If you’re someone who’s curious about alternative treatments you might be wondering—does Medicare cover holistic doctors? As more people turn to holistic medicine for a natural approach to health care the big question is: Will Medicare help with the cost? Let’s break it down and see what’s covered and what’s not.

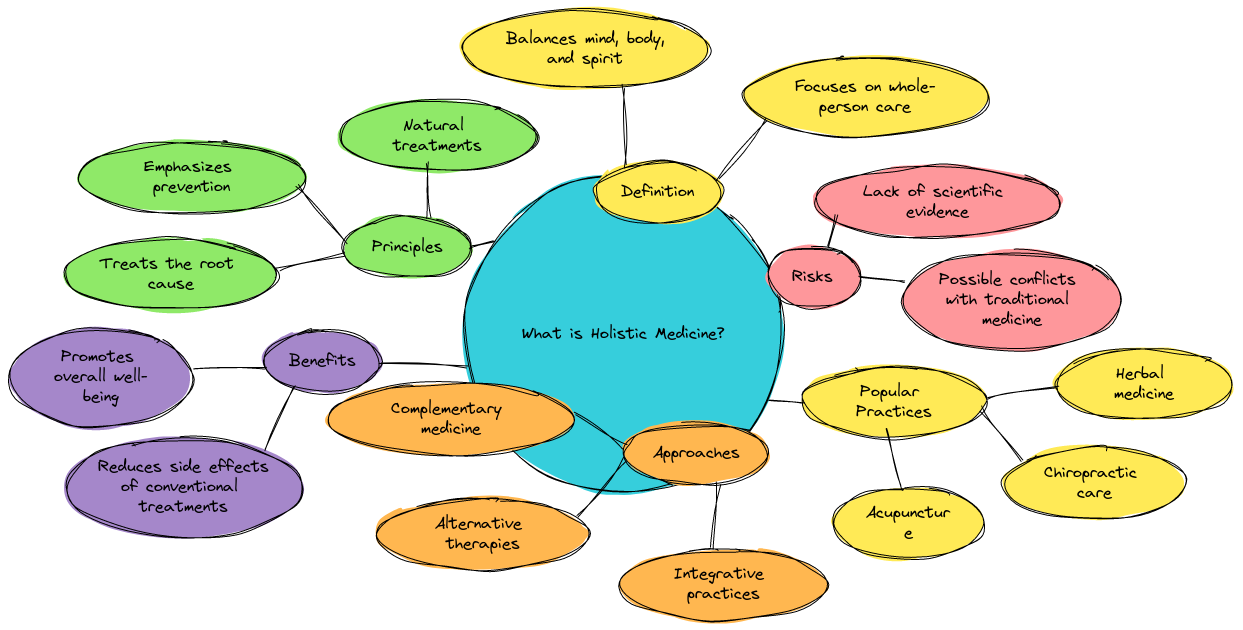

What is Holistic Medicine?

Holistic medicine is all about treating the whole person—body, mind, and spirit—not just focusing on a specific illness or symptom. Holistic doctors use a mix of treatments that range from acupuncture and chiropractic care to herbal remedies and nutritional advice.

Common Holistic Treatments:

- Acupuncture

- Chiropractic Care

- Massage Therapy

- Herbal Medicine

- Yoga & Meditation

The idea is to create balance in all areas of your life—whether it’s physical, emotional, or spiritual. Sounds great right? But the real question is—what does Medicare have to say about it?

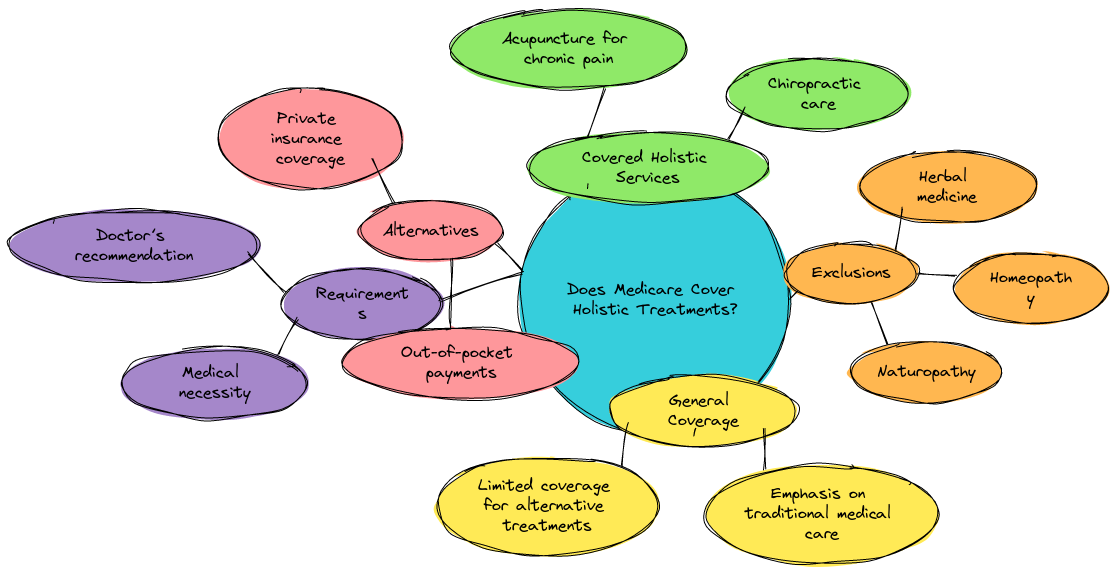

Does Medicare Cover Holistic Treatments?

