“Securing Your Health Future: Medigap Plans in NJ“

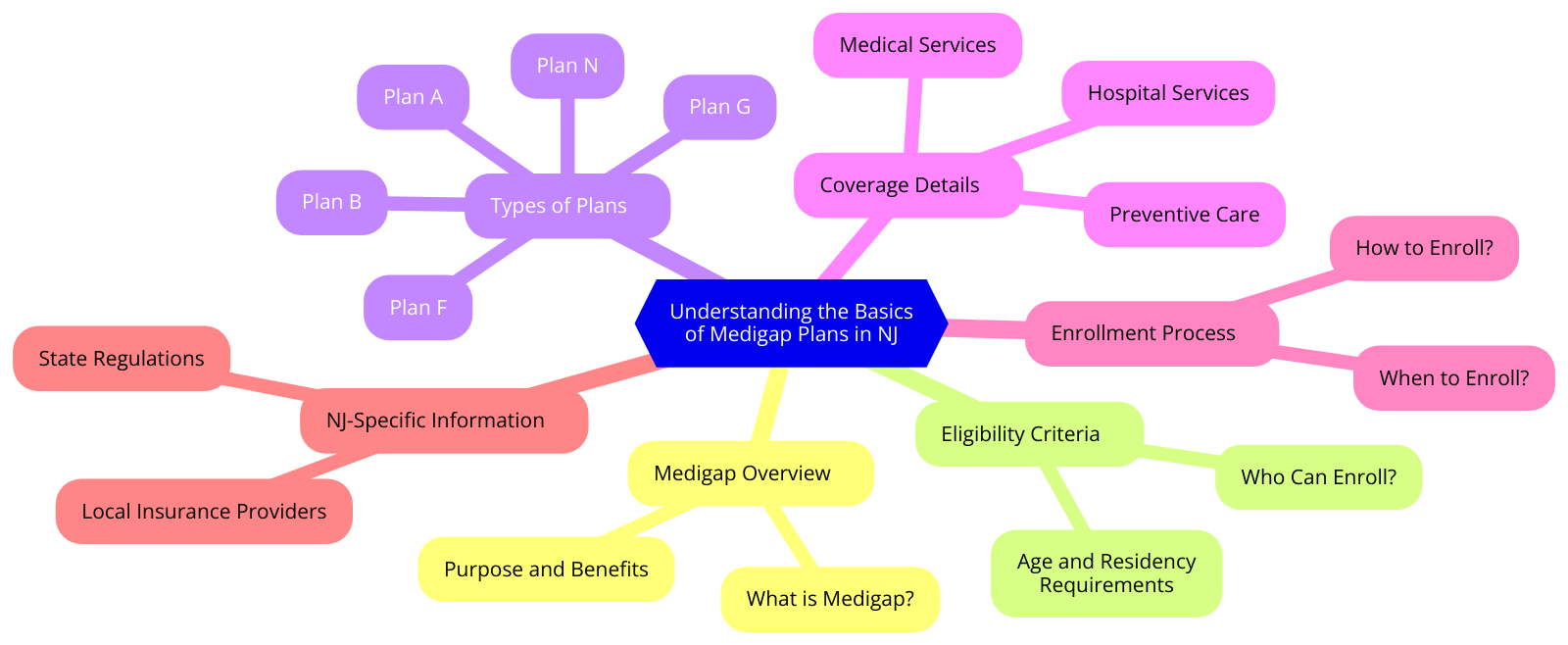

Understanding the Basics of Medigap Plans in NJ

In the golden years of life, when the sun sets in a blaze of glory, painting the sky with hues of red and orange, it’s time to sit back, relax, and enjoy the fruits of your labor. It’s a time to cherish the memories of yesteryears and look forward to a peaceful, worry-free future. However, the rising costs of healthcare can often cast a shadow over this serene picture. But fear not, for Medigap plans in NJ are here to light the way, ensuring that your golden years remain truly golden.

Medigap, as the name suggests, is designed to fill the gaps left by Medicare. It’s like the hero who swoops in to save the day when Medicare has done all it can. Medicare, while a boon for seniors, often leaves certain costs uncovered. These could be copayments, coinsurance, deductibles, or even medical care when you travel outside the U.S. This is where Medigap steps in, covering these out-of-pocket costs and ensuring that your healthcare does not become a financial burden.

In the Garden State, there are ten standardized Medigap plans, each labeled with a letter from A to N. Each plan offers a different level of coverage, but all provide the basic benefits of covering Part A hospital coinsurance and providing an additional 365 days of hospital care after Medicare benefits are exhausted. It’s like having a safety net, always there to catch you when you need it the most.

Choosing a Medigap plan is like choosing the perfect pair of shoes. It needs to fit you just right. It should cater to your specific needs and be within your budget. The beauty of Medigap plans in NJ is that they offer a variety of options, allowing you to choose the one that suits you best. Whether you need comprehensive coverage or just a little extra help, there’s a Medigap plan for you.

