“Securing Your Health in Old Dominion: The Best Medicare Supplement Plans in Virginia.”

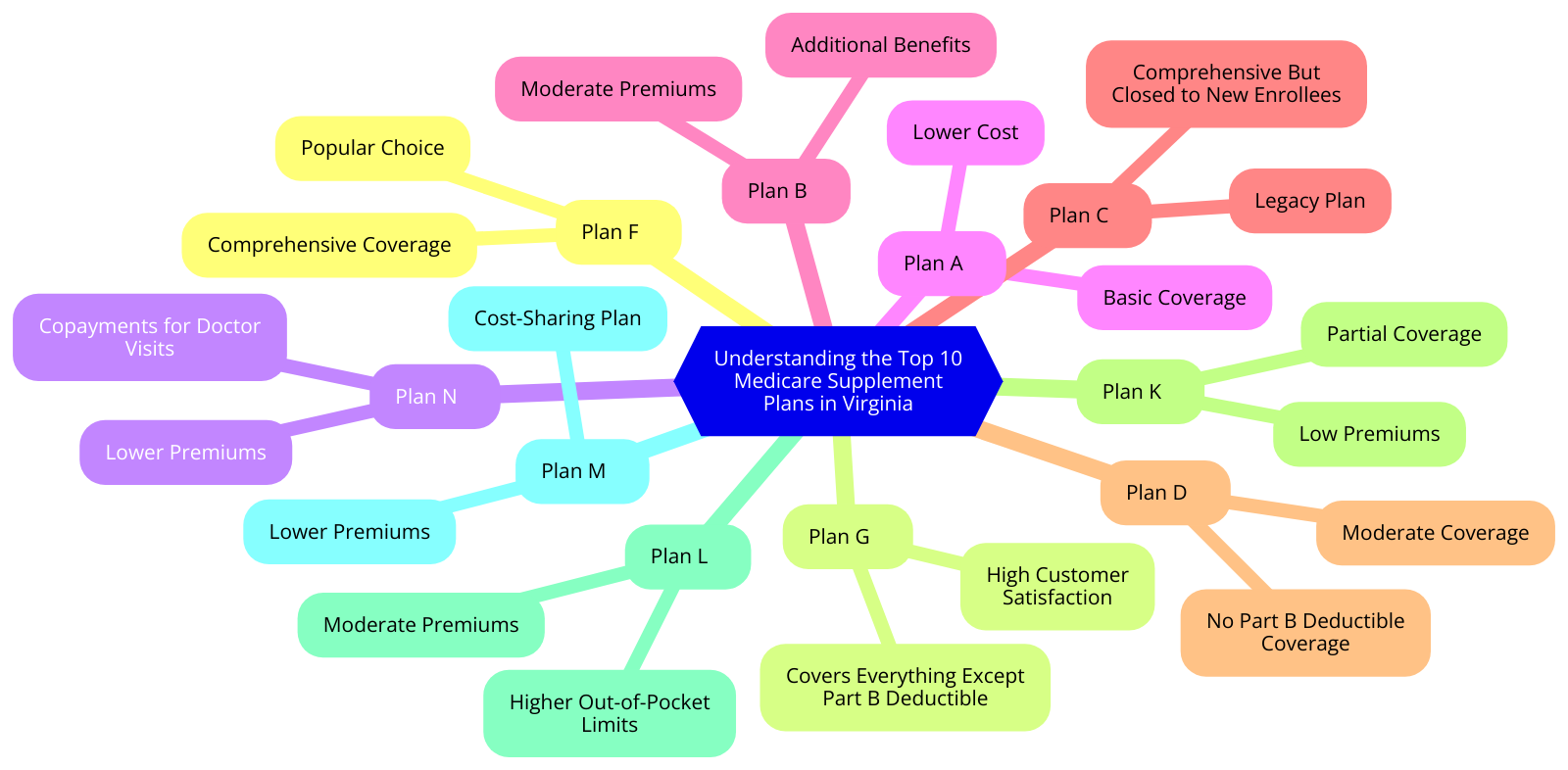

Understanding the Top 10 Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps the sandy shores, the golden years of life are embraced with a spirit of vitality and grace. Virginia, a state steeped in history and rich in natural beauty, is a haven for retirees. However, as we age, healthcare becomes a paramount concern. Thankfully, Virginia offers a plethora of Medicare Supplement Plans, ensuring that the health of its senior citizens is well taken care of.

