“Securing Health, Ensuring Peace: Georgia’s Medigap Plans”

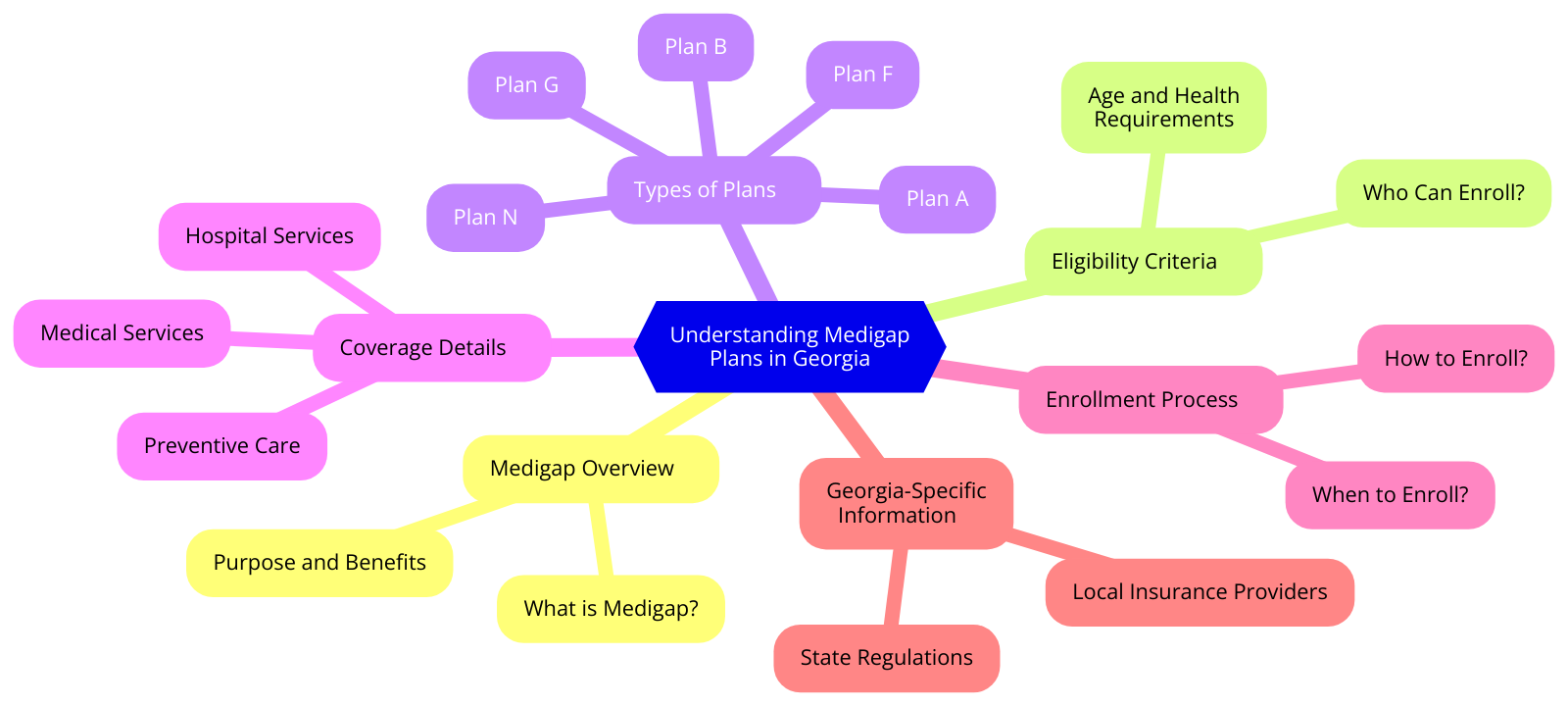

Understanding Medigap Plans in Georgia

In the heart of the South, where peaches are as sweet as the hospitality, Georgia stands as a beacon of warmth and charm. But beyond its picturesque landscapes and vibrant culture, Georgia also offers a unique advantage for its senior residents – a comprehensive range of Medigap plans. These plans, as the name suggests, are designed to fill in the gaps left by traditional Medicare coverage, ensuring that Georgia’s seniors can enjoy their golden years with peace of mind and financial security.

Imagine a safety net, woven with threads of compassion and understanding, designed to catch you when life’s unexpected health issues arise. That’s what Medigap plans in Georgia aim to be. They are the unseen heroes, stepping in to cover out-of-pocket costs that Medicare Parts A and B don’t cover, such as copayments, coinsurance, and deductibles.

Like a trusted friend, Medigap plans are there when you need them most. They offer a variety of options, each tailored to meet different needs and budgets. From Plan A, which provides basic benefits, to Plan N, which offers a more comprehensive coverage, there’s a Medigap plan for every Georgian senior.

But the beauty of Medigap plans in Georgia isn’t just in their variety. It’s in their consistency. Regardless of the insurance company, the benefits offered by each Medigap plan are standardized. This means that Plan G from one company will offer the same benefits as Plan G from another. This consistency allows seniors to choose a plan based on price and customer service, rather than getting lost in a maze of varying benefits.

