“California’s Key to Comprehensive Health Coverage: Medicare Supplement Plans”

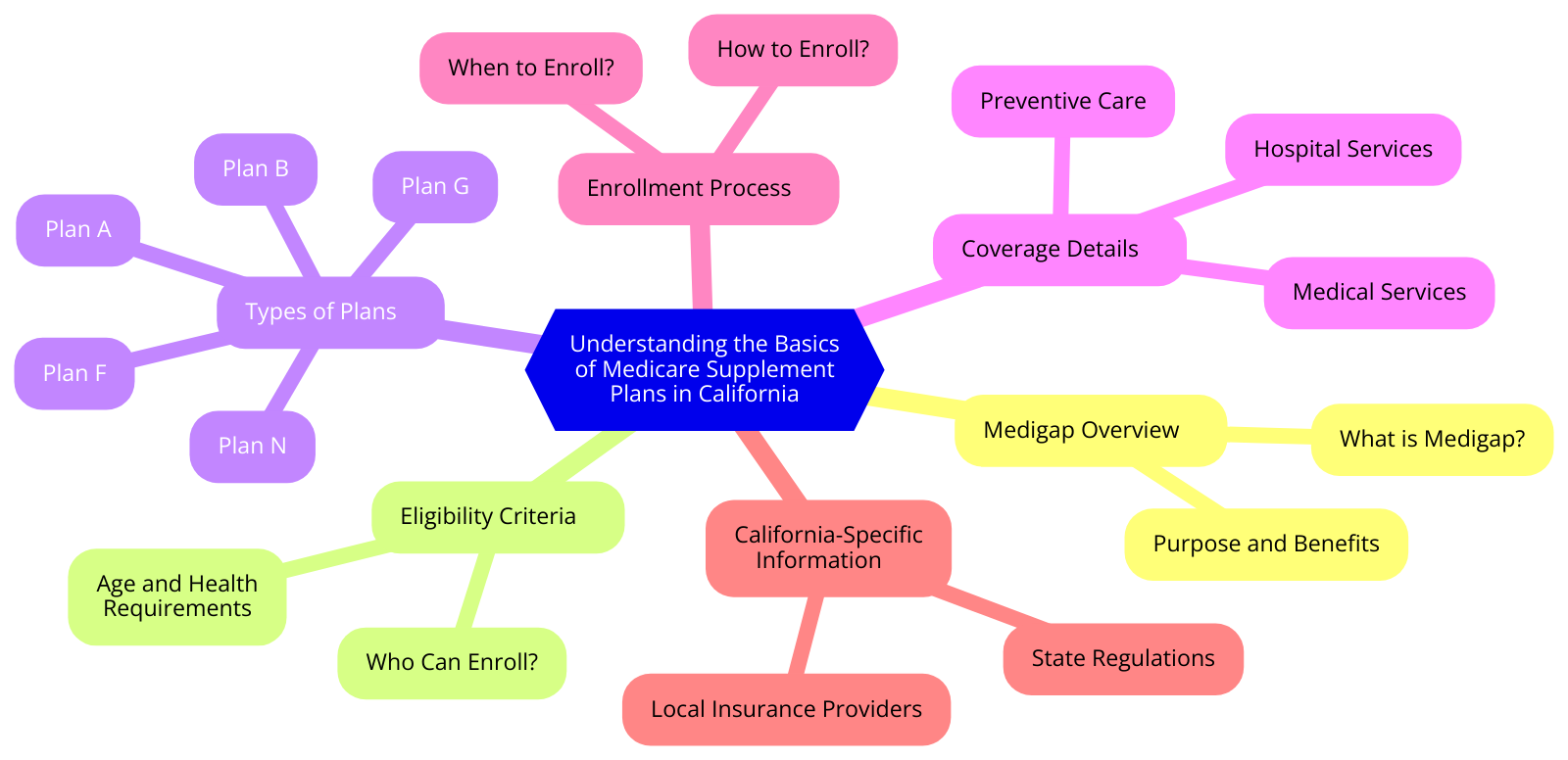

Understanding the Basics of Medicare Supplement Plans in California

In the golden state of California, where the sun shines brightly and the Pacific Ocean waves crash against the shore, the topic of healthcare may not be the first thing that comes to mind. However, as we age, the importance of understanding our healthcare options becomes increasingly paramount. One such option is Medicare Supplement Plans, a beacon of hope in the often confusing world of health insurance.

Medicare Supplement Plans, also known as Medigap, are policies designed to fill in the “gaps” left by Original Medicare. Picture it as a safety net, catching those unexpected healthcare costs that can often leave us feeling financially vulnerable. It’s like the lifeguard watching over you as you surf the waves of the California coast, ready to step in when you need it most.

Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), covers a significant portion of your healthcare costs. However, it doesn’t cover everything. That’s where Medicare Supplement Plans come in, covering those out-of-pocket costs such as copayments, coinsurance, and deductibles. It’s like having an extra layer of sunscreen, protecting you from the unexpected burns of healthcare costs.

