“Find the Right Plan for You in 2023 – Compare Medicare Advantage Plans Now!”

Exploring the Different Types of Medicare Advantage Plans for 2023

Are you looking for the best Medicare Advantage plan for 2023? With so many options available, it can be hard to know which one is right for you. But don’t worry – we’ve got you covered! Here’s a quick overview of the different types of Medicare Advantage plans available for 2023, so you can make an informed decision.

First, let’s talk about Health Maintenance Organizations (HMOs). These plans offer comprehensive coverage and typically have lower premiums than other types of plans. They also usually require you to use in-network providers, so it’s important to make sure your doctor is in the plan’s network before signing up.

Next, there are Preferred Provider Organizations (PPOs). These plans offer more flexibility than HMOs, as you can use out-of-network providers, but you’ll likely pay more for the privilege.

Finally, there are Special Needs Plans (SNPs). These plans are designed for people with specific health conditions, such as diabetes or heart disease. They offer tailored coverage and may include additional benefits, such as transportation to medical appointments.

No matter which type of Medicare Advantage plan you choose, you can rest assured that you’ll be getting quality coverage. So take your time, do your research, and find the plan that’s right for you!

Find Medicare Plans in 3 Easy Steps

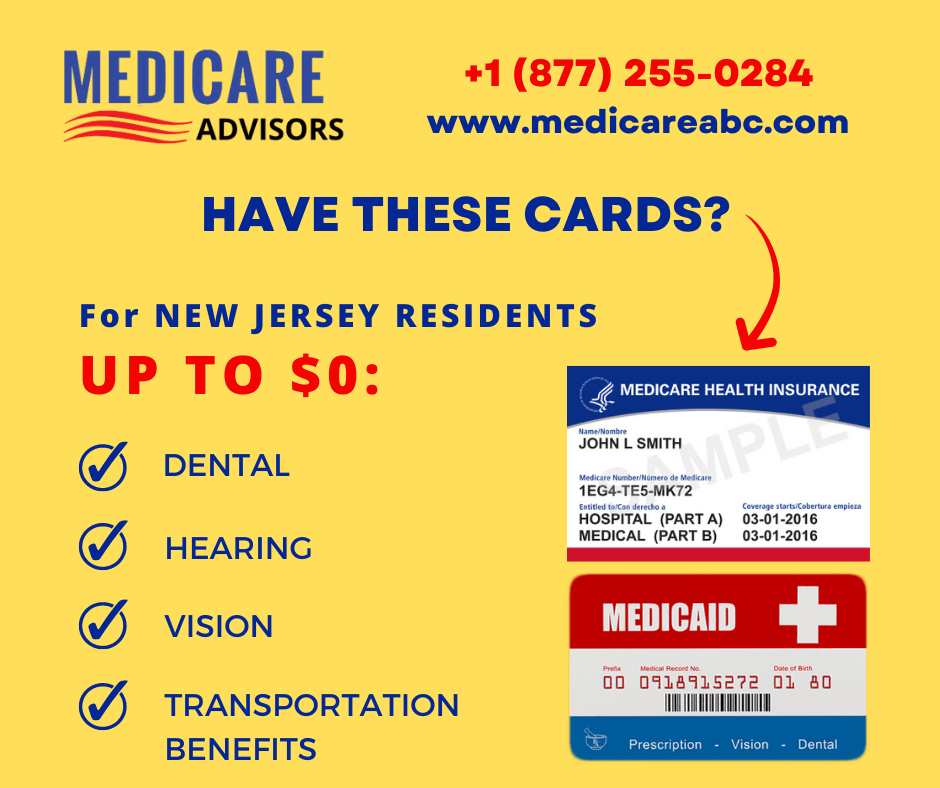

We can help get up to $0 monthly premium Medicare plans

Comparing the Benefits and Costs of Medicare Advantage Plans for 2023

As the 2023 Medicare Advantage plan year approaches, it’s important to compare the benefits and costs of the various plans available. With so many options, it can be difficult to know which plan is right for you. Fortunately, there are a few key factors to consider when comparing the benefits and costs of Medicare Advantage plans.

First, consider the coverage offered by each plan. Medicare Advantage plans typically offer a wide range of coverage, including hospitalization, doctor visits, prescription drugs, and more. It’s important to compare the coverage offered by each plan to make sure it meets your needs.

Second, consider the cost of each plan. Medicare Advantage plans typically have a monthly premium, as well as copayments and coinsurance for services. It’s important to compare the cost of each plan to make sure it fits within your budget.

Finally, consider the quality of care offered by each plan. Medicare Advantage plans are required to meet certain quality standards, so it’s important to compare the quality of care offered by each plan. This includes things like customer service, provider networks, and more.

By comparing the benefits and costs of Medicare Advantage plans for 2023, you can make an informed decision about which plan is right for you. With so many options available, it’s important to take the time to compare the coverage, cost, and quality of care offered by each plan. With the right plan, you can get the coverage you need at a price you can afford.

