When it comes to eye health Medicare can seem confusing especially when you’re dealing with a condition like glaucoma. One of the treatments commonly recommended for certain types of glaucoma is Laser Iridotomy. But the big question remains: Does Medicare cover laser iridotomy?

Henry Beltran the owner of Medicare Advisors Insurance Group LLC always says “It’s not just about coverage, it’s about making sure people understand their options so they don’t miss out on essential treatments.” Let’s break it all down in a way that’s easy to understand—without all the fluff.

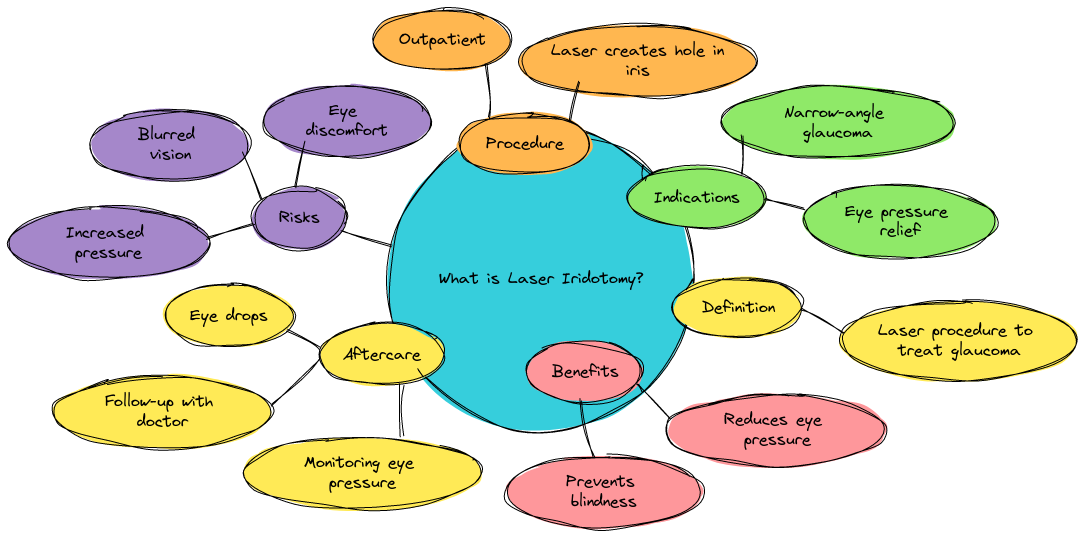

What is Laser Iridotomy?

Laser Iridotomy is a surgical procedure often used to treat narrow-angle glaucoma. It involves creating a small hole in the iris to improve fluid drainage from the eye and reduce intraocular pressure. Sounds intense right? But don’t worry, it’s relatively quick and minimally invasive.

However, you’re probably more interested in whether this procedure is covered by Medicare. So let’s dig into that.

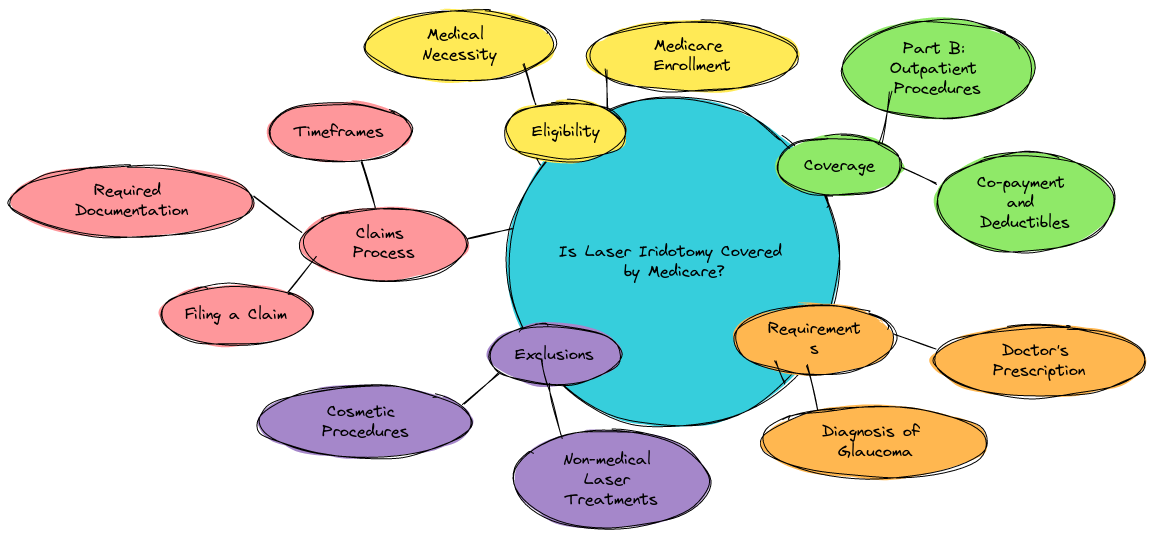

Is Laser Iridotomy Covered by Medicare?

