Is Dupixent Covered by Medicare? Your Simple Guide to Dupixent and Medicare in 2024

You’ve probably heard of Dupixent—the wonder drug for eczema and asthma—and now you’re asking yourself, “Is Dupixent covered by Medicare?” Well buckle up because we’re diving into what you need to know about how Medicare handles Dupixent. We’ll talk about what you might pay how to lower costs and why insurance can sometimes feel like a headache.

What’s Dupixent?

Dupixent (dupilumab) is a breakthrough injectable medication used to treat conditions like atopic dermatitis (eczema) asthma and chronic sinusitis with nasal polyps. It’s been a lifesaver for people who haven’t found relief with standard treatments like creams or light therapy. But like all good things—there’s a catch. Dupixent can be pretty pricey especially if you’re on Medicare or have a limited budget.

-

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Cover Dupixent?

The short answer—yes. Medicare can cover Dupixent but it depends on your specific health plan. Whether you’re using Original Medicare (Part A and Part B) or a Medicare Advantage plan the details can vary widely.

Medicare Part B or Part D—Which One Pays?

Medicare Part B: If you get Dupixent injections in your doctor’s office or an outpatient setting Part B might pick up the bill. But watch out for out-of-pocket costs like deductibles and coinsurance.

Medicare Part D: Most folks get Dupixent under their Medicare Part D plan which covers outpatient prescription drugs. If your plan lists Dupixent as a covered drug—awesome! But you may still need prior authorization from your insurance provider. And your cost could vary depending on your plan.

As Henry Beltran—owner of Medicare Advisors Insurance Group LLC—puts it: “Medicare does cover Dupixent but your out-of-pocket cost depends on whether your insurance plan lists it as a covered drug. I also recommend checking for patient assistance programs to help reduce those costs.”

