When it comes to understanding Medicare options Aetna Medicare seminars can be a real lifesaver. Let’s be honest Medicare isn’t exactly the easiest thing to figure out. Between Original Medicare Medicare Advantage Part D and Medigap—it can feel like you’re trying to learn a new language. So where do you start? Well that’s where Aetna’s Medicare seminars come in! They’re designed to help you get a grip on the complexities of Medicare so you can make the best decision for your healthcare.

These seminars are not only informative but also give you the opportunity to ask real-time questions about your specific needs. Let’s dive into what these seminars offer why you should attend and—yes—some potential drawbacks with a little humor sprinkled in for good measure!

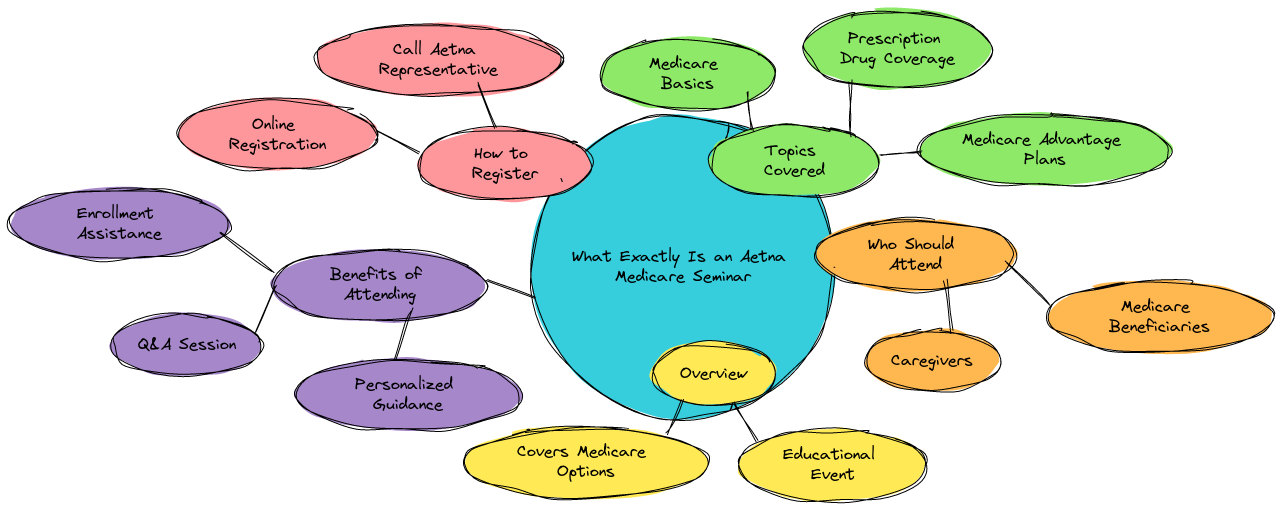

What Exactly Is an Aetna Medicare Seminar?

An Aetna Medicare seminar is an in-person or virtual event designed to help you understand Medicare plans particularly those offered by Aetna. You’ll learn about Medicare Advantage Plans (Part C) Medicare Prescription Drug Plans (Part D) and Medigap (Medicare Supplement Insurance). Aetna’s licensed agents break down the nitty-gritty details so you don’t have to. These seminars are a great opportunity to get all your questions answered especially those that you didn’t even know you had!

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Key Benefits of Attending an Aetna Medicare Seminar:

- Clarity: Get easy-to-understand explanations of Aetna’s Medicare plans

- Ask Questions: Live Q&A sessions with Aetna’s licensed agents

- Compare Plans: See side-by-side comparisons of different options

- Personalized Advice: You can ask about your specific health needs

- Free: These seminars are typically free and include materials like brochures and plan comparisons

Aetna Medicare Advantage Plans

Aetna’s Medicare Advantage Plans bundle hospital medical and prescription drug coverage into one plan. These plans also often include additional perks like vision dental and wellness programs. It’s a one-stop-shop for all your Medicare needs.

