“Securing Your Health in the Lone Star State: The Best Medicare Supplement Plans in Texas.”

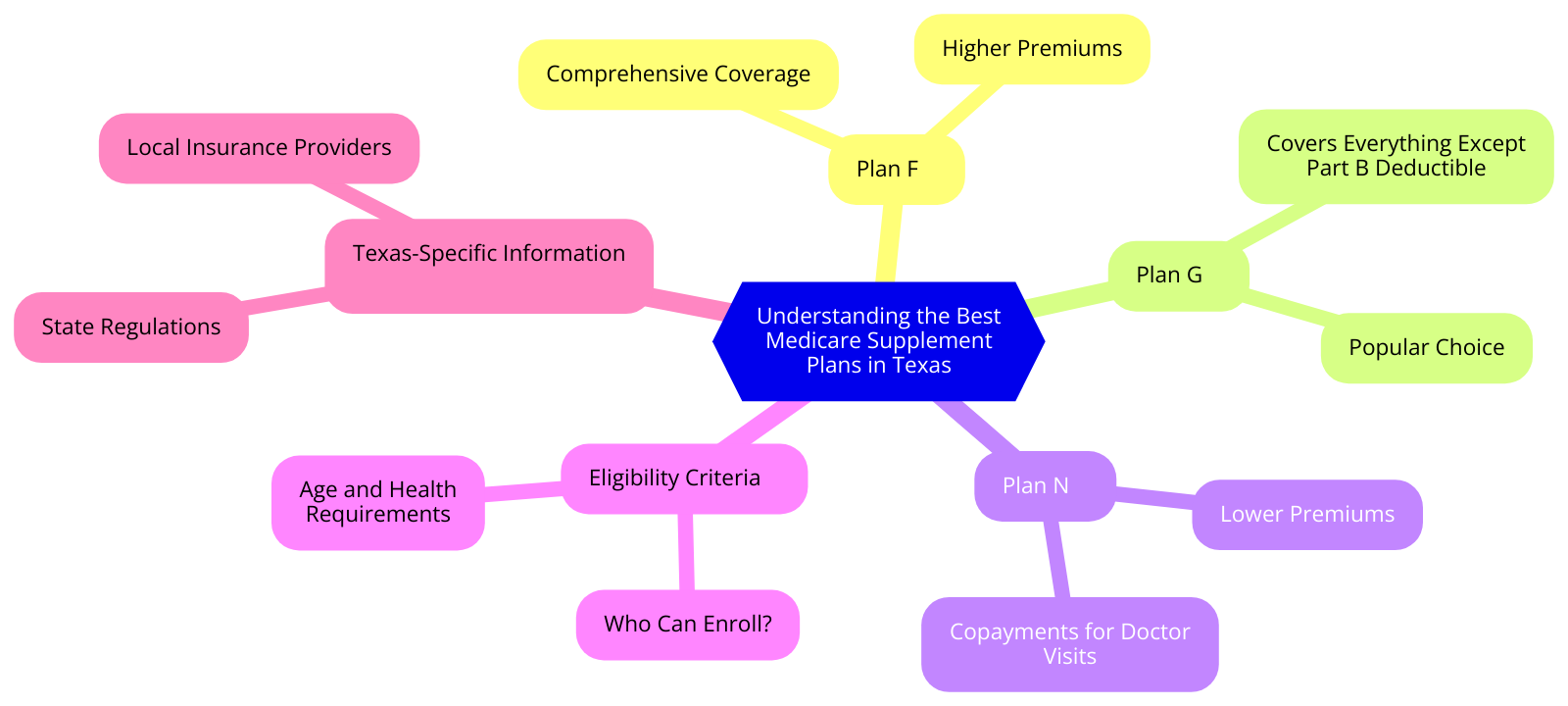

Understanding the Best Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the sunsets paint the sky with hues of orange and purple, and the spirit of resilience and independence is as vast as the Texas plains, there’s a topic that often stirs up a whirlwind of questions – Medicare Supplement Plans. As we journey through the golden years of our lives, it becomes increasingly important to understand and choose the best Medicare Supplement Plans, also known as Medigap, to ensure a healthy and secure future.

Imagine standing at the crossroads of life, where one path leads to a worry-free retirement, filled with laughter, family gatherings, and the freedom to explore the beauty of Texas, from the bustling city of Houston to the serene landscapes of Hill Country. The other path, however, is laden with uncertainty, financial stress, and the fear of unexpected medical expenses. The choice seems clear, doesn’t it? This is where Medicare Supplement Plans come into play, serving as a beacon of hope, guiding you towards a path of peace and security.

Medicare Supplement Plans in Texas are designed to fill the gaps in Original Medicare coverage. They cover out-of-pocket costs such as deductibles, co-payments, and coinsurance, providing a safety net for Texans. But with ten different plans to choose from, each denoted by a letter from A to N, the task of selecting the best plan can seem as daunting as finding a single star in the vast Texas night sky.

However, fear not, for the stars have aligned to guide you on this journey. Plan F, often hailed as the most comprehensive plan, covers all deductibles, coinsurance, and excess charges that Original Medicare does not pay. It’s like having a trusty steed that carries you safely across the rugged terrains of unexpected medical costs. But remember, the most comprehensive doesn’t always mean the best. It’s essential to choose a plan that aligns with your unique health needs and financial situation.

Plan G, another star in the constellation of Medicare Supplement Plans, offers benefits similar to Plan F, but with one key difference – it does not cover the Part B deductible. This plan is often favored for its lower premiums, making it a shining choice for those seeking comprehensive coverage without straining their budget.

Then there’s Plan N, a rising star in the Medigap universe. It offers lower premiums in exchange for a small copayment for some office visits and emergency room trips. This plan is ideal for those who want a balance between cost and coverage, like finding the perfect spot between the heat of the Texas sun and the cool shade of a Lone Star oak tree.