In California, there are ten standardized Medicare Supplement Plans, labeled A through N. Each plan offers a different level of coverage, but all provide the basic benefits of covering Part A hospital coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. It’s like having a variety of surfboards to choose from, each designed to ride the waves of healthcare costs in a way that best suits your needs.

One unique feature of California’s Medicare Supplement Plans is the “birthday rule.” This rule allows you to switch to a different Medigap plan of equal or lesser benefits within 30 days of your birthday each year, without any medical underwriting. It’s like getting a birthday gift each year, offering you the flexibility to adjust your coverage as your healthcare needs change.

Choosing a Medicare Supplement Plan in California is an important decision, and it’s essential to consider your healthcare needs, budget, and lifestyle. It’s like choosing the perfect beach to spend your day, considering factors such as the size of the waves, the temperature of the water, and the proximity to your home.

In the end, Medicare Supplement Plans offer Californians peace of mind, knowing they have additional coverage when they need it most. It’s like watching the sunset over the Pacific Ocean, feeling a sense of calm and tranquility as the day comes to a close.

So, as you navigate the golden years of your life in the golden state, consider the benefits of a Medicare Supplement Plan. It’s an investment in your health, offering you the freedom to enjoy all that California has to offer without the worry of unexpected healthcare costs. It’s like riding the perfect wave, feeling the exhilaration of the ride and the peace of knowing you’re protected.

In the world of healthcare, Medicare Supplement Plans are the golden ticket, offering Californians a brighter, healthier future. So, dive in, explore your options, and find the plan that’s right for you. After all, in California, the possibilities are as endless as the Pacific Ocean.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Top 10 Providers of Medicare Supplement Plans in California

In the golden state of California, where the sun shines brightly and the Pacific Ocean waves dance to the rhythm of life, the health of its residents is a top priority. The state is home to a diverse population, many of whom are seniors who have contributed significantly to the growth and development of this beautiful region. As they age, their healthcare needs become more complex, and Medicare Supplement Plans, also known as Medigap, step in to fill the gaps left by traditional Medicare coverage. Let’s embark on a journey to discover the top 10 providers of Medicare Supplement Plans in California, each offering a unique blend of benefits designed to meet the diverse needs of its residents.

Our journey begins with UnitedHealthcare, a trusted name in the healthcare industry. UnitedHealthcare offers a variety of Medigap plans, each designed to provide comprehensive coverage that complements your existing Medicare benefits. Their commitment to customer service and extensive network of healthcare providers make them a popular choice among Californians.

Next, we encounter AARP, an organization dedicated to empowering people to choose how they live as they age. Their Medicare Supplement Plans, insured by UnitedHealthcare, offer a range of benefits designed to give seniors the peace of mind they deserve.

As we continue our journey, we come across Mutual of Omaha, a company with a rich history of serving the healthcare needs of seniors. Their Medigap plans are known for their affordability and comprehensive coverage, making them a favorite among many Californians.

Our journey then takes us to Blue Shield of California, a not-for-profit health plan dedicated to providing Californians with access to high-quality healthcare. Their Medigap plans are designed to provide coverage that complements your existing Medicare benefits, ensuring that you have the coverage you need when you need it most.

Next, we encounter Cigna, a global health service company dedicated to improving the health, well-being, and peace of mind of those they serve. Their Medigap plans offer a range of benefits designed to meet the diverse needs of Californians.

As we continue our journey, we come across Aetna, a company with a long history of providing healthcare solutions. Their Medigap plans are known for their comprehensive coverage and commitment to customer service.

Our journey then takes us to Humana, a company dedicated to helping people achieve their best health. Their Medigap plans are designed to provide the coverage you need to maintain your health and well-being.

Next, we encounter Anthem, a trusted health insurance plan provider. Their Medigap plans offer a range of benefits designed to meet the diverse needs of Californians.

As we near the end of our journey, we come across Health Net, a company dedicated to transforming the health of the community, one person at a time. Their Medigap plans are known for their comprehensive coverage and commitment to customer service.

Finally, we arrive at our last stop, Kaiser Permanente, a company dedicated to improving the health of their members and the communities they serve. Their Medigap plans offer a range of benefits designed to meet the diverse needs of Californians.

In the golden state of California, where the sun sets over the Pacific Ocean and the stars twinkle in the clear night sky, the health of its residents remains a top priority. These top 10 providers of Medicare Supplement Plans in California are committed to ensuring that seniors have the coverage they need to live their golden years in health and happiness.

How to Choose the Right Medicare Supplement Plan in California

In the golden state of California, where the sun shines brightly and the Pacific Ocean waves dance to the rhythm of life, the health of its residents is a priority. As the years pass, the need for a comprehensive health care plan becomes more apparent. This is where Medicare Supplement Plans, also known as Medigap, come into play. These plans are designed to fill in the gaps left by Original Medicare, ensuring that Californians can continue to enjoy the vibrant life they love. But with so many options available, how does one choose the right Medicare Supplement Plan in California?

