When it comes to Medicare options Clearview Medicare plans might just make you scratch your head and go “Wait what?” But don’t worry I’m here to help you make sense of it all. If you’re sitting there wondering what’s the deal with Clearview Medicare you’re not alone. With so many plans and options available it’s easy to get overwhelmed.

Here at Medicare Advisors Insurance Group LLC we like to break things down for our clients in a way that’s straightforward and easy to understand. Henry Beltran our founder says “Choosing the right Medicare plan shouldn’t feel like reading a legal contract at a coffee shop in French. We help you choose wisely so you don’t regret it like that haircut you thought was a good idea in the 90s.”

What is Clearview Medicare?

Clearview Medicare is a health insurance provider offering a variety of Medicare Advantage Plans also known as Part C. These plans are an all-in-one alternative to Original Medicare. They typically cover hospital insurance (Part A) medical insurance (Part B) and often include Part D (prescription drug coverage) along with some added perks like vision dental and hearing.

But before you dive headfirst into any plan there are a few things to consider—potential drawbacks and all. Let’s break it down.

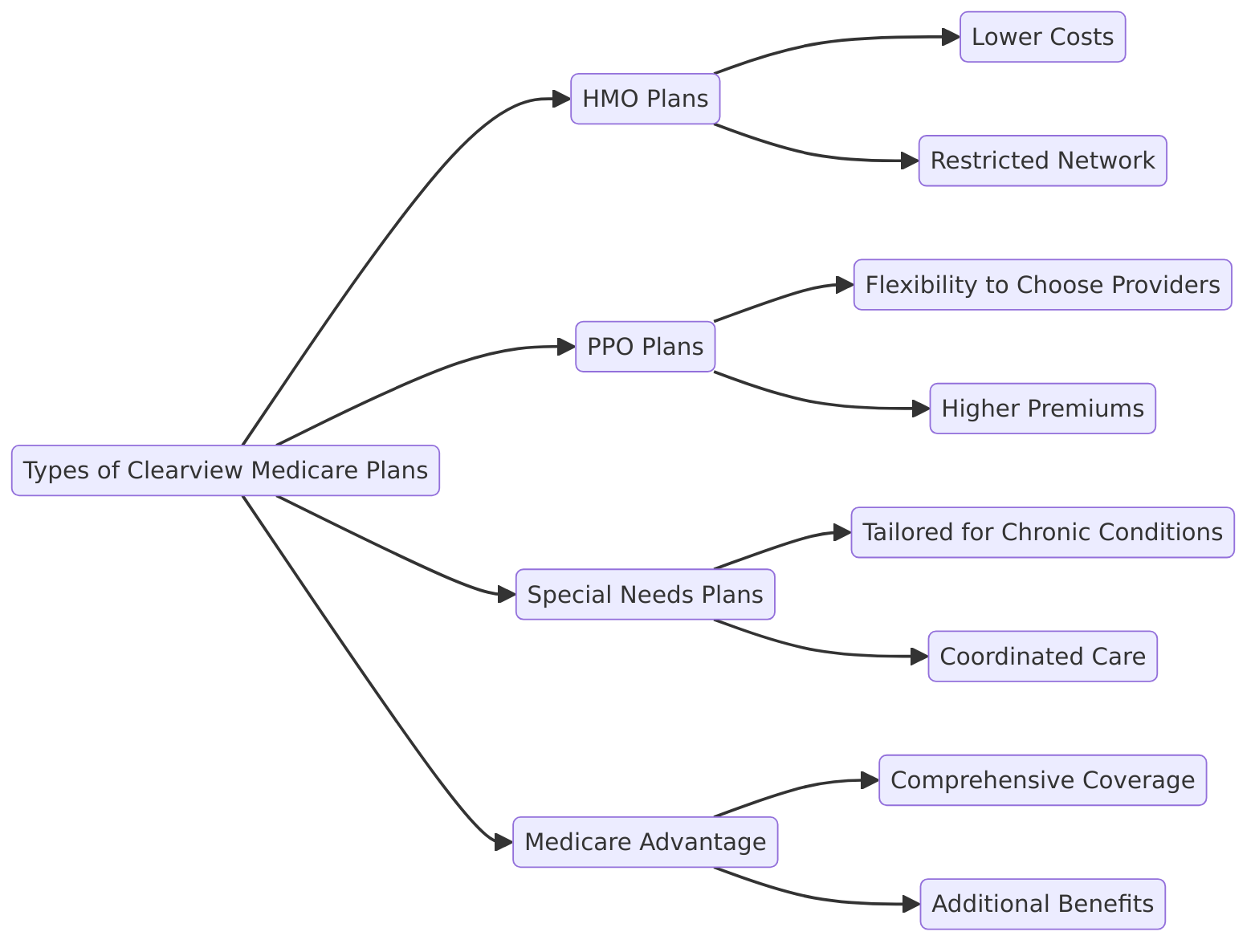

Types of Clearview Medicare Plans

Clearview Medicare offers different Medicare Advantage plans designed to fit different needs. While this sounds great on paper (or your screen) not every plan is sunshine and rainbows.

1. Clearview Medicare HMO Plans

Clearview’s HMO plans might be the perfect option if you enjoy following the rules (and I mean really follow the rules). You’ll need to stick to a network of doctors and specialists if you don’t you might find yourself with a bill bigger than your last online shopping spree.

Pros:

- Low out-of-pocket costs

- Coordinated care

- Prescription drug coverage often included

Cons:

- Limited provider network (Goodbye doctor you’ve known for 20 years)

- Referrals needed for specialists (Enjoy that waiting game)

- No coverage if you decide to get care outside the network unless it’s an emergency (So much for that spontaneous trip to Hawaii)

As Henry puts it “HMO plans are like those all-inclusive vacations – great if you stay inside the resort but wander too far and you’ll pay extra.”

2. Clearview Medicare PPO Plans

Now if you like a little more freedom (and who doesn’t?) then the PPO plan is where it’s at. With PPO plans you can see any doctor or specialist you want – even if they’re not in the network. But there’s always a catch right? You’ll likely pay a little more for that freedom.

Pros:

- Freedom to choose your providers (Feel the wind in your hair)

- No need for referrals (A victory for procrastinators everywhere)

- Larger network of doctors

Cons:

- Higher premiums and out-of-pocket costs

- Higher costs for out-of-network care (Yep they charge extra for freedom)

As Henry likes to joke “A PPO plan is like ordering a la carte at a restaurant – you get exactly what you want but your wallet might cry a little afterward.”

3. Clearview Medicare Special Needs Plans (SNPs)

If you have a chronic condition or qualify for both Medicare and Medicaid the Special Needs Plan (SNP) could be the one. These plans are tailored specifically to people with unique healthcare needs. But be warned—this plan is not for the indecisive or the “I feel fine maybe I don’t need this” crowd.

Pros:

- Tailored coverage for chronic conditions

- Coordinated care

- Prescription drug coverage often included

Cons:

- Restricted to people with specific health conditions or dual eligibility (So if you’re perfectly healthy this is like ordering off the wrong menu)

- You must stick to the network (We see a theme here don’t we?)

Henry’s two cents? “SNP plans are great if you need them but it’s like having an exclusive club membership – only the chosen ones get in.”

