People enrolled in both Social Security and Medicare have their premiums automatically deducted from their monthly checks.

You can have your Medicare premiums automatically withdrawn from your Social Security check each month if you get both Medicare health insurance benefits and Social Security retirement benefits. As you won’t have to bother about manually paying your premiums, you can save a lot of time and effort this way. Every component of Medicare, including the private Medicare Advantage and Medicare Part D plans, has this choice.

Everything you require to know about how much will be taken from your Social Security benefits is covered in this article.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How do I know if I will have money taken out of my Social Security check?

Medicare benefits will be automatically taken from your Social Security retirement income. This implies that when you sign up for Medicare, this will happen automatically without you having to do anything.

You shouldn’t anticipate receiving a bill for your premiums if you enroll in Original Medicare during your Initial Enrollment Period (IEP) and already receive Social Security retirement benefits. Instead, because the money is withdrawn from there, your Social Security payout will be reduced.

How much is taken out, exactly?

When you enroll in Medicare, no set sum is deducted from your Social Security check. Instead, several variables affect how much is subtracted. Medicare has various cost components. Additionally, since Part C and Part D are provided by private insurance, the monthly premiums for each vary much more.

Although Part A and Part B have set monthly premiums, the exact amount varies a little every year. Depending on your economic level, you might also have to pay additional expenses. Below, we go into greater detail about these.

How much is deducted from Social Security for Medicare Part A?

Medicare Part A hospital insurance is generally free of premiums. The fact that you still have to pay your deductible, co-insurance, and other out-of-pocket expenses means that it is not free. However, if you are eligible, there are no monthly subscription expenses.

At age 65, you are qualified for Part A coverage without paying a premium if:

- For ten years or more, you or your spouse paid Medicare taxes.

- You already get Railroad Retirement Board or Social Security retirement payments.

- Despite being eligible, you haven’t yet gotten these advantages.

- You or your spouse worked for the government and received Medicare benefits.

If you’re under 65, you can also access Part A without paying a premium. This will occur if you meet specific requirements and have been receiving Social Security or Railroad Retirement Board disability benefits for more than 24 months, or if you have the end-stage renal disease (ESRD).

Income taxes that you pay while working are used to pay for Part A. The number of years that you paid this tax is used to calculate how much you pay in premiums as a result.

How much do Part A premiums cost?

The 2023 Part A premium for those who paid Medicare taxes for fewer than 30 quarters is $506. The monthly cost for those who paid Medicare taxes for 30 to 39 quarters is $278. Please be aware that you are not eligible for Social Security benefits if you must pay monthly Medicare premiums. In that situation, you won’t need to worry about money withdrawals for the time being.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How much is deducted from Social Security for Medicare Part B?

Medicare Part B doesn’t have a version without premiums. Your Medicare Part B premiums are automatically withdrawn if you are enrolled in Part B and receive Social Security payments. Your monthly premium must be paid online or by check if you are enrolled in Part B but do not receive Social Security payments.

In 2023, Part B’s average monthly premium will be $164.90. Nevertheless, based on your income, you might have to pay extra each month.

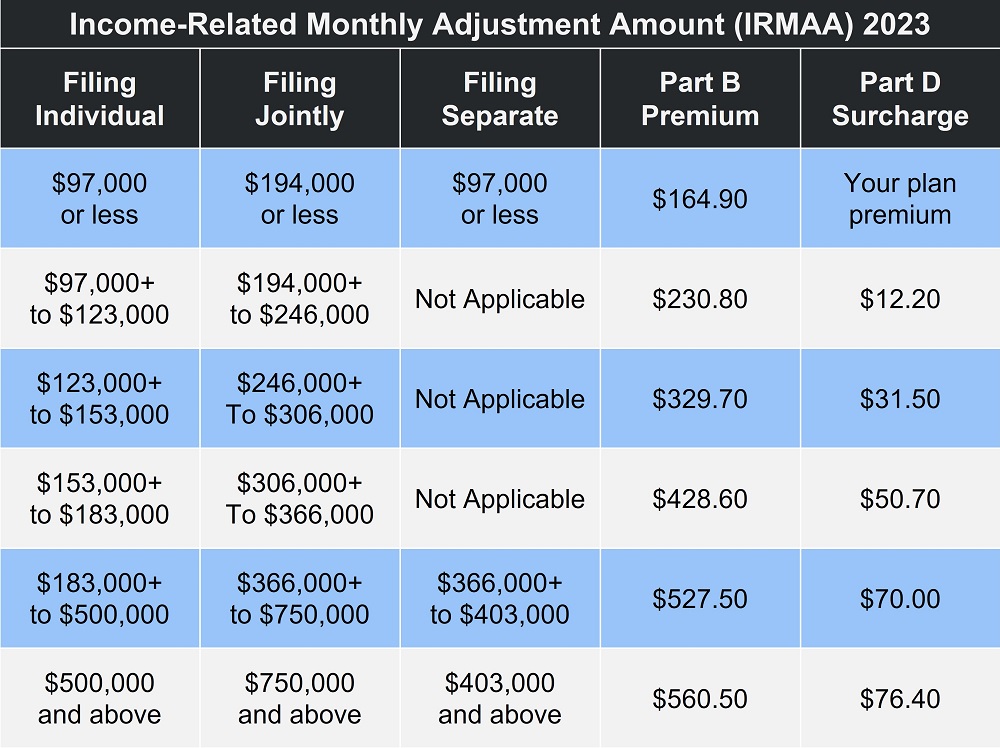

The Income-Related Monthly Adjustment Amount is the name of this additional cost (IRMAA). Depending on the income you disclosed to