Imagine standing on the shores of the Pacific, the waves lapping at your feet, each one different from the last, just like the myriad of Medicare Supplement Plans available. The first step in choosing the right plan is understanding your needs. Just as you would choose a beach based on whether you want to surf, sunbathe, or build sandcastles, you should choose a plan based on your health care needs. Do you visit the doctor often? Do you require frequent medical tests or procedures? Do you travel outside the U.S.? These are all questions to consider when evaluating your needs.

Once you’ve identified your needs, it’s time to dive into the details of the plans. Like the intricate patterns in a seashell, each plan has its unique features. There are ten standardized Medicare Supplement Plans in California, labeled A through N. Each plan offers a different level of coverage, with Plan A providing the least and Plan F providing the most. It’s important to compare these plans side by side, just as you would compare seashells on the beach, to see which one best fits your needs.

Now, let’s take a moment to appreciate the beauty of California’s landscapes, from the towering redwoods to the sprawling vineyards. Just as these landscapes vary in price, so do Medicare Supplement Plans. Cost is a significant factor in choosing the right plan. While Plan F might offer the most coverage, it also comes with a higher price tag. It’s essential to balance your need for coverage with your budget, just as you would balance a day of wine tasting in Napa with a hike in Yosemite.

Finally, just as the golden poppy stands out among California’s wildflowers, the reputation of the insurance company stands out among the factors to consider when choosing a plan. It’s important to choose a company that is reliable and has a history of good customer service. Just as you would trust a seasoned surfer to teach you how to ride the waves, you should trust a reputable insurance company to handle your health care needs.

Choosing the right Medicare Supplement Plan in California is like planning the perfect California adventure. It requires understanding your needs, comparing your options, considering your budget, and trusting in a reputable company. But with careful consideration and a little bit of that California spirit, you can find a plan that allows you to continue living the vibrant, active life you love. So, go ahead, dive into the world of Medicare Supplement Plans, and find the one that’s just right for you. After all, in the golden state of California, life is a beach, and your health is the sunshine that makes it sparkle.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Cost of Medicare Supplement Plans in California

In the golden state of California, where the sun kisses the Pacific and the redwoods reach for the stars, the topic of healthcare often takes center stage. Among the many options available, Medicare Supplement Plans, also known as Medigap, offer a beacon of hope for those seeking comprehensive coverage. These plans, designed to fill the gaps left by traditional Medicare, are a testament to the belief that everyone deserves access to quality healthcare, regardless of age or circumstance.

As the sun sets over the Pacific, painting the sky with hues of orange and pink, one might wonder about the cost of such comprehensive coverage. The answer, like the California coastline, is both beautiful and complex. The cost of Medicare Supplement Plans in California varies, much like the state’s diverse landscapes, from the sandy beaches of San Diego to the snow-capped peaks of the Sierra Nevada.

The price of these plans is influenced by a multitude of factors. Age, location, and health status all play a role in determining the cost. Just as the waves shape the shoreline, these factors shape the cost of your Medicare Supplement Plan. However, despite these variables, the promise of comprehensive coverage remains constant, like the steady rhythm of the Pacific’s tide.

In California, the average monthly premium for a Medicare Supplement Plan can range from around $100 to over $200. This cost, while significant, pales in comparison to the peace of mind that comes with knowing you’re covered. It’s the reassurance that, like the enduring strength of the redwoods, your health coverage will stand firm in the face of adversity.

Yet, the cost of these plans is not just measured in dollars and cents. It’s also measured in the freedom they provide. The freedom to choose your doctors. The freedom to seek treatment at the hospital of your choice. The freedom to live your golden years on your own terms. This freedom, like the California sun, is priceless.

Moreover, the cost of a Medicare Supplement Plan is also an investment. An investment in your health, in your future, and in your peace of mind. It’s an investment that, like the fertile soil of the Napa Valley, can yield a bountiful harvest. A harvest of health, happiness, and the freedom to enjoy all that California has to offer.

In the end, the cost of Medicare Supplement Plans in California is more than just a number. It’s a testament to the value we place on health and well-being. It’s a reflection of our commitment to ensuring that everyone, from the sandy shores of the Pacific to the towering peaks of the Sierra Nevada, has access to the healthcare they need.

So, as the sun dips below the horizon and the stars begin to twinkle in the California sky, remember this: The cost of a Medicare Supplement Plan is not just an expense. It’s an investment in your health, your freedom, and your future. It’s a commitment to living your golden years in the golden state to the fullest. And that, dear reader, is truly priceless.

Benefits of Enrolling in a Medicare Supplement Plan in California

In the golden state of California, where the sun shines brightly and the Pacific Ocean waves dance to the rhythm of life, the health and well-being of its residents are of paramount importance. The state, known for its vibrant lifestyle and diverse culture, is also home to a significant number of seniors who have contributed immensely to its growth and prosperity. As they bask in the glory of their golden years, it is essential that they have access to comprehensive healthcare coverage. This is where Medicare Supplement Plans, also known as Medigap, come into play, offering a myriad of benefits that ensure peace of mind and financial security.