The short answer is yes Medicare does cover laser iridotomy but there are some important details you need to know. Medicare Part B generally covers outpatient procedures like laser iridotomy when deemed medically necessary by your healthcare provider.

But and here’s the kicker you won’t just stroll in and out for free. There are always some out-of-pocket costs to consider.

What Costs Can You Expect?

While Medicare Part B covers 80% of the cost after you’ve met your annual deductible you’ll still be on the hook for the remaining 20% of the Medicare-approved amount. For example if the procedure costs $1,000 you could be paying around $200 out of pocket. That’s like a new pair of fancy shoes but for your eyes! Here’s what to look for:

- Part B deductible: You need to meet this first

- 20% coinsurance: After Medicare pays its share

- Supplemental Insurance (Medigap): Could help reduce that remaining 20%

Henry Beltran always advises “Get a Medigap policy to help cover the gaps! Otherwise you might find yourself a little too surprised by the bill.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Potential Drawbacks of Laser Iridotomy Coverage

Now let’s not pretend it’s all sunshine and roses. Medicare does cover the procedure but there are some considerations to keep in mind.

Referrals and Pre-Authorization Requirements

Medicare can require a referral or pre-authorization in some cases which might delay your treatment. Nobody likes waiting around especially when it’s your vision on the line. Imagine it like waiting for your Uber but it’s a bit blurry and you’re not sure it’ll show up in time.

Extra Costs for Follow-Up Care

Another potential drawback? Follow-up appointments might come with extra costs. Just like your car, your eyes need maintenance checks after a laser iridotomy. Unfortunately Medicare doesn’t always pick up the tab on everything. Sometimes it’s just like those unexpected mechanic bills. “You thought you were done paying? Surprise!” You might need extra treatments or meds that could add up.

The Risk of Needing Additional Procedures

Laser iridotomy isn’t always a one-and-done solution. If your glaucoma progresses you might need additional treatments and surgeries. Medicare coverage for other interventions like trabeculectomy or tube shunt surgery varies. So you’re kind of taking a gamble here. It’s like fixing one tire but realizing your whole car needs an overhaul. Oh joy!

Tips for Getting the Most Out of Medicare

Navigating Medicare can feel like driving a car without a GPS—frustrating and easy to get lost. Here are a few quick tips to ensure you’re making the most of your benefits:

Understand Your Medicare Parts

- Part A: Covers inpatient hospital stays but probably won’t be much help here

- Part B: This is your go-to for outpatient procedures like laser iridotomy

- Medigap: These supplemental policies help cover the leftover 20% so you’re not stuck footing a huge bill

Always Check for Pre-Approvals

Make sure to check if Medicare requires pre-authorization for the procedure. Better safe than sorry! That’s one less headache to deal with.

Have a Backup Plan

You might want to consider vision insurance on top of Medicare for added protection. After all who wants to skimp when it comes to their eyesight? Henry Beltran always emphasizes “Your vision is priceless but that doesn’t mean it should cost you a fortune.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Avoid Unexpected Costs

- Ask questions: Don’t be afraid to ask your provider if all aspects of your treatment are covered.

- Get a second opinion: Make sure the procedure is truly necessary. Laser surgery sounds cool but make sure you actually need it!

- Check your insurance: Review your policy so you’re not hit with unexpected costs.

Is Laser Iridotomy Right For You?

Medicare may cover it but it’s essential to talk to your doctor and weigh your options. Laser iridotomy is a great option for certain types of glaucoma but it’s not the only one. There are medications and alternative surgeries that might suit you better depending on your specific case.

Remember no medical procedure is without risk and you should always get a second opinion to confirm if it’s the best treatment for your condition. After all we’re talking about your eyesight here—not something to take lightly!

Henry Beltran sums it up well: “At Medicare Advisors Insurance Group LLC we always tell our clients it’s about knowing your options so you’re not left in the dark—literally!”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

Laser iridotomy can be a highly effective treatment for glaucoma and yes Medicare does cover it when it’s deemed medically necessary. Just be sure to plan for out-of-pocket costs and stay informed so you’re not caught off guard. Remember Medicare can be tricky but with the right guidance and a little patience you can make sure your eyes and your wallet both stay healthy.