But remember, timing is everything. The best time to buy a Medigap policy is during your Medigap open enrollment period. This six-month period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this period, you have the guaranteed right to buy any Medigap policy sold in your state, regardless of your health status. It’s like having a golden ticket, granting you access to the best healthcare coverage options.

Medigap plans in NJ are more than just insurance policies. They are a promise, a commitment to safeguard your health and your finances. They are a testament to the belief that everyone deserves access to quality healthcare, regardless of their age or health status. They are a beacon of hope, shining brightly in the face of rising healthcare costs.

So, as you embark on this journey into the sunset years of your life, let Medigap be your guide. Let it light the way, ensuring that your path is free of financial worries and full of peace and tranquility. After all, you’ve earned it. You’ve worked hard all your life, and now it’s time to enjoy the fruits of your labor. With Medigap plans in NJ, you can do just that. So, here’s to a future filled with health, happiness, and peace of mind. Here’s to a future filled with golden sunsets and worry-free days. Here’s to you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Choose the Right Medigap Plan in NJ

Choosing the right Medigap plan in New Jersey is like finding the perfect pair of shoes. It’s not just about the style or the price, but how well it fits and supports you in your journey. It’s about finding a plan that not only covers your medical needs but also aligns with your financial capabilities. It’s about finding a plan that gives you peace of mind, knowing that you’re protected against unexpected health care costs.

Imagine standing in front of a vast array of shoes, each pair unique in its design and purpose. Similarly, there are ten different Medigap plans available in New Jersey, each offering a different level of coverage. Just as you would carefully consider the terrain you’ll be walking on before choosing your shoes, you should consider your health care needs before selecting a Medigap plan.

If you’re someone who frequently visits the doctor or hospital, you might want to consider a plan that offers comprehensive coverage, like Plan F or Plan G. These plans cover almost all Medicare Part A and Part B out-of-pocket costs, providing a safety net for those with high health care needs. On the other hand, if you’re in good health and want to keep your premiums low, a high-deductible Plan F or Plan G might be a better fit.

Now, let’s talk about the price. Just as you wouldn’t buy a pair of shoes without checking the price tag, you shouldn’t choose a Medigap plan without considering the cost. The premiums for Medigap plans vary widely, depending on the level of coverage and the insurance company. It’s important to shop around and compare prices to ensure you’re getting the best value for your money.

But remember, the cheapest plan isn’t always the best fit. Just as a pair of shoes that’s too tight or too loose can cause discomfort, a Medigap plan that doesn’t provide adequate coverage can leave you vulnerable to high out-of-pocket costs. It’s important to balance cost with coverage to ensure you’re getting a plan that meets your needs and fits your budget.

Choosing the right Medigap plan is also about finding a reliable insurance company. Just as you would trust a reputable shoe brand for quality and durability, you should choose an insurance company with a strong track record and excellent customer service. You want a company that will be there for you when you need them, just like a sturdy pair of shoes that won’t let you down when the terrain gets tough.

Finally, remember that choosing a Medigap plan is a personal decision. Just as no two feet are the same, no two individuals have the same health care needs. What works for your neighbor might not work for you. It’s important to take the time to understand your options and make an informed decision.

Choosing the right Medigap plan in New Jersey is a journey, not a destination. It’s about finding a plan that fits you perfectly, supports you in your health care journey, and gives you the confidence to stride forward, knowing you’re protected. So, take your time, do your research, and find the plan that’s just right for you. After all, just like the perfect pair of shoes, the right Medigap plan can make all the difference.

The Benefits of Medigap Plans for NJ Seniors

In the golden years of life, when the sun sets in a blaze of glory, painting the sky with hues of wisdom and experience, the Garden State of New Jersey offers a unique gift to its seniors – Medigap plans. These plans, like a gentle hand guiding you through the twilight years, provide a safety net, ensuring that you can enjoy your retirement without the worry of unexpected medical expenses.

Medigap plans, as the name suggests, are designed to fill the gaps left by Original Medicare. They cover the costs that Medicare doesn’t, such as copayments, coinsurance, and deductibles. Imagine a bridge, if you will, spanning the chasm between what Medicare covers and the actual cost of your healthcare. That bridge is Medigap, a beacon of hope in the often confusing world of healthcare.

In New Jersey, Medigap plans are particularly beneficial for seniors. The state’s high cost of living can make healthcare expenses seem daunting, but Medigap plans help to alleviate these concerns. They provide a sense of security, a promise that you won’t have to face these costs alone. It’s like having a trusted friend by your side, ready to step in when you need them most.

One of the most significant benefits of Medigap plans is their consistency. Regardless of the provider, each Medigap plan offers the same basic benefits. This means that you can choose a plan based on your individual needs and budget, without worrying about missing out on essential coverage. It’s like choosing a path in a garden – each one leads to the same beautiful destination, but you can select the one that suits your journey best.