Imagine a life where you don’t have to worry about unexpected medical costs or the stress of navigating through complex healthcare systems. That’s the promise of Medicare Supplement Plans. These plans are designed to fill in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. This means that you can focus on what truly matters – your health and happiness, rather than fretting over medical bills.

In the land of dreams and opportunities, California offers a wide array of Medicare Supplement Plans, each tailored to meet the unique needs of its residents. Whether you frequently visit the doctor or have a chronic condition, there’s a plan designed just for you. The beauty of these plans lies in their flexibility and adaptability. You have the freedom to choose a plan that best fits your health needs and budget, ensuring that you receive the care you deserve without breaking the bank.

But the benefits of enrolling in a Medicare Supplement Plan in California extend beyond financial protection. These plans offer nationwide coverage, allowing you to seek treatment from any doctor or hospital in the United States that accepts Medicare. This means that whether you’re soaking up the sun on the beaches of Santa Monica or exploring the majestic Yosemite National Park, you can rest assured knowing that you’re covered.

Moreover, these plans offer guaranteed renewability. Regardless of any changes in your health status, your policy cannot be canceled as long as you continue to pay the premiums. This offers a sense of security and stability, knowing that your coverage will remain intact even as you navigate the unpredictable journey of life.

Enrolling in a Medicare Supplement Plan in California also means that you have access to a wealth of resources and support. From personalized assistance in understanding your coverage options to guidance in managing your healthcare costs, you’re never alone in your journey towards health and wellness.

In the grand tapestry of life, health is the thread that weaves together our stories, experiences, and dreams. It is the foundation upon which we build our lives, the canvas upon which we paint our futures. And in the golden state of California, where dreams take flight and possibilities are endless, Medicare Supplement Plans offer the assurance of comprehensive healthcare coverage, the promise of financial security, and the freedom to live life on your own terms.

So, as you embark on the journey of your golden years, remember that your health is your wealth. Embrace the benefits of enrolling in a Medicare Supplement Plan in California, and let it be your guiding light, illuminating the path towards a future filled with health, happiness, and peace of mind. After all, you’ve earned it.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Comparing Different Medicare Supplement Plans in California

In the golden state of California, where the sun kisses the Pacific and the redwoods reach for the sky, the health of its residents is a priority that shines as brightly as the stars in Hollywood. The state is home to a diverse population of seniors who, like the state itself, are vibrant and full of life. To ensure they continue to enjoy the golden years in good health, it’s essential to understand the importance of Medicare Supplement Plans.

Medicare Supplement Plans, also known as Medigap, are like the lifeguards of your health, standing by to rescue you from unexpected healthcare costs that could otherwise pull you under. They fill in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. In California, there are several different Medigap plans available, each offering a unique set of benefits to cater to the diverse needs of its senior population.

Imagine, if you will, a beautiful California vineyard. Each row of grapes represents a different Medicare Supplement Plan, each with its unique flavor and character. Just as a sommelier would guide you in choosing the perfect wine, let’s navigate through the vineyard of Medigap plans to find the one that suits your palate the best.

Plan A, the first row in our vineyard, is the most basic of all the plans. It covers your Part A hospital coinsurance and provides an additional 365 days of coverage after Medicare benefits are exhausted. It’s like a crisp, light white wine – simple, yet essential.

Moving on to Plan B, it adds coverage for your Part A deductible to the benefits of Plan A. It’s like a slightly more complex Chardonnay, offering a bit more depth and coverage.

Plan C, like a full-bodied Cabernet Sauvignon, offers a more comprehensive coverage. It includes everything from Plans A and B, plus coverage for your Part B deductible, skilled nursing facility care coinsurance, and even emergency health care when you travel outside the U.S.

Plan F, the Merlot of our vineyard, is the most comprehensive of all the plans. It covers all the gaps left by Original Medicare, including Part B excess charges, which are the extra charges from doctors who do not accept Medicare as full payment. It’s like a rich, complex Merlot that leaves no stone unturned.

Finally, we have Plan N, the Pinot Noir of our vineyard. It offers similar coverage to Plan F, but with a lower premium in exchange for a small copayment for some office visits and emergency room visits. It’s like a Pinot Noir – lighter than a Merlot, but still full of character.

Just as you would savor each sip of wine, take the time to consider each Medicare Supplement Plan. Think about your healthcare needs, your budget, and your lifestyle. Remember, the best plan for you is not necessarily the most expensive or the most comprehensive, but the one that fits your needs the best.

In the end, choosing a Medicare Supplement Plan in California is about ensuring that you can continue to enjoy the golden years in the golden state, with the peace of mind that comes from knowing you’re covered. So, raise a glass to your health, and here’s to finding the perfect Medigap plan that lets you live your best life.