Medicare Advantage premiums and Social Security benefits

Private insurance providers who work with Medicare can offer Medicare Advantage, sometimes referred to as Medicare Part C. The plans are administered by private insurance companies, but they are constrained by rules set by the federal government. They are only accessible to those with Original Medicare eligibility.

Similar to other commercial insurance plans, Medicare Advantage premium costs vary. As a result, it is impossible to estimate your cost without first receiving a quote.

You must speak with the Social Security Administration to arrange for your Medicare Advantage monthly premium to be taken from your Social Security payment. If not, you will need to pay your insurance company’s premium directly.

How much is taken out for Part D drug plans?

Prescription drug expenditures are partially covered by Medicare Part D coverage. Original Medicare does not contain this coverage (Medicare Parts A and B). But some Medicare Advantage plans also cover prescription drugs. You are not permitted to enroll in a stand-alone Part D plan in addition to a Medicare Advantage Prescription Drug plan (MA-PD).

The same private insurance companies that sell Medicare Advantage plans also sell Part D policies. This implies that they will have different prices, exactly as Part C plans. However, you might also be responsible for paying the Part D plan’s Income-Related Monthly Adjustment Amount. The Part D fee is shown in the IRMAA table above for each income level.

Your Social Security payout may be reduced by this sum as well as the premium itself. To arrange this, get in touch with the Social Security Administration.

Key things to remember about Social Security and Medicare

Finding out how much will be deducted from your Social Security check is typically pretty simple. The procedure is automated if you have Original Medicare and get retirement benefits. Your monthly Part B premium ($164.90 or more in 2023) is deducted. If you are eligible for retirement benefits, you most likely won’t be required to pay the Part A premium.

The most important thing to keep in mind is that even if you have Medicare Advantage or Part D coverage, the process is not automated. To arrange for the Social Security Administration to take your premiums from your monthly payment, you must give them a call. After you start the process, be sure to check every month because the installation can occasionally take longer than expected.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

FAQs

What are the Social Security benefits?

Based on lifetime earnings, Social Security replaces a portion of a worker’s pre-retirement income. Your earnings and the date you decide to begin receiving benefits will determine how much of your average wage is replaced by Social Security retirement benefits.

How much are Social Security benefits?

The eligible individual maximum monthly payments for 2023 are $914, the eligible individual plus eligible spouse’s maximum monthly payments are $1,371, and the essential person’s maximum monthly payments are $458.

Who gets Social Security benefits?

If you are 62 years of age or older, disabled or blind, and have enough work credits, you may be eligible to receive Social Security benefits based on your earnings history. Family members who are entitled to benefits based on their employment history do not require labor credits.

What is Medicare premium deduction?

Image result for medicare premiums deducted

Your Medicare and Medigap premiums are deductible from your taxes as a below-the-line expense. You must break down the premium costs in this. You are eligible for the deduction if they total more than 7.5% of your AGI when combined with your other medical expenses.

What is meant by prescription drug coverage?

Health insurance or plan that helps pay for prescription drugs and medications. All Marketplace plans cover prescription drugs.

How do I calculate my modified adjusted gross income?

To find your MAGI, take your AGI and add back: Any deductions you took for IRA contributions and taxable Social Security payments. Deductions you took for student loan interest.

What age are Medicare beneficiaries?

Generally, Medicare is for people 65 or older. You may be able to get Medicare earlier if you have a disability, End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant), or ALS (also called Lou Gehrig’s disease).

What is the Social Security benefit?

Social Security replaces a percentage of a worker’s pre-retirement income based on lifetime earnings. The amount of your average wages that Social Security retirement benefits replace depends on your earnings and when you choose to start benefits.

What is the function of Medicare and Medicaid Services?

The Centers for Medicare and Medicaid Services (CMS) provides health coverage to more than 100 million people through Medicare, Medicaid, the Children’s Health Insurance Program, and the Health Insurance Marketplace.

What is a Medicare premiums payment?

What is it? The “Medicare Premium Bill” (CMS-500) is a bill for people who pay Medicare directly for their Part A premium, Part B premium, and/or. Part D IRMAA. Part D IRMAA. An extra amount you pay in addition to your Part D plan premium if your income is above a certain amount.

What is the difference between Medicare and Medicare premiums?

Premium: The monthly fee you pay to have Medicare or your health plan. Deductible: What you must pay before Medicare or your health plan starts paying for your care. Copayment/coinsurance: Your share of the cost you pay for each service. Part A: Medicare hospital insurance for inpatient care.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How much are monthly Medicare premiums?

In 2023, the premium is either $278 or $506 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.