Choosing the best Medicare Supplement Plan in Texas is like navigating the vast Texas landscapes. It requires understanding, patience, and the spirit of resilience that Texans are known for. But remember, you’re not alone in this journey. Just as the North Star guides lost travelers, resources like the Texas Department of Insurance and licensed insurance agents are there to guide you.

In the end, the best Medicare Supplement Plan is not just about covering medical costs; it’s about securing a future where you can bask in the golden Texas sunsets, without the shadow of medical expenses looming over you. It’s about embracing the spirit of Texas – independent, resilient, and ready to face whatever comes with courage and confidence.

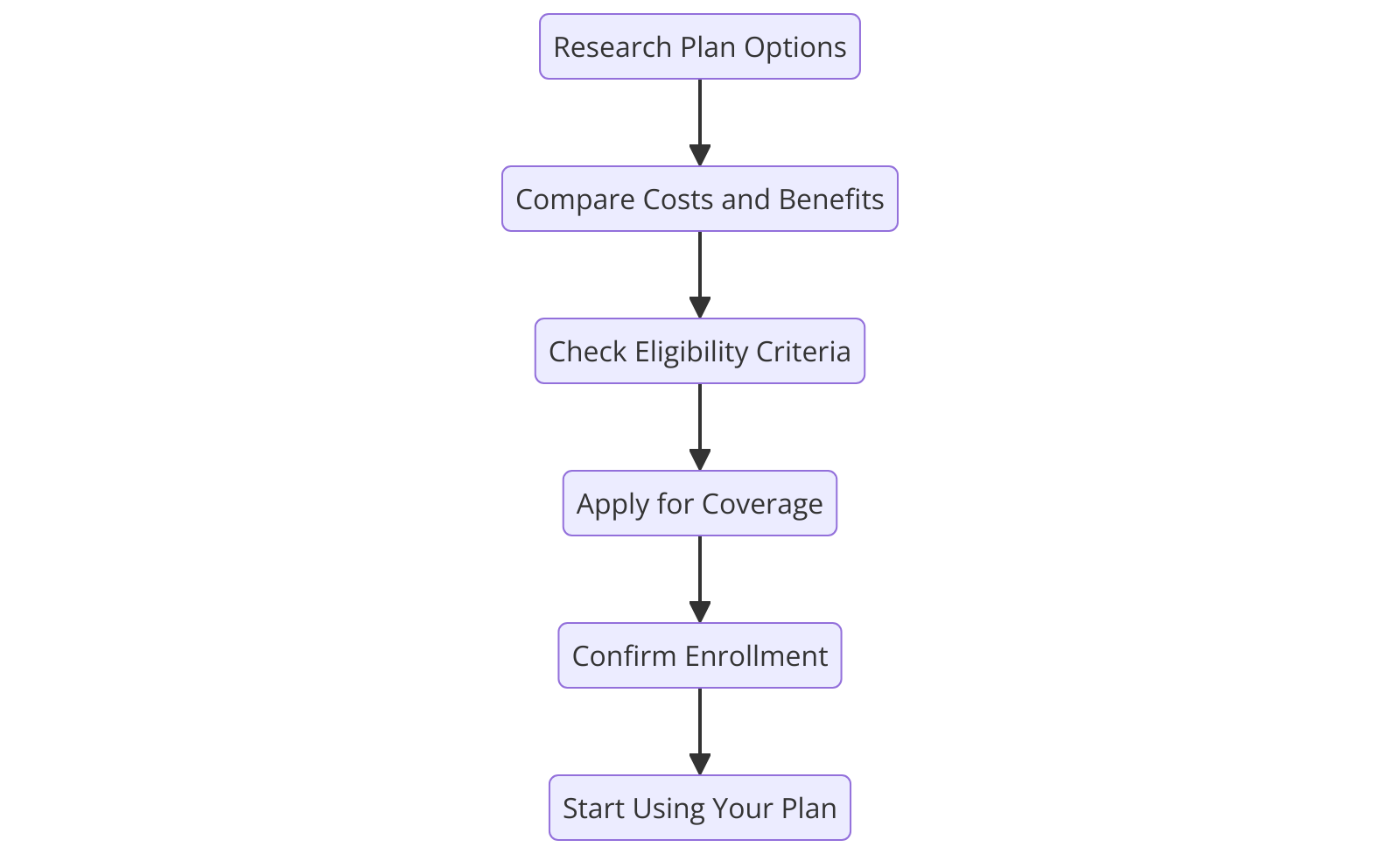

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Top 10 Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the spirit of independence and self-reliance runs deep, Texans understand the value of a good safety net. This is especially true when it comes to healthcare, and more specifically, Medicare. As we age, the need for comprehensive healthcare coverage becomes increasingly important. Medicare, while a valuable resource, often leaves gaps in coverage that can lead to unexpected out-of-pocket expenses. This is where Medicare Supplement Plans, also known as Medigap, come into play. These plans are designed to fill in the gaps left by traditional Medicare, ensuring that Texans can access the healthcare they need without breaking the bank.

Among the myriad of options available, ten Medicare Supplement Plans in Texas stand out for their comprehensive coverage and affordability. These plans, each with their unique benefits, offer a beacon of hope, a promise of security in the golden years of life.

First on the list is Plan F, often hailed as the most comprehensive Medigap plan. It covers all Medicare Part A and B deductibles, coinsurance, and copayments, and even offers coverage for foreign travel emergencies. However, it’s worth noting that Plan F is not available to those newly eligible for Medicare after January 1, 2020.

Next up is Plan G, a close second to Plan F in terms of coverage. It offers the same comprehensive coverage as Plan F, minus the Part B deductible. This plan is a popular choice for its balance between coverage and cost.

Plan N is another strong contender, offering full coverage for Part A deductible and coinsurance, and partial coverage for Part B coinsurance. It requires a small copayment for some office visits and emergency room visits, making it a cost-effective option for those who don’t mind paying a little out-of-pocket.

