What is Medicare?

Medicare is more than just a federal health insurance program—it’s an essential support system for over 60 million Americans. It serves individuals aged 65 and older certain younger people with disabilities and those suffering from End-Stage Renal Disease (ESRD) commonly known as Lou Gehrig’s disease. Medicare ensures these groups have access to the medical treatments they need providing peace of mind and stability in managing health-related expenses.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why is Medicare Essential?

Imagine a scenario where after decades of work seniors had to drain their savings just to pay for basic healthcare or where individuals with severe disabilities faced insurmountable medical bills with no aid. Medicare prevents these distressing scenarios serving as a cornerstone of the US healthcare system and ensuring access to essential services such as hospital visits prescription medications and home health care.

How Does Medicare Work?

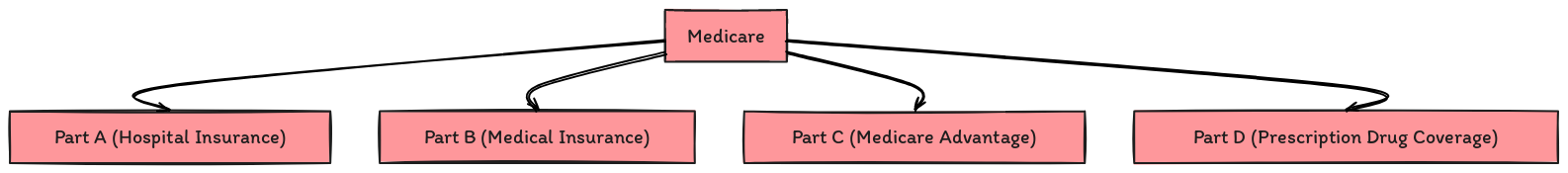

Medicare is divided into several parts each designed to cover different aspects of healthcare:

- Medicare Part A (Hospital Insurance): Covers hospital stays hospice care and some home health care.

- Medicare Part B (Medical Insurance): Covers doctor visits outpatient care and other medical services not covered by Part A.

- Medicare Part C (Medicare Advantage): An alternative to Original Medicare offering additional benefits through private insurance companies.

- Medicare Part D: Covers prescription medications helping with the costs of drugs that can often be prohibitively expensive.

Henry Beltran the owner of Medicare Advisors Insurance Group LLC often says “Medicare not only supports our seniors and disabled but upholds the dignity and health of our communities.” His words highlight the program’s broader impact on American society.

When and How to Enroll in Medicare?

Enrollment in Medicare is pivotal and can sometimes be automatic for those receiving Social Security benefits. The Initial Enrollment Period (IEP) is your first chance to join starting three months before your 65th birthday and extending three months after. However if you miss this window the Special Enrollment Period (SEP) allows you to enroll later under certain circumstances without facing late penalties.

Are There Any Costs?

While Medicare Part A is premium-free for most people who have paid into Social Security for a sufficient number of years Parts B and Part D require a monthly premium. These costs are important to consider as they affect your budget planning. Additionally understanding the coverage details is crucial—what services are covered and to what extent? For example while many types of essential surgeries and treatments are covered some newer drugs or experimental treatments might not be.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Should You Do Next?

If you’re nearing the age of eligibility or if you have a qualifying disability it’s crucial to get informed. Visit Medicare.gov the official U.S. government site for Medicare or contact reputable organizations like Medicare Advisors Insurance Group LLC for personalized guidance. “Deciding on Medicare coverage can be complex but with the right information you can find a plan that fits your needs and gives you control over your health,” advises Henry Beltran.

Remember understanding Medicare is not just about knowing what is covered but understanding how it affects your life. Whether it’s the peace of knowing that your medical treatments will be covered the relief of affordable prescriptions or the assurance that you can receive care in your home Medicare provides a safety net that allows seniors and disabled individuals to maintain their health with dignity.

For those interested in detailed research or additional resources institutions like the Mayo Clinic and Johns Hopkins Medicine provide extensive health information that complements the benefits Medicare offers.

Medicare Coverage Options: Understanding Your Benefits

Medicare provides extensive health coverage through different parts each tailored to address various healthcare needs. Knowing these options can significantly affect both your healthcare experience and your expenses.

