Introduction

Navigating the complex world of Medicare can feel overwhelming especially for seniors and people with disabilities. Have you ever found yourself drowning in piles of paperwork trying to make sense of what’s covered and what’s not? Or perhaps you’re worried about whether your healthcare plan will meet your unique needs. These are common concerns and that’s where Kantime Medicare comes into play.

What is Kantime Medicare?

Kantime Medicare is not just another healthcare plan. It’s designed specifically to make your life easier providing you with the coverage you need without the headaches. Imagine a world where managing your healthcare is as simple as a few clicks. That’s what Kantime aims to deliver.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why is Choosing the Right Medicare Plan Important?

Choosing the right Medicare plan can be the difference between peace of mind and constant stress. Your health and well-being are too important to leave to chance. With the right plan you can rest easy knowing you’re covered for routine check-ups, emergencies, and everything in between.

Meet Henry Beltran

Henry Beltran the owner of Medicare Advisors Insurance Group LLC puts it best: “At Medicare Advisors Insurance Group we believe in empowering our clients with the knowledge they need to make informed healthcare decisions”. We’re here to guide you through every step ensuring you get the best care possible.

Why Kantime Medicare Stands Out

So why should you consider Kantime Medicare? For starters it integrates seamlessly with traditional Medicare plans offering enhanced features that cater specifically to seniors and individuals with disabilities. Think of it as Medicare on steroids (but the good kind that won’t get you disqualified from the Olympics).

The Challenges of Traditional Medicare

Traditional Medicare is great but let’s face it: it’s not perfect. It can be confusing and sometimes it feels like you need a PhD just to understand your coverage. Plus there are gaps that can leave you hanging when you need care the most. Kantime Medicare fills those gaps and then some making sure you’re covered from head to toe and everything in between.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Emotional Journey

Picture this: You’re trying to manage a chronic condition like diabetes. With traditional Medicare you might find yourself jumping through hoops just to get the care you need. But with Kantime Medicare everything is streamlined. You get the care you need when you need it without the hassle. It’s like having a personal healthcare concierge at your service.

Understanding Kantime Medicare

A New Approach to Medicare

Kantime Medicare isn’t just another option on a long list of Medicare plans. It’s a revolutionary approach designed to streamline your healthcare needs. Imagine having a plan that integrates seamlessly with traditional Medicare, adding extra features and benefits tailored specifically for seniors and individuals with disabilities. Sounds too good to be true? Well, it’s not.

Key Features of Kantime Medicare

- Comprehensive Coverage: Kantime Medicare covers everything from routine check-ups to specialized treatments. You won’t have to worry about unexpected gaps in your coverage.

- User-Friendly: The plan is designed to be easy to understand and manage. Say goodbye to confusing paperwork and hello to a more straightforward healthcare experience.

- Enhanced Support: With Kantime, managing chronic conditions like diabetes or heart disease becomes much simpler. You’ll have access to a range of services that make your day-to-day life easier.

Why Kantime Medicare is a Game-Changer

Henry Beltran the owner of Medicare Advisors Insurance Group LLC says “Kantime Medicare is all about putting the power back in your hands”. Traditional Medicare can sometimes feel like navigating a maze with no end in sight. But Kantime makes everything more straightforward. For example if you’re dealing with a chronic condition Kantime offers specialized support that traditional Medicare might not cover. It’s like having a healthcare concierge at your service ready to assist you whenever you need it.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Unique Features and Benefits

Seamless Integration with Traditional Medicare

Kantime Medicare doesn’t replace your traditional Medicare plan it enhances it. Think of it as adding a turbocharger to your car. You still have the same reliable vehicle but now it’s faster and more efficient.

More Than Just Coverage

- Preventive Care: Regular screenings and preventive services are included to keep you healthy and catch potential issues early.

- Chronic Condition Management: Specialized programs to help manage chronic conditions making your daily routine easier and less stressful.

- Wellness Programs: Access to wellness programs designed to improve your overall health and well-being.