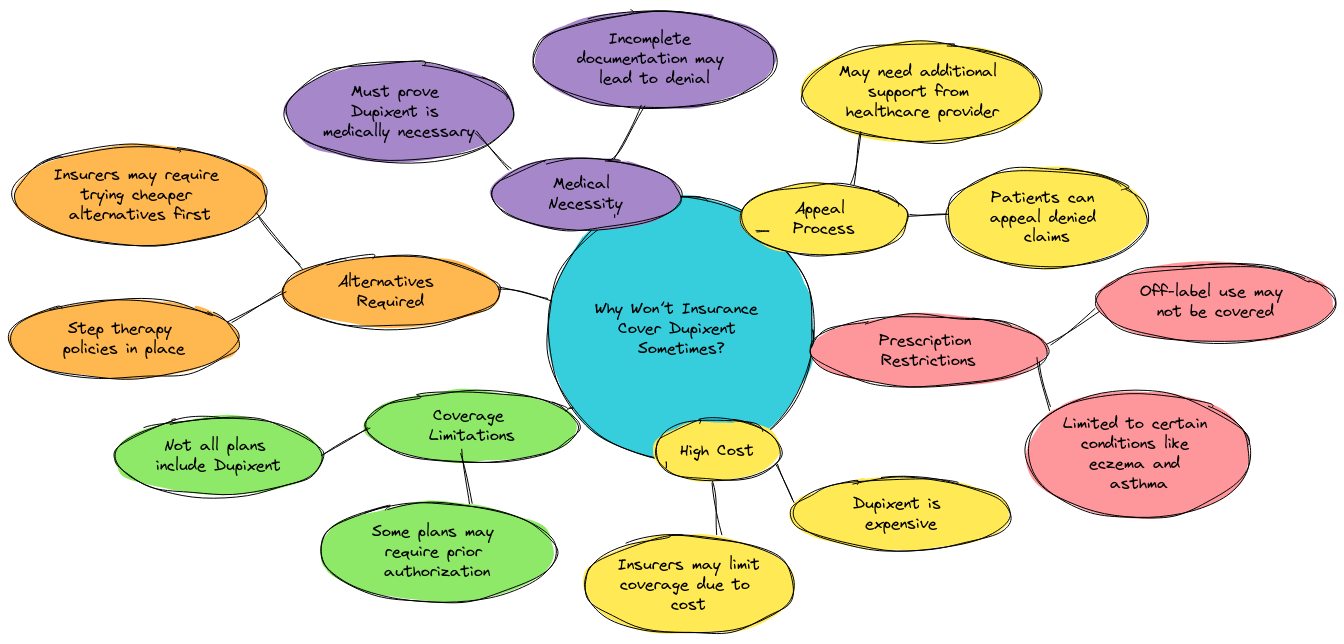

Why Won’t Insurance Cover Dupixent Sometimes?

Wondering why your insurance might say no to Dupixent? It usually comes down to cost. Insurance companies like to compare Dupixent with cheaper options like topical treatments or other prescription drugs. If they think those alternatives will work just as well—they may push you to try them first.

Here’s a fun way to think of it—insurance companies see Dupixent as the “fancy champagne” of medications but they’d rather you stick to “store-brand soda.” They know Dupixent’s good—but they like to save money when they can!

The Dupixent MyWay Copay Card—A Lifesaver for Some

If you’ve got a commercial health insurance plan the Dupixent MyWay copay card can be a big help. This copay card can lower your out-of-pocket expenses depending on your insurance provider. There’s also financial assistance available for people who qualify.

Here’s the catch—Medicare patients can’t use the Dupixent MyWay program. If you’re on Medicare the copay card won’t work for you unfortunately.

How to Lower Dupixent Costs—Financial Help Is Available

Even if you’re on Medicare and can’t use the Dupixent MyWay program there’s still hope. Patient assistance programs from Regeneron Pharmaceuticals (the company that makes Dupixent) could help if you meet the income criteria. These programs look at income limits to see if you qualify for financial support.

Plus if you’ve got a limited income you might qualify for a low-income subsidy through Medicare Part D which can lower your prescription drug benefits costs.

What’s Dupixent Going to Cost You?

Without insurance Dupixent can cost around $3,000 a month—yikes! But with Medicare Part D you might pay a few hundred to over a thousand dollars per month depending on your plan and whether you’ve hit your deductible.

Prices can also vary between pharmacies—one patient paid $800 at one pharmacy and just $200 at another. So yeah—shopping around can be worth it!