Yet, the true magic of Medigap plans lies in their ability to inspire a sense of security. They are like a lighthouse in a storm, guiding Georgia’s seniors through the often turbulent seas of healthcare costs. With a Medigap plan, unexpected medical expenses no longer need to be a source of stress or worry. Instead, they become manageable, allowing seniors to focus on what truly matters – enjoying their retirement and spending time with loved ones.

In the same way that Georgia’s landscapes change with the seasons, so too do the needs of its seniors. That’s why it’s important to review your Medigap plan annually. As your health needs evolve, you may find that a different plan better suits your current situation. Remember, the goal of Medigap is to provide you with the best possible coverage for your unique needs.

In the end, understanding Medigap plans in Georgia is about more than just understanding insurance. It’s about understanding the value of peace of mind, the importance of financial security, and the power of choice. It’s about recognizing that every Georgian senior deserves the chance to enjoy their golden years without the burden of unexpected healthcare costs.

So, as the sun sets over Georgia’s rolling hills and the scent of sweet peaches fills the air, remember this: Medigap plans are more than just insurance. They are a promise – a promise that Georgia’s seniors will always have the support they need to navigate the complexities of healthcare costs. And that’s a promise worth believing in.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Choose the Right Medigap Plan in Georgia

Choosing the right Medigap plan in Georgia is akin to finding the perfect peach in a sprawling orchard. It requires patience, discernment, and a keen understanding of your unique needs. Just as every peach has its own distinct flavor and texture, each Medigap plan offers a different blend of benefits designed to supplement your Medicare coverage. The key is to find the one that best complements your health and financial situation, ensuring you can savor the sweetness of comprehensive healthcare without the bitter aftertaste of unexpected costs.

Imagine standing at the edge of that peach orchard, the sun warming your skin as you survey the trees laden with fruit. This is where your journey begins. The first step in choosing the right Medigap plan is understanding what it is and how it works. Medigap, also known as Medicare Supplement Insurance, is designed to fill in the “gaps” in Original Medicare coverage. It helps pay for out-of-pocket costs like deductibles, copayments, and coinsurance, providing a safety net that can catch you if health issues arise.

Now, picture yourself walking through the orchard, reaching out to touch the peaches, feeling their weight in your hand. This is the research phase. There are ten standardized Medigap plans available in Georgia, each labeled with a different letter from A to N. While all plans offer basic benefits, some provide additional coverage for services like foreign travel emergency care or skilled nursing facility care. Take the time to explore each plan, comparing their benefits side by side. Consider your current health status, your budget, and your future healthcare needs.

As you delve deeper into the orchard, you start to notice the subtle differences between the peaches. Some are larger, some are sweeter, and some have a more vibrant color. Similarly, while all Medigap plans of the same letter offer the same basic benefits, the premiums can vary widely between insurance companies. It’s essential to get quotes from multiple insurers to ensure you’re getting the best value for your money.

Finally, you find the perfect peach. It’s ripe, juicy, and just the right size. You know it’s the one because it meets all your criteria. In the same way, the right Medigap plan will tick all your boxes. It will offer the coverage you need at a price you can afford. But remember, choosing a plan is not a one-time decision. As your health needs change, your Medigap plan may need to change too. Regularly review your coverage to ensure it continues to serve you well.

Choosing the right Medigap plan in Georgia is a journey of discovery. It’s about understanding your needs, exploring your options, and making informed decisions. It’s about finding the perfect peach in a sprawling orchard, knowing that it will provide the nourishment you need. So, take your time, do your research, and savor the process. After all, the journey is just as important as the destination. And when you finally find the right Medigap plan, you’ll realize it was worth every step.

The Benefits of Medigap Plans for Georgia Residents

In the heart of the South, where the peaches are sweet and the hospitality is sweeter, Georgia residents are discovering the benefits of Medigap plans. These plans, designed to supplement Medicare coverage, are like a warm, comforting blanket on a chilly Georgia night, providing an extra layer of financial protection when you need it most.

Imagine, if you will, a beautiful Georgia sunset. The sky is ablaze with hues of orange, pink, and purple, and as the sun dips below the horizon, the world is bathed in a soft, warm glow. This is the peace and tranquility that Medigap plans can bring to your life. Just as the sunset fills the sky with color, Medigap fills in the gaps left by Medicare, ensuring that you’re covered for the unexpected.

Medigap plans are like the sweet Georgia peaches that fill our summer baskets. Just as each peach is unique, each Medigap plan offers different benefits, allowing you to choose the one that best fits your needs. Some plans cover copayments and deductibles, while others provide coverage for medical care when you travel outside the United States. Like biting into a juicy peach on a hot summer day, finding the right Medigap plan can bring a sense of relief and satisfaction.

But the benefits of Medigap plans extend beyond financial protection. They also provide peace of mind, much like the comforting lullaby of a Georgia night filled with the soft chirping of crickets and the gentle rustling of leaves. With a Medigap plan, you can rest easy knowing that you’re prepared for whatever comes your way. You can enjoy your golden years without the constant worry of medical expenses hanging over your head, much like the clear, star-filled Georgia sky.

Just as the Georgia landscape is filled with rolling hills, lush forests, and sparkling rivers, the world of healthcare can be a complex terrain to navigate. But with a Medigap plan, you have a guide to help you through the twists and turns. These plans simplify the healthcare process, making it easier to understand what’s covered and what’s not. It’s like having a trusty compass on a long hike through the Georgia wilderness, always pointing you in the right direction.

