If you’re battling with acne and wondering if Medicare will cover your dermatology appointments you’re not alone! While acne might seem like a small concern to some for others it’s a pretty big deal. After all nobody wants to spend their life hiding behind acne scars or dealing with persistent breakouts. Let’s dive in to see whether Medicare has your back when it comes to dermatology services for acne. Spoiler alert—it’s not always straightforward but hey nothing really is right?

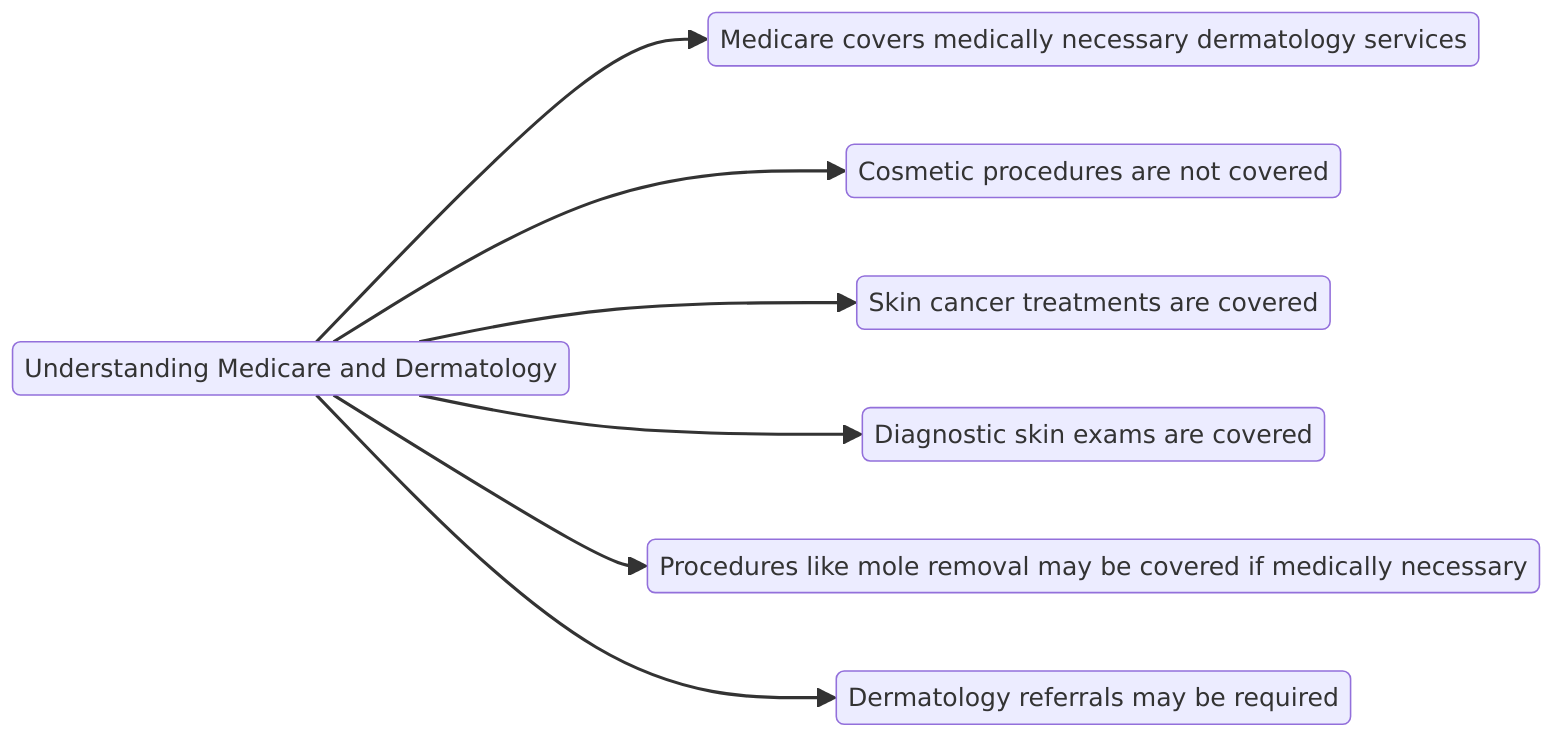

Understanding Medicare and Dermatology

First things first Medicare is a health insurance program mainly for individuals aged 65 or older but it also covers certain younger individuals with disabilities. Now does it cover dermatology? Yes but not always for cosmetic reasons. That’s where it can get tricky with acne treatment. Medicare loves to cover “medically necessary” treatments but if you’re thinking about just getting rid of a few zits because you want clearer skin well you might be on your own for that bill!

What Does “Medically Necessary” Even Mean?

Well it means that if your acne is causing severe health issues like infections or is part of an underlying medical condition then Medicare might pitch in to help. For example if you’re seeing a dermatologist because of recurring painful cystic acne that causes scarring Medicare could consider that a medical necessity. However if you’re looking to clear up some regular pimples to look extra fly on your next Zoom meeting Medicare might just turn a blind eye. Ouch.

So… What Does Medicare Cover For Dermatology?

Here’s what Medicare may cover when it comes to dermatology visits:

- Medical Conditions like cystic acne, eczema, psoriasis, or skin cancer. Acne is sometimes lumped in there—if severe.

- Skin biopsies or excisions for lesions. If your dermatologist suspects something more sinister like skin cancer while treating your acne Medicare will cover it.

