“Securing Your Health: Medigap Guaranteed Issue States – Your Right to Coverage, Regardless of Health Status.”

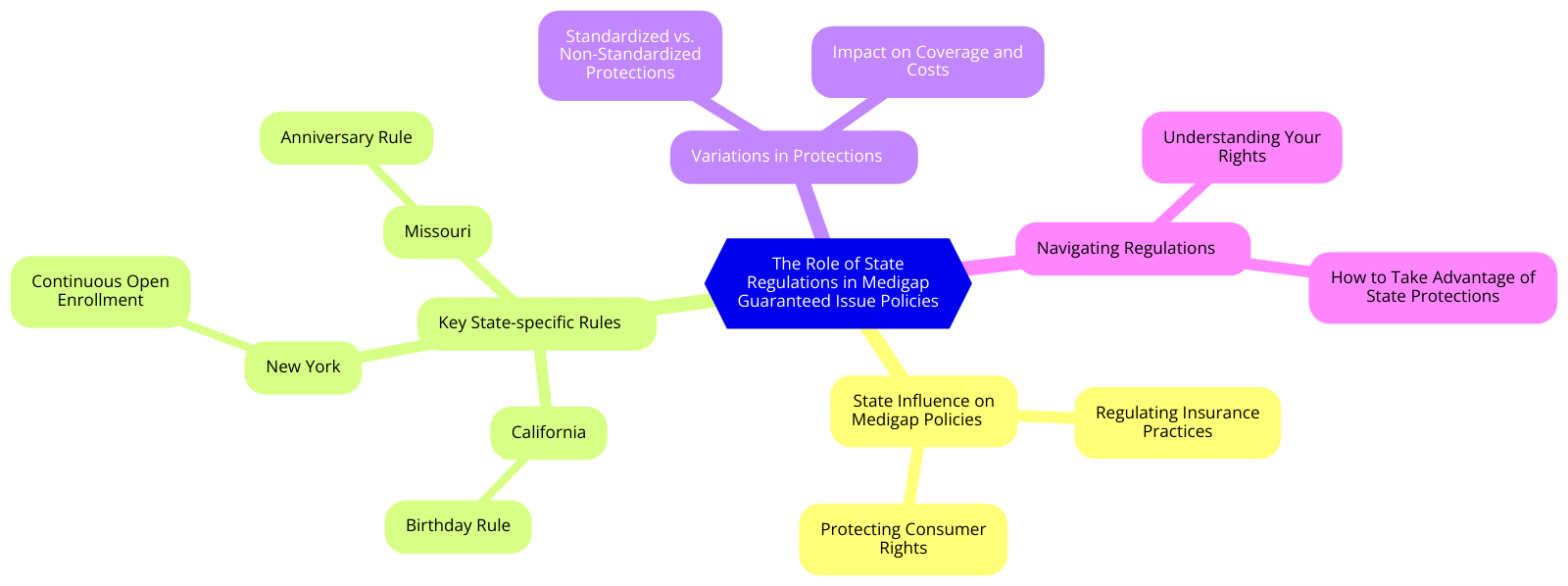

Understanding Medigap Guaranteed Issue Rights in Different States

Medigap, a beacon of hope for many, is a supplemental insurance policy that works in tandem with Medicare to cover costs that Medicare alone does not. It’s a lifeline, a safety net, a comforting reassurance that when health issues arise, you won’t be left floundering in a sea of medical bills. But what happens when you move to a different state? Does your Medigap coverage move with you? The answer lies in understanding Medigap guaranteed issue rights, a topic that can seem as vast and varied as the states themselves.

Imagine you’re a kite, soaring high above the ground, your string firmly anchored in the hands of Medigap. No matter how the winds of health issues buffet you, you’re secure, knowing that Medigap has you tethered. But what if you want to fly your kite in a different state? Will Medigap still hold your string? The answer is a resounding yes. Medigap is a federally regulated program, which means that it’s available in all 50 states. However, the specifics of what is covered can vary from state to state, and this is where guaranteed issue rights come into play.

