. It’s like a safety net, catching those unexpected health care costs that can otherwise leave you feeling as if you’re freefalling. With a Medigap plan, you can rest easy knowing that those unforeseen expenses, from deductibles to co-payments, are covered. It’s a plan that offers peace of mind, a plan that says, “We’ve got you covered.”

On the other hand, Medicare Advantage plans are like a one-stop-shop for all your health care needs. They bundle together Parts A and B of traditional Medicare, often throwing in Part D prescription drug coverage for good measure. Many even offer additional benefits, like vision, dental, and hearing coverage, making them a comprehensive solution for those who want everything under one roof. It’s a plan that offers convenience, a plan that says, “We’ve got everything you need.”

But how do you choose between peace of mind and convenience? Between a safety net and a one-stop-shop? It’s a question as complex as the crossroads of America itself, and the answer lies in understanding your own unique needs and circumstances.

If you’re someone who values predictability, who likes to know that no matter what happens, you won’t be hit with unexpected costs, then a Medigap plan might be the right choice for you. It’s a plan that offers stability, a plan that says, “You can count on us.”

But if you’re someone who values simplicity, who likes the idea of having all your health care needs met by a single plan, then a Medicare Advantage plan might be the way to go. It’s a plan that offers ease, a plan that says, “We’ve made it easy for you.”

In the end, the choice between Medigap and Medicare Advantage is a deeply personal one. It’s a choice that should be made with careful consideration, with an understanding of your own health care needs and financial circumstances. It’s a choice that, ultimately, is about ensuring that your golden years are as golden as they can be.

So, as the sun sets over the Indiana plains, casting long shadows over the fields of corn and wheat, remember this: Whether you choose a Medigap plan or a Medicare Advantage plan, you’re making a choice for your health, for your future, and for the peace of mind that comes with knowing you’re covered. And that, dear Hoosiers, is something truly inspirational.