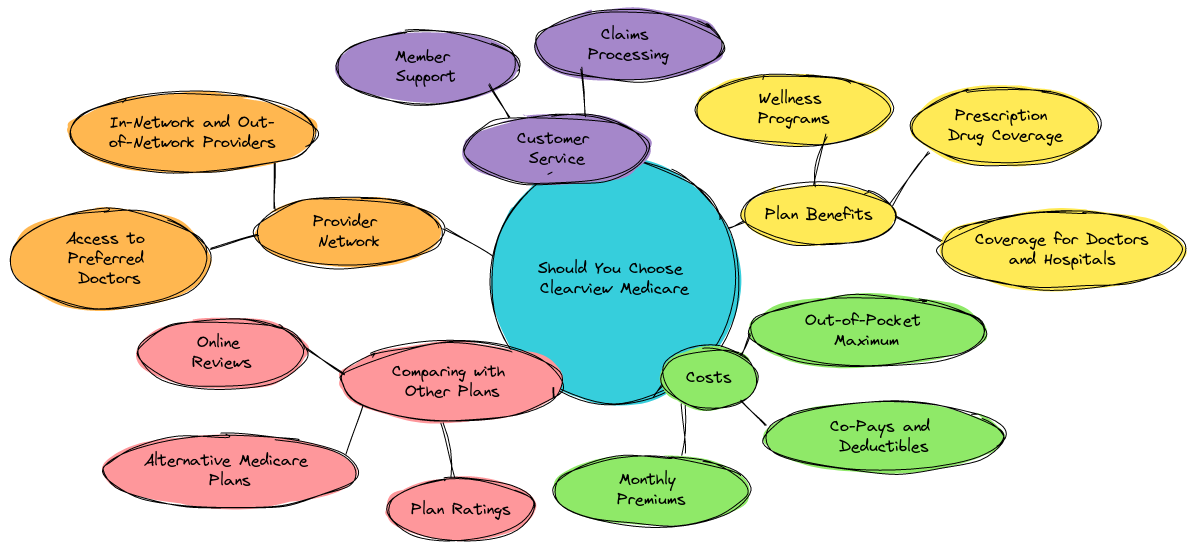

Should You Choose Clearview Medicare?

So the million-dollar question – should you go for Clearview Medicare? Well it really depends on your specific health needs. Are you someone who likes having options and not being tied down to one doctor? Or do you love the idea of keeping your care simple and affordable within a network?

Factors to Consider

Your Budget

No one wants to overspend on healthcare (we all have better things to spend our money on right?). But the cost of your monthly premium deductibles and co-pays should match your financial situation. Some plans offer $0 premiums but make up for it with higher out-of-pocket costs.

Your Healthcare Needs

Do you visit the doctor often? Need specific medications or frequent care? Make sure your plan covers everything you need without making you jump through a bunch of hoops.

Plan Benefits

Does the plan offer extra perks like dental vision and hearing coverage? Some plans include extras like gym memberships (because we all promise we’ll go).

How to Enroll in Clearview Medicare

Once you’ve made up your mind here’s what you do next.

- Check your eligibility for Medicare Advantage and make sure you’re enrolled in Medicare Part A and Part B.

- Compare Clearview Medicare plans available in your area. You’ll want to compare the premium deductibles and benefits.

- Contact a Medicare Advisor (like us!). We’ll help you sort through the fine print and figure out which plan fits you best.

The Enrollment Periods

- Initial Enrollment Period (IEP): 7 months surrounding your 65th birthday (because nothing says “Happy Birthday” like enrolling in Medicare).

- Annual Enrollment Period (AEP): October 15th – December 7th (Mark your calendar this is like Black Friday for Medicare).

- Special Enrollment Period (SEP): If you qualify due to a special life event like moving or losing other insurance.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

FAQs About Clearview Medicare

Here are some questions you might have that are probably keeping you up at night:

Is Clearview Medicare available everywhere?

Clearview Medicare plans may not be available in all areas. You’ll need to check if it’s offered in your state. If you’re somewhere remote you might be stuck with fewer options (like ordering delivery in a small town).

Do I need to switch doctors?

With HMO plans probably unless your doctor’s in the network. With a PPO plan you can keep your doctor but again it’ll cost you more if they’re out of network.

Can I switch plans later?

Yes but timing is everything. You can switch during the Annual Enrollment Period or if you qualify for a Special Enrollment Period. But if you try to switch outside those windows you’re out of luck until the next year.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Conclusion

At the end of the day Clearview Medicare offers solid options for those looking for Medicare Advantage plans but like anything in life it’s not one-size-fits-all. With so many options to choose from it’s important to weigh the pros and cons before diving in.

If you’re still feeling unsure Henry Beltran sums it up best: “When it comes to Medicare it’s like shopping for shoes. You have to find the right fit or you’ll be stuck with blisters down the road. And trust me no one wants Medicare blisters.”

So whether you’re eyeing an HMO or a PPO plan or you think you’re eligible for a Special Needs Plan we at Medicare Advisors Insurance Group LLC are here to guide you every step of the way. Because let’s face it healthcare is complicated – but your choices don’t have to be.

Contact us today to discuss your options with one of our friendly knowledgeable advisors!

Ready to take the next step? Call us now at 1-800-Your-Medicare!