- Consultations related to acne if your doctor deems it medically necessary. Your dermatologist could argue that your acne is more than skin-deep (literally) causing infections or pain.

Now let’s talk about what Medicare usually doesn’t cover (brace yourself):

- Cosmetic treatments (Sorry no fancy acne peels or laser treatments just to look pretty).

- Over-the-counter medications for acne (That benzoyl peroxide lotion is on you my friend).

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Different Medicare Parts: What’s The Deal?

Let’s break it down into Parts A B C and D.

Part A

Medicare Part A covers hospital care. If your acne problem somehow lands you in the hospital (severe infections happen!) you could get coverage under Part A. But I mean let’s hope it doesn’t come to that.

Part B

Now Medicare Part B is your best bet for outpatient visits. If your acne treatment is medically necessary (remember that magic phrase!) Part B can cover the dermatologist appointment. So if you’re dealing with something more serious than just teen breakouts you might be in luck.

Part C

This is Medicare Advantage. These plans are provided by private insurance companies and sometimes cover more services than Original Medicare. So check your plan—you may be able to sneak in some extra coverage for acne treatment. As Henry Beltran the owner of Medicare Advisors Insurance Group LLC says “It’s always smart to review your Advantage plan because some of these plans can really offer some surprising coverage!”

Part D

Part D covers prescription drugs. If your dermatologist prescribes medications for your acne like oral antibiotics or retinoids Part D can help with the cost. But again over-the-counter meds? Nope you’re on your own there.

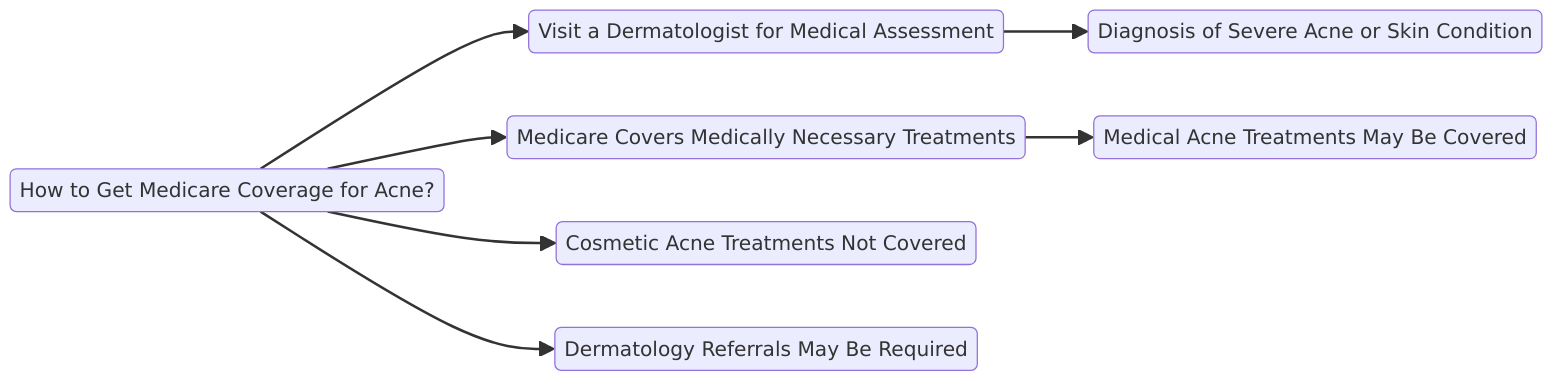

How to Get Medicare Coverage for Acne?

Okay so if you’re thinking “I’ve got acne but I think it might be severe enough for coverage” here’s what you do:

- Talk to your primary care doctor. They can refer you to a dermatologist which will be important for Medicare coverage.

- Get your dermatologist to document everything. If your acne is causing infections or pain they need to spell that out in your records.

- Check your specific Medicare plan. Some Advantage plans might have extra perks but it’s always best to confirm before you start racking up those derm visits.

What’s the Catch?

Now even though Medicare can cover some acne treatments there are a few drawbacks that might make you want to pull your hair out (but don’t because that could lead to more skin issues!).

Drawbacks with a Humor Twist

- Long waits for dermatologist appointments with Medicare can have you wondering if your acne will clear up on its own before you even get in! It’s like trying to catch the last train but realizing you should’ve started walking ages ago.

- Out-of-pocket costs may still surprise you. Sure Medicare might cover part of your dermatologist visit but if you want that extra laser zap to finally banish your acne scars—you might be paying out of pocket. Henry Beltran likes to joke “It’s like Medicare gives you half a sandwich and you’ve got to find the other half yourself!”

- No cosmetic treatments covered. Sorry folks if you’re hoping for a spa-like experience with your acne treatment forget about it! Medicare’s not paying for that luxurious face mask. It’s like asking a strict parent for ice cream before dinner—ain’t gonna happen.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts

Acne can be a real pain—literally and emotionally—but Medicare does offer some help if your condition is severe enough. Just remember “medically necessary” is the key to unlock those Medicare dollars! As Henry Beltran wisely says “At the end of the day it’s about understanding your coverage knowing your options and talking to your doctors to make sure you’re getting what you need.”

If you want more information about your Medicare coverage or to see how you can make the most of your plan feel free to reach out to Medicare Advisors Insurance Group LLC. We’re always here to help!