Plan K and L offer similar coverage, with the main difference being the percentage of costs covered. Plan K covers 50% of certain costs, while Plan L covers 75%. These plans are ideal for those who want some coverage but are willing to share in the cost.

Plan A, the most basic of all Medigap plans, covers Part A hospital coinsurance and provides limited coverage for Part B coinsurance and copayments. It’s a good starting point for those new to Medicare.

Plan B, C, and D offer varying levels of coverage, with Plan C being the most comprehensive of the three. However, like Plan F, Plan C is not available to those newly eligible for Medicare after January 1, 2020.

Finally, there’s Plan M, which covers 50% of the Part A deductible and full coverage for Part B coinsurance. It’s a good middle-ground option for those who want more coverage than Plan A but don’t need the full coverage of Plans F or G.

Choosing the right Medicare Supplement Plan is a deeply personal decision, one that should be made with careful consideration of your healthcare needs and financial situation. But rest assured, in the vast landscape of Texas, there’s a Medigap plan that’s just right for you. These top ten Medicare Supplement Plans in Texas are more than just insurance policies; they are a testament to the Texan spirit of independence and self-reliance, a promise of security and peace of mind in the golden years of life.

Choosing the Right Medicare Supplement Plan in Texas

Choosing the right Medicare Supplement Plan in Texas can feel like navigating a labyrinth. With so many options, it’s easy to feel overwhelmed. But fear not, for the journey to finding the best Medicare Supplement Plan is not as daunting as it may seem. It’s a journey of empowerment, a testament to your resilience, and a step towards ensuring your golden years are filled with health and happiness.

Imagine standing at the entrance of this labyrinth, armed with the knowledge that you’re about to make a decision that will safeguard your future. The first step is understanding what a Medicare Supplement Plan is. Also known as Medigap, these plans are designed to fill in the “gaps” left by Original Medicare, covering costs like deductibles, copayments, and coinsurance. It’s like having a safety net, ensuring that unexpected medical costs won’t throw you off balance.

As you delve deeper into the labyrinth, you’ll encounter various Medigap plans, each with its unique set of benefits. In Texas, there are ten standardized plans, labeled A through N. Each letter represents a different level of coverage, but rest assured, no matter the letter, every plan is designed with your wellbeing in mind.

Now, you might be wondering, “How do I choose the right plan?” The answer lies in understanding your healthcare needs. Are you someone who frequently visits the doctor or hospital? If so, a plan with comprehensive coverage like Plan F or G might be your best bet. These plans cover all the gaps in Original Medicare, ensuring you won’t have to worry about out-of-pocket costs. On the other hand, if you’re in good health and want a lower premium, Plan K or L, which covers a percentage of your healthcare costs, might be more suitable.

As you navigate this labyrinth, remember that choosing a Medicare Supplement Plan is not just about the cost. It’s about investing in your health and peace of mind. It’s about ensuring that you can enjoy your golden years without the burden of unexpected medical expenses. It’s about taking control of your future and making a decision that aligns with your needs and lifestyle.

The journey to finding the best Medicare Supplement Plan in Texas is not a solitary one. You’re not alone in this labyrinth. There are resources available to guide you, from the Texas Department of Insurance to licensed insurance agents. They can provide valuable insights, answer your questions, and help you compare different plans.

As you stand at the exit of this labyrinth, having chosen the right Medicare Supplement Plan, you’ll feel a sense of accomplishment. You’ve navigated the complexities of Medicare, made an informed decision, and taken a significant step towards securing your future. It’s a testament to your resilience and a cause for celebration.

Choosing the right Medicare Supplement Plan in Texas is a journey of empowerment. It’s about taking control of your health and future. It’s about making a decision that ensures your golden years are filled with health and happiness. So, embark on this journey with confidence, knowing that the best Medicare Supplement Plan is waiting for you at the end of the labyrinth.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Comparing the Best Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the sunsets paint the sky with hues of orange and purple, and the spirit of resilience and independence is as vast as the Texas plains, the quest for the best Medicare Supplement Plans is a journey worth embarking upon. It’s a journey that leads to peace of mind, security, and the freedom to enjoy the golden years of life with the confidence that your health is well taken care of.

As you traverse the landscape of Medicare Supplement Plans in Texas, you’ll find a myriad of options, each with its unique benefits and features. Like the diverse Texas terrain, from the rolling hills of the Hill Country to the sandy beaches of the Gulf Coast, these plans offer a variety of coverage to suit every individual’s needs.

The first stop on this journey is Plan F, often hailed as the most comprehensive plan. It’s like the mighty Texas Longhorn, robust and reliable. Plan F covers all Medicare Part A and B deductibles, coinsurance, and excess charges, leaving you with minimal out-of-pocket costs. It’s a plan that offers peace of mind, much like the tranquility of a Texas night sky, studded with countless stars.

However, as we move forward, we encounter Plan G, a worthy contender for the title of the best Medicare Supplement Plan in Texas. Like the Bluebonnet, the state flower of Texas, Plan G is a symbol of resilience and adaptability. It offers almost identical coverage to Plan F, with the exception of the Part B deductible. It’s a plan that combines comprehensive coverage with cost-effectiveness, a testament to the Texas spirit of getting the best value for your money.

As we journey further, we come across Plan N, a plan that embodies the spirit of the Texas frontier, where independence and self-reliance are virtues. Plan N offers lower premiums in exchange for a small copayment for some office visits and emergency room trips. It’s a plan for those who are comfortable with a little out-of-pocket cost in exchange for lower premiums, much like the pioneers who were comfortable with the challenges of the frontier in exchange for the freedom it offered.

The journey through the landscape of Medicare Supplement Plans in Texas is not a solitary one. You’re accompanied by experienced insurance agents, who, like the Texas Rangers, guide you through the terrain, ensuring you make the best choice for your needs. They help you compare the plans, understand the benefits, and make an informed decision, much like a trusty compass guiding you through the vast Texas plains.