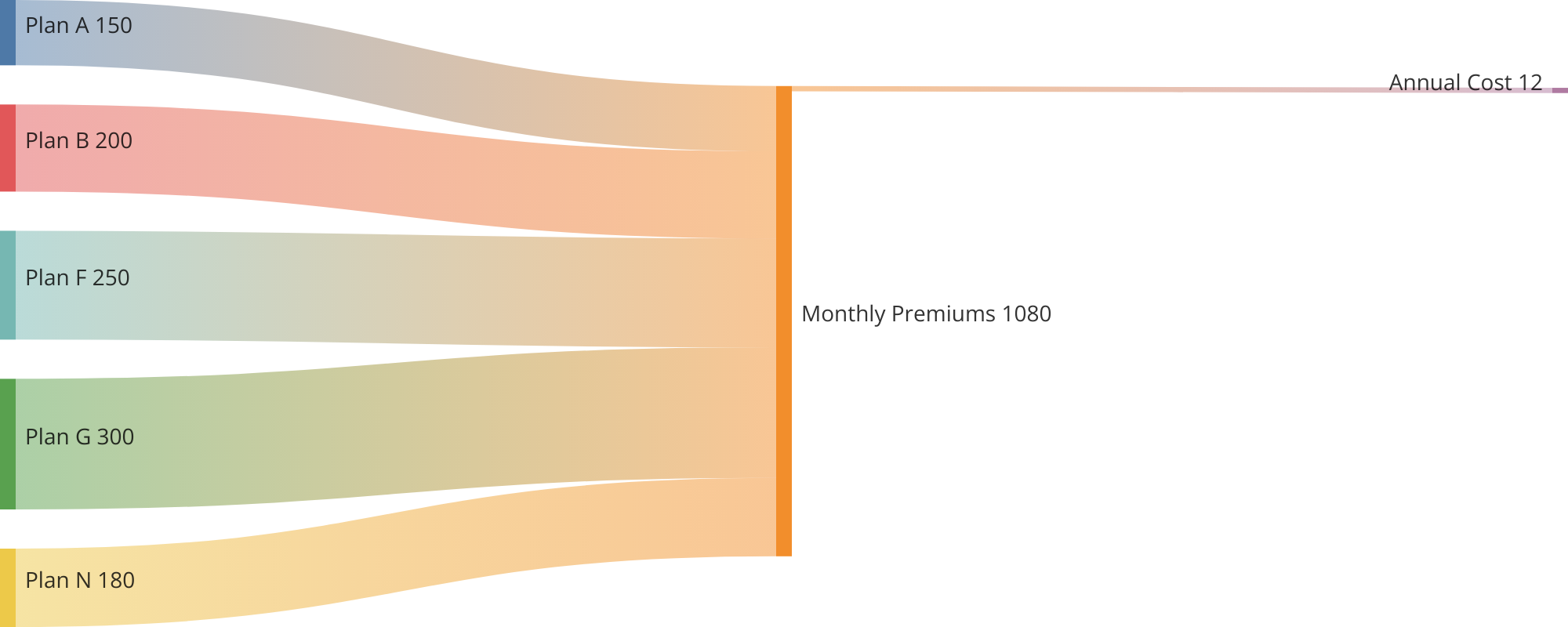

Medicare Supplement Plans, also known as Medigap, are policies designed to fill in the “gaps” in Original Medicare coverage. These gaps can include co-payments, deductibles, and other out-of-pocket expenses. In Virginia, there are ten standardized Medigap plans, each labeled with a letter from A to N. Each plan offers a different level of coverage, allowing you to choose the one that best fits your needs and budget.

Plan A, the cornerstone of all Medigap plans, covers the basics. It pays for your Part A hospital coinsurance and provides coverage for an additional 365 days after Medicare benefits are exhausted. It also covers your Part B coinsurance or co-payment, the first three pints of blood you might need in a medical procedure, and Part A hospice care coinsurance or co-payment.

Plan B, on the other hand, covers everything Plan A does, but also pays your Part A deductible. As we move along the alphabet, each plan adds more coverage. Plan C, for instance, covers everything Plan B does, plus it pays your Part B deductible and provides skilled nursing facility care coinsurance.

Plan D is similar to Plan C but does not cover the Part B deductible. Plan F, often considered the most comprehensive plan, covers all the gaps in Original Medicare. It even covers excess charges that doctors outside of the Medicare system might charge. However, Plan F is not available to those who became eligible for Medicare on or after January 1, 2020.

For those individuals, Plan G is the next best thing. It covers everything Plan F does, except for the Part B deductible. Plan G also has a high-deductible version, which requires you to pay for Medicare-covered costs up to the deductible amount before the plan begins to pay.

Plan K and Plan L both have out-of-pocket limits, which means once you reach a certain amount in out-of-pocket costs, the plan will pay 100% of your covered services for the rest of the calendar year. Plan M covers 50% of the Part A deductible, while Plan N covers everything Plan D does, but with a co-payment for some office visits and emergency room trips.