Hospital Insurance (Part A)

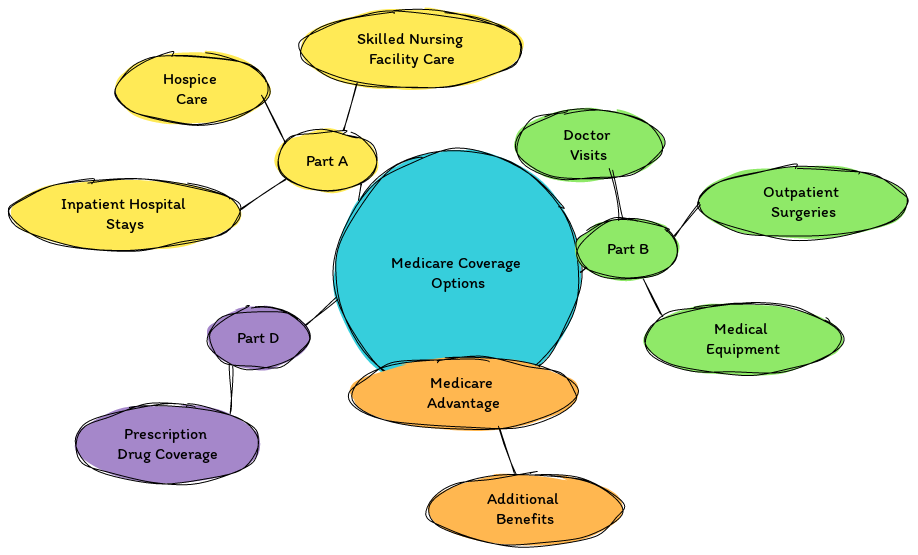

Medicare Part A commonly known as hospital insurance is essential for covering significant health-related expenses. It covers:

- Inpatient hospital stays

- Skilled nursing facility care

- Hospice care

Most beneficiaries do not pay a monthly premium for Part A if they or their spouse have contributed to Medicare through employment for at least 10 years. This premium-free benefit is crucial for substantial healthcare coverage.

Henry Beltran owner of Medicare Advisors Insurance Group LLC emphasizes “Securing Part A coverage is like building a safety net for your most critical healthcare needs. It’s essential for more than just hospital visits—it’s about ensuring comprehensive care when it’s most needed.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medical Insurance (Part B)

Medicare Part B serves as your medical insurance covering aspects outside the hospital setting such as:

- Doctor visits

- Outpatient surgeries

- Medical equipment

This part is a pivotal component of Medicare ensuring access to routine and preventative care without a heavy financial burden.

For those already receiving Social Security or Railroad Retirement Board (RRB) benefits enrollment in both Part A and Part B is automatic simplifying access to necessary medical services for many seniors. However if you are not receiving these benefits you will need to actively enroll in Part B during your Initial Enrollment Period to avoid coverage gaps and late enrollment penalties.

Medicare Prescription Drug Coverage (Part D)

Medicare Part D offers prescription medication coverage an integral component of managing health conditions for many seniors and disabled individuals. To benefit from this coverage beneficiaries must enroll in a Medicare-approved plan that offers drug coverage. While each plan has different premiums and covers different drug lists all must provide at least the standard level of coverage defined by Medicare.

“Selecting the right Part D plan can significantly reduce your out-of-pocket expenses on medications and enhance your quality of life” advises Henry Beltran. It’s important to review each plan’s formulary to make sure it includes the medications you need.

Why Choose Medicare Coverage Options?

Navigating through Medicare’s options might seem daunting but armed with the right information you can make decisions that positively impact both your health and finances. Each part of Medicare is designed to provide specific types of coverage ensuring you’re covered whether it’s a hospital stay or just a routine doctor’s visit.

For more in-depth information on your Medicare options visiting Medicare.gov can provide personalized details and help you manage your healthcare proactively. Additionally reputable sources like WebMD and Healthline offer valuable health-related content that can further enhance your understanding of Medicare.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Enrollment and Eligibility for Medicare

Understanding the enrollment process and eligibility criteria for Medicare is crucial for making timely and informed decisions about your healthcare coverage. Here we’ll break down the essentials of Medicare enrollment and eligibility and explore the necessary steps to manage your coverage effectively.

Eligibility and Enrollment Periods

Medicare is accessible to individuals who are 65 or older as well as younger individuals with qualifying disabilities. While Medicare Part A (hospital insurance) is free for most—those who have paid Medicare taxes for at least 10 years—others may need to pay a premium to receive this coverage.