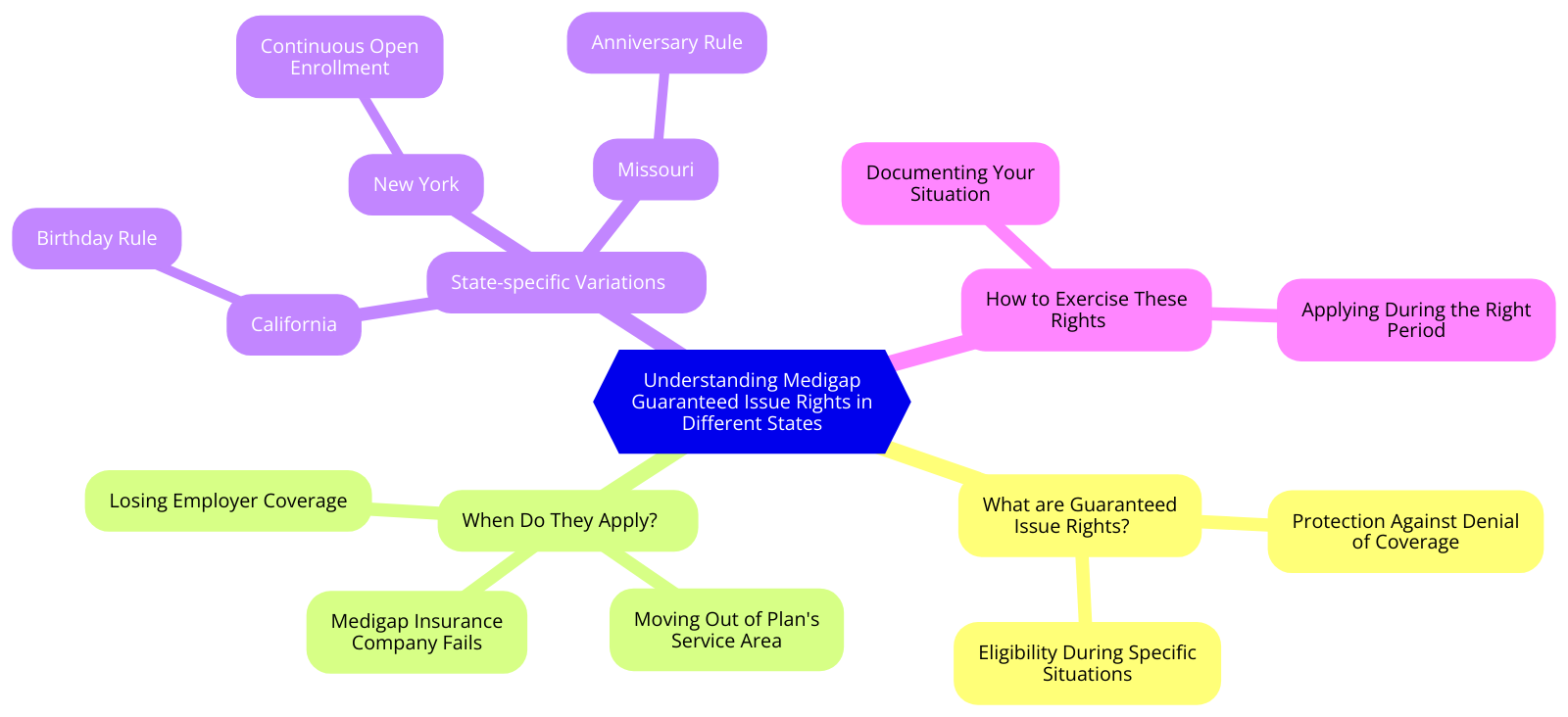

Guaranteed issue rights, also known as Medigap protections, are rights you have in certain situations when insurance companies must offer you certain Medigap policies. In these situations, an insurance company must sell you a Medigap policy, must cover all your pre-existing health conditions, and can’t charge you more for a policy because of past or present health problems. It’s like a golden ticket, a key that unlocks the door to comprehensive health coverage.

However, like a kaleidoscope, the landscape of these rights can shift and change depending on the state. Some states, like California and Oregon, have additional guaranteed issue rights. These states have what’s known as a “birthday rule,” which allows policyholders to switch to a like kind policy within 30 days of their birthday each year without underwriting. It’s a gift, a yearly opportunity to reassess and adjust your coverage as needed.

On the other hand, states like New York and Connecticut have continuous open enrollment and guaranteed issue for Medigap policies. This means that you can purchase a Medigap policy at any time, regardless of your health status. It’s a promise of constant availability, a reassurance that no matter when you need it, Medigap will be there.

But what about states that don’t have these additional protections? Fear not, for the federal guaranteed issue rights still apply. These rights kick in during specific situations, such as if you lose your health coverage, if you join a Medicare Advantage Plan and it’s your first year, or if your Medigap insurance company goes bankrupt. In these situations, you’re protected, your kite still securely tethered.

Understanding Medigap guaranteed issue rights in different states can seem like navigating a labyrinth, but it doesn’t have to be. With knowledge comes power, the power to understand your rights, to make informed decisions about your health coverage, and to fly your kite with confidence, no matter where in the country you may be. Medigap, with its guaranteed issue rights, is more than just an insurance policy. It’s a promise, a commitment, a steadfast assurance that when health issues arise, you won’t be left to face them alone.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

A Comprehensive Guide to Medigap Guaranteed Issue States

Medigap, a supplemental insurance policy that works in tandem with Medicare, is a beacon of hope for many seniors across the United States. It fills the gaps left by Medicare, covering costs such as copayments, coinsurance, and deductibles. However, the availability and accessibility of Medigap policies can vary from state to state. This is where the concept of Medigap Guaranteed Issue States comes into play, a concept that is as intriguing as it is vital for seniors seeking comprehensive healthcare coverage.

