When it comes to abdominal aortic aneurysms (AAA) you don’t want to mess around. We’re talking about a bulge in the artery that carries blood from your heart to your belly. If that thing bursts it’s a medical emergency you don’t want to experience trust me. The good news? Medicare often covers the surgery to fix it. But hey we’re not just here for the good news, let’s dive into the details so you know what’s what.

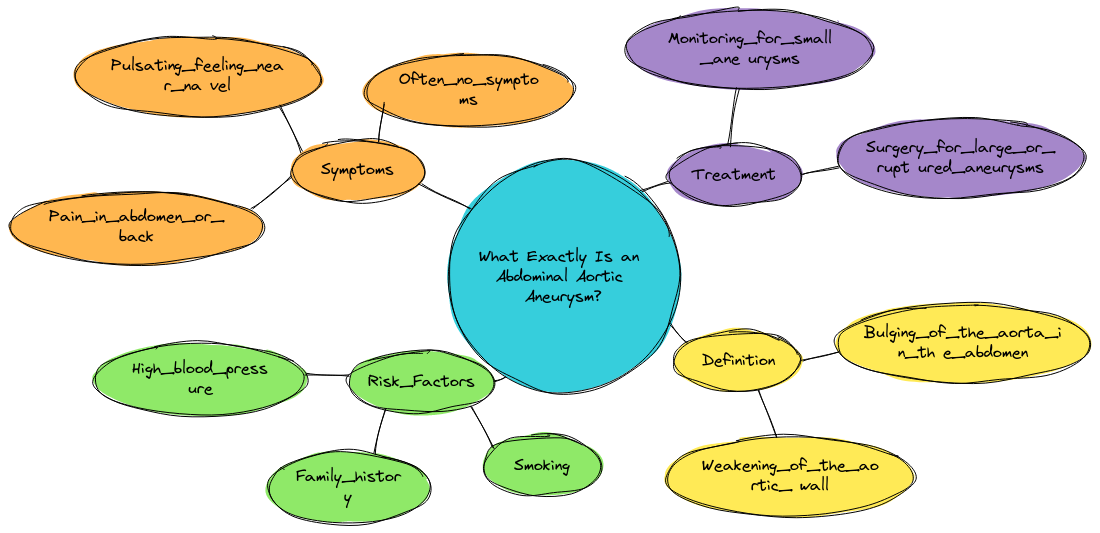

What Exactly Is an Abdominal Aortic Aneurysm?

First things first let’s understand what we’re dealing with. An abdominal aortic aneurysm occurs when the aorta—the largest blood vessel in the body—swells or balloons out. Usually this happens in your abdomen. Sounds kind of scary right? Well it can be. If the aneurysm gets too big it might burst and we’re talking life-threatening. That’s why surgery is a common treatment option to prevent the aneurysm from rupturing.

Medicare and AAA Surgery

So does Medicare cover this kind of surgery? The answer is yes—well mostly. Medicare Part B covers abdominal aortic aneurysm screening if you’re considered at risk. Specifically if you’re a man between 65-75 who’s smoked at least 100 cigarettes in your life or have a family history of aneurysms you’re eligible. However surgery coverage falls under Medicare Part A since it involves hospital care.

Let’s break it down a bit more:

- Medicare Part B: Covers the ultrasound screening for those at risk

- Medicare Part A: Covers the actual surgery and hospital stay

- Medicare Advantage Plans (Part C): These plans are required to provide the same coverage as Original Medicare but they might offer extra benefits depending on your plan

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How Much Will Surgery Cost Under Medicare?

Here’s the kicker—Medicare doesn’t cover 100% of the costs. Surprise! You’ll still be on the hook for deductibles copayments and maybe even coinsurance. With Medicare Part A you’ll have to pay the $1600 deductible before Medicare picks up the tab. After that Medicare covers 80% of the costs but you’ll still need to fork over 20%. And let’s not forget about additional costs if you’re prescribed medications post-surgery.

Henry Beltran the owner of Medicare Advisors Insurance Group LLC explains “Medicare does a pretty good job covering the big stuff but you need to be aware of the small print. That’s where folks get blindsided.”

Different Types of Abdominal Aortic Aneurysm Surgery

When it comes to the surgery itself you’ve got two main types: open surgery and endovascular repair. Both have their pros and cons so let’s lay it all out on the table.

Open Surgery

Open surgery is the classic method. The surgeon makes a large incision in your abdomen and repairs the aneurysm directly by replacing the damaged section of the aorta with a graft. It’s pretty intense and requires a longer hospital stay and recovery.