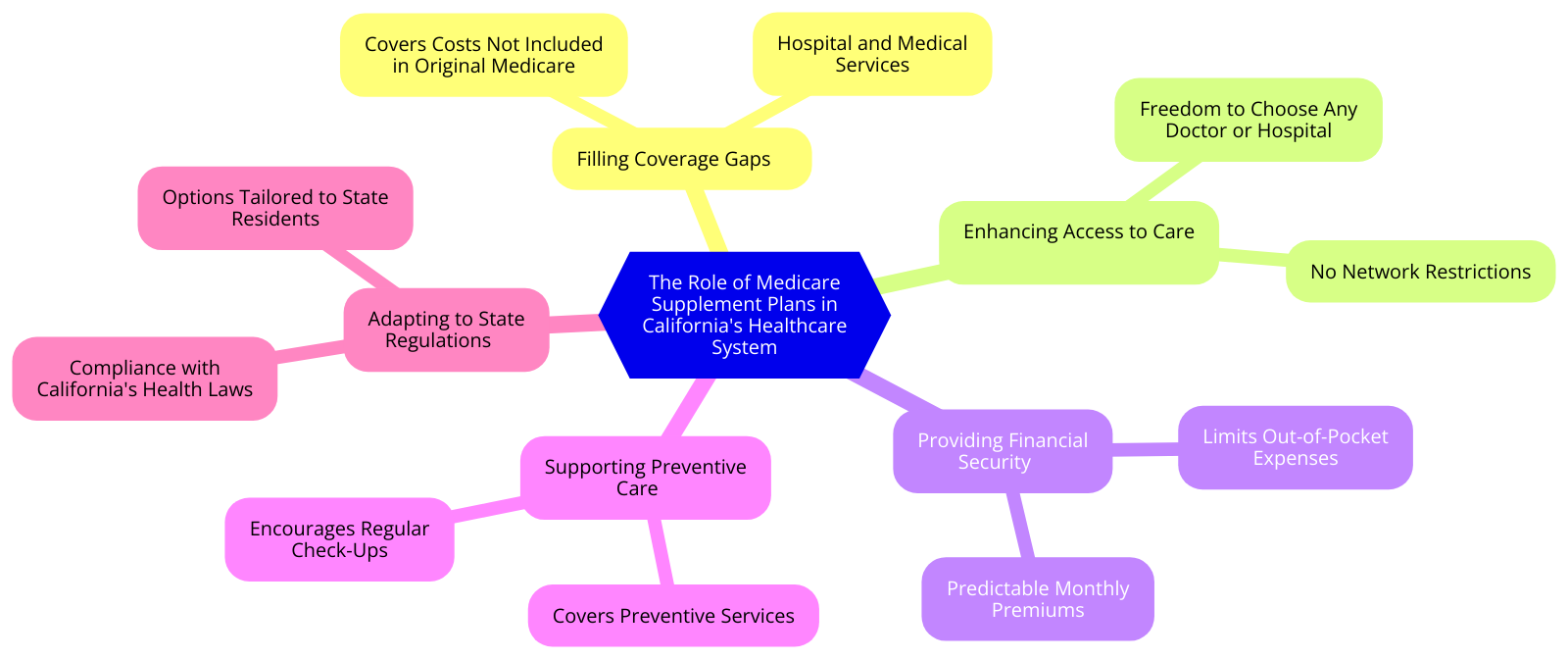

The Role of Medicare Supplement Plans in California’s Healthcare System

In the golden state of California, where the sun kisses the Pacific and the redwoods reach for the sky, healthcare is more than just a necessity. It’s a testament to the state’s commitment to the well-being of its residents, a promise of care and support in times of need. At the heart of this commitment lies Medicare, a federal program designed to provide health insurance for individuals aged 65 and older. But like the sun setting over the Pacific, Medicare alone often falls short of covering all the healthcare needs of Californians. This is where Medicare Supplement Plans, also known as Medigap, come into play, filling in the gaps and ensuring that no Californian is left without the care they need.

Medicare Supplement Plans in California are like the state’s iconic lifeguards, standing ready to dive in when the waves of medical expenses threaten to pull you under. They are designed to cover costs not covered by traditional Medicare, such as copayments, coinsurance, and deductibles. These plans are the safety net, catching those who might otherwise fall through the cracks of the healthcare system.

In the vast landscape of California’s healthcare system, Medicare Supplement Plans are the bridges that connect individuals to comprehensive care. They ensure that the journey to health is not hindered by financial obstacles, allowing Californians to focus on what truly matters – their recovery and well-being. These plans are the golden thread woven into the fabric of California’s healthcare system, strengthening its structure and enhancing its ability to serve its residents.

But the role of Medicare Supplement Plans in California’s healthcare system extends beyond just financial coverage. They also provide peace of mind, a priceless commodity in times of health crises. Knowing that unexpected medical costs will be covered can alleviate stress and anxiety, allowing individuals to focus their energy on healing and recovery. In this way, Medicare Supplement Plans contribute not only to the physical health of Californians but also to their mental and emotional well-being.

