Riding a motorcycle can be a blast—until something goes wrong. When you’re cruising along with the wind in your face, a nasty spill is probably the last thing on your mind. But accidents happen—so if you find yourself in a wreck, you’ll probably be wondering, “Does Medicare cover my medical bills?” Well—it’s not as straightforward as you’d hope, but let’s break it down so it’s easy to understand.

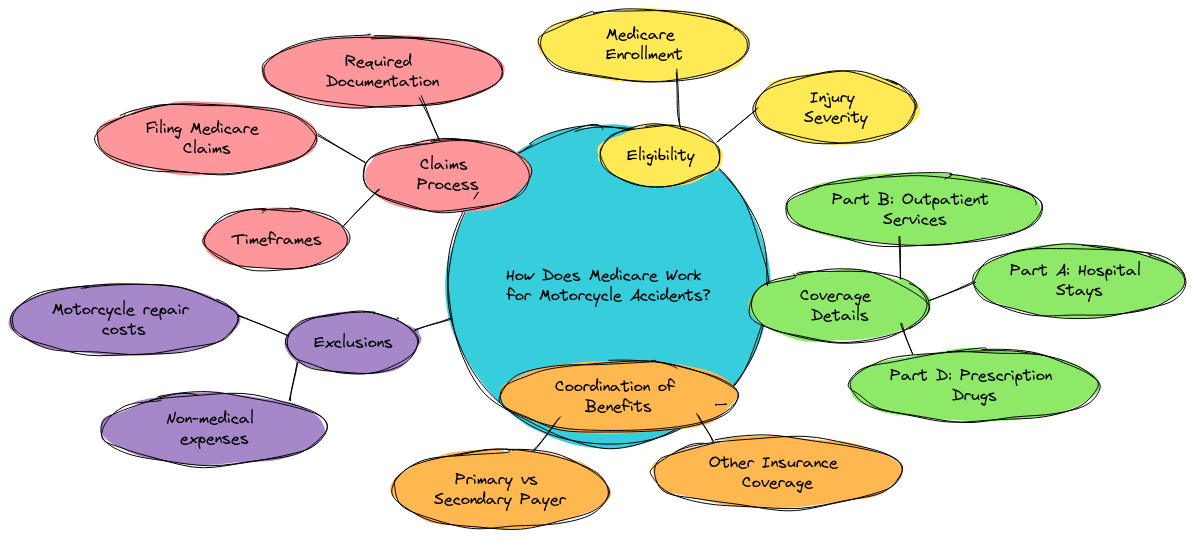

How Does Medicare Work for Motorcycle Accidents?

Medicare is a federal health insurance program mainly for folks 65 and older, or younger people with certain disabilities. But here’s the deal—Medicare doesn’t cover everything, and that includes some costs from motorcycle accidents. Depending on what kind of injury you get, things can get confusing. Let’s break it down step by step.

Part A – Hospital Insurance

If you end up in the hospital after a motorcycle accident—Medicare Part A is likely going to cover your stay. That includes hospital care, some home health care, and skilled nursing once you’re discharged. Sounds like a sweet deal, right? But before you start celebrating—Part A doesn’t cover long-term care or stuff like getting help with daily tasks like showering or dressing if you’re laid up for a while.

- Hospital stay: Covered

- Skilled nursing care: Covered (with some limits)

- Long-term care: Nope—not covered

Drawback: Sure—Part A takes care of you in the hospital—but if you’re hoping it’ll cover the extra help you might need at home when you’re binge-watching shows during recovery—you’re out of luck. As Henry Beltran—owner of Medicare Advisors Insurance Group—says, “Part A’s great until you realize it doesn’t do everything.”

Part B – Medical Insurance

Now, if you’re thinking—”Great—Part A has my hospital stay—what about all those doctor visits, X-rays, and the physical therapy I’ll need to get back on my feet?” Enter Medicare Part B. This part covers outpatient services like doctor visits, ambulance rides, and therapy.

- Ambulance ride: Covered

- Doctor visits: Covered

- Physical therapy: Covered

But there’s a catch—Part B doesn’t come free. You’ve gotta pay a deductible, and then 20% of the costs for services after that. So if you’re seeing the doctor or need therapy after your accident—you’ll still be covering a chunk of the bill.

Drawback: While Medicare Part B helps a lot, that 20% can add up—especially with ongoing therapy and doctor visits. Replacing your bike might feel cheaper by comparison!

Part C – Medicare Advantage Plans

Now if you’re after something a little fancier, check out Medicare Advantage Plans (Part C). These plans, offered by private companies, cover everything from Part A and Part B, plus they often throw in extras like vision, dental, and sometimes prescription drugs.

But—here’s the thing—every Advantage Plan is different. Some might be great, covering things like specialized care you need after an accident. Others—not so much. You’ll want to read the fine print and make sure you’re getting what you need.

Drawback: Advantage Plans are like that one friend who’s full of surprises—sometimes great—sometimes not so much. Henry Beltran puts it like this, “With Medicare Advantage—you might get a good deal—or you might be left scratching your head. It’s a gamble.”

Part D – Prescription Drug Coverage

After a motorcycle accident, you might need pain meds or other prescriptions to help you recover. If you’ve got Medicare Part D, you’re covered for your prescriptions. Without it, those meds could be crazy expensive.

- Prescription drugs: Covered (if you have Part D)

Drawback: Just like picking the right motorcycle, picking the right Part D plan takes some thought. If you don’t choose carefully, you might pay way more than expected for the meds you need. And no one likes surprises when it comes to medical bills.