Imagine a world where you could access the healthcare you need without worrying about pre-existing conditions or age-related exclusions. This is not a utopian dream, but a reality in Medigap Guaranteed Issue States. In these states, insurance companies are required by law to offer Medigap policies to all Medicare beneficiaries, regardless of their health status. This means that even if you have a chronic illness or are of advanced age, you are still entitled to the same coverage as anyone else. It’s a testament to the power of legislation in creating a more equitable healthcare landscape.

The journey to understanding Medigap Guaranteed Issue States begins with the realization that not all states are created equal when it comes to healthcare. Some states have adopted the guaranteed issue rights for Medigap policies, while others have not. However, the beauty of this system lies in its potential for change. As more states recognize the importance of providing comprehensive healthcare coverage to all seniors, the number of Medigap Guaranteed Issue States continues to grow. It’s a movement that is gaining momentum, fueled by the belief that everyone deserves access to quality healthcare.

Navigating the world of Medigap policies can be a daunting task, but the rewards are well worth the effort. In Medigap Guaranteed Issue States, seniors can rest easy knowing that they are protected against the financial burden of unexpected healthcare costs. It’s a safety net that provides peace of mind, allowing seniors to focus on what truly matters: enjoying their golden years.

But the benefits of Medigap Guaranteed Issue States extend beyond the individual. They also have a profound impact on the broader community. By ensuring that all seniors have access to comprehensive healthcare coverage, these states are fostering a healthier, happier population. It’s a ripple effect that touches every corner of society, from reducing the strain on public healthcare resources to promoting a more inclusive and equitable healthcare system.

The story of Medigap Guaranteed Issue States is one of progress and hope. It’s a testament to the power of policy in shaping a better future for all. As more states join the ranks of Medigap Guaranteed Issue States, the dream of universal healthcare coverage becomes a little closer to reality. It’s a journey that we are all a part of, and one that inspires us to continue striving for a world where everyone has access to the healthcare they need.

In conclusion, Medigap Guaranteed Issue States are a beacon of hope in the complex world of healthcare. They represent a future where access to comprehensive healthcare coverage is not a privilege, but a right. It’s a future that we can all look forward to, and one that is worth fighting for. So, let’s continue to champion the cause of Medigap Guaranteed Issue States, because together, we can make a difference.

The Role of State Regulations in Medigap Guaranteed Issue Policies

In the grand tapestry of life, health is the golden thread that weaves together our experiences, dreams, and aspirations. It is the cornerstone of our existence, the foundation upon which we build our lives. Yet, as we age, the thread may fray, and the foundation may crack. It is in these moments that we turn to the safety net of health insurance, and more specifically, to the comforting embrace of Medigap policies.

Medigap, as the name suggests, fills in the gaps left by Medicare, providing coverage for out-of-pocket costs such as deductibles, co-payments, and coinsurance. However, the availability and terms of these policies can vary greatly from state to state, painting a complex landscape of health insurance regulations. This is where the concept of Medigap Guaranteed Issue States comes into play, a beacon of hope in the often confusing world of health insurance.

In the realm of insurance, the term “guaranteed issue” is akin to a promise, a pledge that an insurance company will offer a policy to any eligible applicant, regardless of their health status or pre-existing conditions. It is a powerful concept, one that can provide a lifeline to those in need. However, the application of this principle is not uniform across the United States. Instead, it is shaped by the unique regulations of each state, creating a patchwork of policies that can either empower or limit individuals in their quest for comprehensive health coverage.

In some states, the promise of guaranteed issue is a constant, unwavering presence. These states have chosen to extend the Medigap open enrollment period, a six-month window that begins when a person is both 65 or older and enrolled in Medicare Part B. During this period, insurance companies are required to sell Medigap policies to all applicants, regardless of their health status. By extending this period, these states have created an environment of inclusivity and accessibility, ensuring that their residents have ample opportunity to secure the coverage they need.

However, not all states have chosen this path. In others, the promise of guaranteed issue is more fleeting, available only during the Medigap open enrollment period or under specific circumstances, such as the loss of certain types of health coverage. In these states, the quest for Medigap coverage can be more challenging, requiring individuals to navigate a more restrictive landscape.

Yet, even in the face of these challenges, there is hope. The variability of state regulations underscores the importance of being informed, of understanding the unique insurance landscape of your state. It is a call to action, a reminder that knowledge is power. By understanding the regulations of your state, you can plan accordingly, ensuring that you are prepared to secure the coverage you need when the time comes.

In the end, the role of state regulations in Medigap Guaranteed Issue policies is a testament to the power of policy, a reflection of the profound impact that legislation can have on our lives. It is a reminder that, while the thread of health may fray and the foundation may crack, there are systems in place to provide support. And in this knowledge, there is comfort, there is hope, and there is the promise of a healthier future.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Navigating Medigap Guaranteed Issue Rights in Your State

Medigap, a supplemental insurance policy that works in tandem with Medicare, is a beacon of hope for many seniors across the United States. It fills in the gaps left by Medicare, covering costs such as copayments, coinsurance, and deductibles. However, the process of obtaining a Medigap policy can sometimes feel like navigating a labyrinth, especially when it comes to understanding your guaranteed issue rights. These rights are your safety net, ensuring that you can secure a Medigap policy even when health issues might otherwise make it difficult.