In the end, Medigap plans are about more than just coverage. They’re about freedom. The freedom to choose the care you need, the freedom to travel without worry, and the freedom to enjoy your life without the burden of unexpected medical costs. It’s the same freedom that’s embodied in the spirit of Georgia, from the bustling streets of Atlanta to the quiet, peaceful shores of the Georgia coast.

So, as the sun sets on another beautiful Georgia day, consider the benefits of a Medigap plan. Like the vibrant colors of the sunset, these plans can bring a sense of calm and security to your life. They’re a testament to the resilience and strength of Georgia residents, a symbol of the care and compassion that defines the Peach State. With a Medigap plan, you can face the future with confidence, knowing that you’re covered, no matter what comes your way.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Comparing Different Medigap Plans in Georgia

In the heart of the South, where peaches are sweeter and hospitality is a way of life, Georgia stands as a beacon of warmth and charm. But even in this idyllic setting, the complexities of health care can be as tangled as Spanish moss in an old oak tree. For those navigating the Medicare maze, Medigap plans in Georgia offer a lifeline, a beacon of hope in the often confusing world of health insurance.

Medigap, as the name suggests, is designed to fill in the gaps left by traditional Medicare coverage. It’s like the sweet tea that complements a hearty Southern meal, providing that extra bit of comfort and reassurance. But just as there are many ways to brew that perfect glass of sweet tea, there are also many different Medigap plans to choose from.

In Georgia, there are ten standardized Medigap plans, each labeled with a letter from A to N. Each plan offers a different combination of benefits, like different notes in a symphony, each contributing to the overall melody. Plan A, for instance, is the most basic, covering coinsurance costs for hospital stays and providing an additional 365 days of coverage after Medicare benefits are exhausted. It’s like a simple, comforting lullaby, providing a basic level of reassurance.

On the other hand, Plan F is the most comprehensive, covering all the gaps left by Medicare. It’s like a grand symphony, with every note in perfect harmony, providing complete peace of mind. However, it’s important to note that as of 2020, Plan F is no longer available to new Medicare enrollees. But don’t fret, Plan G offers nearly identical coverage, with the only difference being that it doesn’t cover the Medicare Part B deductible. It’s like a symphony without the opening overture, but still beautiful and complete in its own right.

Comparing different Medigap plans in Georgia can feel like trying to choose the best peach in a Georgia orchard – they all look good, but each one is slightly different. It’s important to consider your individual health needs and budget when making a decision. Some may need the comprehensive coverage of a Plan G, while others may find that a more basic plan, like Plan A or B, is more than sufficient.

Remember, the best Medigap plan is not necessarily the one with the most coverage, but the one that best fits your individual needs. It’s like finding the perfect pair of cowboy boots – it’s not about the fanciest design or the highest price tag, but about the fit and comfort.

In the end, choosing a Medigap plan in Georgia is about more than just coverage and costs. It’s about peace of mind. It’s about knowing that when health issues arise, you won’t have to worry about unexpected costs or gaps in coverage. It’s about being able to focus on what truly matters – enjoying the sweet, simple pleasures of life in the Peach State.

So, as you navigate the world of Medigap plans in Georgia, remember to take your time, consider your options, and choose the plan that best fits your needs. And remember, just like a Georgia peach, the right Medigap plan can be a sweet and satisfying addition to your life.

The Cost of Medigap Plans in Georgia

In the heart of the South, where peaches are sweeter and hospitality is a way of life, Georgia stands as a beacon of warmth and charm. But even in this idyllic setting, the reality of healthcare costs can cast a shadow over the golden years of retirement. However, there’s a silver lining in the form of Medigap plans, a beacon of hope for Georgia’s seniors.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare coverage. It’s like the sweet tea that complements a hearty Southern meal, making everything just right. But just as the perfect sweet tea recipe varies from one Georgia kitchen to another, so does the cost of Medigap plans.

The cost of Medigap plans in Georgia is influenced by a variety of factors. Age, gender, and location all play a role in determining the premium rates. It’s like the way the taste of a peach is influenced by the soil it’s grown in, the amount of sunshine it gets, and the care with which it’s harvested.