But of course here’s the catch—or at least the humorous side of things: “Trying to choose a Medicare Advantage plan is like picking a new car. You might love the leather seats but hate the gas mileage,” says Henry Beltran the owner of Medicare Advisors Insurance Group LLC. “It’s great having everything in one plan but you need to make sure you actually like everything bundled in there!”

Drawbacks of Medicare Advantage Plans (with a Smile!)

- Network Limitations: Most Medicare Advantage plans require you to stick to a network of doctors which can be limiting. It’s like buying an all-you-can-eat buffet but they only serve salad.

- Prior Authorization: Some treatments and procedures require prior approval from the insurance company. It’s like asking permission to use your own health benefits—talk about a buzzkill!

- Geographical Restrictions: If you love to travel outside your state you might find yourself out of network. Think of it like finding out your favorite restaurant doesn’t exist in the next town over.

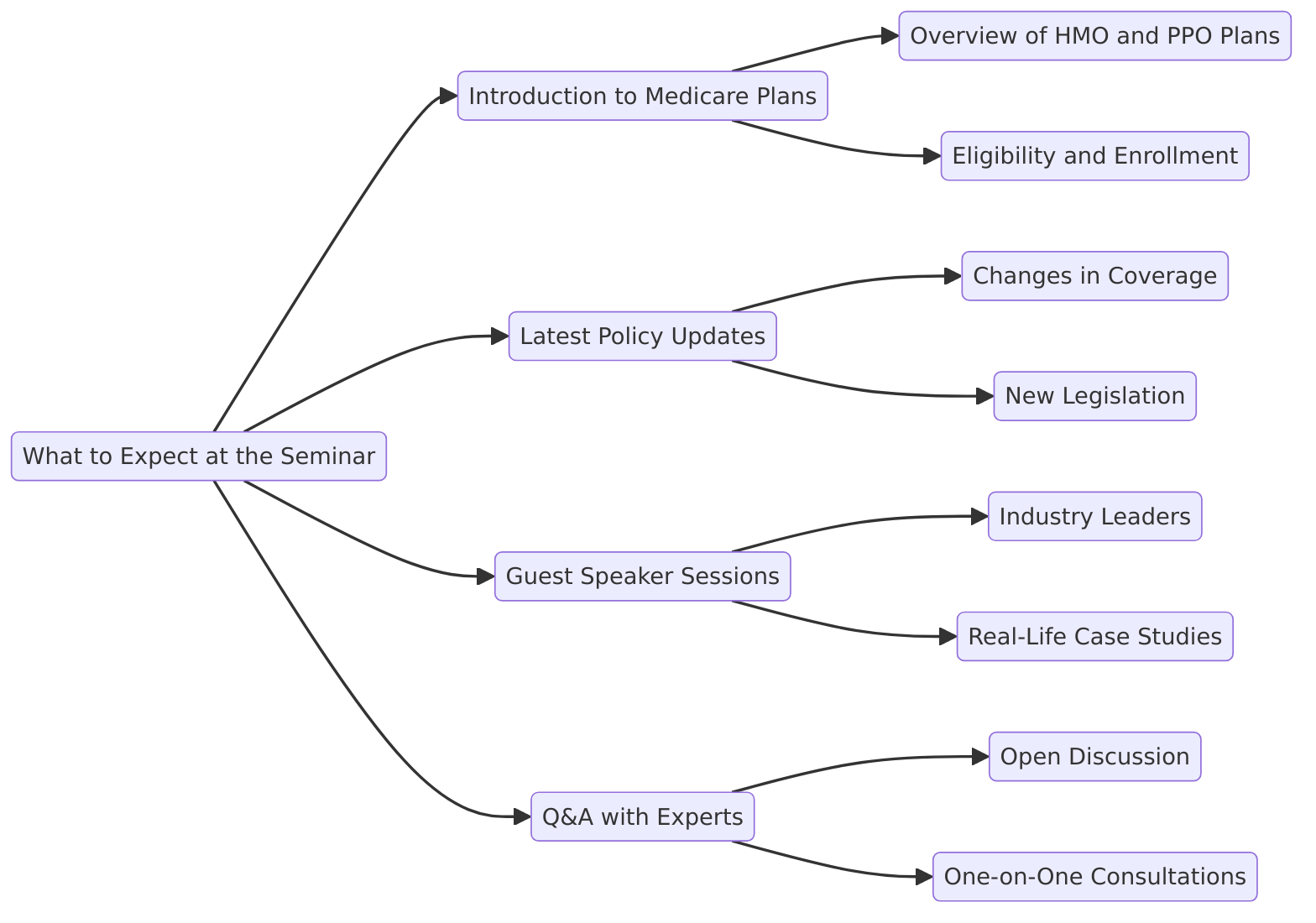

What to Expect at the Seminar

When you attend an Aetna Medicare seminar here’s what you can expect from the get-go:

- A warm welcome from the host (usually a licensed Aetna agent)

- Educational materials: You’ll receive pamphlets brochures and plan details

- Comparative Analysis: Learn how Aetna stacks up against other insurers in the Medicare space

- Real-life examples: Hear success stories from other Medicare enrollees

Step-by-Step Breakdown of a Typical Seminar:

- Introduction to Medicare: This covers Original Medicare Parts A and B.

- What is Medicare Advantage?: Learn about Part C plans and how they differ.

- Medicare Prescription Drug Coverage: A breakdown of Part D.

- Medigap Plans: Discover how Medigap can fill in the gaps of Original Medicare.

- Q&A Session: Get answers to your specific questions.

- Next Steps: How to enroll or get additional information.

Now About That Medigap Coverage…

Medigap is the backup quarterback for Original Medicare—it covers those pesky out-of-pocket expenses like copays and deductibles that can add up fast.

But there’s a small hiccup: Medigap can be a little pricey. “It’s like adding heated seats to your car—they’re nice to have but you’ve gotta be ready to pay for it” jokes Beltran.

Potential Drawbacks of Medigap Plans

- Costs Can Add Up: Monthly premiums can be higher than Medicare Advantage plans.