Navigating the world of Medicare Supplement Plans can be like traversing the winding trails of the Shenandoah Valley. It can be complex and confusing, but with careful consideration and a clear understanding of your needs, you can find the right path. In Virginia, the top 10 Medicare Supplement Plans offer a range of options, ensuring that every senior citizen can find a plan that provides the coverage they need to enjoy their golden years in health and happiness. After all, in a state as beautiful as Virginia, the focus should be on living life to the fullest, not worrying about healthcare costs.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Choosing the Best Medicare Supplement Plan in Virginia: A Comprehensive Guide

Choosing the best Medicare Supplement Plan in Virginia can feel like navigating a labyrinth. With so many options, it’s easy to feel overwhelmed. But fear not, for this comprehensive guide is here to illuminate your path, inspiring you to make the best choice for your health and wellbeing.

Medicare Supplement Plans, also known as Medigap, are policies designed to fill in the “gaps” in Original Medicare coverage. These gaps can include deductibles, coinsurance, and copayments, which can add up quickly if you have a serious health condition. Medigap plans can provide peace of mind, knowing that you’re covered for these unexpected costs.

In the beautiful state of Virginia, there are ten standardized Medigap plans available, each labeled with a letter from A to N. Each plan offers a different level of coverage, allowing you to choose the one that best fits your needs and budget.

Plan F, for instance, is often hailed as the most comprehensive plan. It covers all the gaps in Original Medicare, including Part A and Part B deductibles, coinsurance, and excess charges. This means that if you have Plan F, you won’t have to worry about any out-of-pocket costs when you go to the doctor or hospital. However, it’s worth noting that as of 2020, Plan F is no longer available to new Medicare enrollees. If you were eligible for Medicare before 2020, you can still enroll in Plan F.

Plan G is another popular choice. It offers nearly the same coverage as Plan F, with the exception of the Part B deductible. This makes it a cost-effective option for those who want comprehensive coverage without the higher premium of Plan F.

Plan N is a great choice for those who want a lower premium and don’t mind paying a small copayment for some office visits and emergency room trips. It covers most of the same benefits as Plan G, except for Part B excess charges and the copayments mentioned.

Choosing the best Medicare Supplement Plan in Virginia is not just about the coverage, but also about the insurance company. It’s important to choose a company that is financially stable, has a good reputation for customer service, and offers competitive premiums. Some of the top-rated companies in Virginia include Mutual of Omaha, AARP/UnitedHealthcare, and Aetna.

Remember, the best plan for you depends on your individual health needs and financial situation. It’s important to carefully consider your options and consult with a trusted advisor or insurance agent before making a decision.

In the end, choosing the best Medicare Supplement Plan in Virginia is about more than just coverage and cost. It’s about securing peace of mind, knowing that you’re protected against unexpected medical costs. It’s about ensuring that you can get the care you need, when you need it, without worrying about the financial burden. It’s about safeguarding your health and wellbeing, so you can continue to enjoy all the beauty and adventure that Virginia has to offer.

So, take a deep breath, step into the labyrinth, and let this guide light your way. With a little patience and perseverance, you’ll find the best Medicare Supplement Plan in Virginia, one that offers not just coverage, but also peace of mind. And isn’t that the greatest health insurance of all?

Exploring the Benefits of Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, the people of Virginia are discovering the benefits of Medicare Supplement Plans. These plans, also known as Medigap, are a beacon of hope, a lifeline for those seeking to navigate the often turbulent waters of healthcare costs. They are the unsung heroes of the healthcare world, providing a safety net for those who need it most.

Imagine, if you will, a world where unexpected medical expenses are not a source of dread, but merely a minor inconvenience. A world where you can focus on your health and recovery, rather than worrying about how you’re going to pay for your treatment. This is the world that Medicare Supplement Plans in Virginia are helping to create. They fill in the gaps left by traditional Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance.

But the benefits of these plans extend far beyond financial security. They also offer peace of mind, a priceless commodity in today’s fast-paced, high-stress world. With a Medicare Supplement Plan, you can rest easy knowing that you’re protected against the unexpected. You can live your life with the confidence that comes from knowing you’re prepared for whatever comes your way.

In Virginia, the land of presidents and patriots, the spirit of independence runs deep. Medicare Supplement Plans embody this spirit, offering a level of flexibility and choice that’s hard to find in other types of insurance. You can choose from a variety of plans, each with its own unique set of benefits, to find the one that best fits your needs and budget. You’re not locked into a one-size-fits-all solution, but rather have the freedom to tailor your coverage to your individual circumstances.

And let’s not forget about the convenience factor. With a Medicare Supplement Plan, you’re free to see any doctor or visit any hospital that accepts Medicare. There are no networks to worry about, no need to get referrals for specialist care. You can get the care you need, when you need it, from the providers you trust.

But perhaps the most inspiring aspect of Medicare Supplement Plans in Virginia is the sense of community they foster. These plans are not just about protecting individuals, but about strengthening the fabric of society as a whole. They reflect a collective commitment to care for our seniors, to ensure that they have access to the healthcare they need and deserve. They are a testament to the values that Virginians hold dear: compassion, responsibility, and mutual respect.