Let’s be honest—Medicare isn’t exactly jumping on the holistic bandwagon. It’s a little more old-school. For the most part, Medicare doesn’t cover holistic doctors or treatments—but there are some exceptions. Let’s dive into what Medicare does cover—and where you might be on your own.

1. Acupuncture: Kinda Sorta Covered

Good news—acupuncture is covered by Medicare Part B—but only if you have chronic lower back pain. If you’re dealing with that—Medicare’s got your back (literally). But if you’re hoping to use acupuncture for headaches or anxiety—sorry—you’re out of luck.

Potential Drawback: You’ll have to stick to back pain as your go-to excuse for seeing the acupuncturist. They’ll probably give you a strange look when you say Medicare won’t help with your stress.

2. Chiropractic Care: Only for Specific Issues

Medicare Part B covers chiropractic care—but only for one thing—manual manipulation of the spine to fix a subluxation. So if your back’s a little out of alignment you’re good—but don’t expect Medicare to pay for wellness adjustments or full-body chiropractic care.

Potential Drawback: You might have to explain to your chiropractor that you’re only there for that one adjustment—expect some eye-rolling.

3. Massage Therapy: Relax—But On Your Own Dime

Who doesn’t love a good massage? Unfortunately Medicare doesn’t think it’s medically necessary—so massage therapy isn’t covered at all. Doesn’t matter if you’ve got knots for days—you’ll have to pay for that yourself.

Potential Drawback: Your wallet might feel the pressure more than your muscles after paying out of pocket for that relaxing treatment.

4. Herbal Medicine & Supplements: Sorry—Nope

If you’re into herbal remedies or supplements—don’t expect Medicare to foot the bill. Whether it’s calming chamomile tea or vitamins—Medicare won’t cover it. These are all considered out-of-pocket expenses.

Potential Drawback: Your bank account might be feeling a little less Zen after buying all those herbs on your own.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What Can You Do Instead?

Just because Medicare doesn’t cover most holistic treatments doesn’t mean you don’t have options. Here are a few ideas:

1. Medicare Advantage Plans

Some Medicare Advantage plans (Part C) might cover things like chiropractic care—acupuncture—or even wellness programs. It all depends on the plan you choose and where you live. “If you’re looking for extra coverage for holistic treatments—Medicare Advantage is your best bet,” says Henry Beltran, owner of Medicare Advisors Insurance Group LLC. “It’s all about finding the right plan for your needs.”

Potential Drawback: Going through all the options to find a plan that covers your needs can feel like unraveling a ball of yarn—frustrating but worth it.

2. Pay Out of Pocket

If holistic care is a priority for you—you might want to budget for it. Many holistic practitioners offer cash discounts or payment plans if you’re paying without insurance. It’s not ideal—but it’s doable.

Potential Drawback: Your budget might need some stretching—like a good yoga session—if you plan on paying for all those treatments yourself.

3. Medicaid Could Be an Option

Depending on your situation—you might qualify for Medicaid. Some state Medicaid programs cover holistic treatments like acupuncture and chiropractic care. It varies by state—so check what’s available where you live.

Potential Drawback: Medicaid coverage can be unpredictable—so it’s a bit of a gamble on whether it’ll cover what you need.

Can You Appeal Medicare’s Decisions?

Thinking you can appeal Medicare’s decision to not cover certain holistic treatments? Well—not likely. Medicare’s pretty set in its ways about what it will and won’t cover. Unless something changes big-time—it’s best to look into other options.

Potential Drawback: You could write an appeal letter—but Medicare’s probably just going to tell you “nope.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts from Henry Beltran

Henry Beltran, owner of Medicare Advisors Insurance Group LLC, says it best: “Medicare’s not exactly the most forward-thinking when it comes to holistic care—but that doesn’t mean you’re out of luck. You’ve just got to find the right mix of plans—or budget a little extra if you want to go down that path.”

Holistic medicine can be a great way to improve your overall health—but getting Medicare to cover it is a whole different story.

What’s Next?

- Look into Medicare Advantage plans for more coverage options

- Consider paying out of pocket for treatments

- Check Medicaid coverage if you qualify

Medicare may not be totally on board with holistic medicine—but with a little effort—you can still find ways to include it in your healthcare routine. Good luck on your wellness journey!