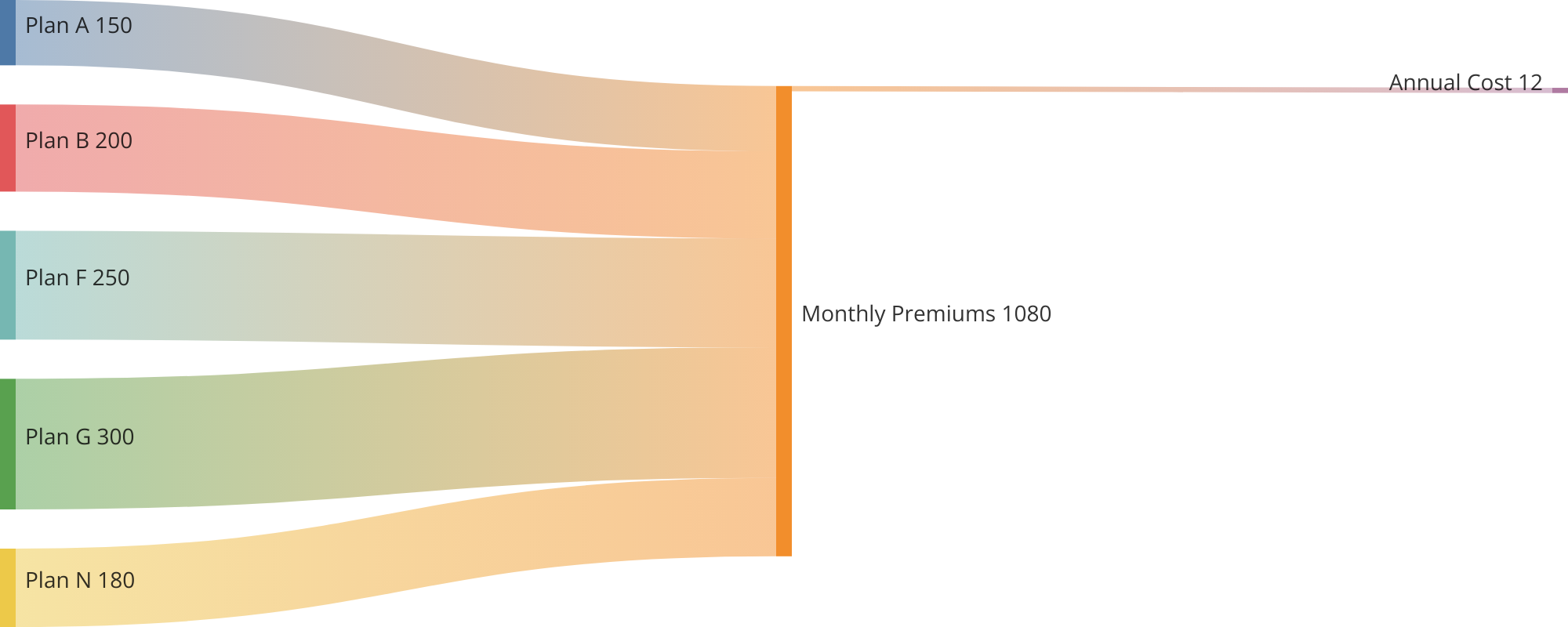

In Georgia, the average monthly premium for a Medigap plan can range from around $100 to over $300. It’s a broad range, much like the diverse landscapes of Georgia, from the bustling city of Atlanta to the serene Blue Ridge Mountains. But don’t let the numbers intimidate you. Just as you would navigate Georgia’s varied terrain, you can navigate the world of Medigap plans with a little guidance and determination.

The cost of a Medigap plan is an investment in your health and peace of mind. It’s like buying a sturdy umbrella before a rainstorm. You might hesitate at the price tag, but when the rain starts pouring, you’ll be glad you have it. With a Medigap plan, you can face the storm of unexpected medical expenses with confidence, knowing you’re covered.

While the cost of Medigap plans in Georgia can seem daunting, it’s important to remember that the right plan can provide invaluable protection against unpredictable healthcare costs. It’s like a lighthouse guiding ships safely to shore amidst a storm. The light might seem small from a distance, but its impact is immeasurable.

Choosing a Medigap plan is a personal decision, much like choosing the perfect peach from a Georgia orchard. It requires careful consideration and a clear understanding of your needs. But once you’ve made your choice, you can enjoy the sweet satisfaction of knowing you’re protected.

In the end, the cost of Medigap plans in Georgia is more than just a number. It’s a testament to the value we place on health and well-being. It’s a commitment to living our golden years with the peace of mind that comes from knowing we’re covered. It’s a reflection of the care and compassion that are as much a part of Georgia as the sweet peaches and the warm Southern hospitality.

So, as you consider the cost of Medigap plans in Georgia, remember this: just as the Georgia sun rises each day, casting a warm glow over the Peach State, so too does the promise of Medigap coverage shine brightly, offering hope and reassurance in the face of healthcare costs. It’s a beacon of hope, a lighthouse guiding us through the storm, a sweet tea that complements our meal. It’s a part of Georgia, and it’s a part of us.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Enrollment Process for Medigap Plans in Georgia

In the heart of the South, where peaches are sweeter and hospitality is a way of life, Georgia residents are discovering the benefits of Medigap plans. These supplemental insurance policies, designed to fill the gaps left by traditional Medicare coverage, are becoming increasingly popular among the Peach State’s senior population. The enrollment process for Medigap plans in Georgia is a journey of empowerment, a step towards securing a future where healthcare concerns don’t overshadow the joy of golden years.

Imagine a world where unexpected medical costs don’t send you spiraling into financial uncertainty. Picture a life where you can focus on enjoying your retirement, rather than worrying about how to pay for your next doctor’s visit. This is the promise of Medigap plans, a beacon of hope in the often confusing world of healthcare.

The journey to this peace of mind begins with understanding. In Georgia, as in the rest of the country, you’re eligible for Medigap if you’re already enrolled in Medicare Parts A and B. The best time to embark on this journey is during your Medigap Open Enrollment Period, a six-month window that begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. During this period, you have a guaranteed right to buy any Medigap policy sold in your state, regardless of your health status.

