When you or a loved one is diagnosed with prostate cancer you may have heard of High-Intensity Focused Ultrasound (HIFU) as a potential treatment option. But you’re probably wondering — does Medicare cover HIFU for prostate cancer? The short answer? It depends on a few things like where you live the kind of plan you have and the specifics of your health care situation. Let’s break it down together (without breaking the bank of course!).

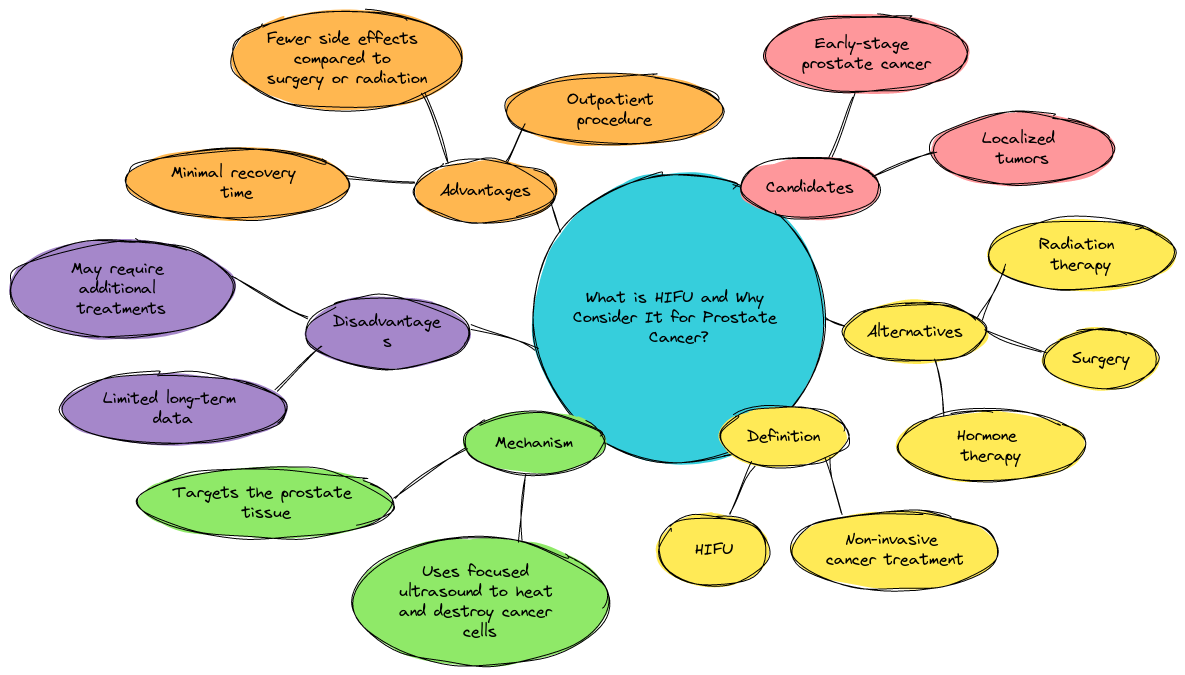

What is HIFU and Why Consider It for Prostate Cancer?

HIFU is a minimally invasive treatment that uses focused ultrasound waves to heat and destroy cancerous prostate tissue. Unlike surgery or radiation it doesn’t involve cutting or exposing your body to ionizing radiation. So it sounds pretty fancy right? Less cutting more zapping!

But before we all get too excited HIFU has its pros and cons just like any other medical treatment.

Advantages of HIFU

- Non-invasive: No knives no scalpels just sound waves doing their thing.

- Faster recovery time: Most people can go home the same day. No long hospital stays!

- Fewer side effects: HIFU can lower the chances of incontinence or erectile dysfunction compared to surgery.

Disadvantages of HIFU (With a Touch of Humor)

- Limited long-term data: Imagine buying a car where the company says, “We’re not sure how this holds up after 10 years.” That’s kind of what HIFU is like – the long-term effectiveness is still being studied.

- Not for everyone: If your cancer’s spread beyond the prostate well HIFU’s laser beams can’t exactly chase it down. You might need more than this non-invasive magic trick.

- Costs: Not to beat around the bush (pun intended) but HIFU can get expensive – especially if Medicare decides not to cover it. You don’t want to end up with a bill that feels like it just hit you with some high-intensity focused dollars!

“Some treatments sound great on paper but you need to know all the facts” says Henry Beltran the owner of Medicare Advisors Insurance Group LLC. “At the end of the day you don’t want to be left with a surprise bill for a treatment that sounds like a Star Wars laser!”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Pay for HIFU?

Now for the million-dollar question: Will Medicare cover your HIFU treatment?

Medicare Part B usually covers medically necessary procedures. However HIFU is still considered experimental in many parts of the US. As of 2024 Medicare doesn’t have a national policy saying “yes we cover HIFU for prostate cancer.” So it’s often a case-by-case decision.

- Original Medicare (Parts A and B): Coverage for HIFU varies. You’ll need to check with your doctor and Medicare to see if your situation qualifies.

- Medicare Advantage Plans (Part C): These plans sometimes offer more flexibility. You might have better luck here depending on the insurance provider.

Steps to Check if Medicare Will Cover HIFU

- Talk to your doctor: Make sure they document why HIFU is necessary for your situation.