Imagine standing at the edge of a vast, beautiful landscape. This is your journey into understanding Medigap guaranteed issue rights. It’s a journey that begins with understanding that these rights vary from state to state. Some states, like New York and Connecticut, offer year-round guaranteed issue rights. This means that no matter when you apply for a Medigap policy, you’re guaranteed to get one, regardless of your health status. It’s like having an open invitation to explore this landscape at any time, knowing you’ll always have a safety net.

However, not all states offer this year-round security. In most states, guaranteed issue rights are triggered by specific situations, such as losing your health coverage or your Medigap insurance company going bankrupt. It’s like having a map with specific paths you must follow to reach your destination. But even in these states, once your guaranteed issue rights are triggered, insurance companies cannot deny you a Medigap policy, charge you more because of health problems, or impose a waiting period for coverage to start.

Now, imagine standing at a crossroads in this landscape. One path leads to a state with year-round guaranteed issue rights, the other to a state with conditional rights. Both paths lead to the same destination: the security of having a Medigap policy. But the journey can be smoother and less stressful if you understand the rules of the landscape.

The key to navigating this landscape is knowledge. It’s about knowing your state’s rules and understanding when and how your guaranteed issue rights can be triggered. It’s about being prepared, so when the time comes to apply for a Medigap policy, you can do so with confidence, knowing that you’re protected.

But remember, this journey isn’t just about reaching a destination. It’s about the journey itself. It’s about understanding the complexities of Medigap and guaranteed issue rights, and using that knowledge to secure your future. It’s about standing at the edge of this vast landscape, knowing that you have the power to navigate it successfully.

So, take a deep breath and step forward. Embrace the journey. Learn about your state’s rules, understand your guaranteed issue rights, and secure your Medigap policy. This is your journey, and you have the power to navigate it successfully.

In the end, understanding Medigap guaranteed issue rights is like holding a compass in this vast landscape. It guides you, gives you direction, and ensures that no matter where you are, you can always find your way. It’s a journey filled with complexities, but also with hope and security. And with knowledge as your compass, you can navigate this landscape with confidence, knowing that you’re protected.

So, embark on this journey. Explore the landscape of Medigap guaranteed issue rights. And remember, no matter where you are in this journey, you’re never alone. You have your guaranteed issue rights as your safety net, and knowledge as your compass. And with these in hand, you can navigate any landscape with confidence and security.

How Medigap Guaranteed Issue Varies Across States

In the grand tapestry of American healthcare, there exists a vibrant thread known as Medigap. This supplemental insurance, designed to fill in the gaps left by Medicare, is a beacon of hope for many seniors navigating the often complex world of medical coverage. However, like the diverse landscapes that make up our great nation, the rules and regulations surrounding Medigap vary from state to state, creating a patchwork quilt of coverage that can be as beautiful as it is bewildering.

Imagine, if you will, standing on the precipice of a new chapter in your life. You’ve worked hard, you’ve saved, and now it’s time to enjoy the fruits of your labor. But as you step into the golden years of retirement, you’re faced with a new challenge: understanding your healthcare options. This is where Medigap comes in, offering a safety net for those unexpected medical costs that Medicare doesn’t cover.

Yet, as you journey from the rocky coastlines of Maine to the sun-kissed beaches of California, you’ll find that Medigap isn’t a one-size-fits-all solution. Instead, it’s a symphony of different notes, each state playing its own unique melody. This is due to the concept of “guaranteed issue,” a term that refers to your right to purchase a Medigap policy regardless of your health status.

In some states, like New York and Connecticut, the melody is sweet and constant. These states offer guaranteed issue year-round, meaning you can purchase a Medigap policy at any time, regardless of your health. This is a comforting refrain, offering peace of mind to those who fear being denied coverage due to pre-existing conditions.

However, as you move across the country, the tune changes. In most states, guaranteed issue is only available during specific periods, such as when you first enroll in Medicare Part B or if you lose certain types of health coverage. This can feel like a crescendo of confusion, but it’s important to remember that even in these states, there are protections in place to ensure you’re not left without coverage.

Then there are states like Massachusetts, Minnesota, and Wisconsin, which dance to their own beat entirely. These states have their own versions of Medigap, with different rules and regulations. It’s a solo performance that stands out from the rest, highlighting the diversity and complexity of our healthcare system.

Navigating this landscape can feel like traversing a vast and varied terrain, but it’s a journey worth taking. Understanding the nuances of Medigap and the concept of guaranteed issue can empower you to make informed decisions about your healthcare, ensuring you’re covered no matter where life takes you.

