When planning for your Medicare needs in 2025, one term you’re likely to encounter is Medicare Part D Creditable Coverage. But what does it mean, and why is it important for your healthcare coverage? Let’s dive in to explain everything you need to know to avoid potential pitfalls—and maybe a headache or two!

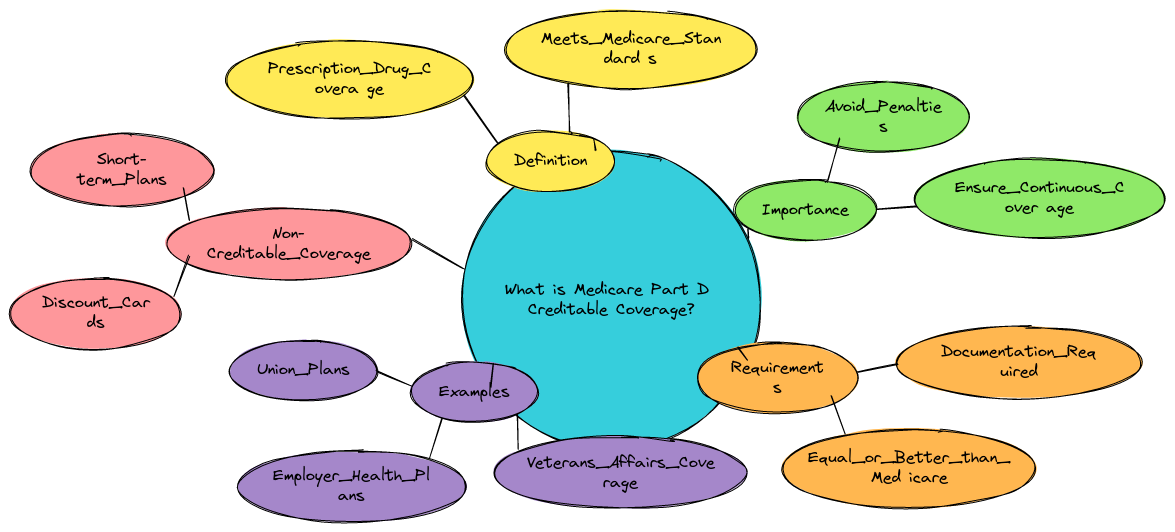

What is Medicare Part D Creditable Coverage?

In simple terms, Medicare Part D Creditable Coverage refers to any prescription drug coverage that is expected to pay at least as much as Medicare’s standard plan. Sounds easy, right? If your plan is deemed “creditable,” you won’t face late enrollment penalties when you decide to sign up for Medicare Part D later on.

Why Does Creditable Coverage Matter?

If you’re like most people, you don’t want to pay more than you have to. That’s where creditable coverage comes in handy. If you already have drug coverage—say from an employer or union plan—and that coverage is deemed creditable, you can delay enrolling in Part D without racking up penalties. But if your current drug coverage doesn’t meet Medicare’s creditable standards and you decide to wait too long, brace yourself for penalties that will follow you like that gym membership you forgot to cancel.

“I always tell my clients that understanding whether or not your drug plan is creditable is like knowing when to stop eating at an all-you-can-eat buffet. If you don’t pay attention, you might end up paying for it later.”

– Henry Beltran, Owner of Medicare Advisors Insurance Group LLC

How Do You Know If Your Coverage Is Creditable?

By law, your plan provider is required to inform you if your coverage qualifies as creditable. Every year, usually around October 15, you should receive a notice—either on paper or electronically—confirming whether your current coverage is creditable or not. Be sure to hold onto this notice like you would your favorite holiday leftovers. Trust us; you’ll need it!

Steps to Confirm Creditable Coverage:

- Check your plan’s annual notice: This is sent directly to you each year. Don’t accidentally toss it out with the junk mail!

- Call your provider: When in doubt, reach out to your benefits administrator or insurance company.

- Consult with a Medicare advisor: Sometimes, getting a second opinion from someone who understands the ins and outs of Medicare can save you a lot of stress.