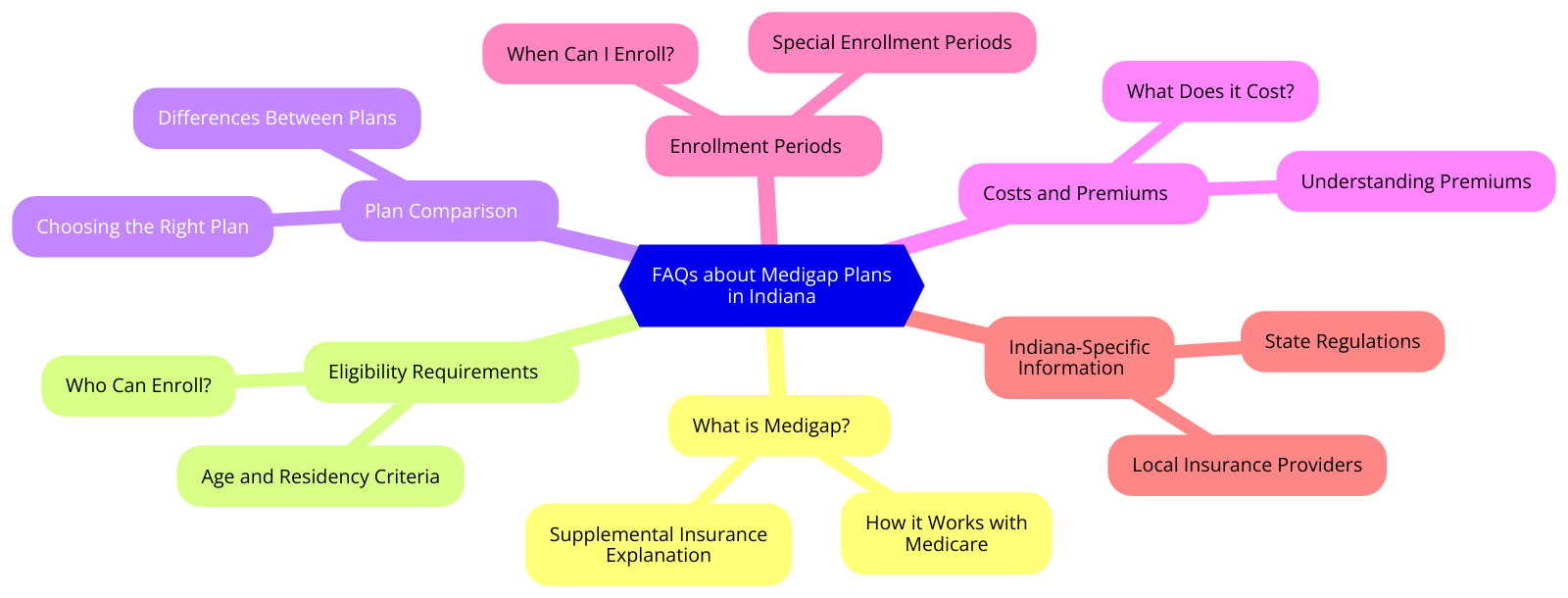

FAQs about Medigap Plans in Indiana

Medigap Plans in Indiana, a beacon of hope for many, are a testament to the power of foresight, planning, and the human spirit’s resilience. These plans, also known as Medicare Supplement Insurance, are designed to fill the gaps left by traditional Medicare coverage, ensuring that Hoosiers have access to the healthcare they need without the burden of unexpected costs.

Imagine, if you will, a safety net, woven with threads of compassion and understanding, ready to catch you when life’s unpredictable health challenges try to knock you off your feet. That’s what Medigap Plans in Indiana represent. They are not just insurance policies; they are a promise of security, a commitment to your well-being, and a testament to the value we place on each life in the Hoosier state.

One of the most frequently asked questions about Medigap Plans in Indiana is, “Who is eligible?” The answer is simple and inclusive. If you’re an Indiana resident aged 65 or older and enrolled in Medicare Part B, you’re eligible to apply for a Medigap plan. It’s a testament to the belief that age should not be a barrier to receiving comprehensive healthcare.

Another common query is, “What does a Medigap plan cover?” The answer is as inspiring as it is practical. Medigap plans are designed to cover out-of-pocket costs not covered by traditional Medicare, such as copayments, coinsurance, and deductibles. Some plans even offer coverage for services that Medicare doesn’t cover, like medical care when you travel outside the U.S. It’s a commitment to ensuring that no matter where life takes you, your health remains a priority.

The question of “When can I enroll?” often arises, and the answer is equally empowering. The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. This six-month period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this period, you have a guaranteed issue right to buy any Medigap policy sold in Indiana, regardless of your health status. It’s a testament to the belief that everyone deserves access to comprehensive healthcare, regardless of their health history.

Finally, many wonder, “How do I choose the right plan?” The answer lies in understanding your unique needs and circumstances. Each Medigap plan offers different levels of coverage, and the right plan for you depends on your health needs and budget. It’s a commitment to individualized care, recognizing that each person’s health journey is unique.

In conclusion, Medigap Plans in Indiana are more than just insurance policies. They are a symbol of our collective commitment to ensuring that every Hoosier has access to the healthcare they need. They are a testament to the power of planning, the importance of individualized care, and the belief that everyone deserves access to comprehensive healthcare. So, as you navigate your health journey, remember that you’re not alone. With a Medigap plan, you have a safety net, ready to catch you when life’s health challenges try to knock you off your feet.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Role of Medigap Plans in Indiana’s Healthcare System

In the heartland of America, nestled between the Great Lakes and the Ohio River, lies the beautiful state of Indiana. Known for its vibrant cities, lush farmlands, and warm-hearted people, Indiana is also home to a healthcare system that is as diverse and dynamic as its landscape. At the heart of this system, playing a pivotal role in ensuring the health and well-being of Hoosiers, are Medigap plans.