So, as you stand on the precipice of this new chapter, take a moment to marvel at the patchwork quilt of Medigap coverage. It’s a testament to our nation’s diversity, a reflection of our commitment to healthcare, and a beacon of hope in the often confusing world of medical insurance. Yes, the melody may change from state to state, but the song remains the same: a song of protection, of security, and of the peace of mind that comes from knowing you’re covered.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Impact of State Laws on Medigap Guaranteed Issue Rights

In the grand tapestry of life, health is the golden thread that weaves together our experiences, dreams, and aspirations. It is the cornerstone of our existence, the foundation upon which we build our lives. Yet, as we age, the thread may fray, and the need for additional healthcare support becomes increasingly apparent. This is where Medigap, a supplemental insurance policy designed to cover the gaps in Medicare, comes into play. However, the accessibility and availability of Medigap policies are not uniform across the United States. They are influenced by state laws, creating a patchwork quilt of coverage that can either empower or limit an individual’s healthcare choices.

Imagine a river, flowing freely, its course determined by the landscape it traverses. Similarly, the course of Medigap policies is shaped by the terrain of state laws, creating a unique healthcare landscape in each state. Some states, like New York and Connecticut, are like wide, open plains where the river flows freely all year round. These states have continuous open enrollment periods for Medigap policies, meaning that residents can purchase a policy at any time, regardless of their health status. This is a testament to the power of state laws in shaping healthcare accessibility, providing a lifeline to those who need it most.

On the other hand, some states are akin to narrow canyons, where the river’s flow is restricted. In these states, the open enrollment period for Medigap policies is limited to six months following the enrollee’s 65th birthday. After this period, insurance companies can use medical underwriting to determine eligibility and premiums, potentially limiting access to those with pre-existing conditions. This is where the concept of Medigap guaranteed issue rights comes into play.

Guaranteed issue rights, also known as Medigap protections, are federal rights that ensure you can purchase a Medigap policy even if you have health problems. These rights are like a sturdy bridge, allowing you to cross the river regardless of how narrow or treacherous the canyon may be. However, the strength and length of this bridge are again determined by state laws. Some states extend these rights beyond the federal requirements, offering additional protections to their residents.

For instance, states like California and Oregon have a birthday rule, which allows residents to switch to a different Medigap policy within 30 days of their birthday each year without medical underwriting. This rule is like a yearly extension of the bridge, providing residents with the opportunity to reassess their healthcare needs and make changes accordingly.

In contrast, states like Missouri have a unique anniversary rule, which allows residents to switch to a like kind Medigap policy on the anniversary of their current policy’s start date. This rule is like an annual maintenance check, ensuring the bridge remains sturdy and reliable year after year.

In the end, the impact of state laws on Medigap guaranteed issue rights is profound. They shape the healthcare landscape, determining the course of the river and the strength of the bridge. They can either widen the path to healthcare accessibility or narrow it down, either extend the bridge of guaranteed issue rights or limit its reach. Therefore, it is essential to understand these laws and their implications, to navigate the healthcare landscape effectively. After all, health is the golden thread of our lives, and we must do all we can to ensure it remains strong and vibrant, just like the river that flows freely across the open plains.

Key Differences in Medigap Guaranteed Issue Policies Across States

Medigap, a beacon of hope for many seniors, is a supplemental insurance policy that works in tandem with Medicare to cover costs that Medicare does not. It’s a lifeline, a safety net, a comforting reassurance that when health issues arise, financial ruin won’t follow. However, the availability and rules of Medigap policies can vary from state to state, creating a patchwork quilt of coverage across the nation. This article will explore the key differences in Medigap guaranteed issue policies across states, painting a picture of the diverse landscape of healthcare in America.

Imagine you’re standing on the shores of the Atlantic Ocean in sunny Florida, a state known for its large population of retirees. Here, insurance companies are required to offer Medigap policies to people under 65 who are enrolled in Medicare due to disability. This is a ray of sunshine for those who need it most, providing a safety net for those who are often most vulnerable to high healthcare costs.

Now, let’s journey to the heartland of America, to the rolling plains of Kansas. Here, the rules are different. Kansas does not require insurance companies to offer Medigap to people under 65. This means that younger people with disabilities may find themselves without the safety net that their peers in Florida enjoy. It’s a stark reminder of the disparities that exist in our healthcare system.

As we continue our journey westward, we arrive in the Golden State of California. Here, the sun shines brightly on a unique rule known as the “birthday rule”. This rule allows Californians to switch Medigap policies within 30 days of their birthday each year without medical underwriting. This is a gift that keeps on giving, allowing people to adjust their coverage as their health needs change.

Finally, let’s venture to the rugged beauty of Alaska. Here, amidst the towering mountains and pristine wilderness, we find a state that does not require insurance companies to offer Medigap policies at all. This leaves Alaskans to navigate the treacherous terrain of healthcare costs on their own, a daunting task for even the hardiest of souls.