In the end, the quest for the best Medicare Supplement Plan in Texas is a journey of discovery. It’s about discovering the plan that best fits your needs, your budget, and your lifestyle. It’s about finding a plan that gives you the freedom to enjoy your golden years without worrying about healthcare costs. It’s a journey that, much like Texas itself, is filled with opportunities, choices, and the promise of a secure future. So, saddle up and embark on this journey, because in Texas, the best is yet to come.

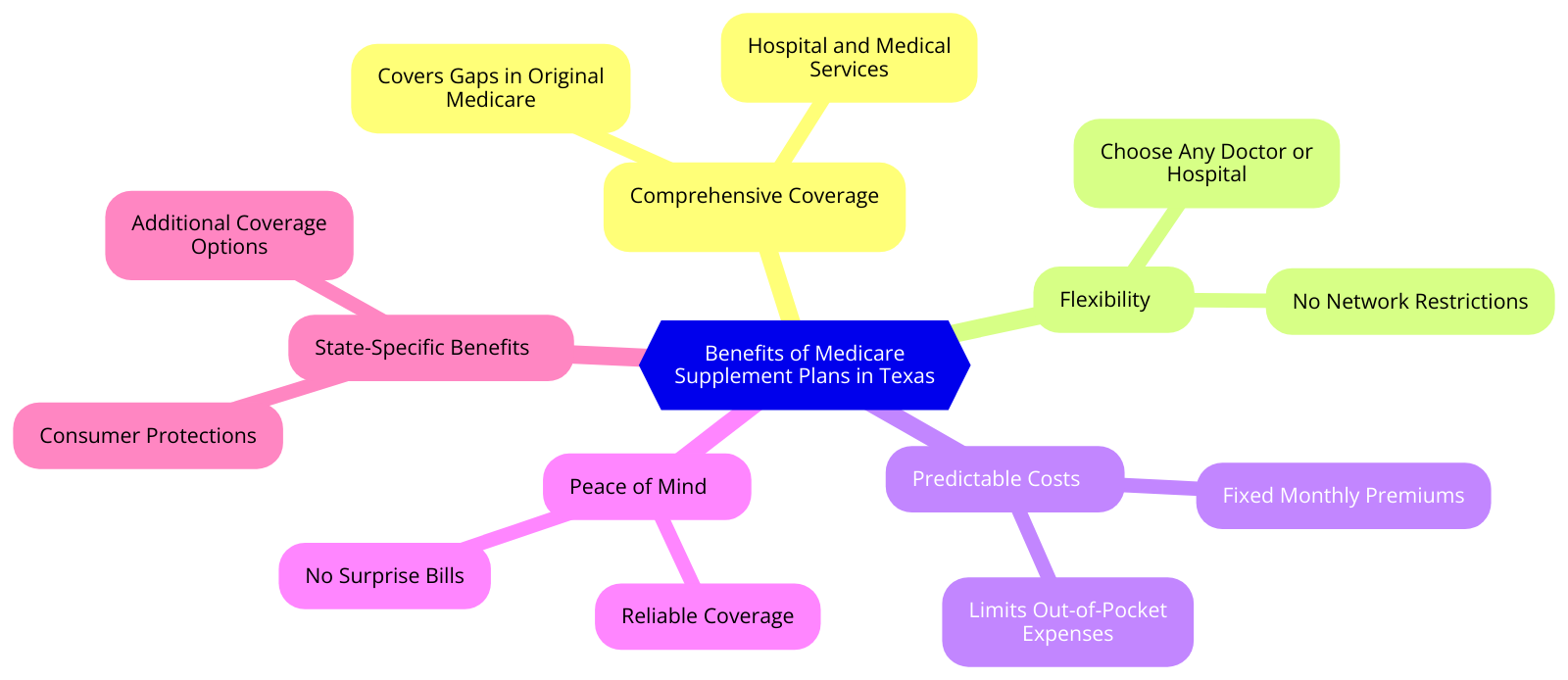

Benefits of Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the sunsets paint the sky with hues of orange and purple, and the spirit of resilience and independence is as vast as the Texas plains, there’s a sense of security that comes with knowing you’re covered by the best Medicare Supplement Plans. These plans, also known as Medigap, are the unsung heroes of healthcare, providing Texans with the peace of mind they need to live their golden years to the fullest.

Imagine, if you will, a safety net woven with threads of assurance, designed to catch you when life’s unexpected health issues arise. That’s what Medicare Supplement Plans in Texas offer. They fill in the gaps left by Original Medicare, covering out-of-pocket costs like deductibles, copayments, and coinsurance. It’s like having a trusted friend who steps in when you need them the most, ensuring you’re never left to face medical expenses alone.

But the benefits of these plans extend beyond financial protection. They also offer flexibility, allowing you to choose any doctor or hospital that accepts Medicare. This means you can continue seeing your trusted healthcare providers or choose new ones if you move or travel. It’s a freedom that echoes the Texas spirit, giving you the reins to your healthcare journey.

Moreover, these plans offer guaranteed renewability, a promise as steadfast as a Texan’s word. Regardless of any health problems you may encounter, your policy cannot be canceled as long as you continue to pay the premiums. It’s a commitment that stands firm, like the enduring Texas oak, providing you with continuous coverage and peace of mind.

In addition, some Medicare Supplement Plans in Texas also cover medical care when you travel outside the United States. It’s like having a travel companion who’s got your back, ensuring you’re covered whether you’re exploring the cobblestone streets of Europe or basking in the tropical sun of the Caribbean.

But perhaps the most significant benefit of these plans is the tranquility they bring. Health issues can cast a shadow over your golden years, but with a Medicare Supplement Plan, you can bask in the Texas sun without worry. It’s the peace that comes with knowing you’re covered, the serenity of a quiet Texas night under a blanket of stars.

