If you or a loved one is dealing with severe hearing loss you may be considering cochlear implant surgery to improve your hearing. But does Medicare cover this life-changing procedure? Let’s dive into the details.

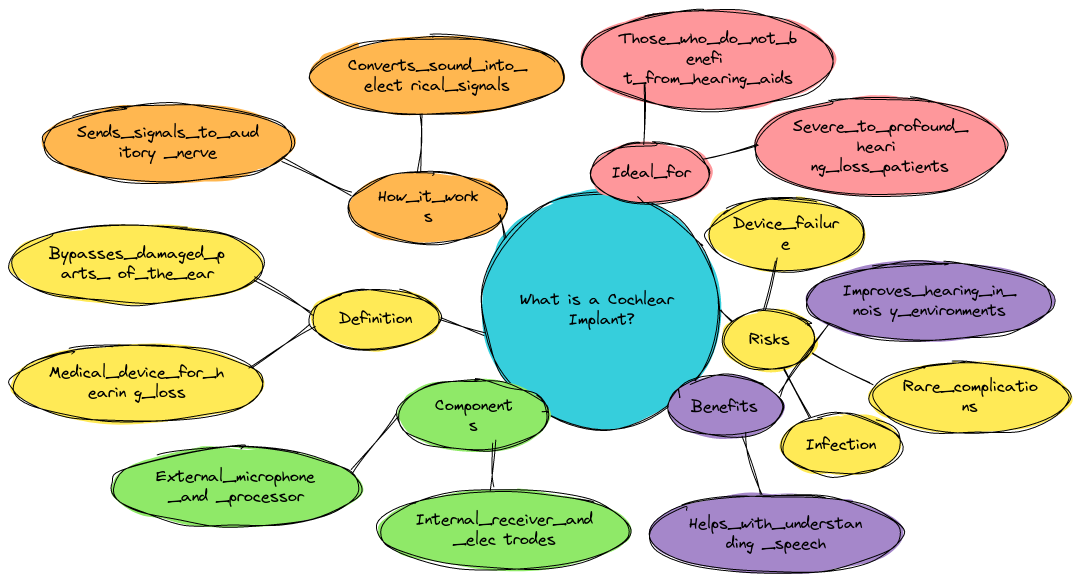

What is a Cochlear Implant?

A cochlear implant is a small electronic device that can help provide a sense of sound to a person who is profoundly deaf or severely hard of hearing. Unlike hearing aids which amplify sound a cochlear implant bypasses damaged portions of the ear and directly stimulates the auditory nerve.

How Does It Work?

The implant has two main components:

- External Processor – Sits behind the ear and picks up sounds.

- Internal Implant – Surgically placed under the skin that sends sound signals to the brain.

Why Choose a Cochlear Implant?

Cochlear implants can be life-changing for people who struggle with hearing aids. For many it’s not just about hearing better it’s about improving communication and quality of life. But before you go racing to the doctor’s office let’s talk about Medicare coverage.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Does Medicare Cover Cochlear Implants?

Yes Medicare does cover cochlear implant surgery but only under specific conditions. The surgery must be deemed medically necessary and prescribed by a healthcare provider. Medicare Part B typically covers 80% of the costs associated with the surgery after you’ve met your deductible.

What Are the Conditions?

Medicare covers cochlear implants if:

- You have severe to profound sensorineural hearing loss in both ears.

- Your hearing aids provide little to no benefit.

- You meet other medical criteria that your doctor determines.

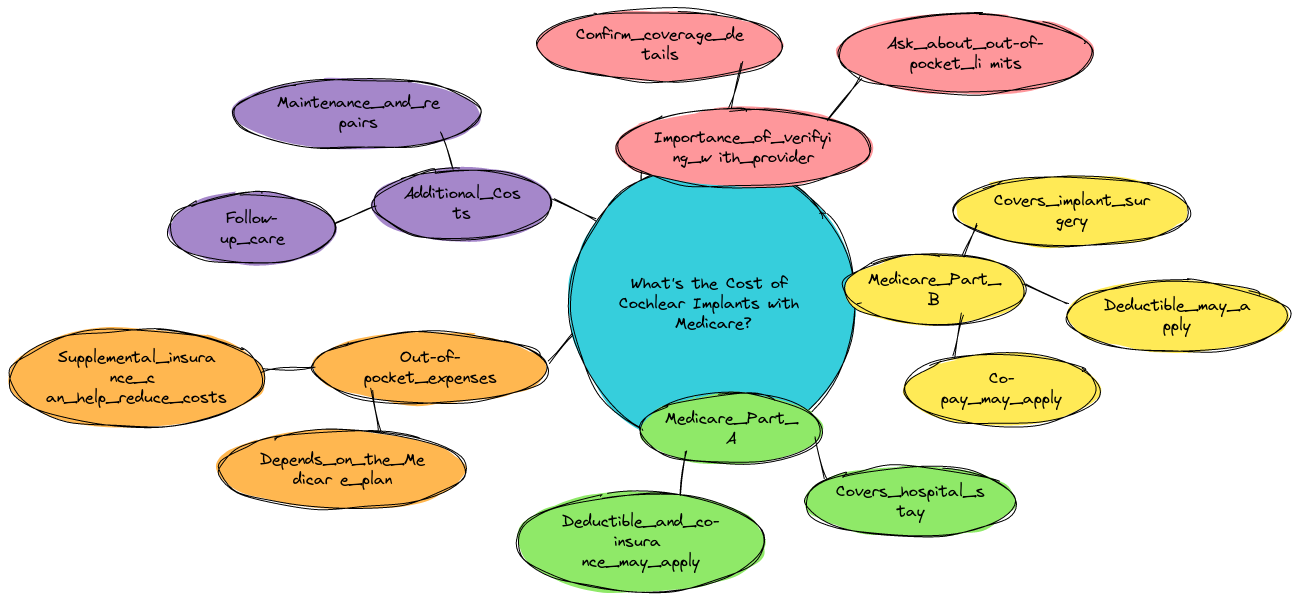

What’s the Cost of Cochlear Implants with Medicare?