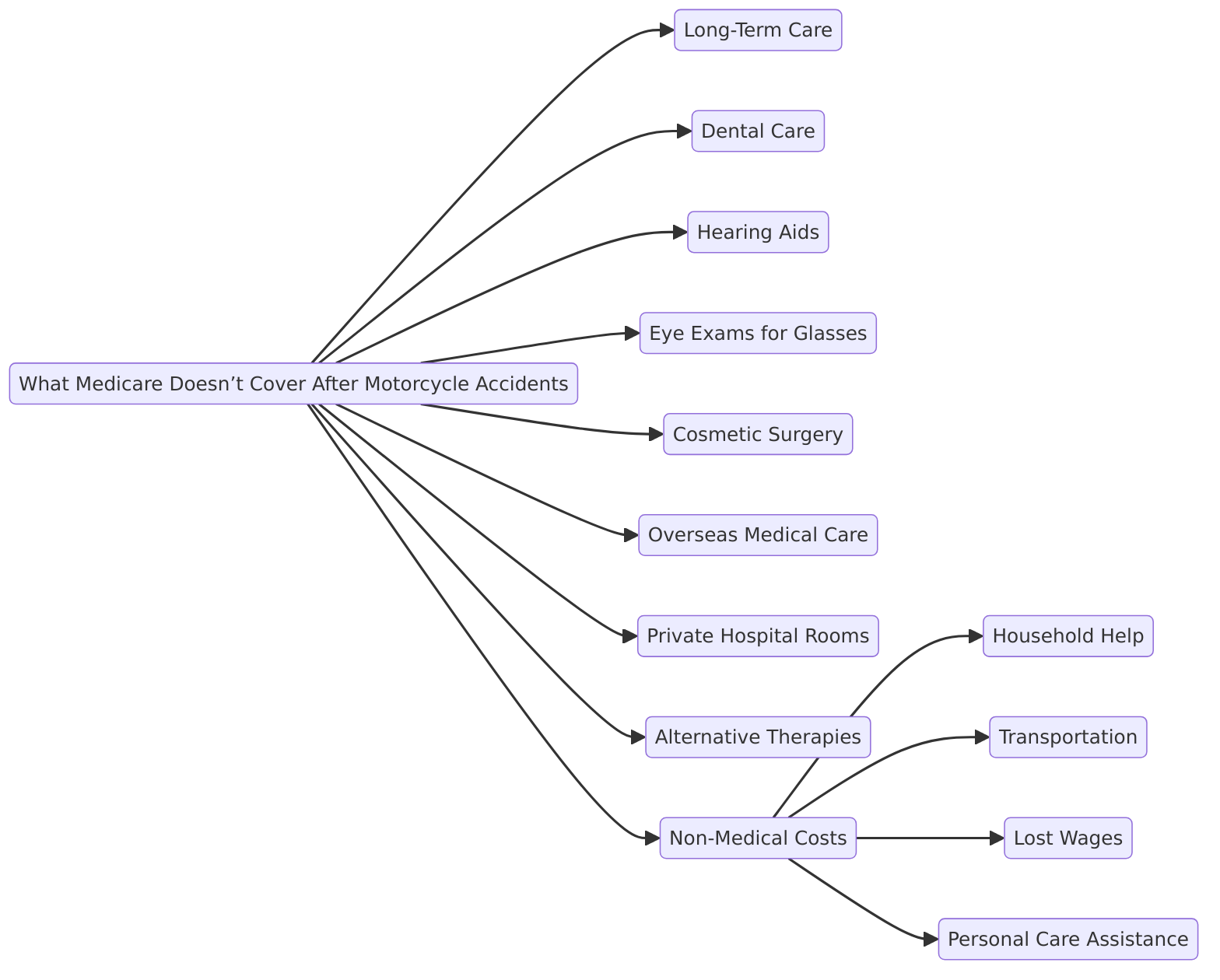

What Medicare Doesn’t Cover After Motorcycle Accidents

Here’s where things get real—while Medicare helps with a lot, it definitely doesn’t cover everything. Some things you’ll need to pay for out of your own pocket. Here are a few:

- Dental Care – If you knock out a tooth in the crash—Medicare won’t help.

- Vision Care – Glasses or contacts? That’s on you.

- Hearing Aids – If the accident messes up your hearing—again, you’re on your own.

- Custodial Care – Need help with daily activities while you recover? Medicare doesn’t cover that.

- Cosmetic Surgery – Want to look as good as you did before the crash? Medicare says, “Nope.”

Drawback: Medicare is great when it comes to hospital stays—but for the smaller stuff—like dental or vision—it’s not your friend. You’ll be pulling out your wallet more than you’d like.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Should You Do?

If you’re someone who loves the open road (and maybe takes a spill now and then), it’s smart to look into supplemental insurance. These Medicare Supplement Plans (Medigap) can fill in the gaps that Medicare leaves wide open.

Pro Tip: Don’t wait until after an accident to figure out your coverage. A little planning now can save you a ton of stress—and money—down the line.

Henry Beltran from Medicare Advisors Insurance Group says it best—“You wouldn’t ride without a helmet—so why leave your medical coverage to chance? Make sure you’re protected for whatever might happen out there.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Wrapping It Up

While Medicare covers a lot after a motorcycle accident—it’s far from perfect. It’ll handle hospital stays and doctor visits—but don’t count on it for things like long-term care or cosmetic surgery. It’s essential to know where Medicare shines and where it falls short so you’re not caught off guard.

Henry Beltran’s advice? “Expect the unexpected when you’re on the road—and that includes your medical bills!”