Choosing a Medicare Supplement Plan in Texas is like choosing a partner for the dance of life. It’s about finding the one that matches your rhythm, understands your needs, and is there for you every step of the way. And with a variety of plans available, you’re sure to find the perfect partner.

So, as you stand on the precipice of your golden years, looking out over the vast Texas landscape, know that with a Medicare Supplement Plan, you’re not alone. You have a partner, a safety net, a steadfast promise of coverage. It’s the Texas way, a testament to the spirit of resilience and independence that defines the Lone Star State. And it’s the peace of mind you need to live your golden years to the fullest, under the vast Texas sky.

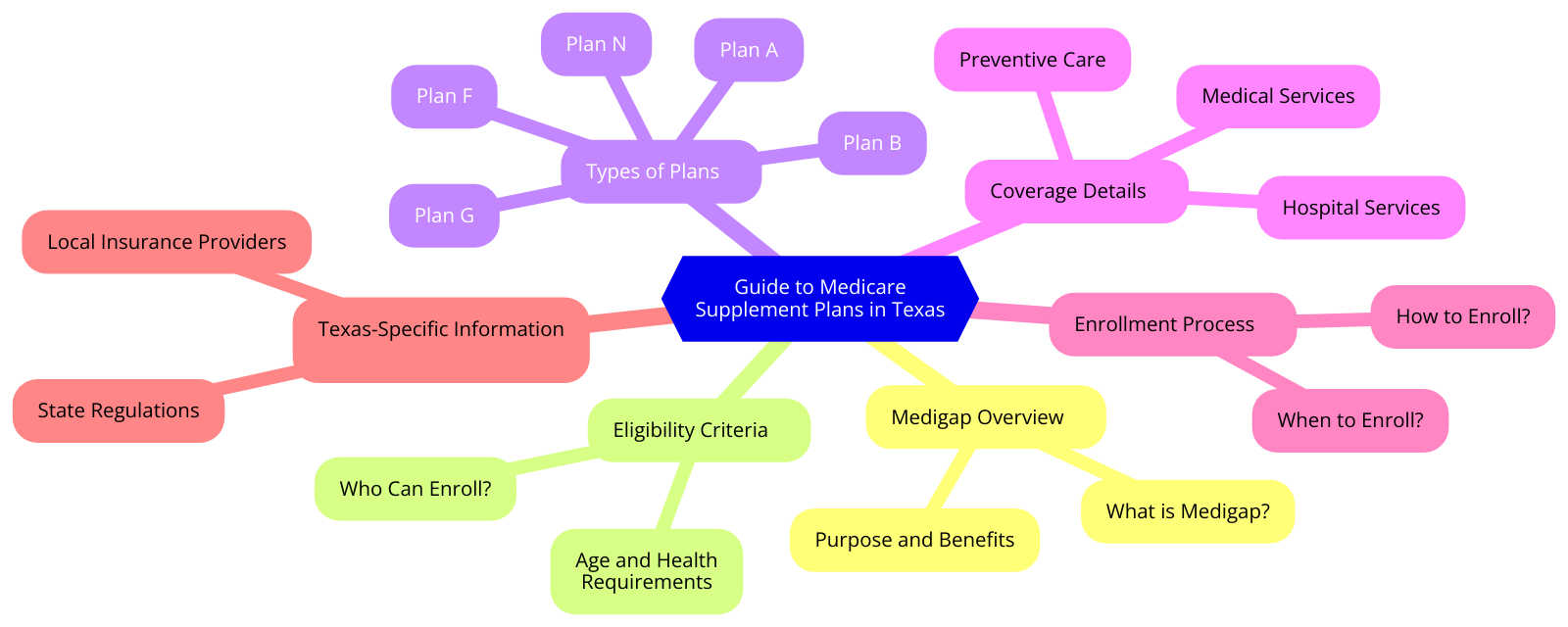

Guide to Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the spirit of independence and self-reliance runs as deep as the Rio Grande, there’s a sense of security that comes from knowing you’re covered when it comes to healthcare. This is where Medicare Supplement Plans, also known as Medigap, come into play. These plans are designed to fill in the gaps left by Original Medicare, ensuring that Texans can face their golden years with confidence and peace of mind.

Imagine standing at the edge of the Grand Canyon. You’re awestruck by its vastness, but also aware of the chasm that lies before you. That’s how it can feel when you’re trying to navigate the world of healthcare in retirement. Original Medicare, while providing a solid foundation, doesn’t cover everything. There are gaps, and falling into them can be costly. But fear not, because just as there are bridges across the Grand Canyon, there are Medicare Supplement Plans to bridge the gaps in your healthcare coverage.

In Texas, there are ten standardized Medicare Supplement Plans, labeled A through N. Each plan offers a different level of coverage, but all are designed to help with costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. It’s like having a safety net, ready to catch you if you stumble.

Plan F, often considered the most comprehensive, covers all Medicare-approved costs not covered by Original Medicare. It’s like having a star to guide you through the darkest night. However, as of 2020, Plan F is not available to those newly eligible for Medicare. But don’t worry, there are other stars in the Texas sky. Plan G, for example, offers nearly identical coverage to Plan F, with the exception of the Part B deductible. It’s a beacon of hope for those seeking comprehensive coverage.

Plan N, on the other hand, is a bit like the Texas prairie: wide-ranging and robust. It covers most Medicare-approved costs, with the exception of the Part B deductible and some small copayments. It’s a popular choice for those who want comprehensive coverage but are willing to share a bit of the cost.

Choosing the right Medicare Supplement Plan is like choosing the right pair of cowboy boots. It’s a personal decision, and what works for one person might not work for another. It’s important to consider your healthcare needs, your budget, and your lifestyle.

Remember, in Texas, the early bird gets the worm. The best time to enroll in a Medicare Supplement Plan is during your Medigap Open Enrollment Period, which starts the month you’re 65 or older and enrolled in Medicare Part B. During this time, you have guaranteed issue rights, meaning you can’t be denied coverage or charged more due to health problems.

