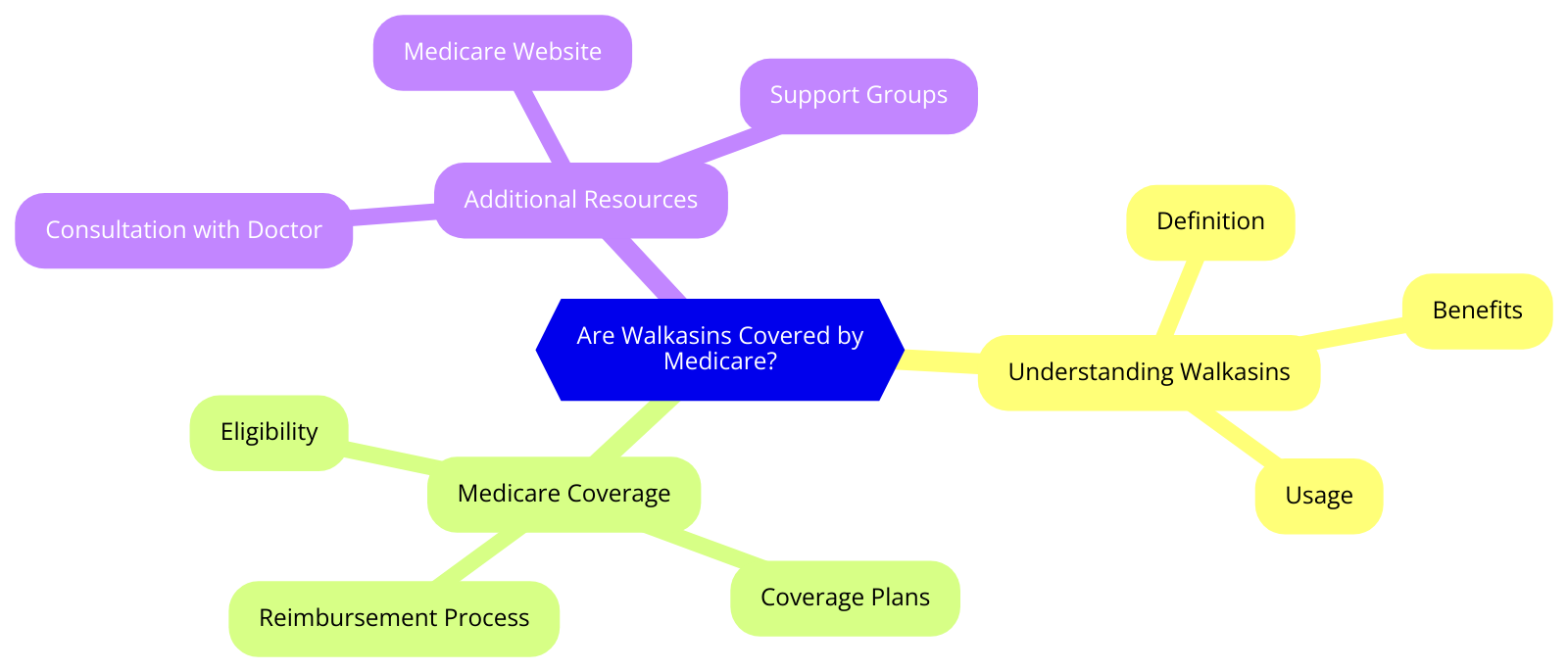

Understanding What Walkasins Are

The Basics of This Innovative Device

Walkasins are wearable sensory prosthetics meant for individuals dealing with peripheral neuropathy a condition common in seniors that causes balance issues due to nerve damage in the legs. These state-of-the-art devices enhance the user’s balance and mobility by providing real-time sensory feedback. Imagine regaining your confidence to walk through a bustling farmers market or to navigate the stairs at your grandchildren’s school play without fear—this is the potential impact of Walkasins.

ChatGPT

Are Walkasins Covered by Medicare? A Detailed Exploration for Seniors

Is Medicare Providing Coverage for Walkasins?