As you navigate the enrollment process, you’ll find that Georgia offers a variety of Medigap plans, each designed to meet different needs. There are ten standardized plans available, labeled A through N. Each plan offers a different combination of benefits, allowing you to choose the one that best fits your healthcare needs and budget. It’s like shopping for the perfect peach at a Georgia farmer’s market – you have the freedom to pick the one that’s just right for you.

Once you’ve chosen your plan, the next step is to apply. This can be done through a private insurance company that sells Medigap policies. While this may seem daunting, remember that you’re not alone. There are numerous resources available to help guide you through the process, from the GeorgiaCares Program, which offers free, unbiased Medicare counseling, to the Georgia Department of Insurance, which can provide information about the companies that sell Medigap policies in the state.

As you complete your application, you may feel a sense of accomplishment. You’re taking control of your healthcare, asserting your right to a worry-free retirement. It’s a moment of triumph, a testament to your determination to live your golden years on your own terms.

Once your application is approved, you’ll begin paying a monthly premium for your Medigap policy, in addition to your Part B premium. It’s a small price to pay for the peace of mind that comes with knowing you’re protected against unexpected healthcare costs.

Enrolling in a Medigap plan in Georgia is more than just a process. It’s a journey, a step towards a future where you can focus on enjoying life, rather than worrying about medical bills. It’s a testament to the spirit of Georgia, a state where people are known for their resilience and determination. So, embark on this journey with confidence, knowing that you’re securing a future where your healthcare is in your hands. After all, in the Peach State, the sweetest things in life are often the ones you work for.

Changes in Medigap Plans in Georgia for 2022

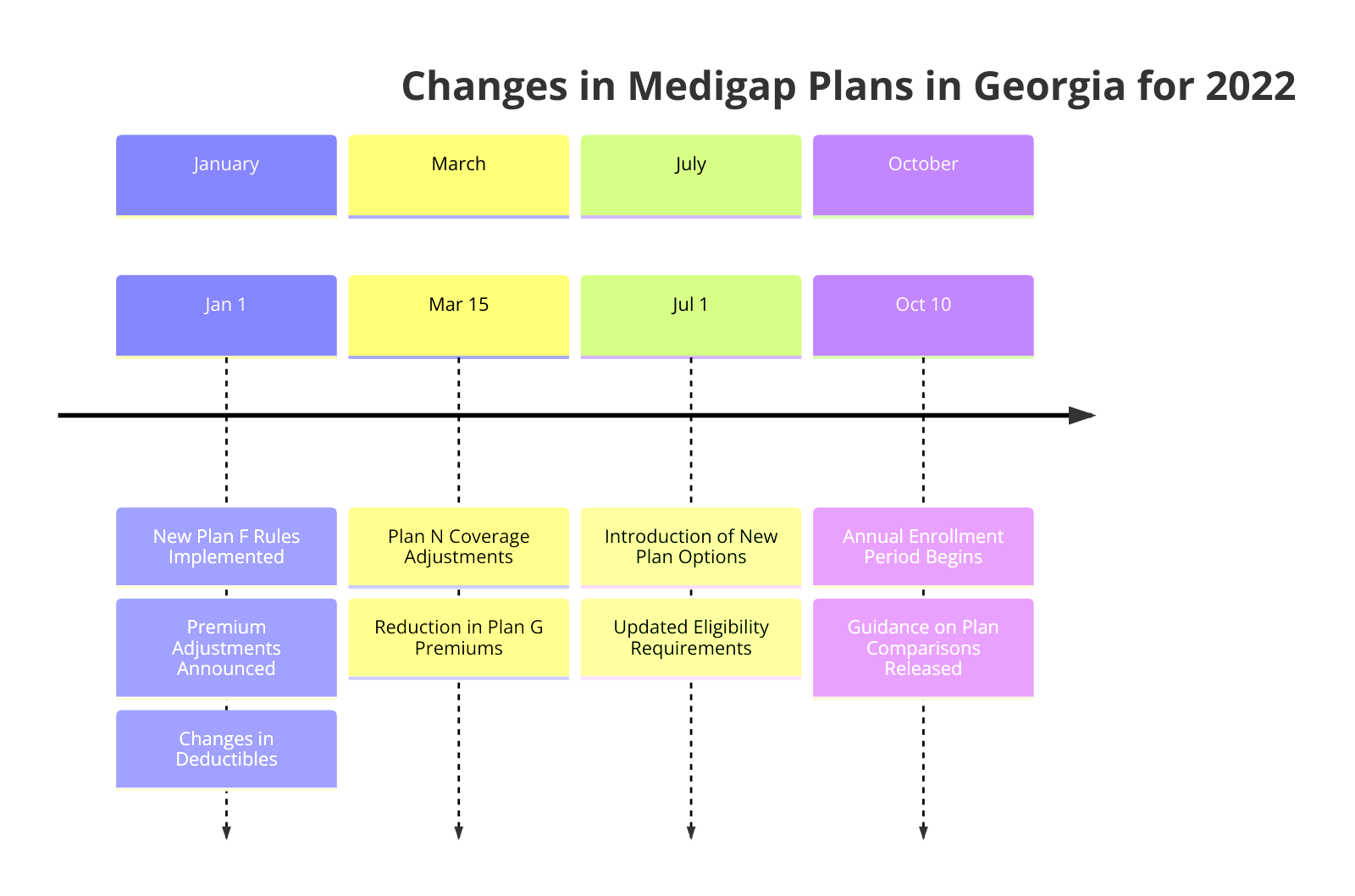

As the sun rises on a new year, it brings with it a fresh wave of changes, opportunities, and possibilities. Among these changes are the modifications to Medigap plans in Georgia for 2022. These alterations, like the shifting tides, are designed to better serve the needs of Georgia’s seniors, providing them with the healthcare coverage they need to live their golden years in comfort and security.

