Forteo Medicare Coverage: Eligibility, Costs, and Assistance Options

Navigating Medicare can feel overwhelming—especially when you’re dealing with prescription drugs like Forteo for osteoporosis. If you’ve been prescribed this medication, you’re probably wondering how it’s covered, what it’ll cost, and if there’s any financial help available. Let’s break it all down in a way that makes sense.

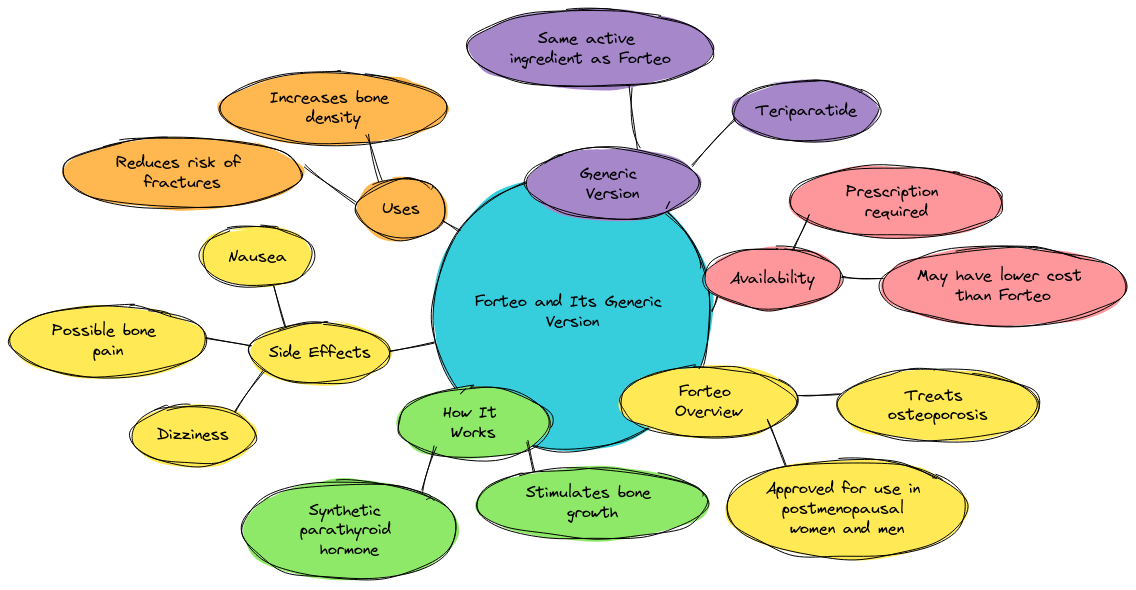

What’s Forteo and Its Generic Version?

Forteo is a medication used to treat osteoporosis for folks at high risk of fractures. It helps boost bone growth—pretty important when your bones need a little extra strength. The active ingredient in Forteo is teriparatide—and here’s the good news—it comes in a generic version too.

The generic drug—also called teriparatide injection—works just as well as the brand-name drug but costs a lot less. That’s a win for your wallet!

Generic drugs are usually cheaper because they don’t have to go through the same long, expensive approval process as brand-name drugs. But the key thing to remember is you’re still getting the same active ingredients and the same benefits—just without the fancy label.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Forteo vs Teriparatide: Does It Really Matter?

Honestly—there’s no major difference between Forteo and teriparatide. They both do the same job with the same active ingredient. So unless you really care about sticking with the brand-name drug, the generic version is a smart choice for saving money.

Henry Beltran—owner of Medicare Advisors Insurance Group LLC—says, “Always check if the generic version is an option. It’s usually the same thing but without the hefty price tag.”

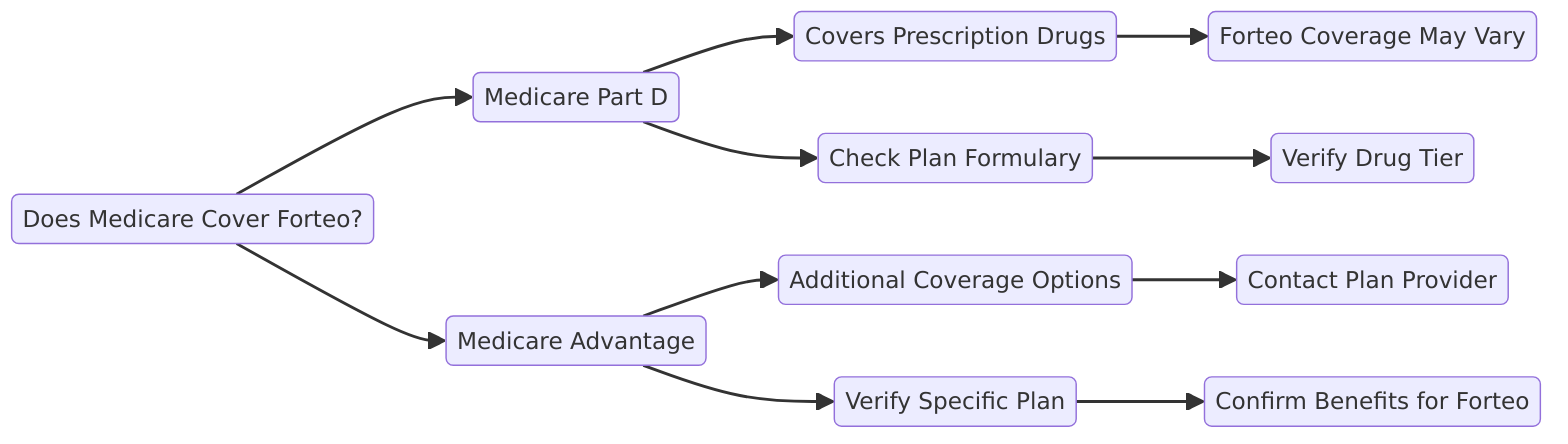

Does Medicare Cover Forteo?