Potential Drawbacks? Let’s Be Honest

No plan is perfect and Kantime Medicare is no exception. But we like to think of these drawbacks as charming quirks rather than deal-breakers.

- Too Much Choice: With so many features you might feel like a kid in a candy store. It can be overwhelming to decide which benefits to use.

- Tech Savvy Required: Some of the best features are accessible online. If you’re not tech-savvy you might feel a bit out of your depth.

- Coordination of Benefits: Sometimes it feels like trying to coordinate a group of cats. But we’re here to help you herd those felines.

Real-Life Examples

Imagine you’re managing diabetes. Traditional Medicare might cover your insulin but what about the other support you need? Kantime Medicare steps in with comprehensive programs that make managing your condition easier. It’s like having a personal healthcare assistant who’s always on your side.

The Benefits of Kantime Medicare

All-in-One Coverage

Kantime Medicare provides comprehensive coverage that includes everything from routine check-ups to specialized treatments. You won’t have to worry about gaps in your coverage. Imagine having all your healthcare needs covered under one plan. No more juggling multiple plans and dealing with endless paperwork.

- Routine Check-ups: Regular visits to your primary care doctor are covered ensuring you stay on top of your health.

- Specialized Treatments: Need to see a specialist? Kantime Medicare has you covered whether it’s for heart disease diabetes or any other chronic condition.

- Emergency Services: In case of an emergency you can rest easy knowing Kantime Medicare will take care of you.

Extra Perks

But wait there’s more. Kantime Medicare also offers additional perks that make your life easier.

- Preventive Care: Access to preventive services like screenings and vaccinations.

- Wellness Programs: Participate in wellness programs designed to keep you healthy and active.

- Chronic Condition Management: Specialized programs to help you manage chronic conditions.

How Kantime Medicare Helps Manage Chronic Conditions

Personalized Care

Managing a chronic condition can be challenging but Kantime Medicare makes it easier with personalized care plans. For example if you have diabetes you’ll have access to nutrition counseling medication management and regular check-ups to monitor your condition.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Real-Life Stories

Take Jane Doe a 68-year-old retiree. “Thanks to Kantime managing my diabetes has become so much easier” she says. With regular check-ins and support from healthcare professionals Jane feels more in control of her health.

Personal Stories from Beneficiaries

John’s Journey

John a 72-year-old with heart disease found himself constantly stressed about his healthcare. But after switching to Kantime Medicare his life changed. “I no longer worry about my medical bills or whether my treatments will be covered. Kantime has taken a huge weight off my shoulders.”

Sarah’s Success

Sarah a 65-year-old with arthritis appreciates the wellness programs offered by Kantime. “I love the yoga and fitness classes. They help me stay active and manage my pain better.”

Potential Drawbacks? Let’s Keep it Real

Honest Insights

No plan is perfect and Kantime Medicare is no exception. But we prefer to see these drawbacks as minor hiccups rather than major obstacles.

- Too Many Choices: With so many benefits you might feel like a kid in a candy store. It can be overwhelming to decide which services to use.

- Tech Savvy Required: Some of the best features are accessible online. If you’re not comfortable with technology you might need a little help getting started.

- Coordination of Benefits: Sometimes it feels like coordinating a circus but we’re here to help you juggle all the pieces.

Expert Opinion

Henry Beltran owner of Medicare Advisors Insurance Group LLC puts it best: “Kantime Medicare is designed to make your life easier. We want you to focus on your health not on dealing with complex insurance issues.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