Moreover, these plans embody the spirit of choice and flexibility that is so characteristic of California. With ten different plans to choose from, each offering a unique combination of benefits, Californians have the freedom to select the plan that best fits their needs and lifestyle. This diversity of options reflects the diversity of California itself, a state that celebrates individuality and personal freedom.

In the grand tapestry of California’s healthcare system, Medicare Supplement Plans are the vibrant threads that add depth and richness. They are the silent heroes, stepping in when Medicare falls short, ensuring that every Californian, regardless of their age or health status, has access to the care they need. They are the embodiment of California’s commitment to its residents, a testament to the state’s belief in the right to health and well-being.

In the end, Medicare Supplement Plans are more than just insurance policies. They are a promise, a pledge of support, a beacon of hope in the often tumultuous sea of healthcare. They are a reflection of California’s spirit, a state that is always striving, always reaching for the stars, always seeking to provide the best for its residents. And in the golden state of California, where dreams are nurtured and possibilities are endless, that is a promise worth holding onto.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Eligibility Criteria for Medicare Supplement Plans in California

In the golden state of California, where the sun shines brightly and the Pacific Ocean waves kiss the sandy shores, the health of its residents is a top priority. The state is home to a diverse population, including a significant number of seniors who have contributed immensely to its growth and development. As these individuals age, their healthcare needs become more complex and demanding. To address this, California offers Medicare Supplement Plans, also known as Medigap, a beacon of hope for those seeking comprehensive healthcare coverage.

Medicare Supplement Plans in California are designed to fill the gaps left by Original Medicare, covering costs such as copayments, coinsurance, and deductibles. These plans are a lifeline for many, providing peace of mind and financial security in times of health uncertainties. However, to access these plans, there are certain eligibility criteria that must be met, a journey that we will embark on together.

The first step on this journey is age. In California, you must be 65 years or older to qualify for a Medicare Supplement Plan. This age requirement is a reflection of the state’s commitment to ensuring that its senior citizens have access to quality healthcare. However, there are exceptions to this rule. Individuals under 65 can qualify if they have certain disabilities or end-stage renal disease. This inclusivity ensures that even the most vulnerable among us are not left behind.

The second step on this journey is enrollment in Medicare Part A and Part B. These are the foundation upon which Medicare Supplement Plans are built. Part A covers hospital insurance while Part B covers medical insurance. Together, they form the cornerstone of your healthcare coverage, providing a safety net that Medicare Supplement Plans can then expand upon.

The third step on this journey is residency. To be eligible for a Medicare Supplement Plan in California, you must be a resident of the state. This requirement ensures that the benefits of these plans are enjoyed by those who call California home. Whether you’re a lifelong resident or a recent transplant, if you’ve chosen to make California your home, the state is committed to taking care of your health.

The final step on this journey is timing. There’s a specific window of opportunity for enrolling in a Medicare Supplement Plan. This period begins on the first day of the month in which you turn 65 and lasts for six months. During this time, you have a guaranteed right to buy any Medicare Supplement Plan sold in California, regardless of your health status. This period is a golden opportunity, a chance to secure your health future without fear of rejection or increased premiums due to health conditions.

Navigating the eligibility criteria for Medicare Supplement Plans in California may seem like a daunting task, but it’s a journey worth taking. These plans offer a lifeline, a safety net, and a promise – the promise of comprehensive healthcare coverage in your golden years. They are a testament to California’s commitment to its residents, a commitment that says, “We care about your health, and we’re here to support you.” So, take that first step on your journey today. The sun is shining brightly, the Pacific Ocean is calling, and a healthier future awaits you in California.