In the end, the best Medicare Supplement Plan is not just about the coverage it provides, but about the difference it makes in people’s lives. It’s about empowering individuals to take control of their health, to live their lives with dignity and independence. It’s about creating a healthcare system that’s not just sustainable, but equitable and just. And it’s about building a brighter, healthier future for all Virginians.

So, as you explore the benefits of Medicare Supplement Plans in Virginia, remember this: you’re not just choosing a plan, you’re choosing a path. A path that leads to financial security, peace of mind, and a healthier, happier life. And that, dear reader, is a journey worth embarking on.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Compare Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, the golden years of life are meant to be savored. Virginia, with its rich history and diverse landscapes, is a haven for retirees. However, as we age, healthcare becomes a paramount concern. Thankfully, Virginia offers a plethora of Medicare Supplement Plans, also known as Medigap, to ensure that your health is well taken care of, allowing you to focus on enjoying the beauty of life.

Medicare Supplement Plans are designed to fill in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. But with so many options available, how do you choose the best plan for you? The answer lies in careful comparison and understanding your unique needs.

Imagine standing at the edge of the Shenandoah Valley, the wind whispering through the trees, the panorama of rolling hills stretching out before you. Just as you would take in the entire view before choosing the perfect spot for a picnic, you should consider all your options before selecting a Medicare Supplement Plan.

Start by understanding the ten standardized Medigap plans available in Virginia, labeled A through N. Each plan offers a different level of coverage, but all provide the basic benefits of Medicare Part A coinsurance and hospital costs. From there, the plans diverge, with some covering skilled nursing facility care coinsurance, Medicare Part B deductible, and even emergency overseas travel coverage.

Think of these plans as different paths through a Virginia vineyard. Some paths may be straight and narrow, offering only the essential coverage. Others may meander through the vineyard, providing additional benefits. Your task is to choose the path that best suits your health needs and financial situation.

Next, consider the cost. Just as you would compare prices at a farmer’s market, compare the premiums of different plans. Keep in mind that lower premiums often mean higher out-of-pocket costs when you need care. It’s a delicate balance, like choosing between the sweetness of a Yorktown Onion and the tang of a Hanover Tomato.

Remember, the best plan for you is not necessarily the one with the most coverage or the lowest premium, but the one that offers the best value for your specific needs. It’s like choosing between a day exploring the historic streets of Williamsburg or a quiet afternoon at Virginia Beach. Both are wonderful, but one may suit you better.

Finally, consider the insurance company. Just as you would trust a Virginia Beach lifeguard to keep you safe in the water, you want an insurance company that is reliable and trustworthy. Look for companies with strong financial ratings and positive customer reviews.

Choosing a Medicare Supplement Plan in Virginia is an important decision, but it doesn’t have to be overwhelming. Take your time, consider your options, and make the choice that feels right for you. After all, life in Virginia is about savoring the moment, whether it’s watching the sun set over the Blue Ridge Mountains, tasting the salt air at Virginia Beach, or selecting the perfect Medicare Supplement Plan. Here’s to your health and happiness in the beautiful state of Virginia.

The Impact of Medicare Supplement Plans on Virginia Seniors

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, Virginia’s seniors are discovering the transformative power of Medicare Supplement Plans. These plans, often referred to as Medigap, are not just insurance policies; they are lifelines, safety nets, and peace-of-mind providers for the state’s elderly population.

As the golden years dawn, health becomes a precious commodity. It’s a time when the body, like a well-loved book, begins to show signs of wear and tear. The pages may be a little frayed, the spine a bit worn, but the story within remains vibrant and full of life. Medicare provides a solid foundation for healthcare, but it doesn’t cover everything. That’s where Medicare Supplement Plans come into play, filling in the gaps and ensuring that Virginia’s seniors can continue to write their life stories without worrying about unexpected medical costs.

Imagine, if you will, a world where you don’t have to choose between filling a prescription and filling your pantry. A world where a trip to the doctor doesn’t mean a dip into your savings. This is the world that Medicare Supplement Plans are creating for seniors in Virginia. These plans cover out-of-pocket costs like deductibles, copayments, and coinsurance, providing a financial buffer against the unpredictable nature of health.

But the impact of these plans goes beyond the financial. They also offer a profound sense of security. Knowing that you have a safety net can alleviate stress and anxiety, contributing to overall mental well-being. After all, peace of mind is priceless, especially in the twilight years.

In Virginia, the best Medicare Supplement Plans are those that cater to the unique needs of each individual. There’s no one-size-fits-all solution here. Some seniors may need comprehensive coverage, while others may only need help with specific costs. The beauty of these plans is their flexibility. They can be tailored to fit each person’s health needs and budget, making them a valuable tool in managing healthcare costs.

The impact of these plans on Virginia’s seniors is palpable. They are empowering the elderly to take control of their health, to seek the care they need without fear of financial ruin. They are providing a safety net, catching those who might otherwise fall through the cracks of Medicare. They are offering peace of mind, a priceless commodity in a world often fraught with uncertainty.