Medicare will cover 80% of the cost for the surgery after your deductible is met. You will be responsible for 20% of the costs which includes surgery hospital stays and audiologist visits. But here’s the catch—Medicare Advantage (Part C) plans may have different cost structures depending on the specific plan.

“Medicare does a great job covering these kinds of essential surgeries” says Henry Beltran the owner of Medicare Advisors Insurance Group LLC. “But I always remind my clients to check with their individual plans because out-of-pocket costs can vary significantly especially with Medicare Advantage.”

What About Additional Costs?

You’ll still have to consider:

- Medicare Part B Deductible – In 2024 the standard deductible is $226.

- Out-of-Pocket Costs – 20% of the Medicare-approved amount. That can add up depending on the hospital and surgeon fees.

- Follow-up Appointments – Regular check-ups with an audiologist are necessary to adjust the device.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Medicare Advantage Plans & Cochlear Implant Surgery

If you’re enrolled in a Medicare Advantage (Part C) plan your coverage might differ. Medicare Advantage plans are required to offer at least the same benefits as Original Medicare but many offer extra benefits such as hearing aids or reduced copayments.

Do You Need Prior Authorization?

With Medicare Advantage plans you might need prior authorization before receiving a cochlear implant. Some plans may cover additional services like rehabilitative therapy or audiologist follow-ups beyond what Original Medicare offers.

Before moving forward with surgery check with your plan to ensure you’re covered and understand any potential out-of-pocket costs.

How to Get Cochlear Implant Surgery Approved by Medicare

To get approval for cochlear implant surgery you will need:

- A comprehensive evaluation from an audiologist.

- A referral from an otolaryngologist (ENT doctor).

- Documentation proving severe to profound hearing loss.

Once these requirements are met Medicare will cover the surgery if it meets their medical necessity guidelines.

What’s the Process?

- Step 1: See your primary care physician and explain your hearing difficulties.

- Step 2: Get referred to an audiologist for testing.

- Step 3: If you qualify your audiologist will refer you to a surgeon who specializes in cochlear implants.

- Step 4: Surgery is scheduled if Medicare approves.

Potential Drawbacks of Cochlear Implants (with a Twist!)

Like any surgery cochlear implant surgery isn’t perfect. Let’s talk about some potential drawbacks—but with a humorous twist.

1. It’s Not an Instant Fix

You won’t come out of surgery hearing like a superhero. It takes time and therapy to adjust to the new sound. Think of it like learning a new language… but for your ears.

2. Surgery Isn’t Fun

You’ll have to undergo surgery which for some folks is like getting a root canal but in your ear. But hey it’s a small price to pay for hearing birds chirp again right?

3. Follow-Up Visits

Cochlear implants require a lot of fine-tuning. It’s not like downloading the latest software update on your phone. Expect regular visits to the audiologist which is great if you love waiting rooms.

4. It Doesn’t Work for Everyone

Some people don’t respond as well to cochlear implants as others. So while you might be dreaming of hearing every word in your favorite Netflix show it might sound more like static. But fingers crossed!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Should You Consider a Supplement Plan?

Since Medicare only covers 80% of your surgery costs and related services some people choose to purchase a Medicare Supplement Plan (Medigap). These plans can help cover that pesky 20% coinsurance and deductibles.

“Medicare Supplement Plans can be a lifesaver for those with big medical expenses like surgery” says Henry Beltran. “It’s a small investment that can save you a lot in the long run especially if you need follow-up care.”

What Types of Medigap Plans Cover Cochlear Implants?

Not all Medigap plans are created equal but most will cover the 20% copayment for Medicare-approved services. Plans F G and N are among the most popular choices because they offer extensive coverage.

Cochlear Implants vs. Hearing Aids – What’s Right for You?

If you’re on the fence about whether to pursue cochlear implant surgery or stick with hearing aids you’re not alone. Here’s a quick breakdown to help you decide:

- Hearing Aids: Amplify sound and work best for mild to moderate hearing loss.

- Cochlear Implants: Bypass the ear’s damaged areas for severe to profound hearing loss.

Which Option is More Expensive?

Hearing aids can cost anywhere from $1,000 to $6,000 depending on the technology level but Medicare usually doesn’t cover hearing aids. On the other hand cochlear implants are a bigger initial investment but covered by Medicare if you meet the qualifications.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Final Thoughts from Henry Beltran

“Cochlear implants are a fantastic option for many people dealing with severe hearing loss but it’s important to understand your Medicare coverage before jumping in” says Henry Beltran. “At Medicare Advisors Insurance Group LLC we’re here to guide you through the process. After all understanding your coverage is key to making informed healthcare decisions.”

If you or someone you know is considering cochlear implant surgery be sure to talk to a Medicare expert about your coverage options. And hey who knows you might just be hearing all those little sounds you’ve been missing sooner than you think!