Medigap plans, also known as Medicare Supplement Insurance, are policies designed to fill in the “gaps” in Original Medicare coverage. These gaps, which can include deductibles, co-payments, and other out-of-pocket costs, can often be a significant burden for many seniors. But with a Medigap plan, these costs can be significantly reduced, providing a safety net for those who need it most.

In Indiana, Medigap plans are not just a financial tool, but a beacon of hope. They represent the state’s commitment to its seniors, a promise that their health and well-being will always be a priority. They are a testament to the Hoosier spirit, a spirit that values community, compassion, and care for all.

But the role of Medigap plans in Indiana’s healthcare system extends beyond just financial support. They also provide peace of mind. Knowing that you have a Medigap plan can alleviate the stress and anxiety that often comes with worrying about medical costs. This peace of mind can have a profound impact on a person’s overall health and well-being, allowing them to focus on what truly matters: enjoying their golden years.

Moreover, Medigap plans in Indiana also foster a sense of independence among seniors. With a Medigap plan, seniors have the freedom to choose their healthcare providers without worrying about network restrictions. This freedom not only empowers seniors but also ensures that they receive the best possible care tailored to their unique needs.

In the grand tapestry of Indiana’s healthcare system, Medigap plans are the threads that hold it all together. They weave together financial support, peace of mind, and independence, creating a safety net that is as strong as it is comprehensive. They are the lifeline for many seniors, a lifeline that ensures they can navigate the often complex world of healthcare with ease and confidence.

As we look to the future, the role of Medigap plans in Indiana’s healthcare system will only continue to grow. As the population ages and healthcare costs continue to rise, the need for comprehensive and affordable coverage will become even more critical. But with Medigap plans, Hoosiers can rest assured knowing that they will always have the support they need.

In the end, Medigap plans are more than just insurance policies. They are a symbol of Indiana’s commitment to its seniors, a commitment that is as enduring as the state’s rolling hills and as steadfast as its people. They are a testament to the power of community, the importance of compassion, and the value of care. They are, in essence, the heart of Indiana’s healthcare system, beating strong and steady, ensuring that every Hoosier can live a healthy, happy, and fulfilling life.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What is a Medigap plan in Indiana?

Answer: A Medigap plan in Indiana is a supplemental insurance policy that helps cover the costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

2. Question: How many Medigap plans are available in Indiana?

Answer: In Indiana, there are 10 standardized Medigap plans available, labeled A through N.

3. Question: Can anyone in Indiana apply for a Medigap plan?

Answer: Yes, anyone in Indiana who is enrolled in Medicare Part A and Part B can apply for a Medigap plan.

4. Question: When is the best time to buy a Medigap plan in Indiana?

Answer: The best time to buy a Medigap plan in Indiana is during the Medigap Open Enrollment Period, which starts the month you turn 65 and lasts for six months.

5. Question: Are prescription drugs covered under Medigap plans in Indiana?

Answer: No, prescription drugs are not covered under Medigap plans in Indiana. For prescription drug coverage, you would need to enroll in a separate Medicare Part D plan.

6. Question: Can I switch Medigap plans in Indiana?

Answer: Yes, you can switch Medigap plans in Indiana, but you may have to go through medical underwriting and your acceptance is not guaranteed.

7. Question: Do all doctors accept Medigap plans in Indiana?

Answer: Any doctor that accepts Medicare will also accept Medigap plans in Indiana.

8. Question: How much does a Medigap plan cost in Indiana?

Answer: The cost of a Medigap plan in Indiana varies depending on the plan type, the insurance company, your age, and your health status.

9. Question: Are Medigap plans in Indiana standardized?

Answer: Yes, all Medigap plans in Indiana are standardized, meaning each plan of the same letter offers the same basic benefits, regardless of the insurance company.

10. Question: Can I have both a Medigap plan and a Medicare Advantage plan in Indiana?

Answer: No, it’s illegal for anyone to sell you a Medigap plan if you have a Medicare Advantage Plan, unless you’re switching back to Original Medicare.