In the end, the best Medicare Supplement Plans in Virginia are those that allow seniors to live their golden years with dignity, security, and peace of mind. They are the plans that recognize the value of a life well-lived, that understand the importance of health in the twilight years. They are the plans that are transforming the lives of seniors, one policy at a time.

So, here’s to the seniors of Virginia, to their health and happiness. Here’s to the Medicare Supplement Plans that are making a difference in their lives. And here’s to a future where every senior has the coverage they need to live their best life. Because in the end, isn’t that what it’s all about?

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Role of Medicare Supplement Plans in Virginia’s Healthcare System

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, the people of Virginia are making a stand for their health. They are embracing the power of Medicare Supplement Plans, a beacon of hope in the complex world of healthcare. These plans, also known as Medigap, are the unsung heroes of Virginia’s healthcare system, providing a safety net for thousands of seniors and disabled individuals.

Medicare Supplement Plans are like the sturdy lighthouses dotting Virginia’s coastline, guiding beneficiaries safely through the stormy seas of healthcare costs. They illuminate the path, helping Virginians navigate the often confusing and costly gaps in Original Medicare coverage. These gaps, like unexpected co-payments, deductibles, and coinsurance, can quickly add up, leaving beneficiaries feeling lost and overwhelmed. But with a Medicare Supplement Plan, these costs are covered, providing peace of mind and financial security.

In the verdant Shenandoah Valley, where apple orchards bloom and rivers meander, Medicare Supplement Plans are as essential as the rain that nourishes the fertile soil. They provide a lifeline for those who need frequent medical care or expensive treatments. Imagine the relief of knowing that a sudden hospital stay or a series of costly medical tests won’t result in financial ruin. That’s the power of a Medicare Supplement Plan.

But these plans are not just about covering costs. They’re about empowering Virginians to take control of their health. They’re about providing the freedom to choose doctors and specialists without network restrictions. They’re about ensuring access to care across state lines, a crucial benefit for those who travel or have homes in different states. In essence, they’re about providing the peace of mind that comes from knowing you’re protected, no matter what health challenges you may face.

In the bustling cities of Richmond and Norfolk, where history and modernity intertwine, Medicare Supplement Plans are the silent partners in the healthcare journey. They work behind the scenes, filling in the gaps, smoothing out the bumps, making the journey less stressful and more manageable. They’re the unseen hands that catch you when you stumble, the safety net that ensures you won’t fall.

In the end, the role of Medicare Supplement Plans in Virginia’s healthcare system is about more than just financial protection. It’s about dignity. It’s about respect. It’s about acknowledging that every Virginian, regardless of age or health status, deserves access to quality healthcare without the fear of crippling costs. It’s about ensuring that the golden years are truly golden, filled with peace, security, and the freedom to enjoy all that Virginia has to offer.

So, here’s to the Medicare Supplement Plans, the unsung heroes of Virginia’s healthcare system. Here’s to the peace of mind they provide, the burdens they lift, the freedom they offer. Here’s to a healthier, happier Virginia, where everyone, regardless of age or health status, can enjoy the beauty of the Blue Ridge Mountains, the tranquility of the Shenandoah Valley, and the vibrant energy of Richmond and Norfolk. Here’s to a future where healthcare is a right, not a privilege, and where every Virginian has the support they need to navigate the healthcare journey with confidence and dignity.

Navigating the Costs of Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, the citizens of Virginia are making wise decisions about their healthcare. As the golden years approach, it’s essential to ensure that you’re covered for any medical expenses that may arise. Medicare provides a solid foundation, but it doesn’t cover everything. That’s where Medicare Supplement Plans, also known as Medigap, come into play. These plans fill in the gaps left by Medicare, ensuring that Virginians can enjoy their retirement without worrying about unexpected medical costs.

Navigating the costs of Medicare Supplement Plans in Virginia can seem like trying to find your way through a colonial-era maze garden, but it doesn’t have to be. With a little knowledge and guidance, you can find a plan that suits your needs and your budget, allowing you to enjoy the peace of mind that comes with comprehensive coverage.

Medicare Supplement Plans are standardized across the nation, meaning that each plan offers the same basic benefits, regardless of the provider. However, the costs can vary significantly from one provider to another. It’s like shopping for apples at a farmer’s market; while each stall might offer the same delicious fruit, the prices can differ greatly. Therefore, it’s essential to shop around and compare prices to ensure you’re getting the best deal.

In Virginia, there are ten different Medicare Supplement Plans to choose from, labeled A through N. Each plan offers a different level of coverage, with Plan A providing the least and Plan F offering the most comprehensive coverage. It’s like choosing between a cozy cabin in the Shenandoah Valley or a grand estate in Alexandria; both have their charms, but one might suit your needs and budget better than the other.

The cost of these plans can vary based on several factors, including your age, gender, and whether or not you smoke. It’s like the changing seasons in Virginia; just as the cost of heating your home can rise in the winter and fall in the summer, the cost of your Medicare Supplement Plan can fluctuate based on these factors.