- No Extra Perks: Medigap doesn’t typically offer things like dental vision or wellness programs.

- Standalone: You still need to buy separate Part D coverage for prescriptions.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Why Aetna?

When it comes to choosing a Medicare plan Aetna is one of the big players. They offer broad coverage competitive premiums and a variety of plans that cater to different healthcare needs.

Key Features of Aetna Medicare Plans:

- Large Network: You’ll have access to a large network of doctors and hospitals.

- Affordable Premiums: Aetna often offers lower premiums than competitors.

- Extra Benefits: Many Aetna plans include dental vision hearing and wellness benefits.

But no plan is perfect. “It’s like driving a car with all the bells and whistles except the cup holder is in the wrong spot,” Beltran says. “Aetna’s got a lot going for it but like any plan it’s important to look at the fine print!”

Common Mistakes to Avoid

Here are a few things to look out for when attending an Aetna Medicare seminar and choosing a plan:

1. Not Asking Questions

You don’t know what you don’t know! Make sure to ask plenty of questions especially about things that matter to you personally.

2. Ignoring Network Restrictions

Before you enroll in a plan check to make sure your doctors and hospitals are in-network. Nobody wants to drive 50 miles to see a specialist!

3. Skipping the Fine Print

This isn’t the time to skim-read. Make sure you understand what’s covered and what’s not. No one likes surprises when it comes to healthcare bills.

Find Medicare Plans in 3 Easy Steps

We can help get up to $0 monthly premium Medicare plans

Wrapping It Up

Attending an Aetna Medicare seminar can help you make sense of the overwhelming world of Medicare. You’ll walk away with a clearer understanding of your options and you’ll be better prepared to choose the right plan for your needs. Just remember like any car purchase there are pros and cons to each plan—some you’ll love and some you’ll wish you could swap out.

Henry Beltran owner of Medicare Advisors Insurance Group LLC leaves us with a final thought: “Think of it this way—you wouldn’t buy a car without taking it for a test drive right? Well an Aetna Medicare seminar is like your test drive for Medicare. You get to kick the tires ask questions and see if it’s the right fit for you.”

Ready to attend an Aetna Medicare seminar? Check out the next event near you or sign up for a virtual session!