These examples illustrate the vast differences in Medigap guaranteed issue policies across states. They highlight the need for a comprehensive understanding of the rules and regulations in your own state. It’s a journey of discovery, a quest for knowledge that can empower you to make the best decisions for your health and your wallet.

But amidst these differences, there is a common thread that binds us all. It’s the universal desire for security, for the peace of mind that comes from knowing that when health issues arise, we won’t be left to face them alone. It’s the hope that Medigap provides, a beacon of light in the often murky waters of healthcare.

So, let’s continue to explore, to question, to learn. Let’s strive to understand the landscape of Medigap guaranteed issue policies in our own states and across the nation. Because knowledge is power, and with power comes the ability to navigate the healthcare system with confidence and grace. And isn’t that a journey worth taking?

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

State-by-State Analysis of Medigap Guaranteed Issue Rights

In the grand tapestry of American healthcare, there exists a vibrant thread known as Medigap. This supplemental insurance, designed to fill the gaps left by Medicare, is a beacon of hope for many seniors navigating the often complex world of medical coverage. However, the availability and accessibility of Medigap policies can vary greatly from state to state. This is where the concept of Medigap Guaranteed Issue Rights comes into play, a shining star guiding those in need towards comprehensive healthcare coverage.

Imagine a quilt, each patch representing a different state, each with its unique pattern of Medigap Guaranteed Issue Rights. Some states, like California and Oregon, have a year-round open enrollment period for Medigap, offering a continuous opportunity for Medicare beneficiaries to secure supplemental coverage. These states are like the vibrant, colorful patches on the quilt, offering warmth and comfort to their residents through their generous policies.

Then there are states like New York and Connecticut, where Medigap policies are guaranteed issue all year round, regardless of any pre-existing conditions. These states are akin to the sturdy, reliable patches on the quilt, providing a sense of security and peace of mind to their residents. In these states, the light of Medigap shines brightly, illuminating the path to comprehensive healthcare coverage for all Medicare beneficiaries.

However, not all patches on this quilt are as vibrant or sturdy. In many states, Medigap policies are only guaranteed issue during a six-month open enrollment period that begins when you turn 65 and enroll in Medicare Part B. Outside of this period, insurance companies can use medical underwriting to determine your eligibility and premiums. These states, like the more muted, fragile patches on the quilt, offer less certainty and protection to their residents.

Despite these differences, the quilt remains a unified whole, each patch contributing to the overall picture of Medigap coverage in the United States. The variations in Medigap Guaranteed Issue Rights from state to state serve as a reminder of the diversity and complexity of American healthcare. Yet, they also highlight the importance of understanding your rights and options when it comes to securing the best possible healthcare coverage.

The journey through the landscape of Medigap can be daunting, filled with unfamiliar terms and complex regulations. But remember, every journey begins with a single step. And in this case, that step is understanding your Medigap Guaranteed Issue Rights. Whether you live in a state with year-round open enrollment, guaranteed issue regardless of pre-existing conditions, or limited open enrollment periods, knowing your rights is the first step towards securing the coverage you need.

So, as you navigate the intricate quilt of Medigap coverage, let the concept of Guaranteed Issue Rights be your guiding star. Let it inspire you to take control of your healthcare journey, to seek out the coverage you need, and to advocate for your rights as a Medicare beneficiary. After all, every patch on the quilt, no matter how vibrant or muted, contributes to the overall picture. And every Medicare beneficiary, no matter their state of residence, deserves access to comprehensive, affordable healthcare coverage.