While the costs can seem daunting, it’s important to remember that investing in a Medicare Supplement Plan can save you money in the long run. Just as planting a small seed in the fertile Virginia soil can yield a bountiful harvest, paying for a Medicare Supplement Plan now can protect you from high medical costs in the future.

Navigating the costs of Medicare Supplement Plans in Virginia is a journey, but it’s one that you don’t have to take alone. There are numerous resources available to help guide you through the process, from state health departments to private insurance advisors. It’s like having a trusty guide to lead you through the winding trails of the Appalachian Trail; with a little help, you can find your way to the perfect plan for you.

In the end, the best Medicare Supplement Plan in Virginia is the one that fits your needs and your budget. It’s about finding the plan that allows you to enjoy all the beauty and history that Virginia has to offer, without worrying about unexpected medical costs. So take a deep breath, step onto the path, and start your journey towards finding the perfect Medicare Supplement Plan for you. After all, in Virginia, the journey is just as important as the destination.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Future of Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Chesapeake Bay laps against the shore, the future of Medicare Supplement Plans in Virginia is taking shape. It’s a future that promises to be as vibrant and diverse as the state itself, offering a wealth of options to ensure that every Virginian has access to the healthcare they need.

As the sun rises on this new era, we find ourselves standing at the crossroads of innovation and tradition. On one hand, we have the tried-and-true Medicare Supplement Plans that have served Virginians well for decades. These plans, also known as Medigap, are designed to fill in the “gaps” in Original Medicare coverage, helping to cover costs like coinsurance, copayments, and deductibles.

On the other hand, we have a wave of new and innovative plans that are pushing the boundaries of what’s possible in healthcare coverage. These plans are leveraging the power of technology and data to deliver personalized, patient-centered care. They’re not just about covering costs; they’re about improving health outcomes and enhancing quality of life.

In the midst of this evolution, one thing remains constant: the commitment to providing Virginians with the best possible healthcare coverage. Whether it’s a traditional Medigap plan or a cutting-edge, tech-driven plan, the goal is the same: to ensure that every Virginian has access to the care they need, when they need it.

This commitment is reflected in the wide range of Medicare Supplement Plans available in Virginia. From Plan A, which covers the basics, to Plan N, which offers a more comprehensive coverage, there’s a plan to suit every need and budget. And with the introduction of innovative plans that offer additional benefits like wellness programs and telehealth services, the choices are only set to increase.

But it’s not just about quantity; it’s about quality too. Virginia’s Medicare Supplement Plans are backed by some of the most reputable insurance companies in the country, ensuring that policyholders receive the highest level of service and support. And with stringent regulations in place to protect consumers, Virginians can have peace of mind knowing that their healthcare coverage is in safe hands.

As we look to the future, we see a landscape that’s ripe with potential. With the continued advancement of technology and the growing emphasis on patient-centered care, the possibilities for Medicare Supplement Plans in Virginia are virtually limitless. We envision a future where every Virginian has access to a plan that’s tailored to their unique needs and preferences, providing them with the best possible healthcare coverage.

In this future, healthcare is not just about treating illness; it’s about promoting wellness. It’s about empowering Virginians to take control of their health and live their best lives. And with the right Medicare Supplement Plan, this future is within reach.

So, as the sun sets on the horizon, casting a golden glow over the Virginia landscape, we can’t help but feel a sense of optimism. The future of Medicare Supplement Plans in Virginia is bright, and we’re excited to be a part of it. Because in the end, it’s not just about healthcare coverage; it’s about ensuring that every Virginian has the opportunity to live a healthy, fulfilling life. And that’s a future worth striving for.

The Pros and Cons of Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, the citizens of Virginia are making important decisions about their healthcare. As they age, they are turning to Medicare for support, but many are finding that Medicare alone doesn’t cover all their needs. Enter the world of Medicare Supplement Plans, a beacon of hope in the complex landscape of healthcare.