Medigap, also known as Medicare Supplement Insurance, is a beacon of hope for many seniors. It fills in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. It’s a safety net, a lifeline, a promise of care and support when it’s needed most. And in 2022, this promise is being renewed and strengthened in Georgia.

The first change to note is the discontinuation of Plan C and Plan F for new enrollees. These plans, once popular choices, have been sunsetted due to the Medicare Access and CHIP Reauthorization Act of 2015. However, like a phoenix rising from the ashes, new plans have emerged to take their place. Plan G, which is similar to Plan F but requires the payment of the Part B deductible, is now available. It’s a new dawn, a new day, and a new opportunity for seniors to get the coverage they need.

Another significant change is the introduction of a high-deductible version of Plan G. This plan offers the same benefits as the standard Plan G but with a higher deductible and lower premium. It’s a testament to the flexibility and adaptability of Medigap, a reflection of its commitment to meet the diverse needs of Georgia’s seniors. Whether you prefer lower premiums or lower out-of-pocket costs, there’s a Medigap plan for you.

In addition to these changes, there’s also been a shift in pricing methods. Some Medigap plans in Georgia are now using a community-rated pricing method, which means that everyone in the same geographic area pays the same premium, regardless of age. It’s a move towards equality, a step towards fairness, a stride towards a world where healthcare is accessible and affordable for all.

But perhaps the most inspiring change of all is the increased focus on preventive care. Many Medigap plans now cover preventive services, encouraging seniors to take proactive steps towards their health. It’s a powerful reminder that healthcare isn’t just about treating illnesses; it’s about preventing them. It’s about empowering seniors to take control of their health, to live their best lives, to shine brightly in their golden years.

The changes to Medigap plans in Georgia for 2022 are more than just alterations to insurance policies. They’re a testament to the power of change, the promise of progress, the potential of a new year. They’re a reflection of the enduring commitment to the health and well-being of Georgia’s seniors. And they’re a reminder that no matter how much things change, the mission of Medigap remains the same: to provide seniors with the healthcare coverage they need to live their lives with dignity, comfort, and peace of mind. So here’s to a new year, a new dawn, and a new chapter in the story of Medigap in Georgia.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medigap Plans vs. Medicare Advantage Plans in Georgia

In the heart of the South, where peaches are sweeter and hospitality is a way of life, Georgia residents are making important decisions about their healthcare. As the golden years approach, it’s essential to understand the options available to ensure the best possible care. Two of these options are Medigap plans and Medicare Advantage plans. Both offer unique benefits, but understanding the differences can be like navigating a labyrinth. Let’s embark on this journey together, illuminating the path to clarity.

Medigap plans, also known as Medicare Supplement Insurance, are like the trusty sidekick to Original Medicare. They swoop in to cover the costs that Original Medicare doesn’t, like copayments, coinsurance, and deductibles. Imagine you’re at a fancy dinner party, and you’ve just finished a delicious meal. Just as you’re about to reach for your wallet, your friend steps in and takes care of the bill. That’s what Medigap does. It steps in to cover the costs that you’d typically have to pay out of pocket.

In Georgia, there are ten standardized Medigap plans available, each labeled with a different letter. Like a box of assorted chocolates, each plan offers something different, allowing you to choose the one that best suits your needs. Whether you need comprehensive coverage or just a little extra help, there’s a Medigap plan for you.

On the other hand, we have Medicare Advantage plans, also known as Medicare Part C. These plans are like the all-in-one tool in your toolbox. They combine Parts A and B of Original Medicare and often include additional benefits like prescription drug coverage, dental, vision, and wellness programs. Imagine you’re planning a trip. Instead of booking your flight, hotel, and car rental separately, you opt for a package deal that includes everything. That’s what Medicare Advantage does. It bundles everything together into one convenient plan.

In Georgia, the variety of Medicare Advantage plans is as diverse as the state’s landscape, from the bustling city of Atlanta to the serene Blue Ridge Mountains. Some plans have low or even zero-dollar premiums, making them an attractive option for those on a tight budget. However, it’s important to remember that while the upfront costs may be lower, you’ll typically have to pay copayments and coinsurance for the services you use.

So, which path should you choose? The answer lies within your unique needs and circumstances. If you value simplicity and comprehensive coverage, a Medigap plan might be your guiding star. If you prefer a budget-friendly option that includes additional benefits, a Medicare Advantage plan could be your compass.

Navigating the world of healthcare can be daunting, but remember, you’re not alone. Like the warm Georgia sun that rises each morning, there’s always hope and help available. Whether you choose a Medigap plan or a Medicare Advantage plan, the goal is the same: to ensure that you receive the care you need, when you need it. After all, isn’t that what healthcare should be about?