“Look, we get it—insurance paperwork isn’t exactly light reading. But if you’re unsure whether your coverage is creditable, it’s better to check now than regret it later when penalties come knocking.”

– Henry Beltran

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks of Non-Creditable Coverage

Okay, here’s the deal. If your current plan isn’t creditable and you delay signing up for Medicare Part D, you might face some not-so-fun penalties. For each month you go without creditable coverage, Medicare will tack on a 1% late penalty based on the national base beneficiary premium. These penalties can snowball faster than a toddler discovering permanent markers. And here’s the kicker: you’ll keep paying these penalties for as long as you have Part D.

Common Mistakes to Avoid:

- Forgetting to check your coverage status: Ignoring that annual notice is like leaving the stove on—you don’t realize the mess until it’s too late.

- Relying on word-of-mouth: Your friend’s cousin’s neighbor’s hairstylist might have great opinions, but they’re not always accurate.

- Procrastination: Thinking you’ll “just figure it out next year” could lead to costly penalties.

Creditable Coverage vs. Medicare Part D

You might be wondering, “Why even bother with Medicare Part D if my current coverage is creditable?” It’s a great question! If your coverage is solid, you might not need Part D right away. But keep in mind that plans change. What’s creditable today might not be tomorrow. In fact, many people are caught off guard when employers or unions scale back drug benefits after retirement. Suddenly that rock-solid coverage looks more like Swiss cheese.

“Medicare Part D might feel like an optional upgrade at first, but it’s like adding heated seats to your car—you don’t think you need it until the cold hits. And once it does, you’ll wish you’d added it sooner.”

– Henry Beltran

Advantages of Sticking with Creditable Coverage:

- No penalties: You can delay Part D enrollment and avoid the late penalty.

- Lower premiums: Your employer might offer a more affordable premium than Medicare Part D.

- Consistency: If you’ve been with your plan for a while, sticking with what you know can provide peace of mind.

Disadvantages:

- Potential for change: What’s good today may not be tomorrow. Employer plans can change without much notice.

- Limited options: If your creditable coverage is limited, especially in retirement, you could miss out on Medicare’s wide selection of drug plans.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Enroll in Medicare Part D if Your Coverage is Not Creditable

If you find out your coverage isn’t creditable, don’t panic. You can still enroll in Medicare Part D during the Annual Enrollment Period (October 15 to December 7). You’ll avoid future penalties if you act fast, and no one likes that feeling of beating the clock with just seconds to spare, right?

Steps to Enroll:

- Compare plans: Check out Medicare’s Plan Finder tool to compare options.

- Choose a plan: Pick a Part D plan that covers the medications you need.

- Enroll online or by phone: You can sign up directly through Medicare’s website or by calling their hotline.

Frequently Asked Questions

What happens if I miss my creditable coverage notice?

If you accidentally toss out your notice, no need to panic! You can always contact your plan provider for a replacement copy. But seriously, don’t let this one slip through the cracks—it’s more important than you might think.

Can I have both creditable coverage and Medicare Part D?

Technically, yes. But it’s kind of like wearing two pairs of socks. If your coverage is creditable, you don’t need Part D until you lose your existing coverage or it stops being creditable.

How do I know if my employer’s plan will stay creditable?

Unfortunately, there’s no crystal ball for this one. Employers and unions can adjust their coverage from year to year, so always double-check during the Annual Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts: Don’t Let Medicare Part D Catch You Off Guard

Understanding Medicare Part D Creditable Coverage is crucial for making smart healthcare decisions in 2025. Whether you’ve got coverage through an employer or you’re weighing your Medicare options, staying on top of this could save you from costly penalties.

“The most important thing you can do is stay informed. Don’t wait until the last minute or make assumptions about your coverage. Get the facts and make the best choice for your future health needs.”

– Henry Beltran

So remember: Keep that notice handy double-check your coverage and consult with someone who knows the ins and outs of Medicare like Henry Beltran and the Medicare Advisors Insurance Group LLC. Your future self will thank you!