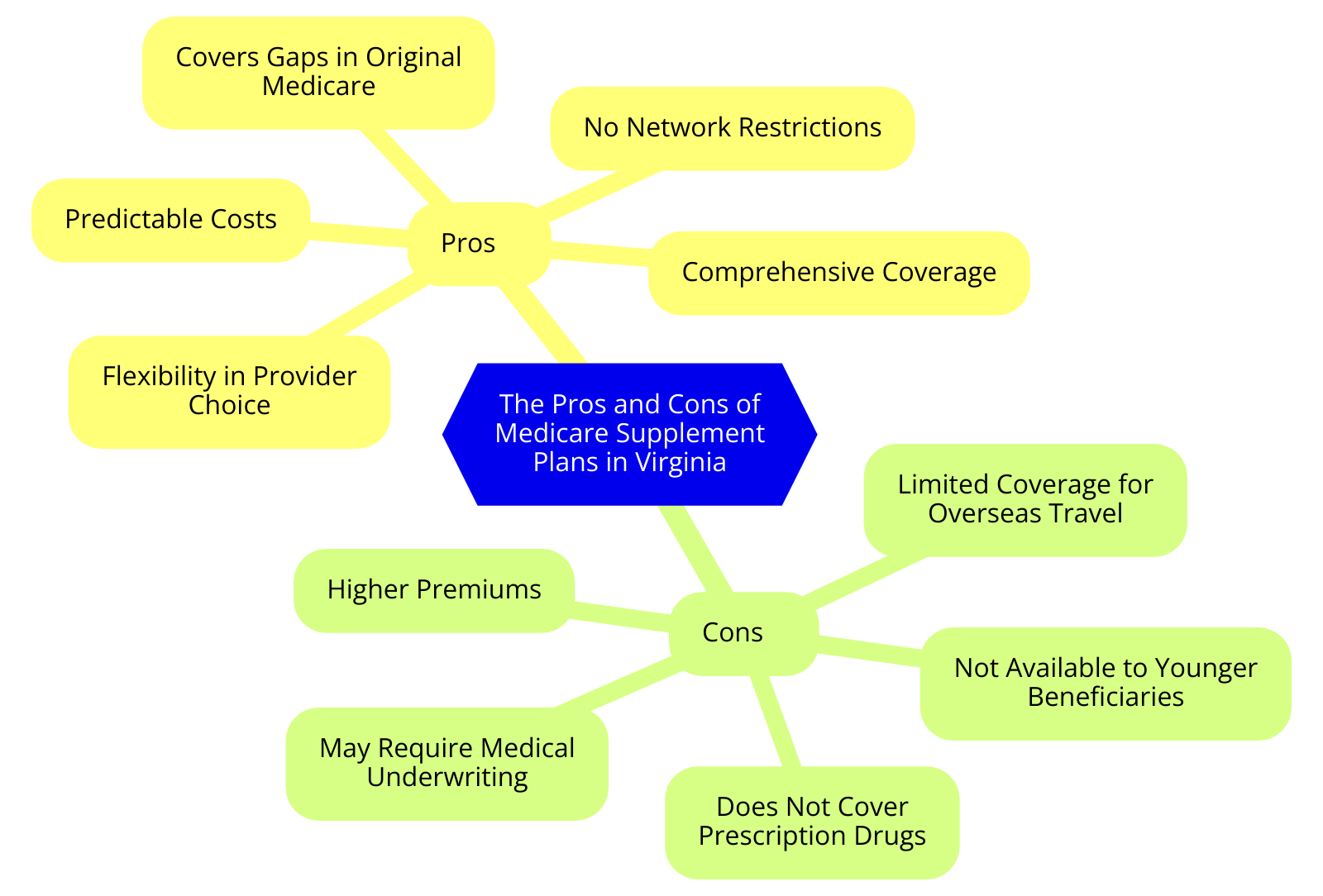

Medicare Supplement Plans, also known as Medigap, are policies sold by private insurance companies to fill the “gaps” in Original Medicare coverage. These gaps can include copayments, coinsurance, and deductibles, expenses that can quickly add up and become burdensome. But like the changing tides of Virginia’s coastline, there are both pros and cons to these plans that must be considered.

On the sunny side, Medicare Supplement Plans offer a wealth of benefits. They provide peace of mind, a priceless commodity in an uncertain world. With a Medigap policy, you can rest easy knowing that unexpected medical costs won’t send you spiraling into financial hardship. These plans also offer flexibility, allowing you to choose any doctor or hospital that accepts Medicare, a freedom that is as refreshing as a cool mountain breeze.

Moreover, the coverage is guaranteed renewable, a promise as steadfast as Virginia’s historic landmarks. Even if you have health problems, your policy cannot be canceled as long as you pay the premium. This assurance is a lifeline for many, a steady hand in the often tumultuous sea of healthcare.

But just as every rose has its thorns, Medicare Supplement Plans have their drawbacks. One of the main cons is the cost. Premiums can be high and they may increase over time, a reality as harsh as a Virginia winter. This can be a significant burden for those on a fixed income.

Additionally, these plans don’t cover everything. Prescription drugs, long-term care, vision, dental, hearing aids, and private-duty nursing are typically not covered. This can be a bitter pill to swallow for those who require these services. It’s like reaching for a ripe Virginia apple only to find it’s just out of grasp.

Lastly, there’s the complexity. Choosing a plan can be as confusing as navigating the winding roads of the Shenandoah Valley without a map. There are ten different Medigap policies to choose from, each with different levels of coverage and cost. This can be overwhelming, especially for those already dealing with the stress of health issues.

Yet, despite these challenges, many Virginians find that the benefits of Medicare Supplement Plans outweigh the drawbacks. They see these plans as a lifeline, a safety net, a beacon of hope in the complex world of healthcare. They are willing to brave the stormy seas for the promise of calm waters ahead.