Henry Beltran, the seasoned owner of Medicare Advisors Insurance Group LLC, advises “Knowing when to enroll in Medicare can save you from unnecessary costs and ensure continuous coverage.” There are several critical times to enroll:

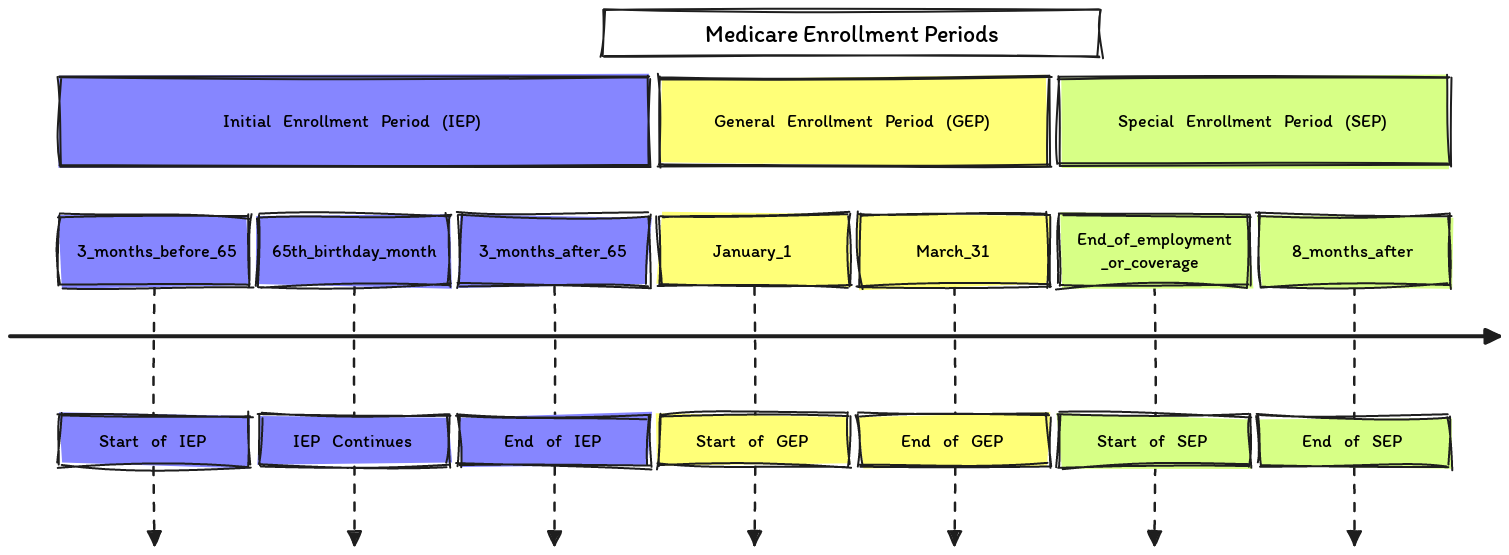

- Initial Enrollment Period (IEP): This is a 7-month period that begins three months before you turn 65 includes the month you turn 65 and ends three months after that month.

- General Enrollment Period (GEP): If you miss the IEP you can enroll between January 1 and March 31 each year with coverage starting July 1.

- Special Enrollment Period (SEP): If you or your spouse are still working and have health coverage through an employer you can enroll in Medicare Part B at any time while still covered or during the 8 months following the end of employment or coverage.

Enrollment Forms and Termination

To enroll in Medicare specific forms are required depending on your circumstances:

- For Part A Enrollment (if not automatically enrolled): Complete the CMS-18-F-5 form or contact Social Security directly at 1-800-772-1213.

- For Part B Enrollment (if you already have Part A but not Part B): Use form CMS-40B to enroll in medical insurance coverage.

It’s important to note that if you are paying premiums for Part A or Part B you can choose to terminate this coverage. “Deciding to terminate premium-based Medicare coverage should be carefully considered weighing the potential future costs and benefits” points out Henry Beltran.

Why is Timely Enrollment Important?

Enrolling in Medicare at the right time is crucial to avoid lifetime late enrollment penalties especially for Part B and Part D (prescription drug coverage). Timely enrollment ensures that you have the necessary health coverage when you need it without unnecessary delays or costs.

Expert Advice and Resources

For those approaching eligibility or considering changes to their Medicare plans consulting resources such as Medicare.gov or contacting experienced advisors at Medicare Advisors Insurance Group LLC can provide clarity and confidence in your decisions. Further health organizations like the AARP and Mayo Clinic offer extensive information on navigating Medicare and understanding its benefits.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Understanding Medicare Costs

Navigating the costs associated with Medicare is crucial for managing your healthcare budget effectively. Let’s delve into the details of premiums deductibles and the available financial assistance programs that can help ease the burden of these expenses.