In the end, it’s not just about making a choice. It’s about making the right choice for you. So, take a deep breath, take your time, and remember, in the world of healthcare, you’re the captain of your ship. And with the right plan, you’ll be ready to sail smoothly into the future.

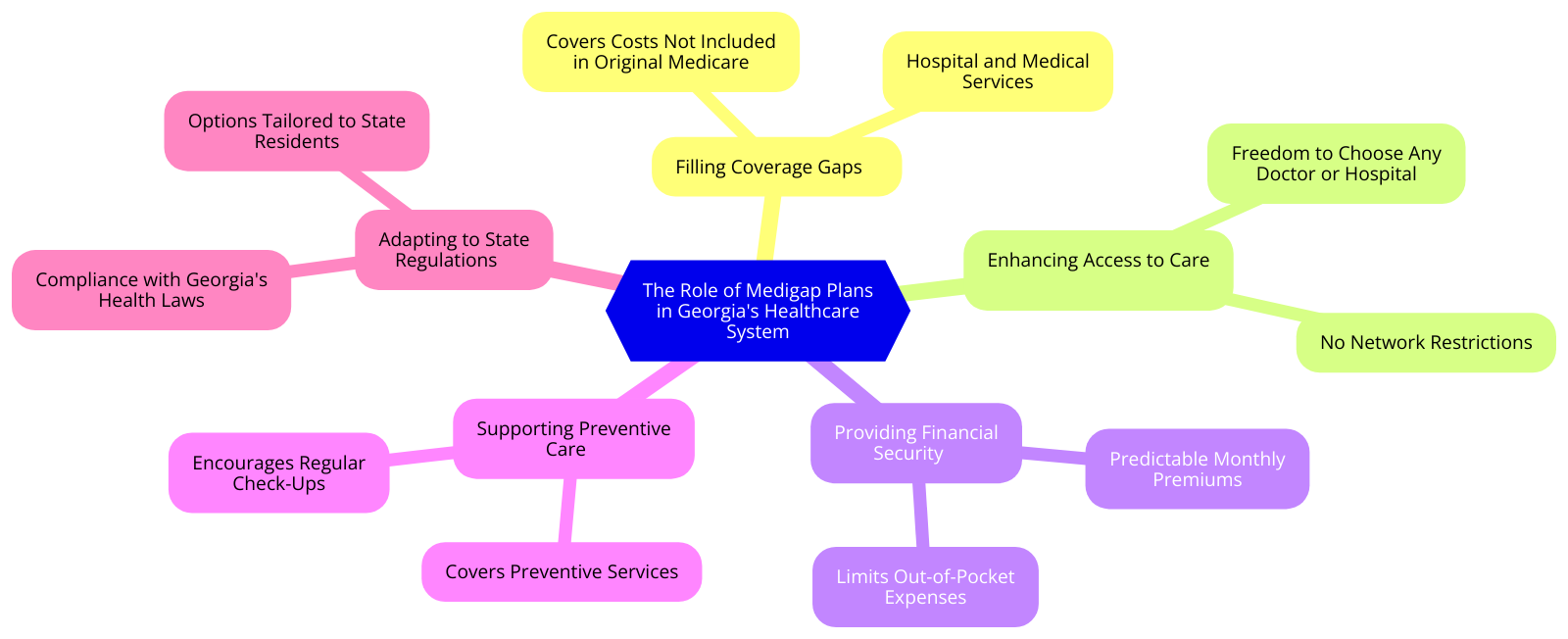

The Role of Medigap Plans in Georgia’s Healthcare System

In the heart of the South, where peaches are as sweet as the people, Georgia stands as a beacon of Southern hospitality. Yet, beneath the charm and warmth, there’s a critical issue that affects the lives of many Georgians – healthcare. As the sun rises over the Blue Ridge Mountains and sets over the Atlantic, the question of healthcare coverage remains a constant concern for many, particularly for those in their golden years. This is where Medigap plans come into play, serving as a lifeline for many seniors in Georgia.

Medigap, as the name suggests, is designed to fill in the gaps left by Medicare. It’s like the sweet tea that complements a hearty Southern meal, making everything more satisfying and complete. Medicare, while a significant help to seniors, often leaves behind certain costs that can be burdensome. These costs, like coinsurance, copayments, and deductibles, can add up, creating a financial strain that no one should have to bear in their sunset years. Medigap plans, offered by private insurance companies, step in to cover these costs, providing a safety net for Georgia’s seniors.

Imagine a warm, sunny day in Savannah, where the Spanish moss hangs like a lace curtain from the trees. A group of seniors gather for their weekly book club in one of the city’s charming squares. Their laughter and lively discussion echo through the park. These are individuals who have worked hard all their lives, contributing to their communities and families. They deserve to enjoy their retirement without the worry of unexpected medical costs. Medigap plans make this possible, offering them the peace of mind to focus on what truly matters – enjoying life and making memories.

In the bustling city of Atlanta, where the pace of life is as fast as the traffic on the I-285, Medigap plans offer a sense of security amidst the hustle and bustle. They ensure that seniors can access the healthcare they need when they need it, without the fear of unmanageable costs. It’s like having a trusted friend by your side, ready to lend a helping hand in times of need.