Good news—Medicare does cover Forteo but there are some hoops to jump through. It’s generally covered under Medicare Part D (that’s the part for prescription drugs). However—your plan might require prior authorization before they agree to pay for it.

What does that mean? Basically—you need permission from your insurance company before they’ll help with the bill. It’s a little extra work but it can save you big money in the long run.

Prior Authorization: The Hurdle You Gotta Clear

Before your insurance provider will cover Forteo—they may ask your doctor to prove you really need it. It’s not too different from convincing your boss you need that day off—you gotta show you really deserve it. Once you get the green light—you’re good to go!

How Much Does Forteo Cost?

Now let’s talk numbers—because you’re probably wondering how much a 28-day supply of Forteo costs. Without insurance—it’s about $5,110 for a 28-day supply. Yeah—it’s pricey.

With Medicare—your costs will depend on your specific insurance plan. You might have some copays or coinsurance to cover but it’ll be a lot cheaper than paying out of pocket.

Tips for Cutting Down Forteo Costs

If the price of Forteo still feels too high—don’t worry—you’ve got options:

90-day supply: Ask your doctor or insurance company if you can get a 90-day supply instead of just 28 days. It’s often cheaper to buy in bulk and you’ll make fewer trips to the pharmacy.

Mail-order pharmacy: Many insurance plans cover mail-order prescriptions which can offer even lower prices. Plus—having your meds delivered to your door is super convenient.

Forteo Co-pay Card: If you’ve got commercial insurance, the Forteo Co-pay Card could drop your cost to as low as $4 for a 28-day supply. Yeah—you heard that right—four bucks!

What If Forteo Is Still Too Expensive?

If Forteo still feels out of reach—don’t lose hope. There are drug assistance programs that can help.

The Lilly Cares Foundation and Patient Access Network Foundation (PAN) offer patient assistance for people who qualify. These programs can cover some—or all—of your Forteo costs if you meet their requirements.

You might also look into SingleCare savings cards to cut down the price of Forteo. Every little bit helps!

Henry Beltran advises, “Don’t be afraid to ask about patient assistance programs. They’re out there to help lower the cost of Forteo.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Are There Other Osteoporosis Treatments?

If Forteo still feels like too much—even with help—there are alternative osteoporosis treatments to consider. Drugs like parathyroid hormone injections or monoclonal antibodies may be cheaper and could still be covered under Medicare.

Make sure to chat with your healthcare professional before switching though. You want to make sure any new treatment will work well for you and your specific situation.

Dealing With Prior Authorization

Remember that prior authorization is usually required for Forteo. This means your doctor will need to prove you need this specific medication. It’s a bit of paperwork—but once you’re approved—you should be good to go!

Brand-Name Drugs vs Generics: The Big Question

So—what’s the real difference between brand-name drugs and generic drugs like teriparatide? Price. That’s it.

The generic version of Forteo—teriparatide injection—has the same active drug but without the high price. So—unless you really want the brand-name packaging—save yourself some money and go with the generic version.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why a 90-Day Supply is a Smart Move

One of the easiest ways to save on Forteo is to get a 90-day supply instead of a 28-day one. Many Medicare plans allow this—especially if you’re using a mail-order pharmacy.

It’s convenient—cheaper—and reduces trips to the pharmacy. What’s not to love?

Can’t Afford Forteo? Here’s What to Do

If the cost of Forteo still feels overwhelming—there are a few other tricks you can try:

Shop around: Not all pharmacies charge the same price for prescription drugs. It’s worth checking out a few to find the best deal.

Check your insurance: Talk to your insurance provider and see if there are any extra discounts or savings programs you can take advantage of.

Ask about generics: Don’t forget about generic drugs like teriparatide injection. They’re usually much cheaper and work just as well.

Other Things to Keep in Mind

Before you fully commit to Forteo—think about your overall osteoporosis treatment plan and discuss it with your healthcare professional. There might be cheaper options that are just as effective.

Also—remember that Forteo isn’t for long-term use—it’s usually only prescribed for up to two years. After that—you’ll need to figure out a new plan for managing your osteoporosis.

FDA-Approved Alternatives

Forteo is an FDA-approved drug—but it’s not the only one out there. Other approved drug products like Prolia or Reclast might work for you—and could be cheaper too. It’s worth asking your doctor if these alternatives make sense for your treatment.

Using the Forteo Pen

If you’re prescribed Forteo—you’ll be using the Forteo pen for your daily injections. The pen is pre-filled and pretty easy to use—it’s designed for subcutaneous use—meaning it’s injected just under the skin.

Daily shots aren’t exactly fun—but the Forteo pen makes it as easy and painless as possible. Make sure to talk to your doctor about how to use it correctly to avoid any issues.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Wrapping It Up

Getting the right treatment for osteoporosis shouldn’t break the bank. Forteo Medicare coverage can be a bit complicated—but with some research—you can find ways to lower the cost of Forteo without sacrificing your health.

As Henry Beltran says, “Don’t be afraid to ask questions and push for a better price. Your health is important—but so is your budget.”

Whether it’s using drug assistance programs—exploring generic versions—or trying a mail-order pharmacy—there are plenty of ways to cut your costs and get the health insurance you need.