Another advantage of Medigap plans is their flexibility. They allow you to see any doctor who accepts Medicare, without the need for referrals. This means that you can continue to see your trusted healthcare providers, or choose new ones if you wish. It’s like having a key to the city, allowing you to go wherever you please.

Medigap plans also offer peace of mind when it comes to out-of-pocket costs. With a Medigap plan, you know exactly what your costs will be, making it easier to budget for healthcare expenses. It’s like having a map in your hands, guiding you through the financial landscape of healthcare.

Finally, Medigap plans offer lifelong coverage. As long as you pay your premiums, your coverage will not be canceled, even if you have health problems. It’s like a steadfast lighthouse, guiding you through the stormy seas of life, always there when you need it.

In the grand tapestry of life, the golden years should be a time of enjoyment and peace, a time to reap the rewards of a life well-lived. Medigap plans in New Jersey offer seniors the opportunity to do just that. They provide a safety net, a bridge, a trusted friend, a path in a garden, a key to the city, a map, and a lighthouse. They are a beacon of hope in the twilight years, a promise that you can enjoy your retirement without the worry of unexpected medical expenses. So, as the sun sets in a blaze of glory, painting the sky with hues of wisdom and experience, take a moment to appreciate the gift of Medigap plans, and the peace of mind they bring.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Comparing Different Medigap Plans in NJ

In the vibrant, bustling state of New Jersey, where life is as colorful as the autumn leaves in the Delaware Water Gap, healthcare is a topic that resonates deeply with its residents. The Garden State, known for its rich history and diverse culture, is also home to a significant population of seniors who are navigating the complexities of Medicare. Amidst the myriad of healthcare options, Medigap plans in NJ stand as a beacon of hope, offering a safety net to those who need it most.

Medigap, as the name suggests, is designed to fill in the gaps left by Original Medicare. It covers out-of-pocket costs such as deductibles, co-payments, and coinsurance, providing a sense of security and peace of mind. However, with ten different Medigap plans available in NJ, each with its unique benefits, choosing the right one can feel like finding a needle in a haystack. But fear not, for the journey of comparing different Medigap plans can be an enlightening and empowering experience.

Imagine standing at the edge of the Atlantic Ocean, the waves lapping at your feet, the salty breeze in your hair. Each wave is different, yet they all belong to the same vast ocean. Similarly, each Medigap plan is unique, yet they all serve the same purpose – to supplement your Medicare coverage. The key is to dive in and explore, to understand the nuances of each plan, and to find the one that resonates with your specific needs.

Plan A, for instance, is the most basic of all Medigap plans. It covers Medicare Part A and Part B coinsurance, offering a solid foundation of coverage. Like the iconic lighthouses that dot the Jersey Shore, Plan A stands as a reliable guide, a beacon of light in the complex world of healthcare.

On the other hand, Plan F is the most comprehensive Medigap plan. It covers all the gaps left by Original Medicare, including Part B excess charges. It’s like the bustling boardwalks of NJ, filled with an array of attractions, offering something for everyone. However, it’s important to note that Plan F is not available to those who became eligible for Medicare on or after January 1, 2020.

Then there’s Plan N, a popular choice among New Jerseyans. It offers a balance between comprehensive coverage and affordability. It’s like the perfect blend of city life and natural beauty that NJ offers, providing a harmonious balance that caters to a wide range of preferences.

Comparing different Medigap plans in NJ is not just about understanding the coverage each plan offers. It’s about understanding your own healthcare needs, your budget, and your lifestyle. It’s about taking control of your health and making informed decisions. It’s about standing at the helm of your life, navigating the waters of healthcare with confidence and grace.

In the end, choosing a Medigap plan is like choosing a path in one of NJ’s beautiful state parks. Each path offers a different journey, a different view, a different experience. But no matter which path you choose, you’re embarking on a journey of empowerment, a journey towards better health and peace of mind. So, take a deep breath, step forward, and embrace the journey of comparing different Medigap plans in NJ. After all, it’s not just about the destination, but the journey itself.

The Cost of Medigap Plans in NJ: What to Expect

In the golden years of life, when the sun sets in a blaze of glory, painting the sky with hues of wisdom and experience, health insurance becomes a beacon of hope. It’s a lighthouse guiding us through the stormy seas of uncertainty, a safety net woven with threads of reassurance. In the Garden State, New Jersey, this beacon shines brightly in the form of Medigap plans.

Medigap, as the name suggests, is designed to fill the gaps left by Original Medicare. It’s like the missing piece of a jigsaw puzzle, fitting perfectly to complete the picture of comprehensive health coverage. But, like any masterpiece, it comes with a price tag. So, what can you expect when it comes to the cost of Medigap plans in NJ? Let’s embark on this enlightening journey together.