Understanding the Different Coverage Options of Medicare Advantage Plans for 2023

Are you looking for a Medicare Advantage plan for 2023? With so many options available, it can be difficult to know which plan is right for you. To help you make an informed decision, let’s take a look at the different coverage options of Medicare Advantage plans for 2023.

First, let’s start with the basics. Medicare Advantage plans are offered by private insurance companies and are an alternative to Original Medicare. These plans provide the same coverage as Original Medicare, but often include additional benefits such as vision, dental, and hearing coverage.

When it comes to coverage, Medicare Advantage plans can be divided into three main categories: HMOs, PPOs, and Special Needs Plans. HMOs are the most common type of Medicare Advantage plan and offer the most comprehensive coverage. These plans typically require you to use a network of providers and have more restrictions than other plans. PPOs are similar to HMOs, but they allow you to use out-of-network providers at an additional cost. Special Needs Plans are designed for people with specific health conditions and offer additional benefits tailored to their needs.

In addition to the different types of plans, Medicare Advantage plans also offer different levels of coverage. Some plans offer basic coverage, while others offer more comprehensive coverage. Basic coverage typically includes hospitalization, doctor visits, and prescription drug coverage. More comprehensive plans may also include vision, dental, and hearing coverage.

When choosing a Medicare Advantage plan for 2023, it’s important to consider your individual needs and budget. Make sure to compare plans and read the fine print to ensure you’re getting the coverage you need at a price you can afford. With the right plan, you can enjoy the peace of mind that comes with knowing you’re covered.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Different Networks of Medicare Advantage Plans for 2023

As the Medicare Advantage landscape continues to evolve, it’s important to stay informed about the different networks of plans available for 2023. With so many options, it can be difficult to know which plan is right for you. That’s why we’re here to help you explore the different networks of Medicare Advantage plans for 2023.

First, let’s take a look at the HMO network. HMO plans are typically the most affordable option, and they offer a wide range of benefits. These plans typically require you to use in-network providers and have a more limited network of doctors and hospitals.

Next, we’ll look at the PPO network. PPO plans are more expensive than HMO plans, but they offer more flexibility. You can use out-of-network providers, and you don’t need a referral to see a specialist.

Finally, we’ll look at the POS network. POS plans are a hybrid of HMO and PPO plans. They offer the flexibility of PPO plans, but they also require you to use in-network providers.

No matter which network you choose, you can rest assured that you’ll have access to quality care. All Medicare Advantage plans must meet certain standards set by the Centers for Medicare & Medicaid Services (CMS). This means that all plans must provide the same basic benefits, such as hospitalization, doctor visits, and prescription drug coverage.

Now that you know more about the different networks of Medicare Advantage plans for 2023, you can make an informed decision about which plan is right for you. With so many options, you can be sure to find a plan that meets your needs and budget.

Examining the Different Prescription Drug Coverage of Medicare Advantage Plans for 2023

Medicare Advantage plans for 2023 are offering an array of prescription drug coverage options that are sure to meet the needs of any senior. From comprehensive coverage to more affordable plans, there is something for everyone. With so many choices, it can be difficult to decide which plan is right for you.

Let’s take a closer look at the different prescription drug coverage options available in Medicare Advantage plans for 2023.

For those who need comprehensive coverage, there are plans that offer coverage for both generic and brand-name drugs. These plans typically have higher premiums, but they provide peace of mind knowing that you are covered for any prescription drug you may need.

For those who are looking for more affordable coverage, there are plans that offer coverage for generic drugs only. These plans typically have lower premiums, but they may not cover all of the medications you need.

Finally, there are plans that offer coverage for both generic and brand-name drugs, but with a higher deductible. These plans may be a good option for those who don’t need comprehensive coverage, but still want some protection in case of an unexpected medical expense.

No matter which plan you choose, it’s important to make sure that it covers all of the medications you need. Be sure to read the plan details carefully and ask questions if you have any.

With so many options available, you can be sure to find a Medicare Advantage plan for 2023 that meets your needs and fits your budget. With the right plan, you can have the peace of mind knowing that you are covered for any prescription drug you may need.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Different Out-of-Pocket Maximums of Medicare Advantage Plans for 2023

Are you looking for a Medicare Advantage plan for 2023? With so many options available, it can be difficult to know which plan is right for you. One important factor to consider is the out-of-pocket maximum. This is the most you will have to pay for covered services in a year.

The good news is that Medicare Advantage plans have different out-of-pocket maximums, so you can find one that fits your budget. In 2023, the maximums range from $3,400 to $7,550. That’s a big difference!

Let’s take a closer look at the different out-of-pocket maximums. The lowest maximum is $3,400. This is a great option if you’re looking for a plan with low out-of-pocket costs. The next tier is $4,500. This is a good choice if you want a plan with moderate out-of-pocket costs.

The highest out-of-pocket maximum is $7,550. This is the most expensive option, but it also offers the most coverage. If you’re looking for a plan with comprehensive coverage, this is the one for you.