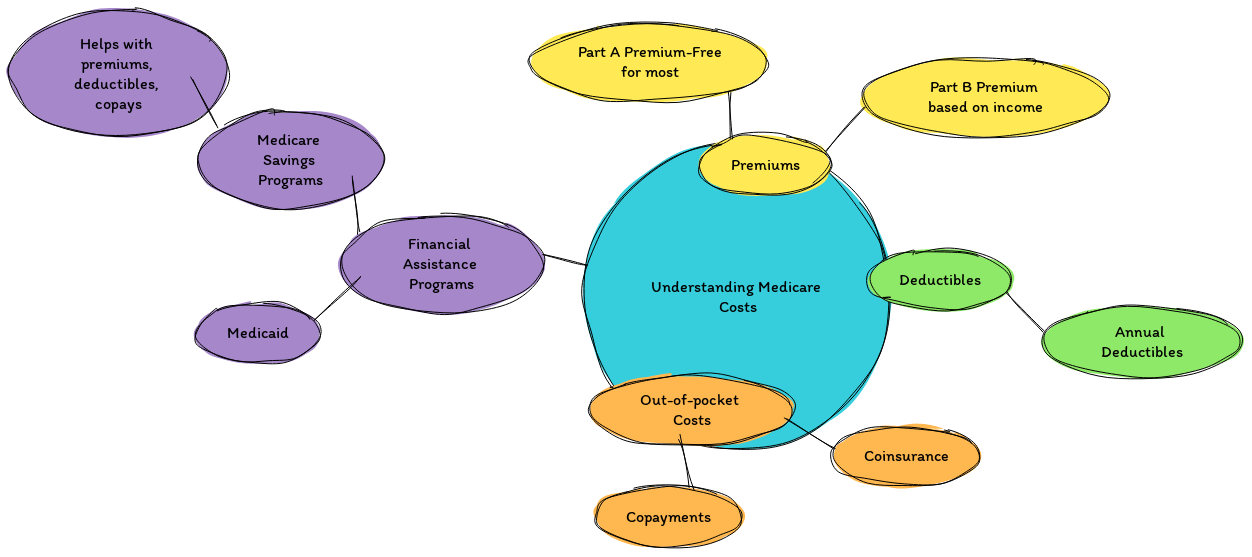

Premiums and Deductibles

Medicare coverage includes Part A and Part B often requires the payment of monthly premiums. For many beneficiaries Part A is premium-free but this depends on whether you or your spouse have paid Medicare taxes for a sufficient amount of time during your working years. Part B however generally comes with a monthly premium that varies based on your income.

Besides premiums Medicare also involves deductibles and other out-of-pocket costs. These deductibles are the amounts you must pay before your Medicare coverage starts to pay. For instance Part B comes with an annual deductible after which it typically covers 80% of approved services leaving you responsible for the remaining 20%.

Henry Beltran the owner of Medicare Advisors Insurance Group LLC explains “Understanding your premiums and deductibles is the first step to mastering your Medicare coverage. It’s about knowing what you’ll need to pay so there are no surprises.”

Financial Assistance and Savings Programs

Recognizing that Medicare costs can be a burden for many several financial assistance programs are available to help:

- Medicaid: This program assists low-income individuals and families. If you qualify for both Medicare and Medicaid most of your healthcare costs are covered.

- Medicare Savings Programs (MSPs): These state-run programs help pay Medicare premiums and in some cases may also pay deductibles and co-pays. There are several types of MSPs each with its own eligibility criteria based on income and resources.

“These programs are designed not just to assist with expenses but to ensure that everyone has access to necessary healthcare without financial hardship” Henry adds.

Eligibility for Assistance

Eligibility for these assistance programs generally depends on your income and assets. Each program has specific guidelines which can vary by state. It is important to apply through your state’s Medicaid office or through the Social Security Administration to determine if you qualify for these savings programs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Managing Medicare Costs Matters

Effectively managing the costs associated with Medicare can significantly impact your financial well-being and quality of life. It ensures that you can afford the care you need without undue stress or financial strain.

For those looking for more detailed information or needing personal guidance visiting Medicare.gov or contacting organizations like Medicare Advisors Insurance Group LLC can be invaluable. Additionally resources like BenefitsCheckUp run by the National Council on Aging offer tools to help seniors find and enroll in these cost-saving programs.