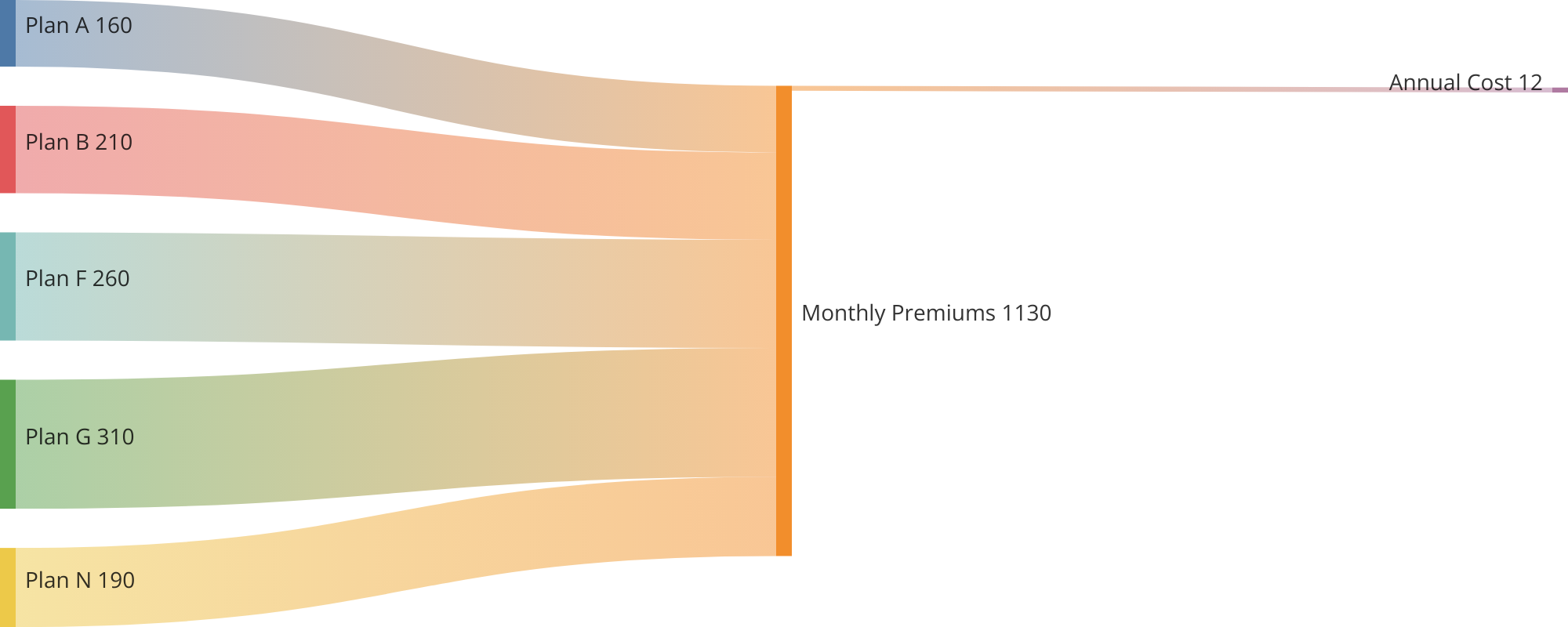

The cost of Medigap plans in NJ is akin to a symphony, with different notes contributing to the final melody. The first note is the monthly premium. This is the amount you pay to keep your Medigap policy active, like the steady rhythm of a drumbeat. The premium varies depending on the plan you choose, with each plan offering a different level of coverage. It’s like choosing between a solo performance or a full orchestra, each with its unique charm and cost.

The second note in our symphony is the type of pricing model the insurance company uses. There are three types: community-rated, issue-age-rated, and attained-age-rated. Each model strikes a different chord, affecting the overall cost of your Medigap plan. Community-rated models are like a choir singing in unison, with everyone paying the same premium regardless of age. Issue-age-rated models are like a melody that changes with the age you are when you buy the policy. Attained-age-rated models are like a crescendo, with premiums increasing as you age.

The third note is the out-of-pocket costs. These are the co-payments, deductibles, and coinsurance that play the role of the subtle background score, often overlooked but integral to the overall composition. They add to the cost of your Medigap plan, making it crucial to consider them when estimating your total healthcare expenses.

The final note is the timing of your enrollment. Just like a well-timed cymbal crash can enhance a musical piece, enrolling in a Medigap plan during your Medigap Open Enrollment Period can significantly impact your costs. During this six-month period, insurance companies cannot refuse coverage or charge higher premiums due to health conditions. It’s like hitting the high note, securing the best possible coverage at the most affordable price.

The cost of Medigap plans in NJ, therefore, is a symphony composed of various elements. It’s a melody that changes with each individual, resonating with their unique needs and circumstances. It’s a tune that can be harmonious and affordable with the right knowledge and guidance.

So, as you stand on the shores of life’s sunset years, let the beacon of Medigap guide you. Let it illuminate the path to a secure and worry-free future, where the melody of comprehensive health coverage plays a soothing lullaby. After all, the golden years should be a time of peace and tranquility, a time to enjoy the beautiful symphony of life. And with Medigap plans in NJ, you can do just that.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Enrollment Process for Medigap Plans in NJ

In the golden years of life, when the sun sets a little earlier and the pace slows down, the Garden State of New Jersey offers a comforting embrace to its senior citizens. It’s a time to relish the fruits of years of hard work, a time to enjoy the tranquility of life. However, it’s also a time when healthcare needs become more pronounced. To ensure that these needs are met without causing financial strain, New Jersey offers Medigap plans, a beacon of hope in the twilight years.