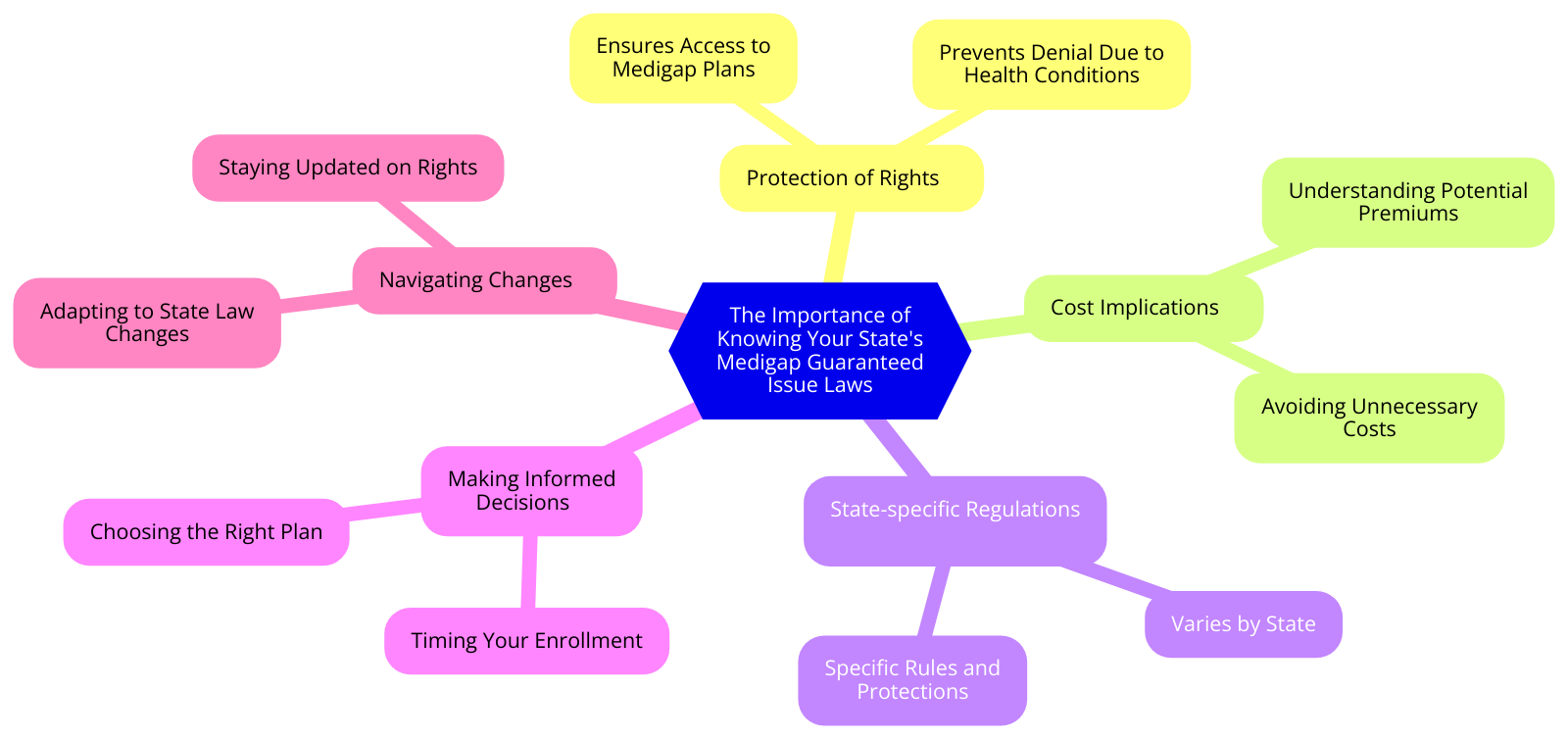

The Importance of Knowing Your State’s Medigap Guaranteed Issue Laws

In the grand tapestry of life, health is the golden thread that weaves together our experiences, dreams, and aspirations. It is the silent partner in our journey, often overlooked until it demands our attention. As we age, the importance of health becomes more pronounced, and the need for comprehensive health coverage becomes paramount. This is where Medigap, a supplemental insurance policy designed to cover the gaps in Medicare, comes into play. However, the rules and regulations surrounding Medigap can vary from state to state, particularly when it comes to guaranteed issue rights. Understanding your state’s Medigap guaranteed issue laws is not just a matter of legal compliance; it’s a matter of safeguarding your health and your future.

Imagine standing at the edge of a vast, beautiful landscape. The horizon stretches out before you, filled with possibilities. This is your life, your journey. Now, imagine that journey with the peace of mind that comes from knowing you have comprehensive health coverage. That’s the power of Medigap. But like any journey, there are rules to follow, paths to take, and signs to read. The Medigap guaranteed issue laws are those signs, guiding you towards the right coverage at the right time.

Medigap guaranteed issue rights, also known as Medigap protections, are federal laws that protect you when you apply for a Medigap policy. These laws ensure that you can’t be denied a policy or charged more due to health problems if you apply during your Medigap open enrollment period. However, states can also establish their own Medigap laws, providing additional protections beyond those offered at the federal level. This is where the importance of knowing your state’s Medigap guaranteed issue laws comes into focus.

Each state is like a unique piece of a puzzle, offering its own set of rules and regulations. Some states may offer additional Medigap protections, while others may have different timelines for when you can apply for a policy. For instance, in some states, you may have guaranteed issue rights even outside of your open enrollment period under certain circumstances. In others, you may be able to switch Medigap policies without medical underwriting during specific times of the year.

Understanding these laws is like having a compass in your hand, guiding you through the complex landscape of health insurance. It empowers you to make informed decisions about your health coverage, ensuring that you can access the care you need when you need it. It’s about standing strong in the face of uncertainty, knowing that you have the tools and knowledge to navigate any challenges that come your way.

But it’s not just about understanding the laws; it’s about embracing them. It’s about seeing them not as obstacles, but as stepping stones towards a healthier, more secure future. It’s about recognizing the power of knowledge and using it to light your path forward.