But the role of Medigap plans in Georgia’s healthcare system extends beyond just financial coverage. They also promote a culture of proactive healthcare. With the assurance that their medical costs will be covered, seniors are more likely to seek regular medical check-ups and preventive care. This not only enhances their quality of life but also reduces the overall strain on the healthcare system.

As we journey to the heart of Georgia, where the Chattahoochee River flows and the cotton fields sway in the breeze, we find that Medigap plans are more than just insurance policies. They are a testament to Georgia’s commitment to its seniors, a reflection of the state’s belief in the dignity and worth of every individual. They are a promise that Georgia’s seniors will not be left behind in the pursuit of quality healthcare.

In the end, Medigap plans in Georgia are like the state’s iconic Southern magnolias – strong, resilient, and ever-present. They stand tall in the face of challenges, providing a canopy of coverage and care for Georgia’s seniors. They are an integral part of Georgia’s healthcare system, filling in the gaps and ensuring that every Georgian, regardless of age, has access to the healthcare they need and deserve. And that, indeed, is as sweet as a Georgia peach.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

FAQs about Medigap Plans in Georgia

In the heart of the South, where peaches are sweeter and hospitality is a way of life, Georgia residents are discovering the benefits of Medigap plans. These plans, also known as Medicare Supplement Insurance, are a beacon of hope, a lifeline for those navigating the often complex world of healthcare. They offer a sense of security, a promise of coverage where traditional Medicare may fall short.

You may be wondering, “What exactly is a Medigap plan?” Picture this: you’re on a journey, traveling down the winding road of life. Medicare is your vehicle, providing the basic coverage you need to keep moving forward. But what happens when you encounter a pothole, an unexpected expense that Medicare doesn’t cover? That’s where Medigap comes in. It’s the spare tire in your trunk, the extra coverage that helps you navigate those bumps in the road.

Now, you might be asking, “How does a Medigap plan work in Georgia?” Just like the state’s famous peaches, Medigap plans in Georgia are ripe with options. There are ten standardized plans available, labeled A through N. Each plan offers a different level of coverage, allowing you to choose the one that best fits your needs. It’s like picking the perfect peach from a Georgia orchard; you have the freedom to choose the one that’s just right for you.

“But what about the cost?” you might be thinking. The cost of Medigap plans in Georgia can vary, much like the price of peaches can fluctuate based on the season. Factors such as the plan you choose, your age, and your health can all affect the price. However, investing in a Medigap plan can provide priceless peace of mind, knowing that you’re covered for those unexpected healthcare costs.

You may also be curious, “When can I enroll in a Medigap plan?” In Georgia, the best time to enroll is during your Medigap Open Enrollment Period. This six-month period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. It’s like the harvest season for peaches; it’s the ideal time to pick your plan.

“But what if I have pre-existing conditions?” you might be concerned. Fear not. During your Medigap Open Enrollment Period, you have guaranteed issue rights. This means that insurance companies can’t refuse to sell you a Medigap policy, charge you more because of health problems, or make you wait for coverage to start, except in some cases for pre-existing conditions.

Lastly, you might be wondering, “Can I switch Medigap plans?” In Georgia, you have the freedom to switch plans, much like you can switch from a peach cobbler to a peach pie. However, outside of your Medigap Open Enrollment Period, you may not have guaranteed issue rights, and you may have to go through medical underwriting.

In the end, Medigap plans in Georgia offer a sense of security, a promise of coverage where traditional Medicare may fall short. They’re the spare tire on your journey, the perfect peach in your basket. So, as you navigate the winding road of life, remember that Medigap is there to help you along the way.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What is a Medigap plan in Georgia?

Answer: A Medigap plan in Georgia is a supplemental insurance policy that helps cover the costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

2. Question: How many Medigap plans are available in Georgia?

Answer: In Georgia, there are 10 standardized Medigap plans available, labeled A, B, C, D, F, G, K, L, M, and N.

3. Question: When can I enroll in a Medigap plan in Georgia?

Answer: The best time to enroll in a Medigap plan in Georgia is during your Medigap Open Enrollment Period, which starts the first month you’re 65 or older and enrolled in Medicare Part B.

4. Question: Can I switch Medigap plans in Georgia?

Answer: Yes, you can switch Medigap plans in Georgia, but you may have to go through medical underwriting and your acceptance is not guaranteed.

5. Question: Are prescription drugs covered under Medigap plans in Georgia?

Answer: No, prescription drugs are not covered under Medigap plans in Georgia. You would need to enroll in a separate Medicare Part D plan for prescription drug coverage.

6. Question: Do all doctors accept Medigap insurance in Georgia?

Answer: Any doctor that accepts Medicare will accept Medigap insurance in Georgia.

7. Question: How much does a Medigap plan cost in Georgia?

Answer: The cost of a Medigap plan in Georgia can vary based on the plan type, the insurance company, your age, and your health status. It can range from around $50 to over $300 per month.

8. Question: Can I have both a Medigap plan and a Medicare Advantage plan in Georgia?

Answer: No, it’s illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you’re switching back to Original Medicare.

9. Question: What is the most popular Medigap plan in Georgia?

Answer: Plan F is the most popular Medigap plan in Georgia because it offers the most comprehensive coverage.

10. Question: Are there any high-deductible Medigap plans available in Georgia?

Answer: Yes, high-deductible options are available for Medigap Plans F and G in Georgia.