In the end, the decision to enroll in a Medicare Supplement Plan is a deeply personal one. It’s a decision that requires careful consideration, a weighing of the pros and cons, and a thorough understanding of one’s own health needs and financial situation. But for those who choose to embark on this journey, the reward can be a sense of security and peace of mind that is as comforting as a Virginia sunset.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

A Closer Look at the Most Popular Medicare Supplement Plans in Virginia

In the heart of the Old Dominion, where the Blue Ridge Mountains kiss the sky and the Atlantic Ocean laps against miles of sandy beaches, the people of Virginia are making wise choices about their healthcare. They are choosing Medicare Supplement Plans, also known as Medigap, to ensure they are fully covered and can enjoy their golden years with peace of mind. These plans are a beacon of hope, a safety net that allows Virginians to navigate the often complex world of healthcare with confidence and security.

As the sun rises over the Shenandoah Valley, casting a golden glow on the vineyards and apple orchards, let’s delve into the most popular Medicare Supplement Plans in Virginia. These plans, like the state itself, are diverse and cater to a variety of needs, ensuring that every Virginian can find a plan that suits them perfectly.

Plan F, for instance, is a favorite among Virginians. It’s like a warm, comforting blanket on a chilly Appalachian night. It covers all the gaps left by Original Medicare, including deductibles, coinsurance, and copayments. It even covers emergency medical care when you travel outside the U.S., so you can explore the world without worrying about unexpected medical costs. However, it’s worth noting that Plan F is not available to those who became eligible for Medicare on or after January 1, 2020.

For those who became eligible after this date, Plan G is a shining star in the constellation of Medicare Supplement Plans. It offers almost identical coverage to Plan F, with the exception of the Part B deductible. It’s like a trusty old friend, always there to lend a helping hand when you need it most.

Plan N is another popular choice, like the mighty James River, it flows smoothly, offering comprehensive coverage with lower premiums. It covers Part A hospital and coinsurance costs, Part B coinsurance costs, the first three pints of blood, and even skilled nursing facility care coinsurance. However, it does require a small copayment for some office visits and emergency room visits.

As the sun sets over the historic city of Richmond, painting the sky with hues of pink and orange, it’s clear that the people of Virginia have a wealth of options when it comes to Medicare Supplement Plans. Each plan, like a beautiful Virginia sunset, has its unique charm and benefits.

Choosing a Medicare Supplement Plan is a significant decision, one that can greatly impact your health and wellbeing. It’s like choosing the perfect spot to watch the sunset over the Chesapeake Bay. You want a place that offers a clear view, comfort, and peace of mind. Similarly, you want a Medicare Supplement Plan that offers comprehensive coverage, affordability, and peace of mind.

In the end, the best Medicare Supplement Plan is the one that fits your needs and budget perfectly, just like a well-tailored suit or a perfectly brewed cup of Virginia’s finest coffee. So, as you explore your options, remember to consider your healthcare needs, your budget, and your lifestyle. And rest assured, in the beautiful state of Virginia, you’re sure to find a Medicare Supplement Plan that’s just right for you.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What are the best Medicare Supplement Plans in Virginia?

Answer: The best Medicare Supplement Plans in Virginia include AARP UnitedHealthcare, Mutual of Omaha, Cigna, Aetna, and Blue Cross Blue Shield.

2. Question: What benefits do these Medicare Supplement Plans offer?

Answer: These plans cover costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S.

3. Question: How many Medicare Supplement Plans are available in Virginia?

Answer: In Virginia, there are 10 standardized Medicare Supplement Plans labeled A, B, C, D, F, G, K, L, M, and N.

4. Question: Does every company offer all 10 plans?

Answer: No, not every insurance company offers all 10 plans. The availability of plans varies by company.

5. Question: How do I choose the best Medicare Supplement Plan in Virginia?

Answer: Consider your health needs, budget, and the plan’s coverage. Also, consider the insurance company’s reputation and customer service.

6. Question: Are prescription drugs covered under Medicare Supplement Plans in Virginia?

Answer: No, Medicare Supplement Plans do not cover prescription drugs. You would need to enroll in a separate Medicare Part D plan for that coverage.

7. Question: Can I switch my Medicare Supplement Plan in Virginia?

Answer: Yes, you can switch your plan anytime, but you may have to go through medical underwriting and your acceptance is not guaranteed.

8. Question: What is the average cost of Medicare Supplement Plans in Virginia?

Answer: The cost varies depending on the plan and the insurance company, but on average, it can range from $70 to $300 per month.

9. Question: Are there any eligibility requirements for these plans?

Answer: Yes, to be eligible for a Medicare Supplement Plan in Virginia, you must be enrolled in Medicare Part A and Part B.

10. Question: Can I use my Medicare Supplement Plan outside of Virginia?

Answer: Yes, these plans are valid anywhere in the U.S. where Medicare is accepted. Some plans even offer coverage for medical care when you travel outside the U.S.