Navigating Medicare’s Guidelines

Typically Medicare Part B covers durable medical equipment (DME) when it is considered medically necessary and prescribed by a doctor. However for newer technologies like Walkasins coverage is often not straightforward until certain criteria are fulfilled.

Currently Medicare does not specifically include Walkasins under covered DME. This leads to an important discussion: why is such a beneficial device not covered? The approval process for new medical devices under Medicare is thorough demanding sufficient proof of the device’s medical necessity and cost-effectiveness.

Why should innovative devices like Walkasins be included in Medicare coverage?

According to Henry Beltran owner of Medicare Advisors Insurance Group “For many seniors the ability to move freely and securely is not just about physical health but emotional and mental well-being. Including devices like Walkasins can transform lives reducing falls and hospital visits which are costly both emotionally and financially.”

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

The Financial Aspect: Analyzing Cost and Affordability

Exploring the Economic Impact on Seniors

The cost of Walkasins can be a major concern for many seniors who rely on a fixed income. Without Medicare coverage the out-of-pocket expense can be overwhelming. This brings up an essential question: Should you have to choose between financial stability and mobility?

The emotional toll of losing independence can be as severe as the physical injuries from falls. Devices like Walkasins not only offer physical support but also bring back a sense of independence to seniors allowing them to engage more in their communities and family activities.

Taking Action: Steps You Can Take

How to Advocate for Change

- Contacting representatives: Make your voice heard by reaching out to your local and state representatives to advocate for expanded Medicare coverage.

- Looking for alternative funding: Investigate grants scholarships or nonprofit organizations that may provide financial assistance for purchasing Walkasins.

- Keeping informed: Stay updated with the latest Medicare developments through trustworthy sources like the official Medicare website or respected healthcare advisors.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Concluding Thoughts

Reflecting on the Future of Senior Care

In a society that prizes technological advancement it is crucial that we close the gap between innovation and healthcare coverage. As Henry Beltran eloquently puts it “Including advanced medical devices like Walkasins under Medicare could be a beacon of hope for many seniors offering them the dignity of mobility and the joy of independence.”

The path to getting Walkasins and similar devices covered by Medicare is long and full of challenges. However it’s a path worth taking for the promise of an enhanced quality of life for our seniors. After all isn’t the true measure of a society how well it cares for its elderly?

As we consider the future of Medicare and medical technology one question remains central: Will we step up to ensure our seniors have the support they need not just to live but to live well?

frequently asked questions

Is Walkasins Covered by Insurance?

Insurance coverage for Walkasins, a lower limb sensory neuroprosthesis designed to improve balance in individuals with peripheral neuropathy, varies. Some insurance companies may cover the device, but not all do. It’s essential to consult with your specific insurance provider to determine if Walkasins is included in your plan.

How Much Does the Walkasins System Cost?

The cost of the Walkasins system is approximately $6,000. However, prices can vary, and it’s advisable to contact the manufacturer or authorized distributors for the most current pricing.

Does Medicare Pay for Neuropathy Treatments?

Yes, Medicare provides coverage for neuropathy treatments. Medicare Part A covers inpatient hospitalization costs, while Part B covers outpatient services, including doctor visits, screenings, and necessary medical equipment. Coverage specifics depend on the type of neuropathy and the treatments deemed medically necessary by your healthcare provider.

Are Good Feet Arch Supports Covered by Medicare?

Good Feet arch supports are generally not covered by Medicare. These supports are often considered comfort or convenience items rather than medically necessary devices. Consequently, The Good Feet Store does not accept medical insurance, including Medicare, for their arch support products.

Do Walkasins Really Work?

Clinical studies have indicated that Walkasins can improve gait and balance function in individuals with peripheral neuropathy. For instance, the walk2Wellness long-term study demonstrated positive outcomes, including improved mobility and reduced fall risk among users. However, individual results may vary, and it’s important to consult with a healthcare professional to determine if Walkasins is suitable for your specific condition.