In the end, the best Medicare Supplement Plan is the one that fits you like a well-worn Stetson. It’s the plan that gives you the freedom to enjoy the Texas sunset without worrying about what lies beyond the horizon. It’s the plan that lets you live your life with the same spirit of independence and self-reliance that makes Texas great. So saddle up, and take the reins of your healthcare future. With a Medicare Supplement Plan, you’re ready for whatever trail lies ahead.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

How to Select the Best Medicare Supplement Plan in Texas

In the heart of the Lone Star State, where the sunsets paint the sky with hues of orange and purple, and the spirit of resilience and independence is as vast as the Texas plains, there’s a topic that often stirs up a whirlwind of questions and concerns – Medicare Supplement Plans. As you navigate the golden years of your life, it’s essential to understand how to select the best Medicare Supplement Plan in Texas, ensuring you’re covered for every health eventuality.

Imagine standing at the crossroads of a dusty Texas town, each path representing a different Medicare Supplement Plan. It’s a daunting prospect, but fear not, for the journey to selecting the best plan can be as smooth as a well-aged bourbon if you know what to look for.

Firstly, it’s crucial to understand that Medicare Supplement Plans, also known as Medigap, are designed to fill in the ‘gaps’ left by Original Medicare. These gaps could be anything from copayments and coinsurance to deductibles and medical care when you travel outside the U.S. Just like the sturdy boots of a Texas cowboy, a good Medigap plan should provide you with solid protection, ensuring you’re not caught off guard by unexpected medical costs.

When selecting the best plan, consider your health needs and budget. Each Medigap plan offers different levels of coverage, much like the varying heat levels of Texas chili. Some like it hot, with comprehensive coverage, while others may prefer a milder option, with lower premiums and less coverage. It’s all about finding the right balance that suits your palate and your pocket.

Next, remember that timing is everything. The best time to buy a Medigap policy is during your 6-month Medigap open enrollment period. This period automatically starts the month you’re 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed issue right, meaning you can buy any Medigap policy sold in Texas, regardless of any health problems. It’s like having a golden ticket to the best rodeo in town, so don’t miss out.

While exploring your options, it’s also important to note that all Medigap policies must follow federal and state laws designed to protect you. They are standardized, meaning each plan must offer the same basic benefits, regardless of which insurance company sells it. It’s like ordering a Texas BBQ; no matter where you go, you know you’re getting quality meat, slow-cooked to perfection.

Lastly, don’t be afraid to seek help. Navigating the world of Medicare Supplement Plans can be as complex as a Texas two-step. Reach out to a trusted insurance agent or counselor who can guide you through the process, ensuring you make an informed decision. Remember, asking for help is not a sign of weakness, but a mark of wisdom.

In the end, selecting the best Medicare Supplement Plan in Texas is about ensuring you can enjoy your golden years with peace of mind, knowing you’re covered for whatever comes your way. It’s about savoring the beauty of a Texas sunset, the joy of time spent with loved ones, and the thrill of new adventures, without the worry of unexpected medical costs. So, take a deep breath, step onto that dusty crossroad, and stride confidently towards the Medicare Supplement Plan that’s right for you. After all, this is Texas, where the spirit of resilience and independence shines as bright as the Lone Star itself.

Review of Top Rated Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the spirit of independence and self-reliance runs as deep as the Rio Grande, the quest for the best Medicare Supplement Plans is a journey that many Texans embark upon. As the golden years approach, the need for a reliable health care plan becomes paramount. The vast expanse of Texas, with its diverse population and unique health care needs, calls for a comprehensive review of the top-rated Medicare Supplement Plans available.

The first step in this journey is understanding the essence of Medicare Supplement Plans, also known as Medigap. These plans are designed to fill in the gaps left by Original Medicare, covering costs such as deductibles, co-payments, and coinsurance. In Texas, as in the rest of the country, there are ten standardized Medigap plans, each identified by a letter from A to N. Each plan offers a different level of coverage, allowing Texans to choose a plan that best suits their individual health care needs and budget.

Among the top-rated Medicare Supplement Plans in Texas, Plan F stands out like the North Star in the Texas night sky. It offers the most comprehensive coverage, taking care of all the gaps left by Original Medicare. From the Part A hospital deductible to the Part B excess charges, Plan F has got you covered. It’s like having a trusty steed that carries you safely across the rugged Texas terrain, ensuring that you’re protected from unexpected health care costs.

However, just as the Texas landscape is diverse, so are the health care needs of its residents. For those who desire a balance between comprehensive coverage and affordability, Plan G emerges as a strong contender. It offers almost the same benefits as Plan F, with the exception of the Part B deductible. Like a sturdy oak tree, Plan G provides a solid foundation of coverage, while allowing you to save on premiums.

Then there’s Plan N, the wild mustang of Medicare Supplement Plans. It offers lower premiums in exchange for a small co-payment for some office visits and emergency room trips. It’s a plan for those who are willing to share a bit of the cost in exchange for lower premiums, embodying the spirit of independence and self-reliance that Texans are known for.

Choosing the best Medicare Supplement Plan in Texas is not just about finding the plan with the most coverage or the lowest premiums. It’s about finding the plan that fits your lifestyle, your health care needs, and your budget. It’s about finding a plan that gives you peace of mind, knowing that you’re covered when you need it most.

In the end, the best Medicare Supplement Plan in Texas is the one that allows you to live your golden years with the same spirit of independence and self-reliance that has guided you throughout your life. It’s the plan that allows you to enjoy the beauty of a Texas sunset, the thrill of a Friday night football game, and the comfort of a home-cooked meal, without worrying about unexpected health care costs. It’s the plan that lets you live your life to the fullest, embodying the true spirit of Texas.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Cost Analysis of Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the spirit of independence and self-reliance runs as deep as the Rio Grande, the quest for the best Medicare Supplement Plans is a journey that many Texans embark upon. The pursuit of these plans, also known as Medigap, is driven by the desire to secure a future where healthcare costs are not a burden but a manageable aspect of life.

