Table of Contents

“Unlock the Benefits of Medicare Advantage with a Crossword Puzzle!”

Introduction

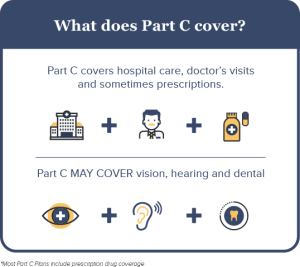

Medicare Advantage is a program offered by the Centers for Medicare and Medicaid Services (CMS) that allows Medicare beneficiaries to receive their Medicare benefits through private health insurance plans. These plans are offered by private insurance companies and provide coverage for hospital, medical, and prescription drug services. Medicare Advantage plans may also offer additional benefits such as vision, hearing, and dental coverage. Medicare Advantage plans are an alternative to Original Medicare and can provide more comprehensive coverage at a lower cost.

Exploring the Benefits of Medicare Advantage Programs

Medicare Advantage programs are a type of health insurance plan offered by private companies that contract with Medicare. These plans provide the same coverage as Original Medicare, but often with additional benefits and lower out-of-pocket costs. For many seniors, Medicare Advantage plans can be a great way to save money and get the coverage they need.

One of the primary benefits of Medicare Advantage plans is that they often offer lower out-of-pocket costs than Original Medicare. Many plans have no deductibles or copayments, and some even offer additional benefits such as vision and dental coverage. This can be especially helpful for seniors who need additional coverage but don’t want to pay the higher premiums associated with supplemental plans.

Another benefit of Medicare Advantage plans is that they often provide access to a larger network of providers. This can be especially helpful for seniors who live in rural areas or who need specialized care. With a larger network of providers, seniors can often find the care they need without having to travel long distances.

Finally, Medicare Advantage plans often offer additional benefits such as fitness programs, health education classes, and discounts on prescription drugs. These benefits can help seniors stay healthy and active, and can also help them save money on their medications.

Overall, Medicare Advantage plans can be a great way for seniors to save money and get the coverage they need. With lower out-of-pocket costs, access to a larger network of providers, and additional benefits, these plans can be a great option for many seniors.

Comparing Medicare Advantage Plans: What to Look For

When comparing Medicare Advantage plans, it is important to consider a variety of factors to ensure you are selecting the plan that best meets your needs. Here are some key points to consider when comparing plans:

1. Coverage: Make sure the plan covers the services you need. Check to see if the plan covers your preferred doctors, hospitals, and other healthcare providers.

2. Cost: Compare the premiums, deductibles, copayments, and coinsurance for each plan. Also, consider any additional costs such as prescription drug coverage.

3. Network: Make sure the plan includes your preferred doctors, hospitals, and other healthcare providers.

4. Quality: Check the plan’s ratings from Medicare and other sources.

5. Benefits: Compare the extra benefits offered by each plan, such as vision, dental, and hearing coverage.

6. Customer Service: Check the plan’s customer service ratings and reviews.

By taking the time to compare Medicare Advantage plans, you can ensure you are selecting the plan that best meets your needs.

Understanding Medicare Advantage Plan Costs and Coverage

Medicare Advantage Plans are a type of health insurance plan offered by private companies that contract with Medicare. These plans provide coverage for hospital, medical, and sometimes prescription drug services. They are an alternative to Original Medicare, which is the traditional fee-for-service Medicare program.

When considering a Medicare Advantage Plan, it is important to understand the costs and coverage associated with the plan. The costs of a Medicare Advantage Plan can vary depending on the type of plan and the services it covers. Generally, Medicare Advantage Plans have a monthly premium, which is the amount you pay each month for the plan. In addition, you may have to pay a copayment or coinsurance for certain services.

The coverage of a Medicare Advantage Plan also varies depending on the type of plan. Most plans cover hospital and medical services, such as doctor visits, hospital stays, and preventive care. Some plans also cover prescription drugs, vision, and dental services. It is important to review the plan’s Summary of Benefits to understand what services are covered and what costs you may be responsible for.

It is also important to understand the network of providers associated with the plan. Most Medicare Advantage Plans have a network of doctors, hospitals, and other health care providers that you must use in order to receive coverage. If you receive care from a provider outside of the network, you may be responsible for the full cost of the services.

When considering a Medicare Advantage Plan, it is important to understand the costs and coverage associated with the plan. Reviewing the plan’s Summary of Benefits and understanding the network of providers associated with the plan can help you make an informed decision about the plan that is right for you.

Navigating the Medicare Advantage Enrollment Process

Navigating the Medicare Advantage enrollment process can be a daunting task. However, with the right information and guidance, it can be a straightforward process. This article will provide an overview of the steps involved in enrolling in a Medicare Advantage plan.

First, you will need to determine if you are eligible for Medicare Advantage. To be eligible, you must be enrolled in both Medicare Part A and Part B, and you must live in the service area of the plan you are considering. You can find out if you are eligible by contacting the Social Security Administration or your local Medicare office.

Once you have determined that you are eligible, you will need to decide which plan is right for you. You can compare plans online or by calling the plan directly. When comparing plans, consider factors such as cost, coverage, and provider networks.

Once you have chosen a plan, you will need to complete an enrollment form. This form can be found online or at your local Medicare office. You will need to provide information such as your name, address, and Social Security number. You will also need to provide information about your current health care providers and any medications you are taking.

Once you have completed the enrollment form, you will need to submit it to the plan. You can do this either online or by mail. Once your enrollment form is received, the plan will review it and contact you if there are any questions or issues.

Once your enrollment is approved, you will receive a welcome packet from the plan. This packet will include information about your coverage, benefits, and any additional documents you may need to submit.

Finally, you will need to make sure that you are using your plan correctly. This includes making sure that you are using in-network providers and that you are taking advantage of any preventive care services that are covered by your plan.

By following these steps, you can successfully navigate the Medicare Advantage enrollment process. With the right information and guidance, you can find the plan that is right for you.

Exploring Medicare Advantage Plan Options for Seniors

Medicare Advantage plans are an increasingly popular option for seniors looking to supplement their Medicare coverage. These plans are offered by private insurance companies and provide additional benefits beyond what is offered by traditional Medicare.

For seniors, Medicare Advantage plans can provide a range of benefits, including coverage for prescription drugs, vision and dental care, and even hearing aids. Some plans also offer additional coverage for medical services such as home health care, transportation to medical appointments, and even gym memberships.

When considering a Medicare Advantage plan, it is important to understand the different types of plans available. There are two main types of plans: Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs typically require members to use a network of providers and offer lower premiums and out-of-pocket costs. PPOs, on the other hand, allow members to use any provider, but typically have higher premiums and out-of-pocket costs.

It is also important to understand the cost of a Medicare Advantage plan. Most plans have a monthly premium, as well as copayments and coinsurance for services. It is important to compare the cost of a plan to the cost of traditional Medicare to determine which plan is the most cost-effective.

Finally, it is important to understand the coverage offered by a Medicare Advantage plan. Each plan is different, so it is important to read the plan’s summary of benefits to understand what is covered and what is not.

For seniors, Medicare Advantage plans can be a great way to supplement their Medicare coverage. By understanding the different types of plans available, the cost of the plan, and the coverage offered, seniors can make an informed decision about which plan is best for them.

Conclusion

In conclusion, the Medicare Advantage program is a great option for those who are looking for a comprehensive health insurance plan that covers a wide range of services. It provides a variety of benefits, including lower out-of-pocket costs, access to a larger network of providers, and additional coverage options. With the help of this program, seniors can enjoy better health care coverage and peace of mind.