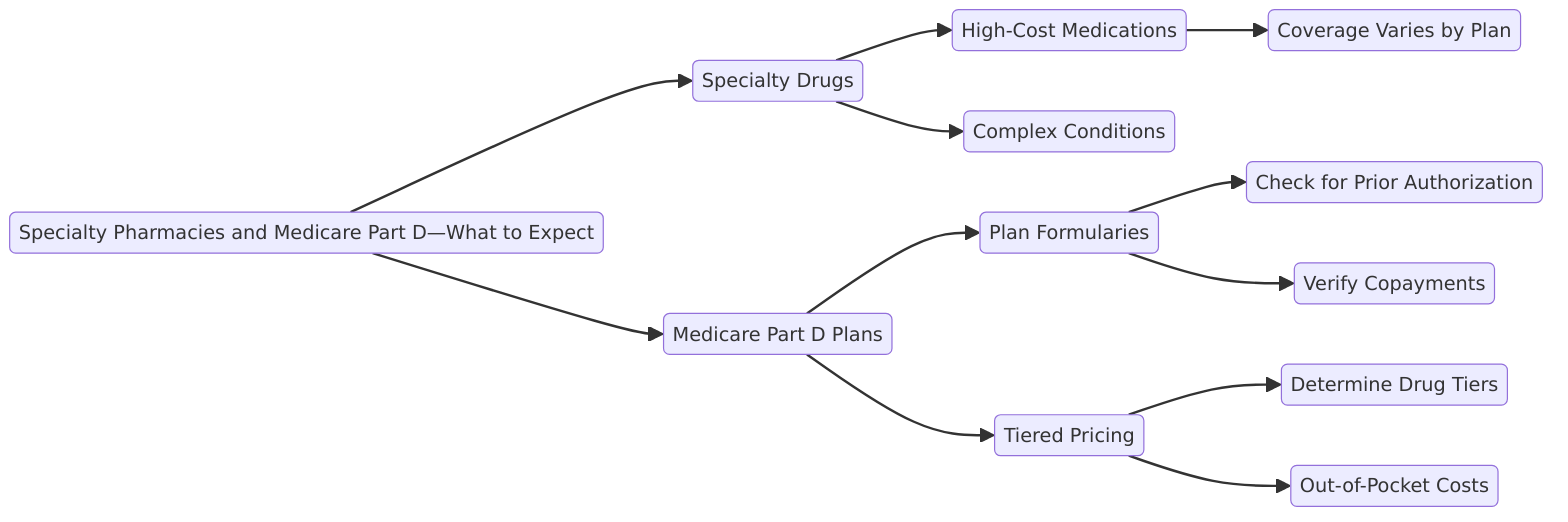

Specialty Pharmacies and Medicare Part D—What to Expect

If you get Dupixent through a specialty pharmacy your insurance company might require prior authorization. This is just a fancy way of saying they need to confirm Dupixent’s necessary before covering it.

As Henry Beltran advises: “Stay in touch with your doctor’s office and insurance plan to make sure you’re getting the prior authorization you need early on. It’ll save you some headaches down the road.”

What If Dupixent Isn’t Covered?

If your insurance doesn’t cover Dupixent or if the costs are still too high—you’ve got options. There are other treatments like light therapy or other biologic drugs that might work for you. You can also look into patient assistance programs that might help cover Dupixent if you’re eligible.

What About Medicaid?

Medicaid can offer better coverage for biologic drugs like Dupixent—but it varies by state. You’ll still likely need prior authorization and you’ll want to check your state’s specific Medicaid coverage policies.

-

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Can You Get Dupixent for Free?

Yes—it’s possible! Some patient assistance programs from the drug manufacturer can cover the full cost for eligible patients. If you qualify based on income limits you might be able to get Dupixent at no cost.

Extra Tips for Lowering Dupixent Costs

If you’ve got a commercial health insurance plan check if Dupixent’s covered—and you’ll probably need prior authorization. If you’re still facing high out-of-pocket costs—check out patient support programs or patient assistance programs that can help lower the Dupixent cost.

Also—some health insurance providers have different coverage tiers for medications like Dupixent. Medicare offers a database of covered drugs that’s worth checking if you’re a specific patient eligible for cost reductions based on your medical insurance status. Always ask your doctor for additional medical information to help with your decisions.

FAQs

How much is Dupixent at Walmart? Prices range from about $800 to $1,000 a month.

Why won’t insurance cover Dupixent? Insurance providers often think cheaper prescription drugs might work just as well.

Does Medicare pay for Dupixent injections? Yes—but how much you pay depends on your plan and deductible.

How do I lower my Dupixent costs? Check for financial assistance programs or Dupixent MyWay—or look into state help if you qualify.

Final Thoughts from Henry Beltran

“Medicare can be tricky” says Henry Beltran. “At Medicare Advisors Insurance Group LLC we’re here to help you figure out your insurance plan and make sure you get the prescription drug benefits you need. Whether it’s Dupixent or another treatment—there are always ways to lower out-of-pocket costs.”

-

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

Sure Dupixent can be expensive—but there are ways to manage those costs. From Medicare Part D coverage to patient support programs there’s almost always something that can help. Talk to your doctor and your insurance provider to find the best option for your situation. And remember—Medicare Advisors Insurance Group LLC is here to guide you every step of the way!

Is Medicare Going to Cost More in 2025?

With the continuous evolution of the U.S. healthcare system, many seniors and Medicare beneficiaries are wondering: Is Medicare going to cost more