As we traverse the landscape of Medicare Supplement Plans in Texas, it’s essential to understand that these plans are designed to fill the gaps left by Original Medicare. They cover out-of-pocket costs like deductibles, copayments, and coinsurance, providing a safety net for those unexpected medical expenses that can often catch us off guard.

However, the cost of these plans can vary significantly, making it crucial to conduct a thorough cost analysis. This process, while seemingly daunting, can be likened to panning for gold in the Hill Country. It requires patience, diligence, and a keen eye, but the reward is well worth the effort.

The first step in this cost analysis is understanding the different types of Medicare Supplement Plans available in Texas. There are ten standardized plans, labeled A through N, each offering a unique blend of benefits. Some plans, like Plan F, offer comprehensive coverage, including all deductibles, copayments, and excess charges. Others, like Plan K, cover fewer expenses but come with lower premiums.

Just as the Texas landscape varies from the coastal plains to the Panhandle, so too do the costs of these plans. Factors such as age, gender, location, and health status can all influence the price of premiums. For instance, a 65-year-old woman living in Austin might pay around $100 per month for Plan F, while a 70-year-old man in Dallas might pay closer to $150 for the same plan.

Yet, the cost of premiums is just one piece of the puzzle. To truly find the best Medicare Supplement Plan in Texas, one must also consider out-of-pocket costs. These are the expenses not covered by the plan, such as prescription drugs or long-term care. A plan with a low premium might seem like a bargain, but if it leaves you vulnerable to high out-of-pocket costs, it may not be the best choice.

In this quest for the best Medicare Supplement Plan, it’s also important to remember that cost is not the only factor to consider. The quality of coverage, the reputation of the insurance company, and the ease of accessing care are all crucial elements to weigh in your decision.

In the end, finding the best Medicare Supplement Plan in Texas is a journey of discovery. It’s about understanding your needs, assessing your options, and making an informed decision that will provide you with peace of mind. It’s about securing a future where you can enjoy the beauty of a Texas sunset without worrying about the cost of healthcare.

So, saddle up and embark on this journey with confidence. With a bit of research and a dash of determination, you can find a Medicare Supplement Plan that not only meets your financial needs but also supports your health and well-being. After all, in the great state of Texas, we don’t just settle for good enough; we strive for the best.