So, as you embark on your journey towards comprehensive health coverage, remember the importance of knowing your state’s Medigap guaranteed issue laws. Let them be your guide, your compass, your beacon of hope in the complex world of health insurance. Because when it comes to your health, knowledge is more than power; it’s peace of mind. And with that peace of mind, you can focus on what truly matters: living your life to the fullest, exploring the vast landscape of possibilities that lie before you, and weaving together a tapestry of experiences that is uniquely yours.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

A Closer Look at Medigap Guaranteed Issue Policies in Each State

Medigap, a beacon of hope for many seniors, is a supplemental insurance policy that fills in the gaps left by Medicare. It covers costs that Medicare doesn’t, such as copayments, coinsurance, and deductibles. But the real magic of Medigap lies in its guaranteed issue rights. These rights, like a protective shield, ensure that insurance companies cannot deny you a Medigap policy or charge you more due to pre-existing health conditions. However, the availability and rules of these guaranteed issue rights can vary from state to state, painting a diverse landscape of Medigap policies across the nation.

In the golden state of California, the sun shines brightly on Medigap policyholders. The state offers a unique “birthday rule,” allowing policyholders to switch to a similar or lesser Medigap policy within 30 days of their birthday each year, without any medical underwriting. This rule, like a yearly gift, provides Californians with the flexibility to adjust their coverage as their health needs change.

Moving eastward, the Empire State of New York stands tall with its continuous open enrollment for Medigap policies. This means that New Yorkers can apply for a Medigap policy at any time during the year, without having to wait for an enrollment period. This continuous open enrollment, like the city that never sleeps, ensures that New Yorkers always have access to the supplemental coverage they need.

In the heartland, the state of Missouri offers a unique “anniversary rule.” Similar to California’s birthday rule, this rule allows Missourians to switch to a similar or lesser Medigap policy on the anniversary of their current policy’s start date. This rule, like a yearly celebration, provides Missourians with the opportunity to reassess their coverage and make necessary changes.

Down south, the Lone Star State of Texas shines with its protections for disabled individuals under the age of 65. While federal law only requires guaranteed issue rights for individuals aged 65 and older, Texas extends these rights to younger individuals with disabilities. This extension, like a helping hand, ensures that all Texans, regardless of age or health status, have access to the supplemental coverage they need.

On the east coast, the state of Connecticut stands out with its continuous open enrollment for Medigap policies, similar to New York. This means that Connecticut residents can apply for a Medigap policy at any time during the year, without having to wait for an enrollment period. This continuous open enrollment, like a lighthouse guiding ships to safe harbor, ensures that Connecticut residents always have access to the supplemental coverage they need.

In the grand scheme of things, these state-specific rules and protections paint a picture of a nation committed to ensuring that its seniors have access to the healthcare they need. They serve as a testament to the power of state governments to shape healthcare policy in a way that meets the unique needs of their residents. And they serve as a reminder that, no matter where you live, there is a Medigap policy out there that can provide you with the coverage you need. So, as you navigate the complex world of Medicare and Medigap, remember that you are not alone. There are protections in place to ensure that you can access the coverage you need, when you need it. And that, in itself, is something truly inspirational.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Q: What is Medigap Guaranteed Issue?

A: Medigap Guaranteed Issue is a right provided by federal law that ensures you can buy a Medigap policy under certain circumstances, such as losing other health coverage, without being denied due to any pre-existing conditions.

2. Q: What are Medigap Guaranteed Issue States?

A: Medigap Guaranteed Issue States are those states in the U.S. that have laws or regulations that allow you to buy a Medigap policy outside of your Medigap Open Enrollment Period or certain guaranteed issue rights.

3. Q: How many states have Medigap Guaranteed Issue laws?

A: There are four states with year-round Medigap guaranteed issue laws: Connecticut, Massachusetts, Maine, and New York.

4. Q: What is the benefit of living in a Medigap Guaranteed Issue State?

A: The benefit of living in a Medigap Guaranteed Issue State is that you can buy a Medigap policy at any time, regardless of your health status.

5. Q: Can insurance companies charge more for Medigap policies in Guaranteed Issue States?

A: No, insurance companies cannot charge more for Medigap policies based on health status in Guaranteed Issue States.

6. Q: What happens if I move out of a Medigap Guaranteed Issue State?

A: If you move out of a Medigap Guaranteed Issue State, you may lose your guaranteed issue rights and may be subject to medical underwriting for a new Medigap policy.

7. Q: Are there specific Medigap plans available in Guaranteed Issue States?

A: Yes, in Guaranteed Issue States, insurance companies must sell you a Medigap Plan A, B, C, F, K, or L that’s available in your state.

8. Q: Can I switch Medigap plans in a Guaranteed Issue State?

A: Yes, in Guaranteed Issue States, you can switch Medigap plans at any time, regardless of your health status.

9. Q: What is the Medigap Open Enrollment Period?

A: The Medigap Open Enrollment Period is a six-month period that starts the month you’re 65 or older and enrolled in Medicare Part B. During this period, you have a guaranteed right to buy any Medigap policy sold in your state.

10. Q: What happens if I miss my Medigap Open Enrollment Period and I don’t live in a Guaranteed Issue State?

A: If you miss your Medigap Open Enrollment Period and don’t live in a Guaranteed Issue State, you may be subject to medical underwriting and could be denied a Medigap policy based on your health status.