- Advantages:

- More direct repair

- Works better for larger or more complex aneurysms

- Drawbacks:

- Long recovery time (like staying at your in-laws for a month)

- Higher risk of complications like infection or breathing issues

- You’ll be out of commission for a while so cancel that hiking trip

Endovascular Repair

Endovascular repair is the newer option. Instead of making a large cut the surgeon inserts a catheter through a small incision and uses a stent to reinforce the aorta. Sounds high-tech right?

- Advantages:

- Smaller incision

- Shorter hospital stay (Yay! Less Jell-O!)

- Faster recovery time (Back to binge-watching Netflix sooner)

- Drawbacks:

- Not always an option for larger aneurysms (You know those problems that need a bigger wrench? Same deal)

- Requires regular follow-ups to make sure the stent stays in place

Henry Beltran also points out “Endovascular surgery might sound like a breeze but it’s not for everyone. You really need to talk with your doctor about which option makes sense.”

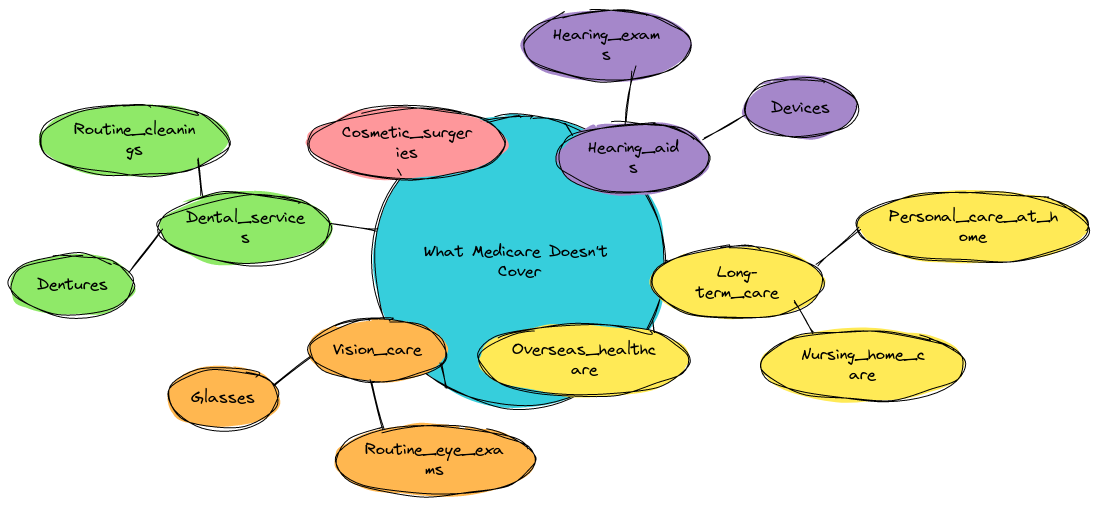

What Medicare Doesn’t Cover

Now let’s talk about what Medicare won’t cover because there’s always something right? While the bulk of the surgery is covered don’t forget that prescription drugs you need post-surgery aren’t fully covered by Original Medicare. You’ll need Medicare Part D or a Medicare Advantage Plan that includes drug coverage. Also home care during recovery if you need it might require a bit more planning.

How to Maximize Medicare Coverage

If you want to make sure you’re not paying out of pocket for unexpected stuff consider these options:

- Supplemental Insurance (Medigap): This helps cover copayments and coinsurance so you’re not stuck with a surprise bill

- Medicare Advantage Plans: These plans offer additional benefits like prescription drugs dental care and sometimes even vision or gym memberships (because you know you’ll want to get back into shape)

- Talk to an Advisor: Yeah a shameless plug but that’s what we do. As Henry Beltran says “We’re here to help folks navigate the maze that is Medicare coverage. Trust me it’s confusing enough on its own.”

Medicare Coverage for Follow-Up Care

After the surgery you’ll need regular checkups especially if you had endovascular repair. Medicare will cover these under Part B but you’ll still need to meet your deductible. Routine care can add up so make sure your plan fits your needs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Important Questions to Ask Your Doctor

Before you go under the knife make sure you’re asking the right questions:

- What are the risks of surgery?

- Which surgery is best for me?

- What will Medicare cover?

- Do I need supplemental insurance to cover the costs?

In Conclusion

Yes Medicare covers abdominal aortic aneurysm surgery but as always there’s a catch or two. Whether it’s understanding your deductibles or figuring out which surgery is right for you it’s important to be fully prepared. And if you’re feeling overwhelmed don’t hesitate to talk to someone like Henry Beltran at Medicare Advisors Insurance Group LLC. We’re here to make the Medicare maze a little easier to navigate. As Henry says “Don’t wait until you’re on the operating table to figure out what’s covered.”