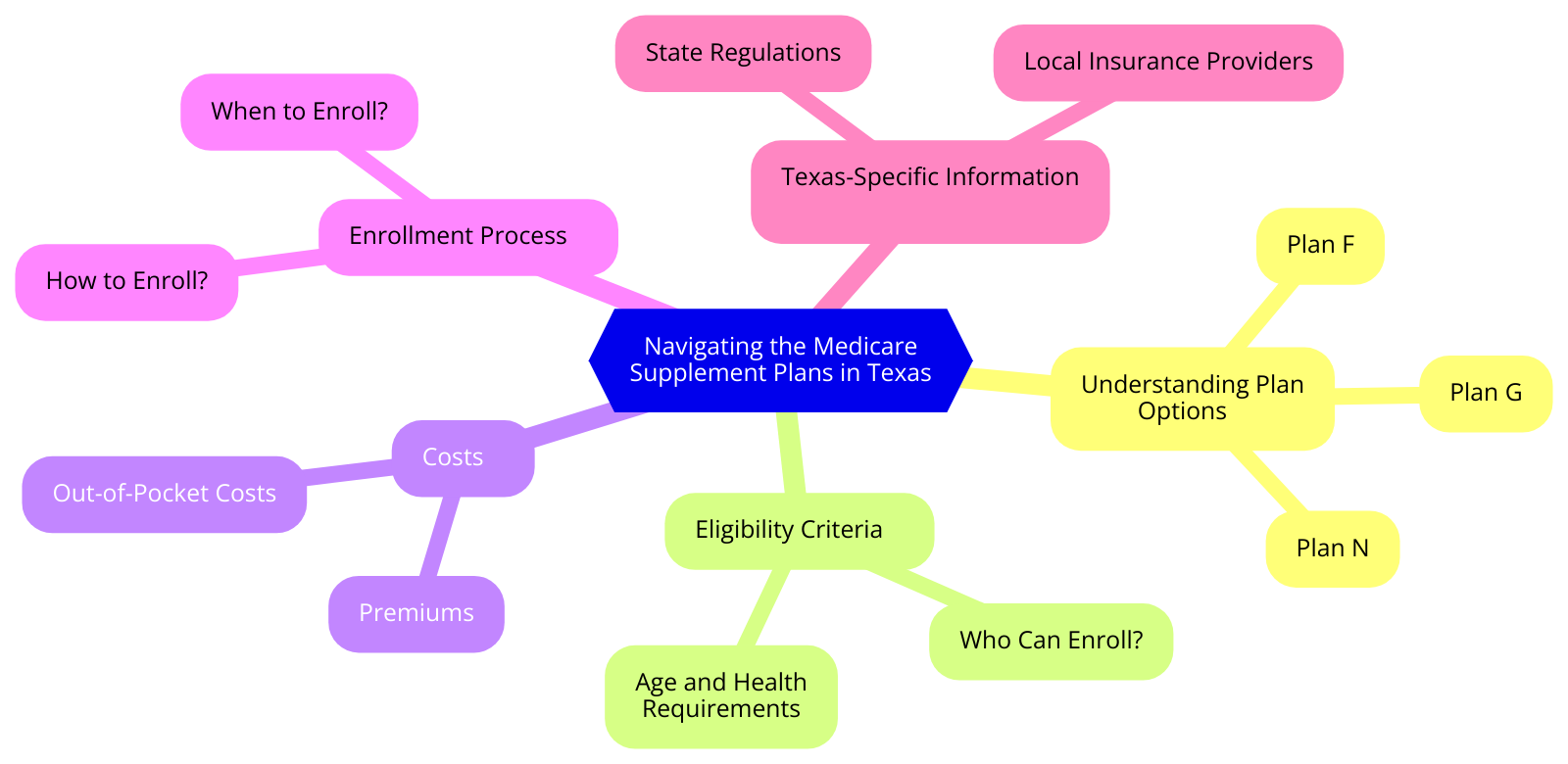

Navigating the Medicare Supplement Plans in Texas

In the heart of the Lone Star State, where the bluebonnets bloom and the longhorns roam, there’s a sense of security and peace that comes with knowing you’re covered by the best Medicare Supplement Plans in Texas. As the sun sets over the sprawling plains, painting the sky with hues of orange and pink, the thought of navigating the labyrinth of healthcare options can seem daunting. Yet, with a little guidance and a touch of inspiration, you can find a plan that suits your needs perfectly, just like a well-worn pair of cowboy boots.

Imagine, if you will, the vast expanse of Texas as a metaphor for the Medicare Supplement Plans available. Each city, each town, each dusty road represents a different plan, each with its unique benefits and features. From the bustling metropolis of Houston to the serene landscapes of Hill Country, the diversity of Texas mirrors the variety of Medicare Supplement Plans available to you.

Just as you would embark on a journey across Texas with a roadmap, so too should you navigate the Medicare Supplement Plans with a guide. This guide is your understanding of the basics. Medicare Supplement Plans, also known as Medigap, are policies designed to cover the ‘gaps’ in Original Medicare, such as copayments, coinsurance, and deductibles. These plans are lettered A through N, each offering a different level of coverage, much like the different landscapes of Texas offer varied experiences.

Now, let’s take a moment to appreciate the beauty of choice. Just as Texas boasts a rich tapestry of cultures, cuisines, and traditions, so too does the selection of Medicare Supplement Plans offer a wealth of options. Whether you’re drawn to the comprehensive coverage of Plan F, the lower premiums of Plan K, or the balanced benefits of Plan G, there’s a plan that’s as unique and individual as you are.

As we journey further into the heart of Texas, let’s consider the importance of timing. Just as the Texas Bluebonnet is at its most beautiful in the spring, there’s an optimal time to enroll in a Medicare Supplement Plan. This period, known as the Medigap Open Enrollment Period, begins on the first day of the month that you’re both 65 or older and enrolled in Medicare Part B. During this six-month period, you have the guaranteed right to join any Medigap plan with no health screening required. It’s a golden opportunity, much like a Texas sunrise, not to be missed.

As our journey across the Texas landscape draws to a close, let’s reflect on the importance of making an informed decision. Just as you would research the best routes, pit stops, and sights before embarking on a road trip across Texas, so too should you explore your options when it comes to Medicare Supplement Plans. Consult with a trusted advisor, compare the benefits and costs of different plans, and consider your healthcare needs both now and in the future.

In the end, finding the best Medicare Supplement Plan in Texas is much like finding your place in this great state. It’s about exploring your options, understanding your needs, and making a choice that brings you peace of mind. So, as the sun sets over the Texas horizon, casting long shadows over the plains, take comfort in knowing that with the right plan, you’re covered. And that, dear reader, is a feeling as warm and reassuring as a Texas sunset.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Q&A

1. Question: What are the best Medicare Supplement Plans in Texas?

Answer: The best Medicare Supplement Plans in Texas include AARP UnitedHealthcare, Blue Cross Blue Shield of Texas, Humana, Aetna, and Mutual of Omaha.

2. Question: What benefits do the AARP UnitedHealthcare Medicare Supplement Plans offer?

Answer: AARP UnitedHealthcare Medicare Supplement Plans offer benefits like coverage for out-of-pocket expenses not covered by Medicare, nationwide coverage, and no referrals needed for specialists.

3. Question: How does the Blue Cross Blue Shield of Texas Medicare Supplement Plan stand out?

Answer: Blue Cross Blue Shield of Texas offers a variety of Medicare Supplement Plans with benefits like comprehensive coverage, a wide network of doctors, and potential discounts for healthy lifestyles.

4. Question: What are the advantages of Humana’s Medicare Supplement Plans?

Answer: Humana’s Medicare Supplement Plans offer benefits such as coverage for out-of-pocket costs, freedom to choose any doctor who accepts Medicare, and no referrals needed for specialists.

5. Question: Why should one consider Aetna’s Medicare Supplement Plans?

Answer: Aetna’s Medicare Supplement Plans offer comprehensive coverage, a wide network of healthcare providers, and potential discounts for healthy lifestyles.

6. Question: What makes Mutual of Omaha’s Medicare Supplement Plans a good choice?

Answer: Mutual of Omaha’s Medicare Supplement Plans offer benefits like coverage for out-of-pocket costs, the freedom to choose any doctor who accepts Medicare, and no referrals needed for specialists.

7. Question: Are there any additional costs associated with these Medicare Supplement Plans?

Answer: Yes, Medicare Supplement Plans come with monthly premiums, and some may have deductibles and co-payments.

8. Question: Can anyone enroll in these Medicare Supplement Plans?

Answer: Generally, anyone who is enrolled in Medicare Part A and Part B is eligible to enroll in a Medicare Supplement Plan.

9. Question: When is the best time to enroll in a Medicare Supplement Plan in Texas?

Answer: The best time to enroll in a Medicare Supplement Plan is during the six-month Medigap Open Enrollment Period, which starts the month you’re 65 or older and enrolled in Medicare Part B.

10. Question: Can I switch my Medicare Supplement Plan later if I am not satisfied?

Answer: Yes, you can switch your Medicare Supplement Plan anytime, but you may have to go through medical underwriting and your acceptance is not guaranteed.