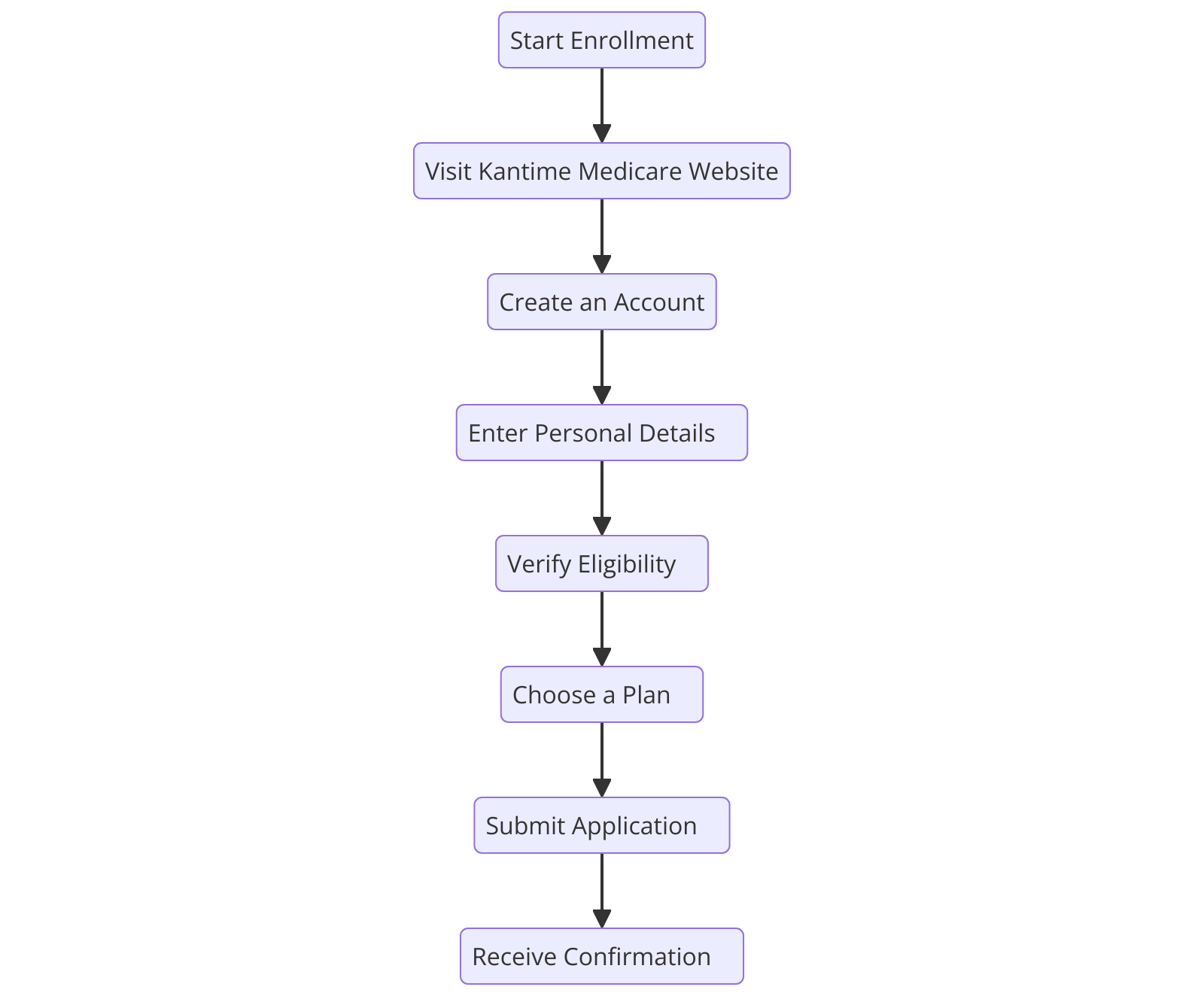

How to Enroll in Kantime Medicare

Step-by-Step Enrollment Guide

Step 1: Check Your Eligibility

First things first you need to make sure you’re eligible for Kantime Medicare. Generally, you qualify if you are:

- 65 years or older

- Under 65 with certain disabilities

- Any age with End-Stage Renal Disease (ESRD)

Step 2: Gather Necessary Documents

Before you start the enrollment process make sure you have all the necessary documents. You’ll need:

- Your Medicare card

- Proof of age (like a birth certificate)

- Proof of residency (utility bills or rental agreement)

Step 3: Understand Your Coverage Needs

Take some time to think about what you need from your Medicare plan. Are you managing a chronic condition? Do you need frequent medical attention? Understanding your needs will help you choose the right Kantime Medicare plan.