- Contact Medicare directly: Call the number on your Medicare card or go online to see if HIFU is covered in your area.

- Look at your supplemental plans: If you have a Medigap plan or Medicare Advantage check what additional coverage is offered for experimental treatments like HIFU.

“It’s important to do your homework” Henry Beltran advises. “If you just assume Medicare will cover HIFU because it’s a hot new treatment – well you might be in for a rude awakening!”

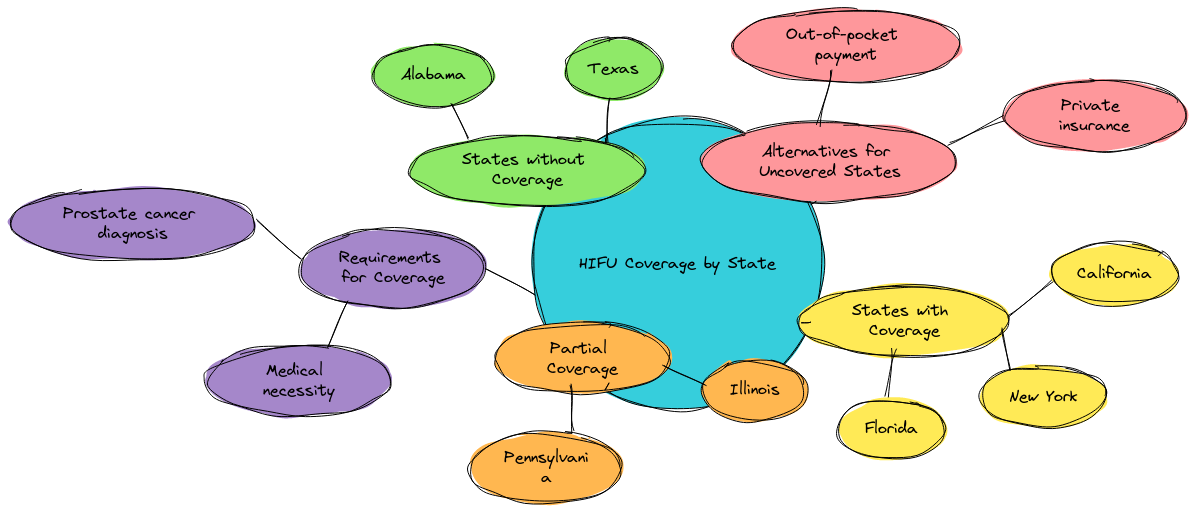

HIFU Coverage by State

Depending on where you live Medicare coverage for HIFU might be more available. Some states are more open to experimental treatments while others are lagging behind.

- Florida: As a retiree hotspot (and where Henry Beltran happens to be based!) Florida is a bit more forward-thinking on Medicare treatments.

- California: Home of tech and innovation – you might think HIFU would be a no-brainer here. But again it depends on your Medicare plan.

- Midwest: If you’re in a rural area well your options might be a bit more limited. Smaller hospitals might not even offer HIFU as an option.

Tips for Navigating Medicare HIFU Coverage by State

- Get a second opinion: If one doctor says no it might be worth checking with a larger medical center.

- Research your hospital’s policies: Not all hospitals are equipped with the technology for HIFU.

- Ask your insurance agent: Sometimes your agent can help with Medicare claims and appeals.

“Location matters more than you think” Henry Beltran says. “You wouldn’t expect healthcare to be like buying real estate but here we are!”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

What If Medicare Won’t Cover HIFU?

Alright so you’ve done the legwork. You’ve called your doctor contacted Medicare and researched your state’s policies – but alas Medicare won’t cover HIFU. What now?

- Out-of-pocket payment: If you’re ready to foot the bill yourself expect to pay anywhere from $15,000 to $25,000. Ouch!

- Private insurance: If you have private insurance outside of Medicare you might have better luck getting HIFU covered.

- Clinical trials: Look for clinical trials offering HIFU treatments. You could get the procedure for free (or at least cheaper) by participating in research.

“It’s always smart to explore all your options” Henry Beltran says. “Sometimes clinical trials can be a hidden gem – you’re helping advance medicine and saving some cash too.”

Ways to Cover HIFU If Medicare Denies You

- Health savings accounts (HSA): If you’ve got money stashed away in an HSA you might be able to use it to cover HIFU.

- Personal loans: If you’re really committed to the treatment a loan could be a last-resort option.

- Appeal Medicare’s decision: If you think your denial was wrong you can file an appeal with Medicare.

Final Thoughts: Is HIFU the Right Choice for You?

Deciding on a treatment like HIFU isn’t just about whether Medicare covers it – though let’s be honest that’s a big part of it! You’ve got to weigh the pros and cons understand the financial risks and do your research. Talk to your doctor reach out to your insurance agent and make sure you’re comfortable with your decision.

“At the end of the day it’s all about making informed choices” says Henry Beltran. “You want to be in control of your healthcare not the other way around.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Key Takeaways

- Medicare coverage for HIFU is spotty at best – be prepared for a case-by-case decision.

- Medigap and Medicare Advantage plans may offer better coverage for experimental treatments like HIFU.

- Do your research talk to your doctor and weigh your financial options before deciding on HIFU.

So while HIFU might sound like a futuristic magic wand (and in many ways it is) remember – just because something sounds cool doesn’t always mean Medicare’s footing the bill!