No matter which out-of-pocket maximum you choose, you can rest assured that you’ll be getting quality coverage. All Medicare Advantage plans must meet the same standards set by the Centers for Medicare & Medicaid Services.

When choosing a Medicare Advantage plan for 2023, make sure to consider the out-of-pocket maximum. With so many options available, you’re sure to find one that fits your budget and meets your needs.

Comparing the Different Premiums of Medicare Advantage Plans for 2023

Are you looking for the best Medicare Advantage plan for 2023? With so many options available, it can be hard to know which one is right for you. That’s why we’ve done the research for you and compared the different premiums of Medicare Advantage plans for 2023.

First, let’s look at the Humana Gold Plus HMO plan. This plan offers a low premium of $0 per month, making it an affordable option for those on a budget. It also offers a wide range of benefits, including prescription drug coverage, vision and dental coverage, and access to a network of providers.

Next, we have the Aetna Medicare Advantage plan. This plan has a slightly higher premium of $30 per month, but it also offers a wide range of benefits, including prescription drug coverage, vision and dental coverage, and access to a network of providers.

Finally, we have the UnitedHealthcare Medicare Advantage plan. This plan has the highest premium of $50 per month, but it also offers a wide range of benefits, including prescription drug coverage, vision and dental coverage, and access to a network of providers.

No matter which plan you choose, you can be sure that you’re getting quality coverage at an affordable price. With so many options available, you can find the perfect plan for your needs. So don’t wait any longer – compare the different premiums of Medicare Advantage plans for 2023 and find the one that’s right for you!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Different Coverage for Vision and Dental Care of Medicare Advantage Plans for 2023

As the year 2023 approaches, it’s important to consider the different coverage options for vision and dental care available through Medicare Advantage plans. With so many plans to choose from, it can be difficult to know which one is right for you. That’s why it’s important to explore the different coverage options available to you.

When it comes to vision care, Medicare Advantage plans typically cover routine eye exams, eyeglasses, and contact lenses. Some plans may also cover additional services such as cataract surgery, glaucoma screenings, and laser vision correction. It’s important to check with your plan to see what services are covered and what your out-of-pocket costs may be.

When it comes to dental care, Medicare Advantage plans typically cover preventive services such as cleanings, X-rays, and exams. Some plans may also cover additional services such as fillings, crowns, and root canals. Again, it’s important to check with your plan to see what services are covered and what your out-of-pocket costs may be.

No matter which plan you choose, it’s important to understand the coverage options available to you. With so many plans to choose from, it can be difficult to know which one is right for you. That’s why it’s important to explore the different coverage options available to you. With the right plan, you can get the vision and dental care you need without breaking the bank.

Examining the Different Coverage for Preventive Care of Medicare Advantage Plans for 2023

As we look ahead to 2023, Medicare Advantage plans are offering more comprehensive coverage for preventive care than ever before. With the right plan, you can get the preventive care you need to stay healthy and active.

From annual physicals and screenings to immunizations and vaccinations, Medicare Advantage plans are providing more coverage for preventive care than ever before. With the right plan, you can get the preventive care you need to stay healthy and active.

For example, many plans now cover annual physicals and screenings, such as mammograms, colonoscopies, and prostate exams. These screenings can help detect potential health issues early, so you can get the treatment you need before it becomes a bigger problem.

In addition, many plans now cover immunizations and vaccinations, such as the flu shot and the shingles vaccine. These can help protect you from serious illnesses and keep you healthy.

Finally, many plans now cover preventive dental care, such as cleanings and check-ups. This can help you maintain good oral health and catch any potential issues early.

With the right Medicare Advantage plan, you can get the preventive care you need to stay healthy and active. So, take the time to explore your options and find the plan that best fits your needs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Exploring the Different Coverage for In-Home Care of Medicare Advantage Plans for 2023

As the population ages, the need for in-home care is becoming increasingly important. Medicare Advantage plans are a great way to ensure that seniors receive the care they need in the comfort of their own homes. In 2023, Medicare Advantage plans will offer a variety of coverage options for in-home care, giving seniors the opportunity to choose the plan that best meets their needs.

For those who need more comprehensive coverage, some plans will offer a full range of in-home care services, including skilled nursing, physical therapy, and home health aides. These plans will provide the most comprehensive coverage for seniors who need more intensive care.

For those who need less intensive care, some plans will offer coverage for basic in-home care services, such as light housekeeping, meal preparation, and assistance with activities of daily living. These plans will provide the necessary care for seniors who need help with everyday tasks.

For those who need more specialized care, some plans will offer coverage for specialized in-home care services, such as hospice care, respite care, and end-of-life care. These plans will provide the necessary care for seniors who need more specialized care.

No matter what type of in-home care you need, there is a Medicare Advantage plan that can provide the coverage you need. With so many options available, you can be sure to find the plan that best meets your needs in 2023.