Step 4: Contact Medicare Advisors Insurance Group

Once you have your documents and a clear understanding of your needs, contact us at Medicare Advisors Insurance Group. Henry Beltran the owner says, “We’re here to guide you every step of the way ensuring you get the best possible coverage.”

Step 5: Choose Your Kantime Medicare Plan

We’ll help you review the different Kantime Medicare plans available and choose the one that best fits your needs. Our team will explain the benefits and costs associated with each plan.

Step 6: Complete the Enrollment Process

Finally, we’ll assist you in completing the enrollment forms. We’ll make sure all your information is accurate and submitted on time.

Important Deadlines and Timelines

Initial Enrollment Period (IEP)

- Begins 3 months before you turn 65

- Includes the month you turn 65

- Ends 3 months after you turn 65

General Enrollment Period (GEP)

- Runs from January 1 to March 31 every year

- Coverage starts July 1

Special Enrollment Period (SEP)

- For those who qualify due to specific circumstances

- Timing varies based on the situation

Tips for a Smooth Enrollment Process

Stay Organized

Keep all your documents in one place. Use a folder or binder to store everything related to your Medicare enrollment.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Ask Questions

Don’t be afraid to ask questions. Our team at Medicare Advisors Insurance Group is here to help you understand every detail.

Be Proactive

Start the enrollment process early. Don’t wait until the last minute to gather your documents or make decisions.

Potential Drawbacks

Even with the best plans there can be some hiccups.

- Paperwork Overload: You might feel like you’re drowning in forms. But hey we’re here to throw you a life raft.

- Timing Confusion: Deadlines can be tricky. Think of it like setting your alarm for the wrong time. But don’t worry we’ll keep you on track.

- Decision Paralysis: So many choices can be overwhelming. It’s like standing in front of 31 flavors of ice cream and not knowing which one to pick. But with our guidance you’ll make the right choice.

Conclusion

Enrolling in Kantime Medicare doesn’t have to be a daunting task. With a clear understanding of the steps and a little help from Medicare Advisors Insurance Group you’ll be on your way to comprehensive coverage in no time. “Don’t wait to secure your healthcare future” encourages Henry Beltran. “Contact us today and let’s get you started on the right path.”

Cost Considerations of Kantime Medicare

Breakdown of Costs Associated with Kantime Medicare

Premiums

Every Medicare plan has a monthly premium and Kantime Medicare is no exception. However, the premium you pay can vary depending on the specific plan you choose and your individual circumstances.

- Basic Plan: This usually has the lowest premium but might have higher out-of-pocket costs.

- Enhanced Plan: Higher premium but lower out-of-pocket costs and more comprehensive coverage.

Deductibles

A deductible is the amount you pay out of pocket before your Medicare plan starts to cover expenses. With Kantime Medicare the deductibles are designed to be manageable.

- Annual Deductible: This is the amount you need to pay each year before your benefits kick in.

Copayments and Coinsurance

Once you meet your deductible you’ll still have to pay a portion of your medical costs. This comes in the form of copayments (a fixed amount for each service) and coinsurance (a percentage of the service cost).

- Doctor Visits: Typically a small copayment per visit.

- Specialist Visits: Slightly higher copayment but still affordable.

Financial Assistance Options

Medicare Savings Programs

For those who need help with costs Medicare Savings Programs can provide financial assistance. These programs can help pay for premiums deductibles and coinsurance.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Extra Help

The Extra Help program is designed to assist with the cost of prescription drugs. If you qualify you could save a significant amount on your medication costs.

State Assistance Programs

Many states offer additional assistance programs to help cover healthcare costs. It’s worth checking with your state’s Medicaid office to see what’s available.

Comparing Costs with Other Medicare Plans

Traditional Medicare

With traditional Medicare you might find yourself needing to purchase supplemental insurance (Medigap) to cover the gaps. This can add to your overall costs.

Medicare Advantage

Medicare Advantage plans can sometimes offer lower premiums but they might come with higher out-of-pocket costs or limited provider networks.

