As we navigate the world of diabetes management it’s common to wonder whether Medicare covers the latest technology like the Omnipod 5. This tubeless insulin pump has gained popularity due to its ease of use and advanced features but understanding how Medicare handles its cost can feel like trying to put a square peg in a round hole. Don’t worry we’ll break it down for you!

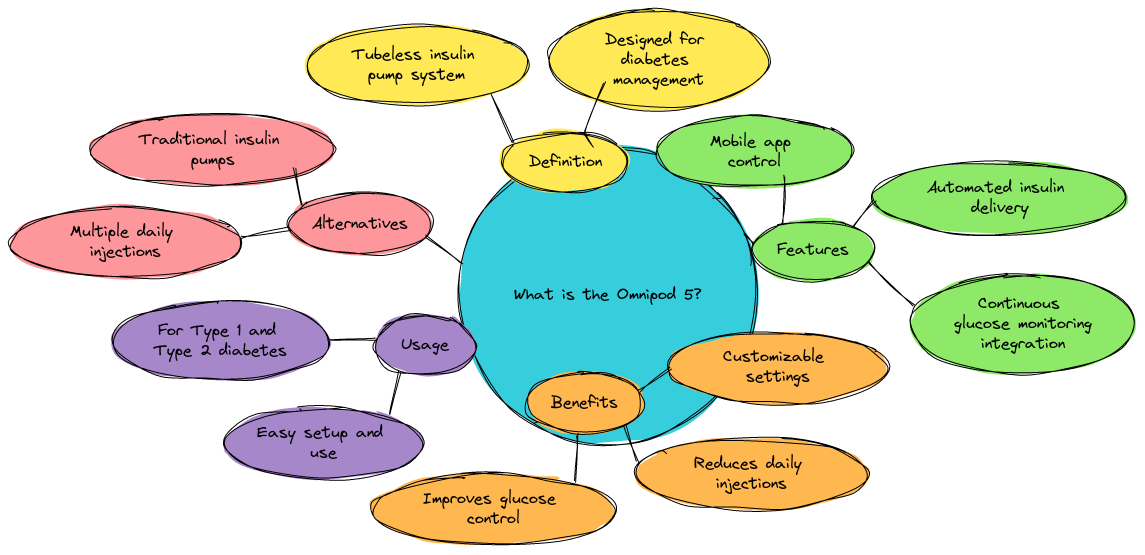

What is the Omnipod 5?

The Omnipod 5 is a tubeless insulin delivery system that continuously administers insulin without the need for constant injections or tubing. It’s loved by those with Type 1 diabetes because it connects to a CGM (Continuous Glucose Monitor) to automatically adjust insulin levels keeping glucose in range. Sounds like magic right? Well almost.

It’s also waterproof and can be worn discreetly under clothes — bonus points for convenience! However the million-dollar question is…

Does Medicare Cover Omnipod 5?

Here’s the short and sweet of it. Yes Medicare covers the Omnipod 5 under Part D — but it’s a little tricky.

How Omnipod 5 Fits Under Medicare

You might think that like most insulin pumps Omnipod would fall under Medicare Part B for durable medical equipment (DME). But nope. The Omnipod 5 is covered under Part D (prescription drug coverage) because it’s classified as a “drug-delivery device.” This distinction is important because it impacts where you can get it and how much you’ll pay.

Medicare beneficiaries will need to enroll in a Part D plan that covers Omnipod 5 supplies. It’s always a good idea to double-check your plan’s formulary to make sure it’s listed. You don’t want to be stuck with surprise bills right?

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What You’ll Pay for the Omnipod 5

Medicare Part D plans vary and costs will depend on your specific plan. Generally expect the following:

- Monthly premiums – Yep those don’t go away.

- Deductible – The amount you pay before the plan starts to share costs.

- Co-payments – A percentage of the cost for your Omnipod supplies.

Potential Financial Pitfalls (or Funny Fails)

- The “I forgot my deductible” slip-up: You think your plan’s got you covered and then—bam—you’re hit with the deductible payment before your Part D plan pitches in. Oops! Keep an eye out for that sneaky cost.

- Coverage Gap (aka the “donut hole”): You may fall into the coverage gap where your plan pays less and you pay more until you hit catastrophic coverage. “Sounds delicious until you realize it’s not an actual donut” jokes Henry Beltran owner of Medicare Advisors Insurance Group LLC. It’s a tricky phase but knowing it’s coming can soften the blow.

Pros and Cons of the Omnipod 5 for Medicare Users

Benefits of Omnipod 5

- Tubeless freedom – No more dangling tubes. It’s literally hassle-free!

- Automatic insulin adjustments – Keeps you in range without constant monitoring.

- Discreet design – Wear it under your clothes without anyone knowing. Well unless you want to show off your cool tech.

Drawbacks of Omnipod 5 (With a Lighthearted Twist)

- Not covered under Part B – Unlike other pumps you can’t get it under durable medical equipment coverage. So if you’re used to thinking “Part B has my back” not this time.

- Higher out-of-pocket costs – Depending on your Part D plan the costs can add up especially if you hit that famous donut hole.

- Supplies and Pharmacy limitations – You’ll need to go through a pharmacy that’s in-network for your Part D plan. It’s not like picking up a loaf of bread at any store — you’ll have to do a little planning.

Henry Beltran chimes in with this little nugget of advice “Medicare beneficiaries using the Omnipod 5 system should compare their Part D plans carefully because not all plans will cover the same amount of costs. It’s better to avoid surprises down the road — trust me.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Steps to Get Omnipod 5 with Medicare

Here’s a quick checklist:

- Enroll in a Part D Plan that covers the Omnipod 5.

- Check your formulary to confirm that Omnipod supplies are covered.

- Compare co-payments between plans — some will cost less for insulin than others.

- Monitor your out-of-pocket costs especially if you hit the coverage gap (donut hole).

Alternatives to Omnipod 5: What to Consider

If Omnipod 5 doesn’t fit into your Medicare plan or budget here are some alternatives to consider:

- Tandem tX2 – This insulin pump is covered under Part B so if you want to go the DME route this might be a better option.

- Medtronic MiniMed – Another traditional pump that falls under Part B coverage.

- Injections – Yep good old-fashioned insulin injections. Simple but it gets the job done.

Each option has its pros and cons so think about what works best for your lifestyle. Omnipod offers freedom from tubes but the tor MiniMed can give you more coverage options under Part B.

Henry’s Final Words of Wisdom

When it comes to Medicare and diabetes technology Henry Beltran says “Navigating Medicare feels like trying to solve a Rubik’s cube blindfolded sometimes. But the Omnipod 5 can be a game changer for a lot of people. Just make sure you understand your Part D plan and how much you’ll be paying out of pocket. It might feel like a maze but we’re here to help make sense of it!”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Key Takeaways

- Omnipod 5 is covered under Medicare Part D not Part B.

- Costs vary depending on your Part D plan so compare your options.

- Watch out for the donut hole where your coverage dips temporarily.

- Consider alternatives like Tandem tX2 or Medtronic MiniMed for better Part B coverage.

What You Should Do Next?

If you’re feeling overwhelmed take a deep breath. Talk to a Medicare advisor (hint: that’s what we do at Medicare Advisors Insurance Group LLC) to compare your options and find a plan that works best for your health needs. Give us a call today — we promise to leave the confusing jargon at the door.