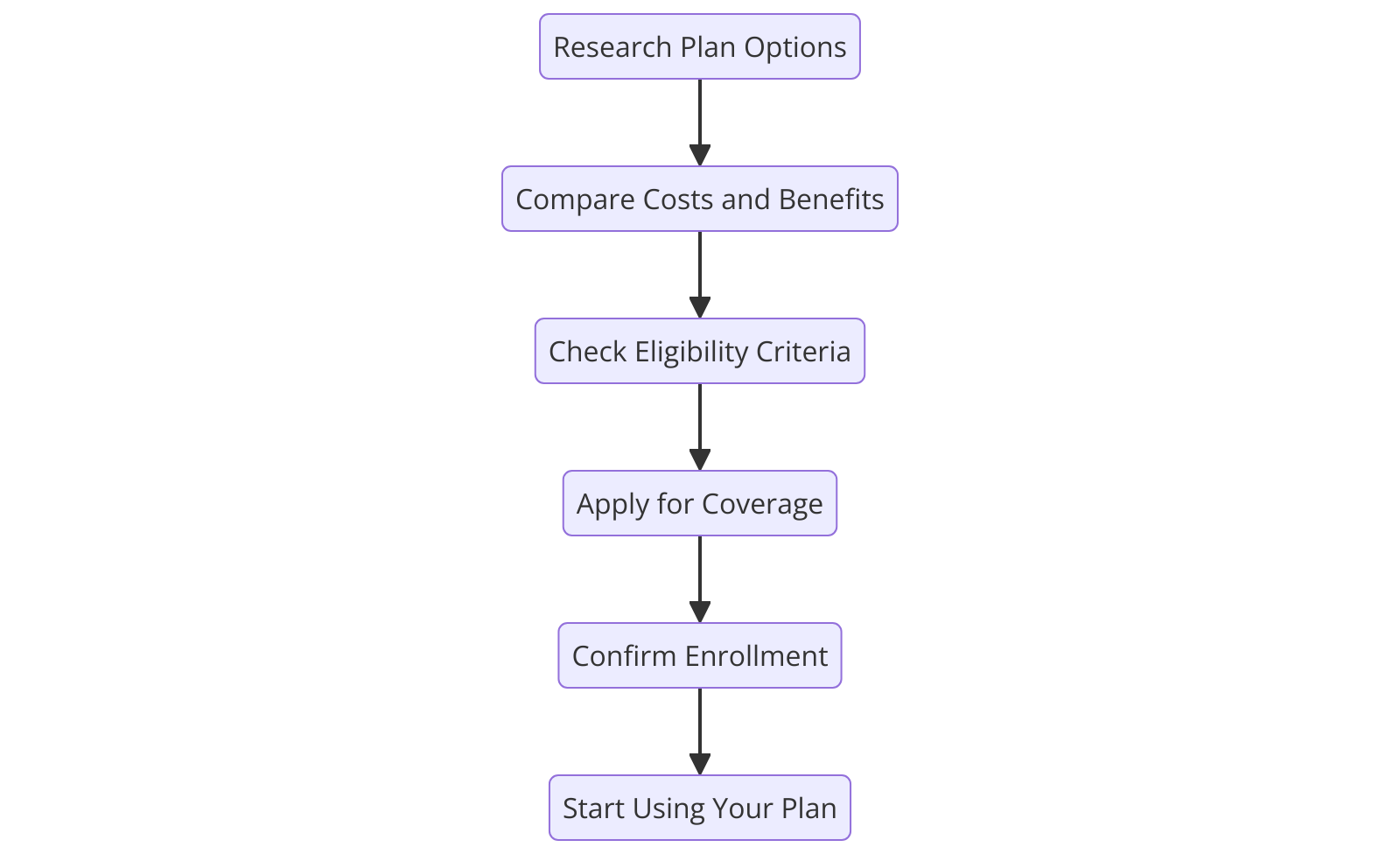

Navigating the Enrollment Process for Medicare Supplement Plans in California

In the golden state of California, where the sun shines brightly and the Pacific Ocean waves dance to the rhythm of life, the journey of aging is a beautiful testament to a life well-lived. As we age, our needs evolve, and one of the most significant changes is the need for comprehensive healthcare coverage. Medicare, the federal health insurance program, provides a safety net for many seniors. However, it doesn’t cover everything. That’s where Medicare Supplement Plans, also known as Medigap, come into play. These plans fill in the gaps left by Medicare, ensuring that Californians can continue to enjoy their golden years without worrying about unexpected medical costs.

Navigating the enrollment process for Medicare Supplement Plans in California can seem like a daunting task, akin to finding your way through the labyrinthine streets of San Francisco. But fear not, for just as the city’s iconic cable cars provide a reliable guide through its hilly terrain, so too can a clear understanding of the enrollment process illuminate the path to securing a Medicare Supplement Plan.

The journey begins when you first become eligible for Medicare, typically at the age of 65. This is when the initial enrollment period opens, a seven-month window that includes the three months before your 65th birthday, your birthday month, and the three months following. This is your golden opportunity to enroll in a Medicare Supplement Plan without facing medical underwriting or being denied coverage due to pre-existing conditions.

As you embark on this journey, it’s important to remember that Medicare Supplement Plans are standardized across the nation, including in California. This means that each plan offers the same basic benefits, regardless of the insurance company providing it. However, the premiums can vary from one company to another. It’s like shopping for avocados at different farmers’ markets; the quality is the same, but the prices can differ.

Once you’ve chosen a plan that suits your needs, the next step is to fill out an application. This process is as straightforward as a drive down the Pacific Coast Highway, with clear signs guiding you along the way. You’ll need to provide some basic information, such as your Medicare number and the date your Part A and/or Part B coverage began.

After submitting your application, you’ll need to wait for approval. This period can feel like the suspenseful pause before the curtain rises at a Hollywood premiere. But rest assured, most applications are approved within a few weeks. Once approved, your coverage will begin, and you can rest easy knowing that you’re protected against unexpected medical costs.

Navigating the enrollment process for Medicare Supplement Plans in California is a journey, but it’s one that you don’t have to undertake alone. There are numerous resources available to guide you, from the California Department of Insurance to independent insurance agents.