Kantime Medicare

With Kantime Medicare you get comprehensive coverage that can actually save you money in the long run. Henry Beltran the owner of Medicare Advisors Insurance Group LLC says “Many of our clients find that Kantime offers a cost-effective solution without compromising on quality”.

Potential Drawbacks? Let’s Be Honest

Too Much Information

Sometimes the sheer amount of information about costs can be overwhelming. It’s like trying to read the fine print on a car lease agreement. But don’t worry we’re here to help you understand everything.

Hidden Costs

Every plan has some hidden costs. It might feel like finding out your new car doesn’t come with floor mats. With Kantime Medicare we aim to keep these surprises to a minimum.

Budgeting Challenges

Sticking to a budget can be tough. It’s like trying to keep your grocery bill under control when you’re shopping while hungry. But with proper planning you can manage your healthcare costs effectively.

Quotes and Statistics

“At Medicare Advisors Insurance Group we strive to make healthcare affordable for everyone” says Henry Beltran. According to recent studies seniors with comprehensive Medicare plans like Kantime Medicare experience fewer financial hardships related to medical costs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

Understanding the cost considerations of Kantime Medicare is crucial for making an informed decision. While the premiums and out-of-pocket costs might seem daunting at first glance the comprehensive coverage and potential savings make it a worthwhile option. “Don’t let cost concerns stop you from getting the healthcare you deserve” encourages Henry Beltran. Contact Medicare Advisors Insurance Group today to learn more about how Kantime Medicare can fit into your budget and provide the coverage you need.

Maximizing Your Kantime Medicare Benefits

Tips and Strategies for Getting the Most Out of Your Plan

Regular Check-Ups and Preventive Care

One of the best ways to stay healthy is through regular check-ups and preventive care. These are covered by your Kantime Medicare plan, and taking advantage of them can help catch potential health issues early.

- Schedule Annual Physicals: Make sure to see your primary care doctor at least once a year for a comprehensive check-up.

- Get Vaccinations: Stay up-to-date with recommended vaccines to protect yourself from preventable diseases.

- Screenings and Tests: Regular screenings for conditions like high blood pressure, cholesterol, and diabetes can help you stay on top of your health.

Utilize Chronic Condition Management Programs

If you have a chronic condition like diabetes or heart disease, Kantime Medicare offers specialized programs to help you manage your health.

- Diabetes Management: Access to nutrition counseling, regular check-ups, and medication management.

- Heart Disease Management: Programs designed to help you monitor and manage your heart health effectively.

Take Advantage of Wellness Programs

Kantime Medicare provides wellness programs designed to improve your overall health and well-being.

- Fitness Classes: Participate in fitness classes tailored to your needs, whether it’s yoga, water aerobics, or strength training.

- Nutrition Workshops: Learn about healthy eating habits and how to maintain a balanced diet.

- Mental Health Support: Access to mental health services and support groups to help you stay emotionally healthy.

Understanding Your Rights and Benefits

Know What’s Covered

It’s important to know what services and treatments are covered under your Kantime Medicare plan.

- Review Your Plan: Take the time to read through your plan details and understand what’s included.

- Ask Questions: If you’re unsure about any aspect of your coverage, don’t hesitate to ask. Our team at Medicare Advisors Insurance Group is here to help.

Handle Claims and Disputes

Sometimes, you might encounter issues with claims or need to dispute a charge. Knowing how to handle these situations can save you time and stress.

- Keep Records: Maintain detailed records of your medical visits, treatments, and communications with healthcare providers.

- Contact Customer Service: If you encounter any issues, reach out to Kantime Medicare’s customer service for assistance.

- Seek Help: Our team at Medicare Advisors Insurance Group can also help you navigate any disputes or issues with your claims.

Resources for Additional Support and Information

Online Resources

- Medicare.gov: The official U.S. government site for Medicare information.

- Kantime Medicare Website: Access detailed information about your plan and available services.

Local Support

- State Health Insurance Assistance Program (SHIP): Offers free, unbiased counseling and assistance.