Medigap, as the name suggests, is designed to fill the gaps left by Medicare. It covers costs that Medicare doesn’t, like co-payments, coinsurance, and deductibles. But how does one enroll in a Medigap plan in New Jersey? The process, like a gentle breeze on a summer day, is straightforward and easy to navigate.

The journey to enrolling in a Medigap plan begins with eligibility. You must be 65 years or older and already enrolled in Medicare Part A and Part B. It’s like being invited to an exclusive club, where the entry pass is your Medicare enrollment. Once you have this, you’re ready to step into the world of Medigap.

The best time to enroll in a Medigap plan is during the Medigap Open Enrollment Period. This six-month window opens on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. It’s like the universe aligns to offer you this golden opportunity, a chance to secure your health without any hindrance. During this period, you have guaranteed issue rights, meaning insurance companies can’t refuse to sell you any Medigap policy they offer, charge you more based on health status, or make you wait for coverage to start.

Choosing a Medigap plan is like picking the perfect apple from a tree laden with fruit. New Jersey offers ten standardized Medigap plans, each labeled with a letter from A to N. Each plan offers a different level of coverage, but all provide the basic benefits of Medicare Part A coinsurance and hospital costs. It’s about finding the plan that fits your needs like a glove, the one that feels just right.

Once you’ve chosen your plan, it’s time to apply. You can do this through an insurance company that sells Medigap plans. It’s like walking into a store filled with options, and all you have to do is pick the one that suits you best. The insurance company will guide you through the application process, answering any questions you may have.

After you’ve applied, all you need to do is wait for approval. Once approved, you’ll start paying a monthly premium for your Medigap plan, in addition to your Part B premium. It’s a small price to pay for the peace of mind that comes with knowing you’re covered.

Enrolling in a Medigap plan in New Jersey is like embarking on a journey towards a worry-free future. It’s a path that leads to peace of mind, a path that ensures you can enjoy your golden years without the burden of unexpected healthcare costs. So, take that step, enroll in a Medigap plan, and let the Garden State take care of you in your twilight years. After all, you’ve earned it.

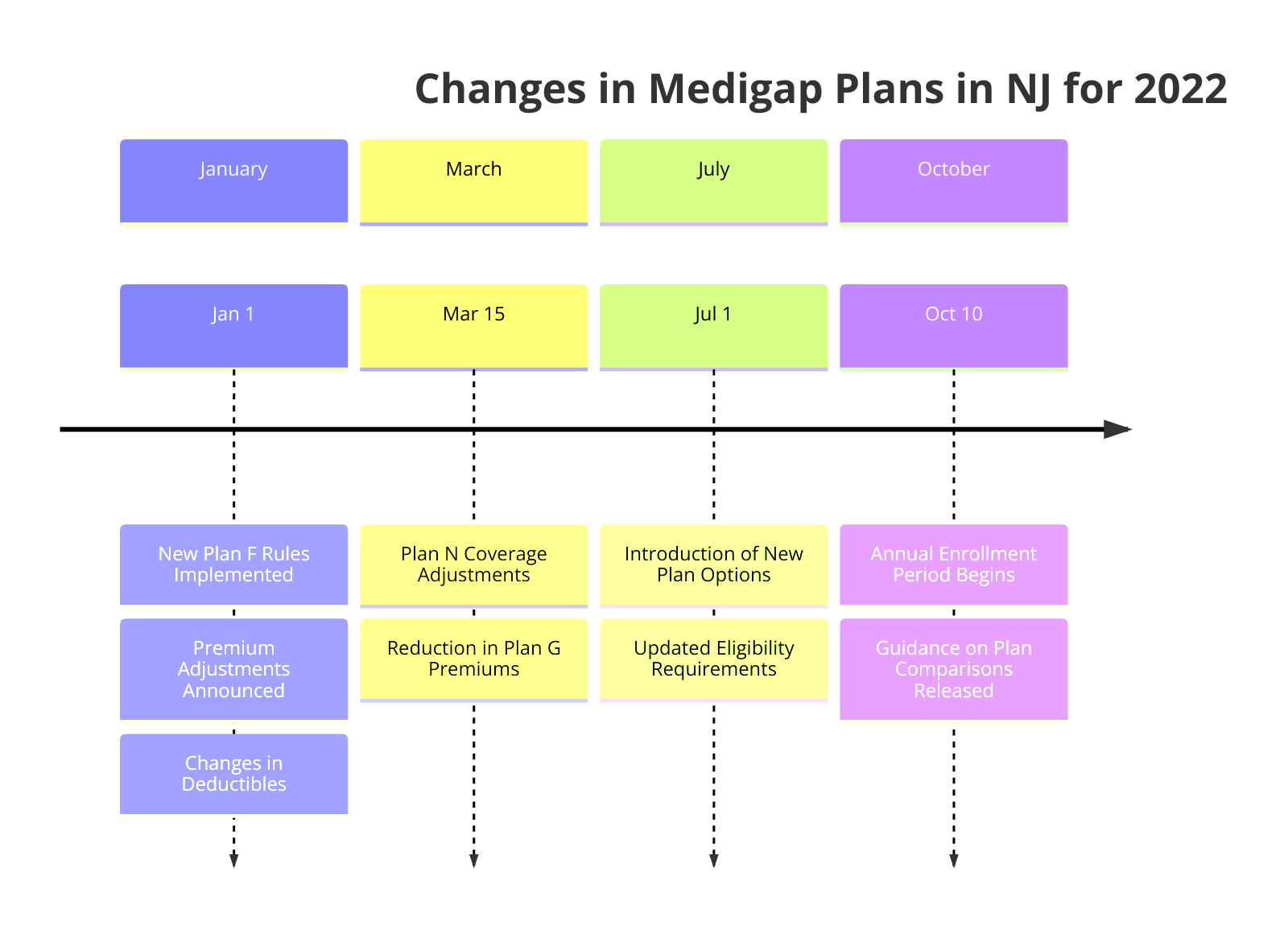

Changes in Medigap Plans in NJ for 2022

As the sun rises on a new year, it brings with it a fresh wave of changes, opportunities, and challenges. Among these changes are the modifications to Medigap plans in New Jersey for 2022. These alterations, like the shifting sands of the Jersey Shore, are designed to better meet the needs of the state’s residents, ensuring they receive the healthcare coverage they deserve.

Medigap, also known as Medicare Supplement Insurance, is a beacon of hope for many. It fills in the gaps left by Medicare, covering costs such as copayments, coinsurance, and deductibles. Like a lighthouse guiding ships safely to shore, Medigap ensures that New Jersey’s seniors navigate the often turbulent waters of healthcare without fear of financial ruin.

In 2022, the landscape of Medigap plans in New Jersey is set to transform, much like the state’s beautiful fall foliage. The changes are designed to provide a more vibrant, robust safety net for seniors, mirroring the strength and resilience of the Garden State’s residents.

One of the most significant changes is the discontinuation of Plan C and Plan F for new enrollees. These plans, once as popular as the boardwalks of Atlantic City, will no longer be available to those who are new to Medicare. However, if you’re already enrolled in these plans, fear not. Like the steadfast loyalty of a Jersey native, these plans will remain with you, continuing to provide the coverage you’ve come to rely on.

In place of Plan C and Plan F, new enrollees will have the opportunity to enroll in Plan G. Like the mighty Delaware River, Plan G flows with comprehensive coverage, including Part A and Part B coinsurance, the first three pints of blood used in a medical procedure, and even foreign travel emergency coverage. It’s a plan as diverse and inclusive as New Jersey itself.

Another change is the introduction of a high-deductible version of Plan G. This plan, like the breathtaking vistas from the top of the Jersey City skyscrapers, offers a broader perspective on healthcare coverage. It provides the same benefits as Plan G but with a higher deductible and lower premium. It’s a testament to the adaptability and resilience of New Jersey’s seniors, offering a flexible solution for those willing to shoulder a higher deductible for a lower monthly cost.

The changes to Medigap plans in New Jersey for 2022 are a reflection of the state’s spirit. They embody the resilience, diversity, and adaptability that New Jersey is known for. They offer a beacon of hope, a lighthouse guiding seniors through the often murky waters of healthcare coverage.

So, as we embrace the dawn of a new year, let’s welcome these changes with open arms. Let’s view them not as obstacles, but as opportunities for growth and improvement. After all, change, like the ebb and flow of the Atlantic Ocean, is a natural part of life. And just as the Garden State has weathered storms and emerged stronger, so too will its residents adapt to these changes and continue to thrive. Here’s to a healthier, brighter future for all New Jersey seniors in 2022 and beyond.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medigap Plans in NJ: Coverage and Limitations

In the golden years of life, when the sun begins to set and the shadows of age start to lengthen, health becomes a paramount concern. It is during this time that we begin to appreciate the true value of a robust health insurance plan. In the Garden State, New Jersey, the beacon of hope for many seniors is the Medigap insurance plan. This plan, as the name suggests, fills in the gaps left by Original Medicare, ensuring that seniors have comprehensive coverage for their healthcare needs.

Medigap plans in NJ are like a symphony, harmoniously working together with Original Medicare to create a beautiful melody of health coverage. They cover the co-payments, deductibles, and coinsurance that Original Medicare does not. Imagine a safety net, ready to catch you when the unexpected happens. That’s what Medigap plans offer. They provide the peace of mind that comes with knowing that your health is well taken care of, allowing you to focus on living your life to the fullest.

However, like any masterpiece, Medigap plans have their limitations. They do not cover long-term care, vision, dental, hearing aids, or private-duty nursing. They also do not cover prescription drugs. But don’t let these limitations discourage you. Instead, view them as the minor chords in the symphony, necessary to create a balanced composition.

Medigap plans in NJ are standardized, meaning that each plan offers the same basic benefits, regardless of the insurance company that sells it. This standardization is like the steady rhythm in a symphony, providing a reliable foundation upon which the melody can build. It ensures that no matter where you purchase your plan, you can be confident in the coverage it provides.

However, while the basic benefits are the same, the premiums can vary. This is where the improvisation in the symphony comes in. Each insurance company can set its own premiums, adding a unique twist to the melody. It’s important to shop around and compare prices to ensure you’re getting the best deal.

Despite the limitations, Medigap plans in NJ are a valuable resource for seniors. They provide a safety net, catching the costs that Original Medicare does not cover. They are the crescendo in the symphony of health coverage, providing a powerful boost to your protection.

In the end, the choice of whether to purchase a Medigap plan is a personal one. It’s like choosing the music that speaks to your soul. You must consider your health needs, your budget, and your peace of mind. But remember, in the symphony of life, it’s important to have a safety net. And that’s exactly what Medigap plans provide.

So, as the sun sets and the shadows lengthen, take comfort in the knowledge that Medigap plans in NJ are there to support you. They are the melody in the symphony of your health coverage, filling in the gaps and providing a harmonious tune of protection. With Medigap, you can face the golden years with confidence, knowing that your health is well taken care of. And that, dear reader, is truly music to our ears.

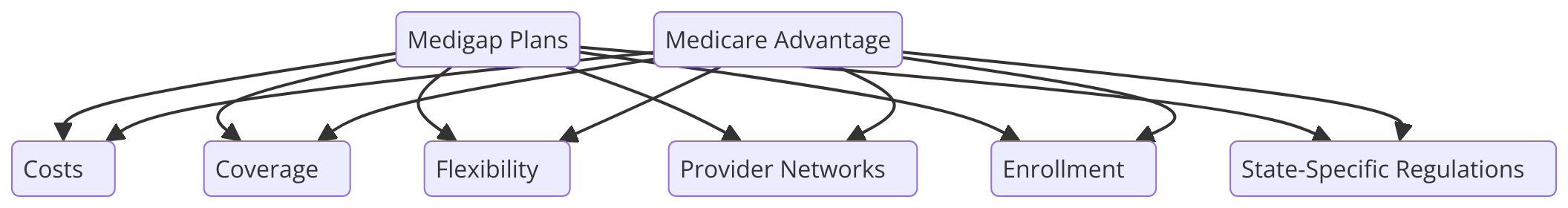

Medigap vs. Medicare Advantage: A Comparison for NJ Residents

In the golden years of life, when the sun sets in a blaze of glory, painting the sky with hues of wisdom and experience, health insurance becomes a beacon of hope. It’s a lighthouse guiding us through the stormy seas of uncertainty, a safety net that catches us when we stumble. For residents of New Jersey, two such beacons shine brightly in the twilight: Medigap and Medicare Advantage.

Medigap, as the name suggests, is designed to fill in the gaps left by Original Medicare. It’s like a puzzle piece that fits perfectly into the spaces, completing the picture of comprehensive health coverage. Medigap plans in NJ cover costs that Original Medicare doesn’t, such as copayments, coinsurance, and deductibles. It’s like having a trusted friend who steps in to help when you’re facing a challenge, lightening your load and making your journey easier.

On the other hand, Medicare Advantage, also known as Part C, is an all-in-one alternative to Original Medicare. It’s like a symphony orchestra, where each instrument plays its part to create a harmonious melody of health coverage. Medicare Advantage plans in NJ often include prescription drug coverage and may offer additional benefits like vision, dental, and hearing care. It’s like having a personal concierge who takes care of all your needs, ensuring you have everything you need to live your best life.

While both Medigap and Medicare Advantage offer valuable benefits, they are as different as a lighthouse and a beacon. Medigap supplements your Original Medicare benefits, while Medicare Advantage replaces them. It’s like choosing between adding a room to your existing house or moving into a new one with different features.

Medigap offers the flexibility to choose any doctor or hospital that accepts Medicare, anywhere in the U.S. It’s like having a magic carpet that can take you wherever you want to go, giving you the freedom to seek the best care available. Medicare Advantage, however, usually requires you to use doctors and hospitals in its network. It’s like having a map with a predetermined route, guiding you along a specific path to your destination.

The cost is another factor that differentiates these two plans. Medigap generally has a higher monthly premium but lower out-of-pocket costs. It’s like paying more upfront for a luxury cruise but enjoying all the amenities without any additional charges. Medicare Advantage often has a lower monthly premium but may require more out-of-pocket costs. It’s like opting for a budget-friendly road trip where you pay as you go.

Choosing between Medigap and Medicare Advantage is like standing at a crossroads, deciding which path to take. Each path offers its own unique journey, with different experiences and rewards. The choice depends on your individual health needs, lifestyle, and budget. It’s about finding the right balance, the perfect harmony between coverage and cost.

In the end, whether you choose Medigap or Medicare Advantage, remember that the goal is to live a healthy, fulfilling life. It’s about embracing the golden years with confidence, knowing that you have a safety net to catch you. It’s about enjoying the sunset, basking in its warm glow, and looking forward to the stars that twinkle in the twilight. After all, health insurance is not just about coverage; it’s about peace of mind. It’s about living your best life, in the best health, for the best years yet to come.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

FAQs about Medigap Plans in NJ

Medigap plans in New Jersey, like a lighthouse in a storm, offer a beacon of hope to those navigating the often tumultuous seas of healthcare. These plans, designed to fill in the gaps left by Medicare, are a lifeline for many, providing the peace of mind that comes with knowing you’re covered, even when Medicare falls short. But, like any beacon, understanding how it works is key to finding your way. So, let’s embark on a journey of discovery, answering some frequently asked questions about Medigap plans in NJ.

Firstly, you may wonder, “What exactly is a Medigap plan?” Picture Medicare as a safety net, catching you when health issues arise. But, like any net, it has holes. That’s where Medigap comes in, patching those holes and ensuring you’re fully covered. Medigap plans are supplemental insurance policies sold by private companies, designed to pay for costs not covered by Medicare, such as co-payments, deductibles, and healthcare if you travel outside the U.S.

Next, you might ask, “Who can get a Medigap plan?” The answer is as simple as a summer breeze. If you have Medicare Part A and Part B, you’re eligible for a Medigap plan. However, there’s a catch. You must purchase these plans during your Medigap Open Enrollment Period, which begins the month you’re 65 or older and enrolled in Part B. This six-month window is your golden opportunity to secure a Medigap plan without worrying about medical underwriting.

Now, let’s address a common concern: “Are all Medigap plans the same?” Just as every snowflake is unique, so too are Medigap plans. In New Jersey, there are ten standardized Medigap plans, each labeled with a letter from A to N. Each plan offers a different level of coverage, but all provide certain core benefits. It’s like choosing a path in a forest; each one leads to a different destination, but all are part of the same beautiful wilderness.

You might also be curious about the cost. “How much does a Medigap plan cost?” The answer is as varied as the colors of a sunset. The cost of Medigap plans can differ based on the plan type, the insurance company, your age, and your health status. However, rest assured that New Jersey is a community-rated state, meaning that everyone in the same area pays the same premium, regardless of age.

Lastly, you may wonder, “Can I switch Medigap plans?” Like the changing tides, your healthcare needs may shift over time. In New Jersey, you can switch Medigap plans anytime, but you may be subject to medical underwriting unless you’re within your six-month Open Enrollment Period or have guaranteed issue rights.

In conclusion, Medigap plans in NJ, like a guiding star, offer a path to peace of mind for those navigating the complexities of healthcare. They fill in the gaps left by Medicare, ensuring that you’re covered when you need it most. So, as you journey through the world of healthcare, remember that understanding is your compass, and Medigap is your North Star, guiding you to the security and peace of mind you deserve.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Q: What is a Medigap plan in NJ?

A: A Medigap plan in NJ is a supplemental insurance policy that helps cover the costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

2. Q: How many Medigap plans are available in NJ?

A: In New Jersey, there are 10 standardized Medigap plans available, labeled A through N.

3. Q: When can I enroll in a Medigap plan in NJ?

A: The best time to enroll in a Medigap plan in NJ is during your 6-month Medigap Open Enrollment Period, which starts the first month you’re 65 or older and enrolled in Medicare Part B.

4. Q: Can I switch Medigap plans in NJ?

A: Yes, you can switch Medigap plans in NJ, but you may have to go through medical underwriting and your acceptance is not guaranteed.

5. Q: Are prescription drugs covered under Medigap plans in NJ?

A: No, prescription drugs are not covered under Medigap plans in NJ. You would need to enroll in a separate Medicare Part D plan for prescription drug coverage.

6. Q: Do all doctors accept Medigap plans in NJ?

A: Any doctor that accepts Medicare will accept Medigap plans in NJ.

7. Q: How much does a Medigap plan cost in NJ?

A: The cost of a Medigap plan in NJ varies depending on the plan type, the insurance company, your age, and your health status.

8. Q: Can I have both a Medicare Advantage Plan and a Medigap plan in NJ?

A: No, it’s illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you’re switching back to Original Medicare.

9. Q: Are there any high-deductible Medigap plans in NJ?

A: Yes, Plan F and Plan G have high-deductible options in NJ.

10. Q: What happens if I move out of NJ with my Medigap plan?

A: Medigap policies are standardized across the U.S., so you can use your coverage anywhere in the country. However, if you move to a different state, you may want to switch to a new policy.