In the end, securing a Medicare Supplement Plan is about more than just healthcare coverage. It’s about peace of mind. It’s about knowing that you can continue to enjoy all that California has to offer, from the sun-kissed beaches of San Diego to the towering redwoods of Northern California, without worrying about unexpected medical costs. It’s about embracing the golden years with confidence and joy, secure in the knowledge that you’re covered. So embark on this journey with optimism and determination, for the destination is well worth the journey.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Changes in Medicare Supplement Plans in California for 2022

As the sun rises on a new year, it brings with it a fresh wave of changes, opportunities, and possibilities. Among these changes are the modifications to the Medicare Supplement Plans in California for 2022. These changes, like the shifting tides of the Pacific, are designed to better serve the needs of the Golden State’s seniors, providing them with the healthcare coverage they need to live their golden years in health and happiness.

The Medicare Supplement Plans, also known as Medigap, are a beacon of hope for many seniors, illuminating the path to affordable healthcare. They bridge the gap left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. However, like the majestic redwoods of California, these plans are not static. They grow and evolve, adapting to the changing needs of the population they serve.

In 2022, the landscape of Medicare Supplement Plans in California is set to transform, like the breathtaking metamorphosis of a caterpillar into a butterfly. One of the most significant changes is the discontinuation of Plan F for new enrollees. Once the most comprehensive plan, Plan F covered all out-of-pocket costs, allowing seniors to access healthcare without financial worry. However, like the setting sun, its time has come to an end for new beneficiaries. Those who were eligible for Medicare before 2020 can still enroll in Plan F, but for those who became eligible after, Plan G is the new horizon.

Plan G, like the golden poppy, is now blooming as the most comprehensive plan for new enrollees. It offers similar benefits to Plan F, covering all out-of-pocket costs except for the Part B deductible. This change is like a gentle sea breeze, subtly shifting the sands but leaving the beach just as beautiful and inviting.

Another change in the 2022 Medicare Supplement Plans in California is the introduction of a high-deductible version of Plan G. This plan, like the mighty Sierra Nevada, stands tall with its high deductible, offering lower premiums in return. It’s a testament to the diversity of California, providing another option for those who prefer to pay a higher deductible for lower monthly costs.

The changes in the Medicare Supplement Plans in California for 2022 are a reflection of the state’s dynamic spirit. They embody the constant evolution of the Golden State, always striving to provide better, more tailored options for its residents. These changes, like the rolling waves of the Pacific, may seem daunting at first, but they bring with them a promise of better days ahead.

As we embrace these changes, let us remember that they are designed with the best interests of California’s seniors in mind. They are a testament to the state’s commitment to providing affordable, comprehensive healthcare for all its residents. So, as we stand on the brink of this new year, let us welcome these changes with open arms, confident in the knowledge that they will help us navigate the journey to better health.

In the end, the changes to the Medicare Supplement Plans in California for 2022 are like a new sunrise, bringing with it a fresh start, new opportunities, and the promise of a brighter, healthier future. So, let’s step into this new day with hope in our hearts and a spring in our steps, ready to embrace the changes that lie ahead.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What are Medicare Supplement Plans in California?

Answer: Medicare Supplement Plans in California, also known as Medigap, are insurance policies that help cover the costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

2. Question: How many Medicare Supplement Plans are available in California?

Answer: In California, there are 10 standardized Medicare Supplement Plans available, labeled A, B, C, D, F, G, K, L, M, and N.

3. Question: Can anyone in California apply for a Medicare Supplement Plan?

Answer: Yes, anyone in California who is enrolled in Medicare Part A and Part B can apply for a Medicare Supplement Plan.

4. Question: When is the best time to enroll in a Medicare Supplement Plan in California?

Answer: The best time to enroll is during the Medigap Open Enrollment Period, which starts the month you’re 65 or older and enrolled in Medicare Part B.

5. Question: Are Medicare Supplement Plans in California standardized?

Answer: Yes, all Medicare Supplement Plans in California are standardized, meaning each plan of the same letter offers the same basic benefits, regardless of the insurance company.

6. Question: How much do Medicare Supplement Plans in California cost?

Answer: The cost of Medicare Supplement Plans in California varies depending on the plan and the insurance company. It can range from around $100 to over $200 per month.

7. Question: Does every insurance company in California offer all 10 Medicare Supplement Plans?

Answer: No, not every insurance company in California offers all 10 Medicare Supplement Plans. The plans they offer may vary.

8. Question: Can I switch my Medicare Supplement Plan in California?

Answer: Yes, you can switch your Medicare Supplement Plan in California, but you may have to go through medical underwriting and your application could be denied based on your health.

9. Question: What is the “birthday rule” in California for Medicare Supplement Plans?

Answer: The “birthday rule” in California allows Medicare beneficiaries to switch to a similar or lesser Medicare Supplement Plan within 30 days of their birthday each year without medical underwriting.

10. Question: Are prescription drugs covered under Medicare Supplement Plans in California?

Answer: No, prescription drugs are not covered under Medicare Supplement Plans in California. For prescription drug coverage, you would need to enroll in a separate Medicare Part D plan.