- Community Health Centers: Provide support and resources for managing your health.

Potential Drawbacks? Let’s Be Honest

Information Overload

Sometimes, the sheer amount of information about your benefits can be overwhelming. It’s like reading a car manual when all you want to do is drive. But don’t worry, we’re here to simplify things for you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Navigating Online Portals

Some features and services are accessible online, which can be tricky if you’re not tech-savvy. Think of it like trying to program a VCR (remember those?). But with a little help, you’ll be navigating like a pro.

Scheduling Challenges

Coordinating all your healthcare appointments can feel like trying to schedule a family reunion. It’s a lot of moving parts, but with proper planning, you can keep everything on track.

Final Thoughts

Maximizing your Kantime Medicare benefits doesn’t have to be complicated. By taking advantage of preventive care, chronic condition management programs, and wellness services, you can ensure you’re getting the best care possible. “Our goal at Medicare Advisors Insurance Group is to make your healthcare journey as smooth and stress-free as possible,” says Henry Beltran. “Don’t hesitate to reach out for help and take full advantage of everything Kantime Medicare has to offer.”

Conclusion: Choosing Kantime Medicare

Choosing the right Medicare plan is a significant decision, especially for seniors and people with disabilities. Your healthcare coverage impacts your quality of life, peace of mind, and overall well-being. So, why should you consider Kantime Medicare?

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Recap of Key Points

Comprehensive Coverage

Kantime Medicare offers comprehensive coverage that goes beyond traditional Medicare. From routine check-ups to specialized treatments and chronic condition management, Kantime ensures you’re covered.

User-Friendly Features

Navigating healthcare can be complicated, but Kantime Medicare simplifies the process. With user-friendly features and seamless integration with traditional Medicare, you get a plan that’s easy to understand and manage.

Financial Benefits

Understanding the costs associated with Medicare is crucial. Kantime Medicare offers a range of plans to fit different budgets, providing financial benefits that can save you money in the long run.

Specialized Programs

Whether you’re managing diabetes, heart disease, or another chronic condition, Kantime Medicare’s specialized programs offer personalized support to help you stay healthy.

Wellness and Preventive Care

Kantime Medicare emphasizes wellness and preventive care, providing access to fitness classes, nutrition workshops, and mental health support. These programs are designed to keep you active, healthy, and engaged.

Encouragement to Explore Kantime Medicare

Choosing the right Medicare plan can feel overwhelming, but you don’t have to do it alone. Henry Beltran, the owner of Medicare Advisors Insurance Group LLC, says, “Kantime Medicare is about more than just coverage. It’s about giving you the support you need to live your best life.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Kantime Medicare?

- Comprehensive and user-friendly: Kantime Medicare makes managing your healthcare straightforward and stress-free.

- Cost-effective: Many clients find Kantime offers a cost-effective solution without compromising on quality.

- Specialized support: From chronic condition management to wellness programs, Kantime Medicare has it all.

Potential Drawbacks? Let’s Be Honest

No plan is perfect, and Kantime Medicare is no exception. Here are a few things to keep in mind:

- Too Many Choices: With so many benefits, it can feel like being a kid in a candy store. It might be overwhelming to decide which services to use.

- Tech Savvy Required: Some features are accessible online. If you’re not comfortable with technology, you might need a little help getting started.

- Coordination of Benefits: Sometimes it feels like coordinating a circus, but we’re here to help you juggle all the pieces.

Final Thoughts and Advice

Healthcare decisions are personal, and what’s right for one person might not be right for another. But with Kantime Medicare, you get a plan that’s designed to meet your unique needs.

“Don’t wait to secure your healthcare future,” encourages Henry Beltran. “Contact Medicare Advisors Insurance Group today to learn more about how Kantime Medicare can work for you.” Take control of your health and make the choice that’s best for you.

Call to Action

Ready to explore how Kantime Medicare can transform your healthcare experience? Reach out to us at Medicare Advisors Insurance Group LLC. We’re here to guide you through every step of the process, ensuring you get the best possible care.

Outbound Links for Credibility: